More Than Digital Gold: How Bitcoin ‘Staking’ Works and Why It’s Needed

Right now, bitcoin makes up 54% of the total market value, ors $1.4 trillion. Because of technical restrictions, this sum isn’t used for blockchain security or often in DeFi. The original cryptocurrency can only be bought and held.. People rely on third-party options like Lightning Network or cross-chain bridges for other transactions.

Ethereum stands out because it’s like a life-giving fluid in the big world of blockchain products. ETH holders have many options to use their assets for projects and financial gain.

The situation can be transformed and the scope of bitcoin can be broadened through the concepts of liquid staking and restaking. The assets locked in smart contracts for these segments amount to over $80 billion.

The Incrypted team has analyzed which projects are moving forward in this direction and how to incorporate the staking model into a network that utilizes the Proof-of-Work (PoW) consensus algorithm.

Bitcoin’s Second Life

Bitcoin is a digital currency that operates through a decentralized peer-to-peer network, allowing for value transfers via the internet and digital technology. The blockchain design was developed based on this principle, which also explains its limitations, such as an incomplete Turing programming language.

Bitcoin has some technical issues, but it’s still one of the most reliable networks. This aspect appeals to developers who want to build products on a strong foundation.

Many initiatives are currently underway to enhance the capabilities of the original cryptocurrency. For example, Ordinals and Inscriptions have facilitated the development of «bitcoin NFTs». BitVM is working to turn the network into a versatile computing platform. Stack and Omni have introduced L2 solutions that connect to the bitcoin blockchain in various ways.

Current bitcoin projects focus heavily on its technical components while ignoring the financial aspect. Meanwhile, miners have already produced almost 20 million bitcoins. Most of these bitcoins sit unused in decentralized finance and serve primarily as a tool for preserving long-term value.

Liquid staking platforms (LSD) quickly became dominant in Ethereum, showcasing the effectiveness of digital assets for boosting security. Right now, developers are about to apply the same concepts to the bitcoin network. Some of the possible outcomes include:

- the integration of bitcoin into the decentralized finance ecosystem;

- new ways to use digital assets;

- increased earnings for holders and the advent of new money-making instruments;

- the emergence of L2 networks of the next generation.

Creating a successful, marketable product can revitalize bitcoin and boost the ecosystem, like how Ordinals renewed interest in the first cryptocurrency and helped miners earn record commissions.

What Is Bitcoin Staking

In «staking», you use cryptocurrency to secure networks that rely on the Proof-of-Stake (PoS) consensus algorithm. Because Bitcoin uses PoW, it’s technically impossible to add staking to it.

«Bitcoin staking» involves locking already mined coins on a third-party platform. These coins provide liquidity or collateral for staking nodes, which offer a level of consensus to a third party. The mechanism and objectives of staking vary from project to project.

Owners typically get passive income in Bitcoin or other cryptocurrencies. They also receive liquid tokens usable in DeFi for providing assets.

It’s similar to how LRT and LST providers work in the Ethereum network. But for Bitcoin, there’s no fixed minimum rate of return or smart contracts available. This makes it hard to set a standard operational model. Every protocol has its own profit-seeking methods. They develop solutions based on the technical limitations of the original cryptocurrency.

Bitcoin Staking Platforms

Stroom

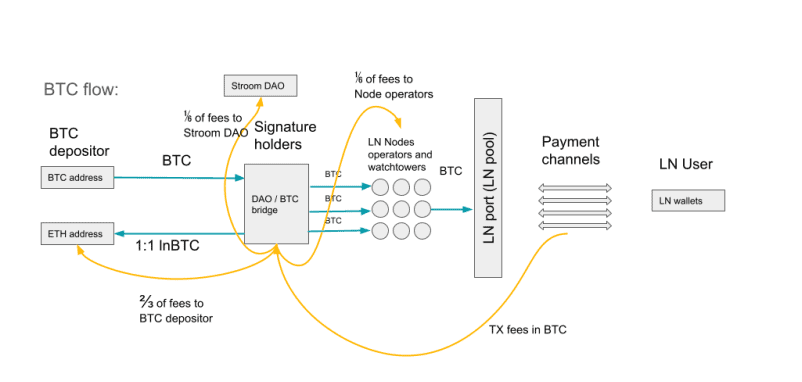

Stroom is a protocol for liquid Bitcoin staking with later asset use on the Lightning Network (LN).

The LN architecture initially focuses on P2P transactions. This makes it hard to develop big projects because they need many payment channels with locked assets. Router nodes address this challenge. They act as liquidity hubs and help set up transaction routes.

The Stroom protocol gathers user assets to operate Lightning Network routing nodes. It then gives them liquidity for other clients to use when making payments on the network.

At the same time, the project earns commissions from transactions processed by Stroom nodes. It then gives a share of the income to stakers. You can receive rewards in bitcoin, unlike other staking platforms that give third-party assets.

During a conversation with Incrypted, Rostyslav Shvets, Сo-founder of Stroom, stated that the team predicts the actual APR for stakers to be between 2-4%. But this figure depends on how much funds are raised and the activity in LN, so we can’t give exact numbers right now.

As of August 2023, the Lightning Network handled 6.6 million transactions valued at $78 million. The network has a potential user base of over 300 million people, providing Stroom with a vast market. The developers also said they’ll add other tokens, like stablecoins, to the LN later. These can be added to Stroom, increasing its earning potential.

By locking their assets, stakers receive liquid tokens (stBTC) on Ethereum and other EVM networks compatible with the DeFi ecosystem.

According to the technical documentation, a federation of Stroom nodes manages a proprietary bridge to lock the cryptocurrency. This federation must approve any transaction to issue or redeem stBTC.

The project plans to issue a STROOM governance token. This token will be used for voting through the DAO and as collateral to run the nodes that manage the bridge and participate in Lightning Network transaction processing.

Shvets says STROOM’s payouts will be linked directly to the amount of locked Bitcoins to ensure fair distribution. The team is also considering a points program, but it is currently unrelated to any potential token airdrop in the future.

At the time of writing, Stroom is still in the development stage and is functioning in a limited capacity. A project representative says the protocol will launch in test mode in the second half of March. The mainnet release is tentatively set for the second quarter of 2024.

The platform will be launched in two phases.

- Deployment of a centralized network of LN nodes managed by Stroom combined with a decentralized bridge.

- Implementation of free node launch for DAO-approved operators.

Nodes with a significant liquidity reserve can drive the development of complex projects and draw LN merchants to the network. Also, Shvets stressed that Stroom’s main competitive advantage lies in developing the Bitcoin ecosystem, especially its use as a payment method. In contrast, Babylon and similar projects focus on third-party networks.

However, Stroom’s impact on the centralization of the Lightning Network is yet to be assessed, as it may increase the dominance of liquidity hubs at the expense of direct payment channels. It is important to check the protocol’s effect on the network after its full launch.

Babylon

Babylon is a project creating a security layer for PoS networks. It uses Bitcoin as collateral for validators. The ultimate goal is to create a consensus-as-a-service platform that can make money by providing validator services to third-party projects. You can think of Babylon as an EigenLayer for Bitcoin.

To achieve this, the project team had to overcome many technical limitations of the original cryptocurrency.

Safe Staking

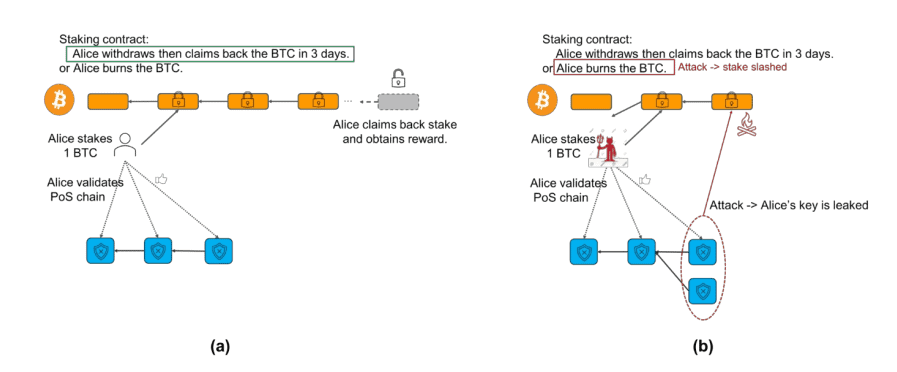

To make traditional cross-chain bridges safer, Babylon uses remote staking, like EigenLayer does. This means the user locks their assets on the main network without sending them to a third party.

This is achieved using P2TR transactions, which enable setting spending conditions for Bitcoins. These transactions represent basic smart contracts with limited functionality.

By contributing assets to the staking, the user performs a P2TR transaction that sets the conditions for spending the locked coins. These conditions can either be:

- unbonding transaction – allows the Bitcoin to be spent three days after initiation;

- slashing transaction – allows for instant spending at the address of burn.

With these restrictions, the validator can either unlock Bitcoins after a set time or lose them forever. This depends on how diligently they followed the protocol’s terms and conditions.

Slashing Mechanism

In mature PoS networks, slashing is quite straightforward because smart contracts support it. These contracts can burn validator assets automatically in case of malicious behavior.

Bitcoin doesn’t have this mechanism, so developers introduced a solution called Extractable One-Time Signatures. EOTS requires that when two blocks are signed at the same height, the validator’s private key is extracted and made publicly available. Anyone can then use this key to start a slashing transaction.

To finish a block, it needs approval from both the network’s validators and EOTS nodes (Bitcoin stakers). The EOTS voting round is flexible and can be added on top of other consensus protocols used by PoS blockchains.

Data Synchronization and Availability

One issue with this mechanism is that managing locked assets happens on the Bitcoin network, while block validation occurs on a third-party blockchain. This can create situations where a validator has started withdrawing assets from staking but still has the right to vote in the PoS network because of time delays. Even if the validator behaves maliciously, slashing cannot be applied to them.

To prevent this, Babylon utilizes the Bitcoin Timestamp solution. This means recording hashes of PoS network blocks and voting results on the Bitcoin blockchain.

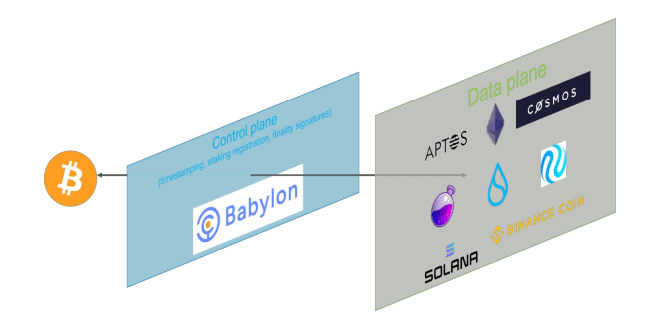

But the whole security setup might be too costly for some projects because of the high expense involved. Thus the Cosmos SDK-based intermediate network, known as the «control plane», is necessary.

This network does several things. It gathers timestamps, keeps and updates a list of EOTS keys, signatures, and voting results. It also syncs the Bitcoin and PoS blockchains.

Data on all Babylon validator transactions can be accessed through the «control plane». Running as a full network is necessary for decentralization and protection from censorship.

At the time of writing, Babylon is running on testnet. So it is impossible to estimate demand from PoS networks and stakers. But Babylon introduces a new feature for Bitcoin, which could have significant and lasting effects on the entire crypto industry.

Also, Babylon doesn’t offer users liquid tokens for locked funds, which could bring about liquid restaking services (LRT) soon. This could create more opportunities for Bitcoin holders.

Social Network

Social Network is a worldwide decentralized network. It uses Bitcoin and Ethereum to make a censorship-resistant platform for storing and sharing data. Its main objective is to reduce commission costs compared to the first cryptocurrency while maintaining security and decentralization.

Social Network combines Bitcoin staking, Ethereum Rollups, and the Nostr social networking protocol. The technical documentation gives more details about how these elements interact. Here are a few key points:

- Social Network uses the Nostr for data exchange and indexing;

- the network’s nodes, which include both Bitcoin nodes and Ethereum light clients, store the data;

- the network compensates node operators for storing data. A hash with a link to the storage is written to the Bitcoin network, while the information itself is located outside the blockchain, reducing maintenance costs;

- users can start their own node or stake a certain amount of BTC to take part in the blockchain.

Owners get a liquid token called eBTC in exchange for the assets they deposit for staking. This token is needed to pay for services within the Social Network. It’s also compatible with the Ethereum mainnet, so it can be used in DeFi applications.

Social Network is a hybrid network that serves as an Ethereum rollup for transactions and has its own set of nodes for data storage, which are protected by Bitcoin staking. The Nostr protocol enables users to index and share information, similar to social networks.

Users can currently install an Earth node or try out Bitcoin staking in test mode. The white paper also mentions the EARTH governance token. It will be distributed through a «fair launch» to node owners, stakers, and active network participants.

New Horizons

The mentioned projects focus on different aspects. Each has its own goal and strategy for implementing Bitcoin staking. They represent significant milestones in the development of the ecosystem, such as introducing novel L2 networks, enhancing the features of the Lightning Network, and establishing a security layer based on the original cryptocurrency.

New market segments can emerge due to the convergence of these trends. Moreover, the technical groundwork for the expansion of Bitcoin-related layer 2 blockchains that utilize PoS algorithms is being established by the introduction of a new level of security.

LRT and LSD are also interesting directions to consider. Ethereum shows how a liquid staking platform can use multiple layers to boost user revenue. The launch of EigenLayer will showcase how developers can enjoy this feature.

There are some initiatives, like Stroom, that currently serve as LSD providers. Meanwhile, ventures like Lorenzo plan to create liquid tokenization services using Babylon. Since liquid tokens can integrate with the DeFi ecosystem, those who possess them can become LPs for decentralized exchanges or lending platforms, which presents opportunities to earn additional revenue.

But stakers will have to rely on current DeFi protocols until a well-established decentralized finance ecosystem is built on the Bitcoin network. This reliance might move economic activity from Bitcoin to other ecosystems via LSD tokens. This is especially true because there’s a lack of technical infrastructure for cryptocurrency holders to have more chances to use it.

It’s important to note that Bitcoin not having native staking is pushing the industry towards adopting cross-chain staking. In this concept, validators and assets from one network protect another network. This could boost modular blockchains and improve connectivity between different ecosystems. Yet, there are no concrete examples of this idea being implemented yet.