Liquid Restaking (LRT): A New Trend in the Ethereum Ecosystem

EigenLayer is currently running in a limited mode to cope with the influx of those wishing to invest in pools. The LSD sector leads the market in capitalization. Meanwhile, there’s a new trend in the network called liquid restaking (LRT).

Currently, there are 12 protocols in this segment. It’s the tenth largest in blocked funds, with $3.6 billion, according to DeFiLlama.

The editorial team at Incrypted investigated liquid restaking, its associated risks and opportunities for users, and the reasons behind the increasing interest in LRT services.

What Is Liquid Restaking

LRT services are developing the restaking concept proposed by EigenLayer. This concept allows Ethereum network validators to add extra security for other projects like cross-chain bridges and oracles.

Validators become so-called operators by taking on extra functions through EigenLayer. Third-party platforms can pay them for providing consensus as a service.

The Ethereum’s slashing mechanism maintains the integrity of AVS (actively validated services) operators, no matter which project they validate data for. If someone acts dishonestly toward an application, they might lose part of their node’s validator stake (32 ETH).

Liquid restaking services will team up with AVS operators, giving them capital to operate or start their own nodes.

During an interview with Incrypted, Rok Kopp, co-founder of Ether.fi, stated that the platform is currently engaging with some AVSs and intends to allocate some of the raised ETH to ensure their security. Kopp mentioned that Ether.fi is developing its own AVS, named DappBridge, but provided no further details.

At the time of writing, EigenLayer is currently operating in a limited mode. Operators only secure the native data availability (DA) layer needed for modular blockchains. However, operator services are expected to be made available to third-party AVSs in the future.

Like LSD, LRT providers let users join EigenLayer restaking without becoming full operators or making a full Ethereum validator deposit. These protocols handle organizational matters and give investors a share of the reward from AVS operators.

So, LRT is built on EigenLayer, which is built on Ethereum’s native staking and liquid staking platforms. This means that the assets of a retail user, who doesn’t plan to run their own node, will be leveraged on four layers simultaneously:

- Ethereum basic staking;

- liquid staking platform (optional);

- EigenLayer restaking pools;

- liquid restaking service.

And the ‘lego’ doesn’t end there. In return for the staked capital, the LRT provider issues liquid tokens to users. You can use these tokens in DeFi transactions, like providing liquidity on DEX.

How Liquid Restaking Affects the Security Of Protocols

Ethereum’s Proof-of-Stake security system lets validators ensure transactions on the blockchain are secure and unchangeable. It is important to note that this protection is limited to on-chain data and does not extend to off-chain information.

Decentralized platforms with a consensus model of operation are often required to create their own nodes or rely on third-party providers, such as oracles and cross-chain bridges. Unfortunately, these elements are also the most vulnerable in the entire DeFi ecosystem. In 2022, for instance, 62% of stolen funds were taken from cross-chain infrastructure.

The problem is that protocol developers often can’t handle a branched consensus network. They stick to only a few, or sometimes just one (like oracles) node. The detrimental effects of an unprofessional consensus system are exemplified by the case of Ronin.

As mentioned before, restaking lets Ethereum validators join in the consensus of applications, not just the blockchain. This change in responsibility to AVS operators, who are more secure both technically and organizationally, lowers the chance of attacks and boosts security.

To become an AVS operator, you must first become an Ethereum validator. This means depositing 32 ETH and having the right skills and gear. This entry threshold limits opportunities for consensus participation.

EigenLayer partly solves the problem by letting users deposit assets into the pool and shifting the technical work to the operators, like LSD protocols do. But unlike LSD protocols, EigenLayer needs a non-refundable cryptocurrency blockchain, which might put off some investors. Additionally, its pools are still limited.

LRT protocols, instead, add liquid tokens to the chain, allowing for further utilization of capital in DeFi operations. This should encourage more restakers to join and create more AVS operators, making their services easier to access.

What Is The Advantage For Users And Projects?

EigenLayer’s liquid restaking services are turning it into the backbone of a whole ecosystem. This ecosystem can establish a fundamentally new security model for blockchain applications. The key benefits for projects include:

- no need to build their own validator pool;

- legacy security from the Ethereum network;

- the ability to manage application security costs more dynamically.

In turn, Ethereum stakers receive:

- tools to increase returns on the ETH held;

- new ways to take part in blockchain projects;

- incentives and rewards from all parts of the LRT chain.

So, Ethereum’s key advantage, its security, helps both technical and organizational projects. Moreover, the expanded consensus system lets more users use resources and earn a steady income while keeping liquidity.

LRT Protocols: Growing Interest And Popular Applications

The restaking ecosystem is now in a testing phase. It will continue until EigenLayer is fully launched and AVS operators emerge. Despite this, LRT protocols are still attracting capital.

The above description outlines the general principle of operation for liquid restaking platforms. Now, let’s examine the specific characteristics of the largest projects in this segment.

As of now, Ether.fi is the largest liquid restaking service. It offers a wrapped eETH token in exchange for restaked Ethereum. Moreover, depositors can choose solo-staking by setting up an Ethereum node with a partial deposit or no deposit at all. EigenLayer and Ether.fi award points to depositors based on the amount deposited. The current APR is 3.95%.

Puffer.fi is a well-known LRT provider. They offer native ETH restaking to EigenLayer with the liquid token pufETH. Users can also run an Ethereum node through their platform.

The protocol stands out because of its top-notch interface and the gamification of the liquidity campaign. Additionally, it has launched a native anti-slashing system and other technical solutions. At the time of writing, the APR is 3.3%.

Kelp was launched by the founders of Studer Labs and is positioned as a DAO. Like other LRT services, it offers points and EigenLayer points. The protocol tokenized the latter by issuing a KEP token, where one KEP equals one EL point. This expands trading opportunities. It lets individuals exit farming before the EigenLayer airdrop.

One main feature of Kelp is its support for a variety of assets. It includes ETH and LSD tokens from different providers. Also, Kelp aims to create a community-driven infrastructure. It embodies the principles of a decentralized autonomous organization. The project documentation provides further technical details.

Renzo protocol accepts ETH, as well as liquid staking tokens from Lido and Binance. The attracted assets go to EigenLayer or to an Ethereum deposit contract for restaking later. Renzo has launched its own points system and referral program. They’ve also introduced the ezETH token. At the time of writing, the APR is 2.83%.

Eigenpie is a SubDAO on Magpie’s DeFi platform. It provides earning opportunities in different decentralized finance applications.

Eigenpie’s key feature is its integration of many LSD providers. Unlike its competitors, the service has isolated pools for each asset. It also allows the minting of individual LRT tokens. This feature lets incentives and rewards be distributed more flexibly. It lowers risks for investors.

Besides these, there are half a dozen smaller projects. Most of them launched a few months ago and likely still have time to prove themselves. Yet, like LSD, the principle of ‘the pioneer gets everything’ may apply. This could bring Ether.fi to the forefront of the market.

Points Programs

Interest in LRT is growing, possibly because people expect an airdrop from EigenLayer and liquid restaking protocols. These mentioned applications have introduced point programs that grant points based on the amount of staked ETH.

When a user provides an asset to an LRT service, they get points from both the project and EigenLayer simultaneously. These points will be converted into tokens in the future. For instance, according to Kopp, the TGE of the Ether.fi protocol has been scheduled for April 2024. As for the EigenLayer team, they have not yet announced a launch date.

These points also include APR for native ETH staking and potential rewards from LSD protocols. Most investors are attracted to the increased rewards for the same amount of locked assets.

The increase in leverage options has amplified this trend, especially in operations such as liquid restaking. Recently, Gearbox platform introduced liquid restaking with leverage of up to x19. Pendle yield trading platform also provides boosts for LRT point farming.

Pendle And Its Importance For LRT

Pendle offers a unique feature: it divides an asset into two tokens – a base part and a yield. You can trade them individually. This feature allows for the maximization of potential returns through leveraged liquidity. Although Pendle became popular during the peak of LSD, its mechanics also suit LRT protocols.

Let’s look at a scenario to explain the process. A user deposits their ETH (or a wrapped version) into the Pendle pool of a liquid restaking protocol like Ether.fi. This will allow them to transform the underlying asset into one of two tokens:

- yield token (YT) enables you to farm EigenLayer and Ether.fi points using leverage. Converting one ETH into YT can provide you with the same number of points as blocking in LRT with six ETH.

As the maturity date of YT approaches, the value of the yield token compared to the underlying asset decreases. On the maturity date, the yield token value becomes zero. So, in essence, the user «burns» the deposited ETH (partially or completely) in exchange for a boost to farming points;

- base token (PT) allows for a fixed yield during a specific period while being locked. When the maturity date arrives, the owner can use the PT to receive their asset and promised profit. But the yield of the PT changes, and you can only get the highest yield on the maturity date.

The liquidity provided by PT holders enables YT holders to receive boosts for farming. YT holders leverage the underlying asset, while PT holders get a fixed interest on the capital they provide. The amount of the boost and the rate of burning the underlying asset during farming depend on the ratio of assets in the YT and PT pools.

To justify such a strategy for point hunters, it is necessary to ensure that the rewards received in the future will outweigh the cost of the «burned» underlying assets. However, currently, neither EigenLayer nor any of the LRT protocols have reported the conversion rate of points to tokens or even the date of distribution. Consequently, farming through Pendle represents a high-risk gamble with many variables.

Liquid Restaking Risks

LRT’s success in the long run hinges on the actual demand for AVS operator services. This demand will determine whether liquid restaking providers can integrate into the current blockchain infrastructure and create a sustainable tokenomics model based on the revenue from the protocols they serve. Nonetheless, there are other potential risks to consider.

Impact on Ethereum consensus. Vitalik Buterin mentioned that while EigenLayer is unlikely to pose a significant threat, the creation of liquid restaking and other financial primitives may have an impact on Ethereum validators. This might lead to issues like slashing nodes from third-party projects and expanding the validator set because of higher rewards.

The first issue hasn’t happened yet, but the second one has already affected the Ethereum transaction finalization process.

Service security. As mentioned before, LRT protocols are the top layer in the system. They include internal providers like EigenLayer and liquid staking providers. All these applications are susceptible to attacks and security breaches. A breach in any of these providers can harm the entire ecosystem’s resilience.

EigenLayer and similar services can become vital to the functioning of entire ecosystems, as liquid restaking allows for the transfer of securities to other platforms.

Suppose that an intruder has gained access to the Puffer protocol. Due to the breach, the attacker could create unsecured LRT tokens and drain the liquidity pools on DEX. This would cause a depeg between wrapped and native ETH. As a result, investors would start withdrawing funds in large amounts. This would force Puffer to liquidate assets from EigenLayer. In the event of a liquidity crisis, EigenLayer may begin to wind down operators. Some legacy security systems could fail or weaken significantly due to a large attack.

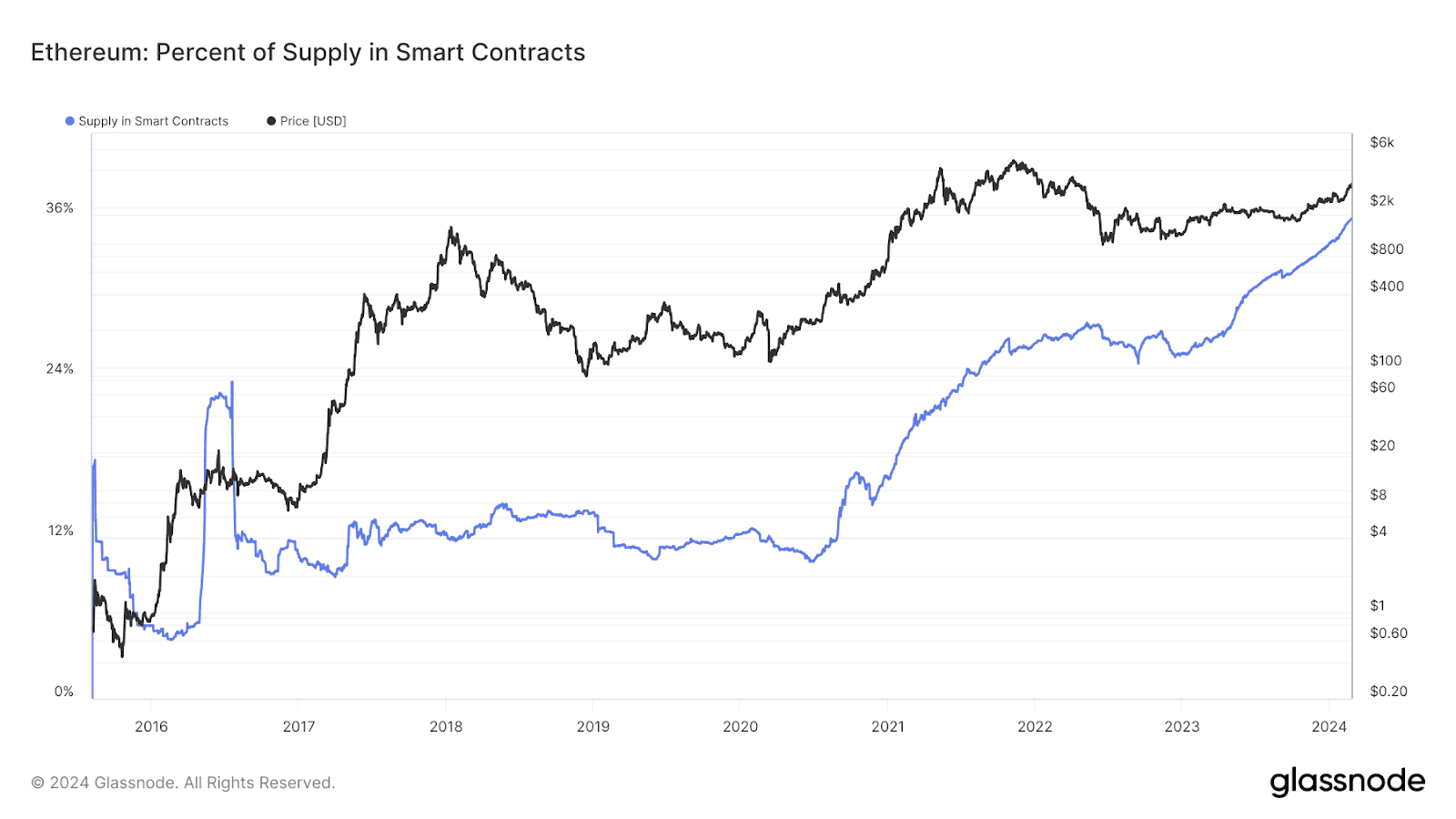

Implications for Ethereum. Passive income is growing more appealing to investors because of incentives offered by LRT protocols. According to Glassnode, currently, the amount of ETH locked in smart contracts is 35% of the total supply, and it’s increasing.

At first glance, this is a good thing, as lower supply with continued demand leads to higher prices. However, a supply shock could also cause a liquidity crisis for native ETH, pushing investors away. If the current trend continues, the only question is how quickly we will reach the supply red line.

It’s tough to predict the real impact of restaking on the blockchain until EigenLayer is fully launched. But the consequences will surely be noticeable, whether in technical or economic terms.

To summarize, liquid restaking is a new feature in the Ethereum network. It’s the next step in developing the restaking concept. Yet, interest in LRT providers is growing primarily because of the anticipation of future airdrops and the chance to boost the potential yield of held ETH.

We can only determine the viability of the «staking pyramid» and its sustainability after token distribution by the actual demand for AVS operator services. The ecosystem’s credibility also depends on the security of all protocols, including LSD, LRT, and restaking.