Multi-level Decentralization: What is DVT and How Can This Technology Help Ethereum?

The blockchain trilemma says a decentralized network can only have two of three main things: scalability, bandwidth, and security. This principle guides developers, showing them the product’s weaknesses and pushing them to find new solutions. Ethereum is not exempt from this rule.

In this context, the primary issue with the network is its low bandwidth. But the rise of liquid staking (LSD) and restaking protocols, which give node control to big operators, also threatens Ethereum’s decentralization.

Using distributed validator technology (DVT) could help safeguard the blockchain against excessive centralization. The Incrypted team researched the mechanism and its effectiveness.

New Level of Ethereum Decentralization

Distributed validator technology (DVT) offers a fresh approach to validator security architecture. In 2021, Vitalik Buterin identified the model as one of Ethereum’s development priorities.

The architecture of Proof-of-Stake (PoS)-based networks typically involves validator nodes that process transactions and validate blocks. In Ethereum, full nodes with validator clients installed perform these functions. These nodes lock 32 ETH as a pledge in the deposit contract.

If a validator goes offline during transaction verification or engages in malicious behavior like signing two different blocks at the same time, penalties or slashing are applied accordingly. Penalties and slashing both cut down the deposit amount, but the severity of the penalty varies.

The validator stores private keys for block signing and deposit output. If an attacker gains access to the node, they could:

- withdraw blocked assets (although this is unlikely due to the deposit contract’s architecture);

- trigger slashing or penalty.

Also, deposits might get lost because of accidental technical problems causing delays or shutting down nodes.

The problem has become more urgent with the rise of LSD providers, who let professional operators handle node management. These operators usually rely on centralized infrastructure and must organize the storage of thousands of keys on their own. In case of their compromise or technical failures, users of liquid staking platforms can lose significant amounts due to slashing.

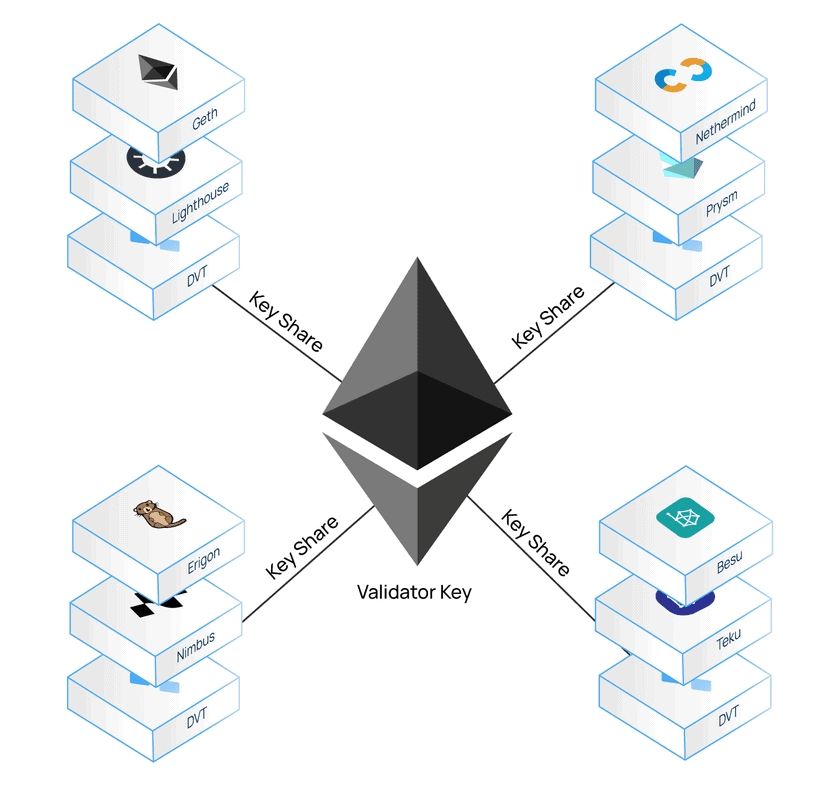

DVT proposes a solution to this problem by transforming the validator into a subnetwork of nodes, with each node owning a fragment of the private key (signature).

How does DVT Works?

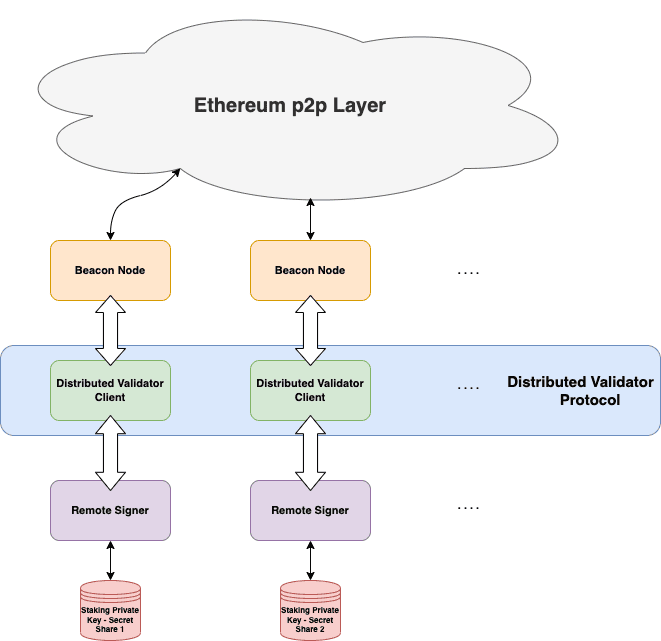

DVT works by linking a subnetwork (cluster) of multiple nodes to a validator node. Each node operates on its own device and stores a part of the signature. In essence, it’s a complete Ethereum node with a DV (decentralized validator) client installed.

Right now, there’s no widely accepted standard DV client for Ethereum, unlike consensus or execution layer clients. Instead, developers of individual projects create their own versions of such software.

Several technologies are combined to divide and aggregate the signature:

- Shamir’s secret sharing – combines the key fragments from cluster nodes into a single aggregated BLS signature;

- threshold signature scheme – determines the number of cluster members required to provide their signatures for the consensus to be considered valid, for example, 2/3 or 6/9;

- distributed key generation – divides an existing or new private key into fragments and distributes them among DV nodes;

- multiparty computation – is used during distributed key generation to ensure that each cluster member knows only his signature fragment.

The cluster uses its own consensus mechanism, usually either Istanbul Byzantine Fault Tolerance (IBFT) or Quorum Byzantine Fault Tolerance (QBFT), with a specific threshold for votes.

In action, the DVT looks like this:

- A random cluster member is selected as the block creator.

- The other nodes in the network inspect this block and vote either for or against signing it.

- The nodes that voted in favor provide their signature part to the subnetwork.

- The transmitted fragments are aggregated and sent to the validator.

In this case, participants are not aware of the entire key or the fragments of other nodes. This makes it more challenging to compromise the subnetwork and enables it to function without trust.

The implementation of DVT does not need any changes to Ethereum’s code. The cluster acts as an extra layer of validation without affecting the main network’s operation or transaction processing.

It’s important to note that Ethereum developers’ solutions for launching DV don’t regulate how validators get funded or set the order for award distribution. Each DVT protocol determines these points independently, and they might vary from one project to another.

What are the Benefits of DVT?

DVTs offer two big advantages over the usual Ethereum node setup, where the validator runs on just one full node:

- sharing signatures across many devices – makes it harder for attackers to compromise the system. An attacker would need to take over a large fraction (usually ⅔) of the devices in a theoretically unlimited cluster, rather than a single node;

- resilience to technical failures – threshold signatures enable validators to maintain operations even if one or more DV nodes go offline. This reduces the probability of penalties due to emergency shutdowns.

For ‘home’ validators (solo-stakers) worried about hardware reliability, a cluster of distributed nodes can act as insurance. Professional operators can use this tool to diversify their infrastructure and key storage. This can boost their credibility with users and protocols.

If widely adopted, DVT could decrease Ethereum’s technical centralization and increase its resilience to disruption.

Additionally, the DV architecture spreads financial risks among all cluster members and lowers the barrier to entry for becoming a validator. These abilities let node owners join in transaction validation and get a share of the validator’s reward without needing a full deposit.

Delays in transaction processing may occur due to the need for consensus at both the Ethereum level and in each subnetwork. Additionally, DVT leads to a significant increase in infrastructure costs for operators.

DVT Key Projects

Although the Ethereum roadmap outlines distributed validator technology, the main development team hasn’t implemented it yet. Instead, individual projects offer their own versions of clients and node interaction protocols. In the following section, we will examine the leaders of this segment.

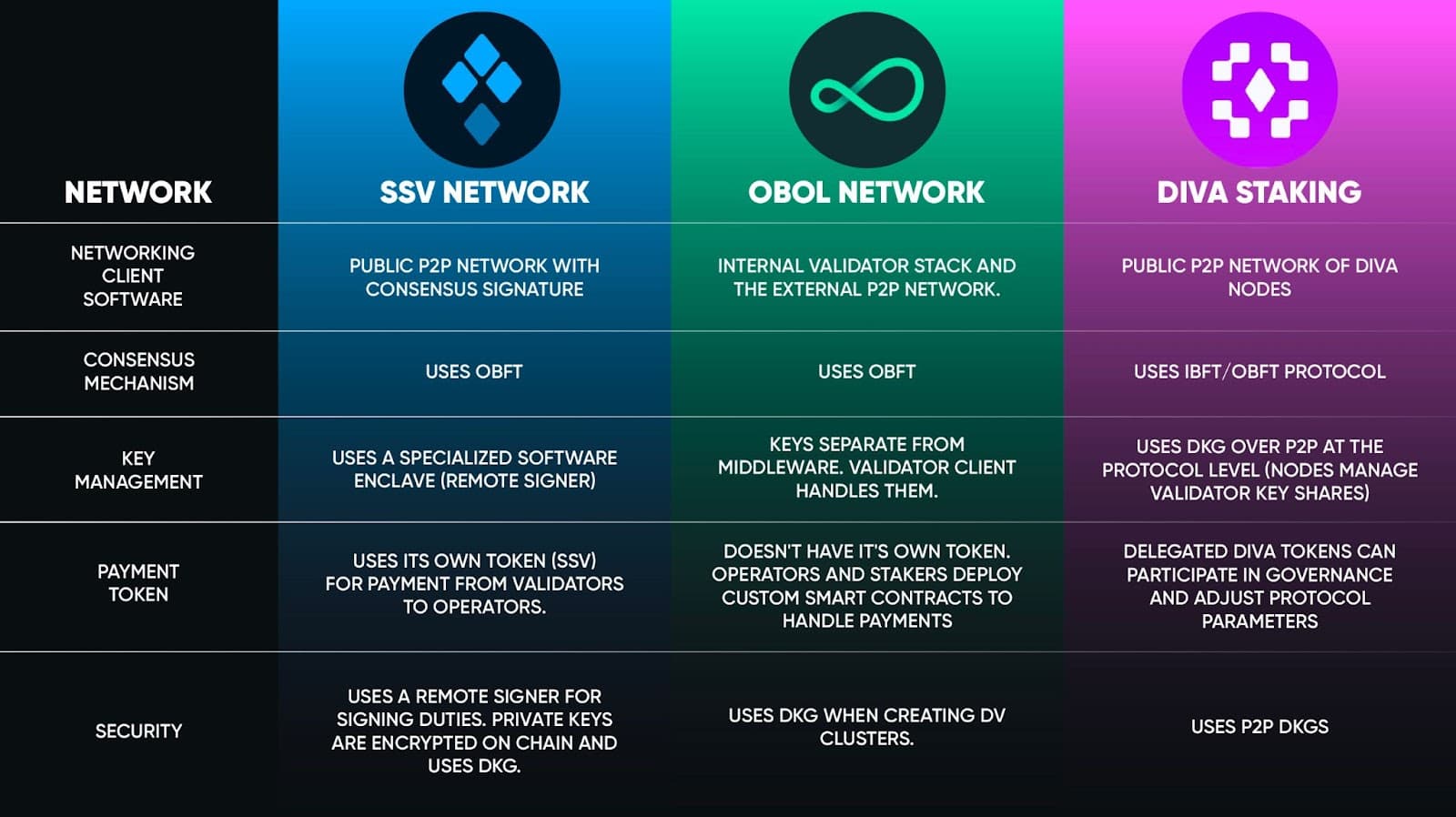

ssv.network

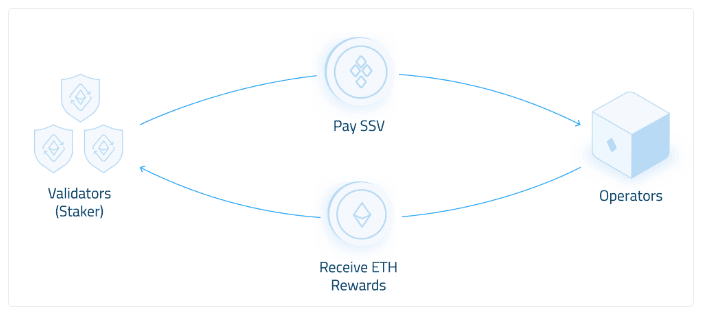

ssv.network is a project that offers DVT-as-a-service as its main product. The protocol establishes a system of incentives and a technical foundation for the development of a decentralized network of validators. The key participants in this network are:

- stakers (validators) – Ethereum validator owners who want to link a DV cluster to their node;

- operators – users who install SSV nodes on their equipment and are responsible for maintaining them.

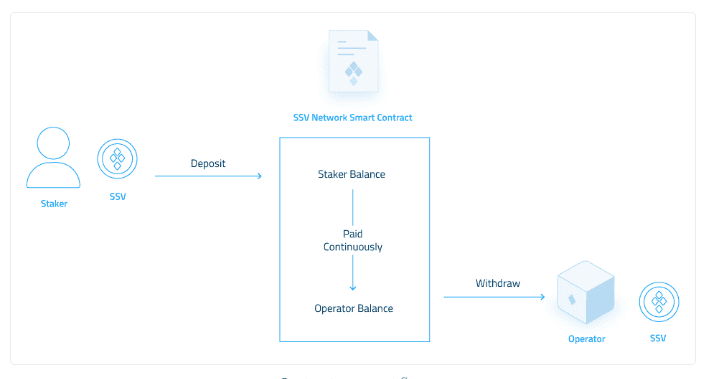

Stakers can choose a cluster whose members will receive fragments of the private key. Each cluster is managed by multiple operators, including verified operators who are identified separately. Once the validator is activated and the subnetwork is connected, the staker pays a service fee to the operators in the site’s tokens. Please visit the project website to see the list of available clusters and operators.

The concept is to offer validators a ‘cluster-as-a-service’. This allows operators to generate revenue through their DV nodes.

To access the protocol, participants must register special accounts through which mutual settlements are made. Currently, the project operates in an open mode, and creating an account doesn’t require approval. Thus, any validator or operator can join the service.

To pay the operators, the staker must hold platform tokens in their account balance. If the staker becomes insolvent, their account will be liquidated and the validator service will be terminated.

A representative from ssv.network, interviewed by Incrypted, stated that when a validator node is liquidated, it becomes inactive and gets removed from the Ethereum node list. The owner’s deposit is not subject to slashing and remains intact.

This operational model helps integrate ssv.network as an extra layer for Ethereum validators already running or being built, whether they’re solo-stakers or protocols like Lido. According to developers, this simplicity and modularity are appreciated by projects, as it allows for rapid increases in resilience and decentralization without the need to build their own infrastructure from scratch. They can effortlessly connect the protocol clusters and pay operators.

Obol

Obol is an infrastructure project for DVT development. Unlike ssv.network, it offers software and tools to operate and manage decentralized validator subnets, rather than a platform to buy clusters.

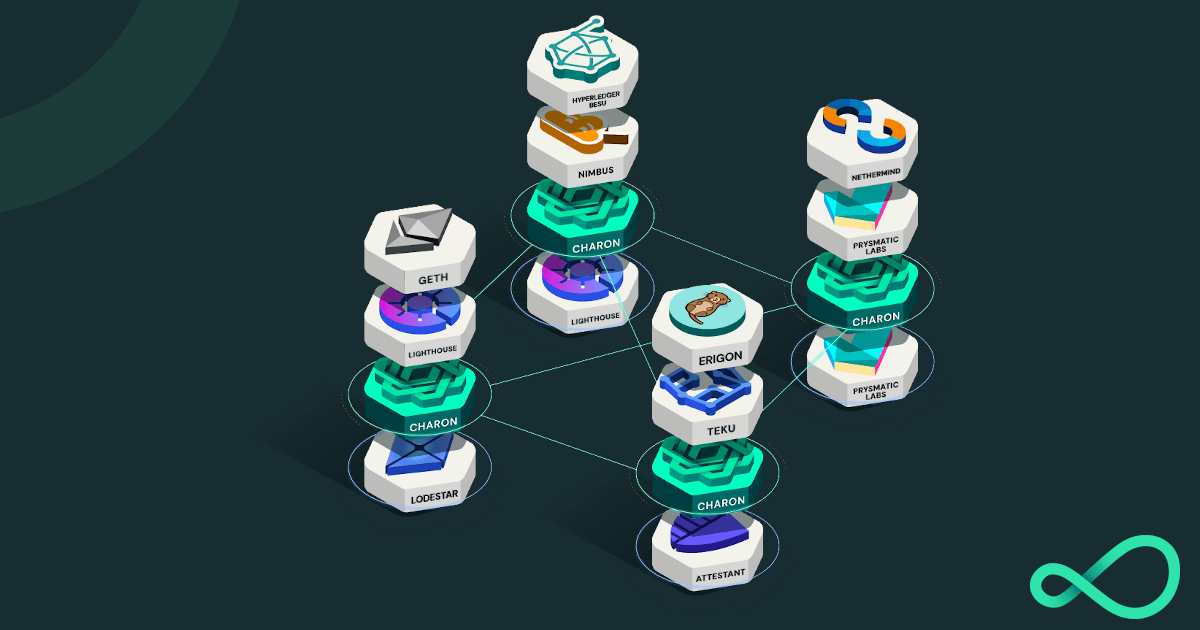

Obol has its own software implementation and a web interface for creating and participating in node clusters. To start an Obol node, the user must install a full Ethereum validator node and a Charon client responsible for communicating on the DV subnet.

Oisín Kyne, co-founder of Obol, told Incrypted that Charon acts as middleware between a validator client and a consensus client. The client assists in generating and distributing keys but does not have access to them at runtime, reducing the risk of cluster utilization.

Obol targets professional operators and solo-stakers who want to connect to DVT. The service offers a dashboard with a web interface and clear instructions for creating a cluster alone or with others.

Kyne stressed that the team plans to launch initiatives to make operator interaction easier and help create clusters. This should stimulate sub-network formation.

Meanwhile, according to Kyne, Obol doesn’t have a strict settlement system like ssv.network, and it doesn’t plan to introduce its own token. The user determines the distribution of rewards within a cluster by using a set of standard Split smart contracts during its creation. Additionally, Obol doesn’t receive or handle user deposits, so validator funding isn’t part of its protocol.

At the time of writing, Obol is in closed beta test mode. The protocol is available on the Holesky and Goerly test networks, as well as on the Ethereum mainnet. According to the project’s co-founder, you don’t need prior authorization to interact, but there are rules to follow when using the software, set by the creator. Currently, there is a ‘one node – one user’ restriction on launching in the mainnet, but it will be lifted soon.

Additionally, the Lido pilot project utilized Obol’s infrastructure. Obol has been working with the liquid-staking protocol for over two years. It has completed three phases of DVT cluster testing with community operators. The initial 12 Obol subnets for Lido DV have already been activated, and another 12 will be deployed soon.

Diva

Diva is a liquid staking platform with integrated distributed validator technology.

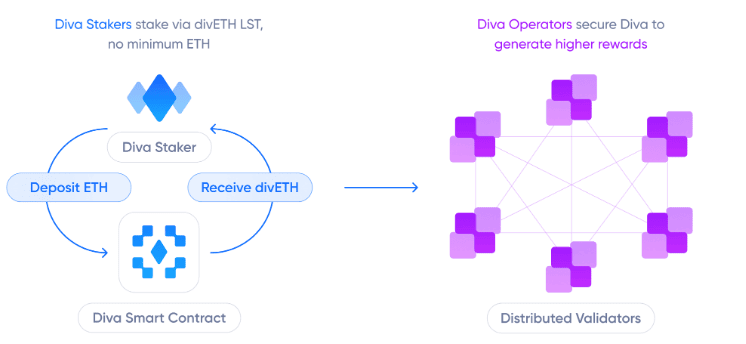

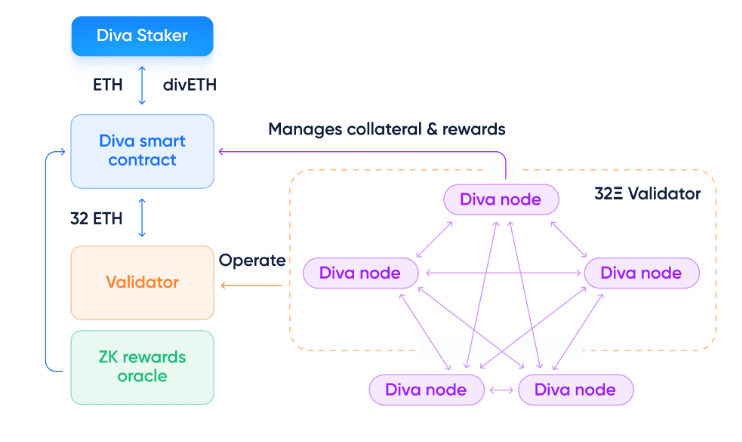

Diva is positioned as an LSD provider. Users can decide if they want to join in developing DVT. The protocol operates as follows:

- The user blocks ETH or stETH and receives a liquid divETH token and a basic staking reward (minus the platform’s commission).

- The user can then use divETH in DeFi to generate more revenue or block it and run a DV node.

- DV nodes form clusters of 16 participants, which are connected to Diva validators.

To begin a DV node, individuals must contribute a pledge of 1 divETH or more. The deposit size affects how likely you are to get the key fragment needed to join the subnetwork. Blocking more divETH increases your chances of being included in the next validator’s cluster and getting extra rewards.

Thus, a two-layer architecture with optional DV clusters is obtained. Even if Diva lacks enough operators for a new subnet, it can work as an LSD provider, paying standard Ethereum rewards to the stakers.

The liquid token model enables the use of the same asset for Ethereum staking and running a DV node. It is unclear if Diva commissions can provide extra rewards to cluster participants.

Note: At the time of writing, Diva is running in test mode. Users can choose to lock ETH in the protocol pool to become early participants. However, the LSD token will only be available after launching on the mainnet. Additionally, it is possible to launch DV notes without making a deposit.

Decentralization of Liquid Staking

Liquid staking platforms dominate Ethereum, accumulating about 90% of all assets blocked in the network’s smart contracts. The business model of these services is based on funding validators with user-raised funds and then receiving rewards for validating blocks.

However, providers of LSD usually outsource the launch and maintenance of new validators. For instance, Lido’s partner network comprises 35 operators. Each has an average of over 8,000 validators.

Yet, many operators are traditional companies that rely on cloud infrastructure. As a result, about 47% of Lido validators use servers from centralized and regulated providers like AWS, GSP, and Digital Ocean.

The case of Hetzer provider demonstrated the consequences of insufficient infrastructure diversification. Hetzer disconnected over 1,000 Solana nodes at once due to a violation of the user agreement.

The risk of social centralization due to LSD for Ethereum appears unlikely. It’s hard to imagine Lido or its operators deliberately attacking a network that brings them profits. The more realistic risks involve technical centralization, like hardware failure, data centers not allowing node maintenance, or key leaks.

DVT fixes weaknesses without needing blockchain upgrades or changes to LSD providers’ business models. So, the latter see the technology as a priority for reducing centralization risks.

For instance, it will enable launching clusters with nodes from various operators or combined with nodes of solo-stakers who make a small deposit and become eligible to receive a portion of the validator’s reward. Additionally, DV might become a must-have or offer extra benefits in the Ethereum ecosystem.

A more centralized approach involves professional operators launching clusters for their own nodes. Yet, even in this scenario, the risks of validator compromise decrease.

Currently, most liquidity-staking platforms are either testing or considering DVT implementation. For example, Lido has tested decentralized validators in trial runs with Simple DVT using Obol and ssv.network clusters. RocketPool is also discussing the chance of launching a similar program. These initiatives show interest in this technology from the major platforms in the segment.

Do Operators Need DVT?

DVT allows for an increase in the number of nodes without affecting the total number of validators. The number of validators depends on the volume of Ethereum in the stack. Traditional architecture needs one full node per validator, while DV needs three or four or even more.

In theory, it’s not necessary (or even preferable) for the validator to run and maintain the entire DV cluster independently, but in the case of professional operators, this is the most likely scenario.

When a 32 ETH pile forms in the LSD platform smart contract, the operator is requested to launch a new validator. If there’s no existing pool of clusters, operators have to create one by launching several nodes. This results in a significant increase in the cost of maintaining the node stack.

The current reward system for Ethereum stakers treats both mono validators and DVs the same, giving them equal rewards despite different costs. Operators will either need to sacrifice some of their profits or raise the node maintenance fee, which stakers will ultimately have to pay.

Even if clusters consist of independent nodes, their owners still need to pay for node maintenance. Thus, the cost of Ethereum infrastructure is likely to increase.

A potential temporary solution to this problem could involve offering incentives through DVT protocols. However, in the long term, it will be necessary to prioritize admission to AVS for distributed validators in order to cover the increased costs, or to revise Ethereum’s DV-aware reward system.

Yet, at present, there aren’t any clear benefits that would convince confident professional operators to raise infrastructure costs. Likewise, there’s no intention to enforce the decentralization of their validators.