What is Liquidity and How Does It Affect the Value of Cryptocurrencies

Cryptocurrencies, like other investment instruments, are influenced by macroeconomic factors, the state of the financial system, and monetary policy. We have already examined how the value of digital assets depends on the US Dollar Index and tthe Federal Reserve’s interest rate, but liquidity is another crucial factor that directly impacts the decisions of all market participants.

The Incrypted team explored what liquidity is, how it is measured, and how it relates to Bitcoin and other cryptocurrencies.

What is Liquidity

In economics, liquidity refers to the property of a good or asset that describes the ability to quickly exchange it for money or its equivalents without significantly affecting its market price.

The definition above suggests that the key component of this measure is the availability of money in a given market. This is why analysts from CrossBorder Capital define liquidity as the sum of cash and credit available in financial markets after satisfying the needs of the real economy.

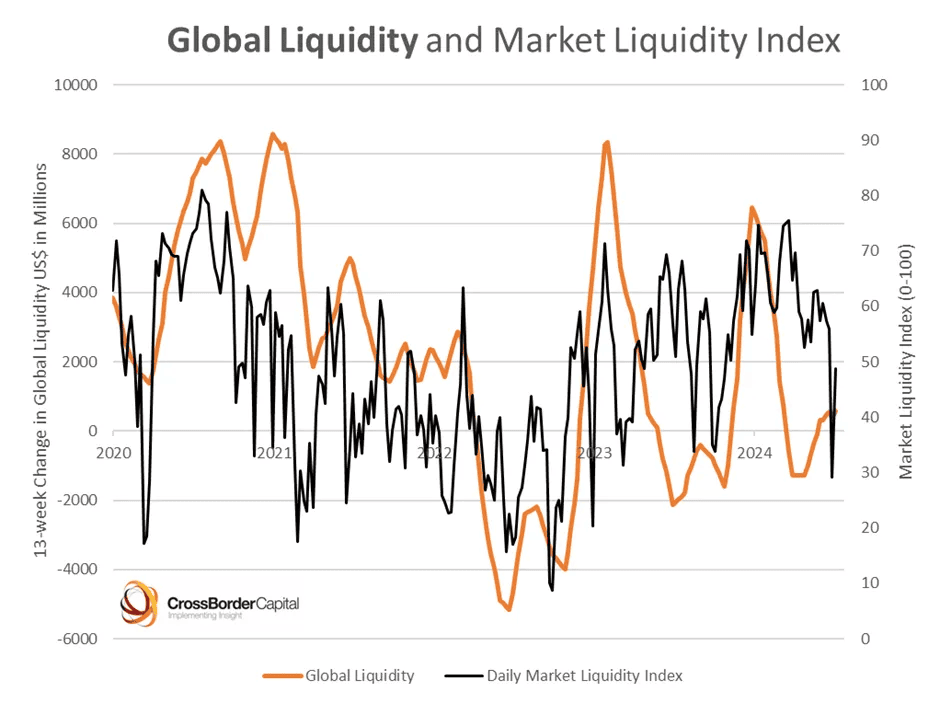

Based on this concept, the company developed its own global liquidity index (GLI), as well as related financial and economic indicators such as the market liquidity index.

A similar principle applies to the Global (World) Monetary Supply, which tracks the balances of central banks in the most populous countries. In other words, it reflects the available money supply in the markets; however, unlike the GLI, it does not account for loans and indirect factors that influence the index.

For the cryptocurrency industry, the primary role is played by dollar liquidity, which is due to both the overall significance of this currency for the global economy and its dominant position in digital asset markets. According to CoinMarketCap, at the time of writing, two US dollar-pegged stablecoins — USDC and USDT — account for over 80% of total trading volume, and most services use dollar-denominated asset values during transactions.

The importance of dollar liquidity for the crypto market has been repeatedly highlighted in essays by Arthur Hayes.

How is Liquidity Measured?

To measure liquidity, this indicator needs to be broken down into components. Based on the definition provided earlier, the factors that affect the liquidity of an asset include:

- The time required to execute a sale;

- The difference between the actual and nominal value (slippage).

Accordingly, the less time required to complete a transaction and the lower the price gap, the higher the liquidity. As Nasdaq notes, this also means cheaper conversions. The most liquid assets, according to Forbes, include cash, government bonds, certificates of deposit, stocks, and some other instruments.

For example, if we compare Bitcoin and a spot Bitcoin ETF from the perspective of a management company, the latter’s shares are less liquid compared to the underlying asset, as the full redemption cycle takes much longer than buying or selling cryptocurrency on an exchange. However, the end buyer might not notice the difference due to the presence of a liquid derivatives market.

To determine the liquidity level in a specific market, traders can use statistical data such as trading volume, price spreads, the depth of the order book at various levels, and average transaction execution times. Based on these, liquidity indices for individual assets are formed, such as the BLX.

If there are no restrictions related to legal formalities, asset specifics, and other non-economic reasons, two main liquidity characteristics — time delays and slippage — are influenced by demand. That is, the availability of enough people willing to exchange the asset for money.

This is why most global liquidity indices are based on the available money supply that economic participants can use in their transactions. And since the volume and availability of the money supply are controlled by central banks and other financial regulators, they partially influence liquidity.

However, it’s important to note that the correlation between regulator actions and global liquidity, as well as liquidity in specific markets, may not be uniform. Some assets may experience a liquidity crisis even during overall liquidity growth.

What Affects Liquidity?

As mentioned earlier, common global liquidity indices essentially equate liquidity with the available money supply, which doesn’t always accurately reflect the market situation. Analysts from the Mises Institute propose a more complex and comprehensive approach, viewing liquidity as a balance between the money supply, economic activity, and inflation.

Money Supply

Typically, there is a strong direct correlation between the volume of the money supply and liquidity, as confirmed by data from CrossBorder Capital.

The Mises Institute points out that this relationship is based on the function of money as a universal medium of exchange and the assumption that participants in economic relations have no incentive to hold excess money. As a result, they seek to get rid of it by exchanging it for goods or services.

Consequently, when the money supply increases through cash issuance, credit creation, or other methods, this surplus flows into the markets, thereby increasing the liquidity of assets. Over time, this indicator stabilizes as prices rise.

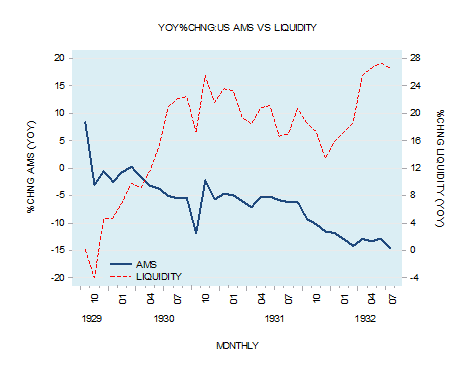

In the case of a reduction in the money supply while the number of goods and services remains the same, the reverse process occurs—demand for money as a medium of exchange increases, causing market participants to exchange their assets for cash. As a result, liquidity decreases, which is gradually balanced by falling prices.

Economic Activity

Economic activity refers to the pace of production of goods or services. In terms of liquidity, if money represents the demand side, economic activity represents the supply side.

Thus, if the growth of the money supply is accompanied by an increase in the number of assets on the market, the liquidity indicator remains unchanged. Conversely, a slowdown in economic activity, even without additional currency issuance, leads to increased liquidity because there is more money relative to available assets. And vice versa.

As with changes in the money supply, the elimination of excess liquidity or the compensation for its shortage happens through rising and falling prices, respectively.

Inflation

The IMF defines inflation as the rate of price increases for goods and services over a specific period.

As mentioned earlier, inflation results from rising liquidity in the market, either due to the issuance of money or the reduction of production, and is necessary to eliminate the excess supply of the medium of exchange. Accordingly, inflation and liquidity have a direct correlation, which is not always true for the relationship between inflation and money supply growth.

The Mises Institute suggests calculating the impact of the above factors on liquidity using the following formula:

liquidity growth = money supply growth – economic activity growth – inflation growth

In simpler terms, according to the Mises Institute, liquidity is the volume of issued money adjusted for inflation and the pace of production of goods. Equating liquidity solely with the money supply is not entirely accurate, as in some situations, they can have an inverse correlation.

What Does the Central Bank’s Rate Have to Do with It?

Changes in liquidity are often associated with fluctuations in the central bank’s interest rate, particularly in relation to the Federal Reserve (Fed). The connection is not always obvious, as lowering the rate itself does not directly result in money issuance. However, the Fed, for example, influences several aspects through its regulation of federal funds:

- The yield on excess reserves held on the central bank’s balance sheet;

- The payout amounts on government bonds and Treasury bills;

- The cost of commercial loans and mortgages.

The first two points relate to liquidity “accumulators” like government debt andthe reverse repo program. The higher the yield on these instruments, the more incentive investors have to invest in them, and the fewer excess funds flow into other markets, such as stocks. Accordingly, by lowering the rate, the regulator “releases” this liquidity, pushing cash flows toward more profitable investment opportunities.

The third point affects the availability of bank lending, which is the primary mechanism for money supply creation in developed economies. High rates reduce demand from companies and individuals, as borrowing becomes “expensive,” while lowering the rate stimulates demand and increases the total volume of credit. Thus, lowering rates accelerates the growth of the money supply (and liquidity), while raising rates slows credit growth and partially withdraws liquidity from the economic system.

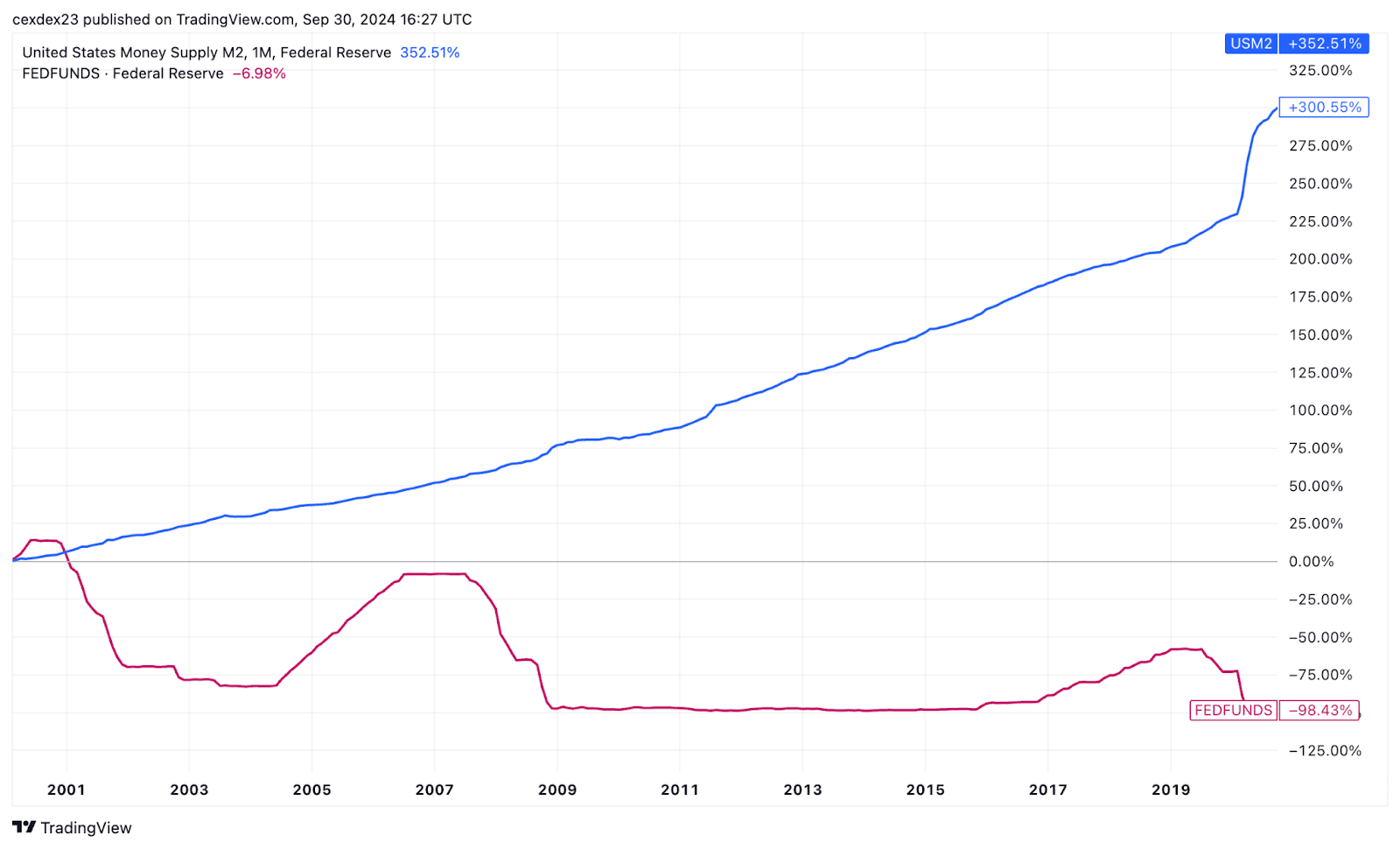

However, as illustrated by the graph above, the most significant influence on the money supply comes from direct or hidden currency issuance by the central bank within economic stimulus programs.

How Liquidity Affects Asset Prices

The overall mechanism by which liquidity impacts prices was essentially outlined in the previous section. It boils down to the fact that an increase in the volume of free money in the market, while the amount of goods and services remains the same, leads to a rise in their value, triggering an inflationary mechanism.

At the core of this process is the previously mentioned rule that participants in economic relations seek to eliminate excess cash, thereby distributing all available money supply across markets and assets.

A similar mechanism is utilized in DeFi liquidity pools. For instance, if the volume of stablecoins in an ETH/USDT pool sharply increases relative to the cryptocurrency, the value of ETH will proportionally rise. The difference, however, is that while providing liquidity in DeFi requires holding both tokens, participants in TradFi are not bound by this rule and can allocate large amounts of both cash and assets separately in the markets, creating an imbalance between supply and demand.

The key question is where the free money supply is directed first and how it moves between markets thereafter. The answer depends on numerous factors, including:

- The mechanism of creation and distribution of the money supply;

- Regulatory requirements regarding risk profiles and investment objects for financial institutions;

- The availability of certain instruments to economic participants;

- The pricing mechanism for various assets.

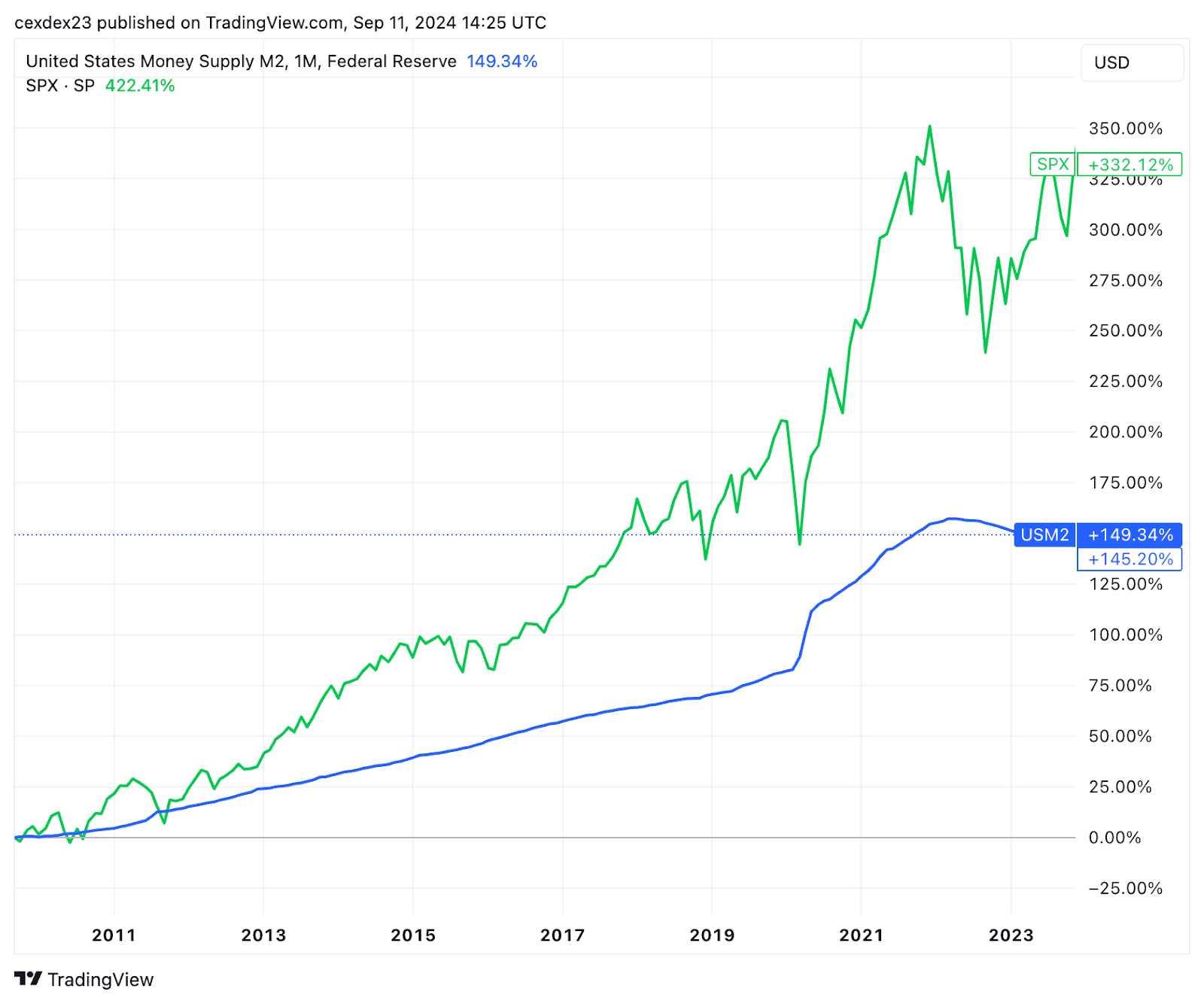

The correlation between the growth of the money supply and the growth of a specific market is generally formed based on historical data. For instance, the graph below reflects a strong relationship between the supply of US dollars and the quotations of the S&P 500 index.

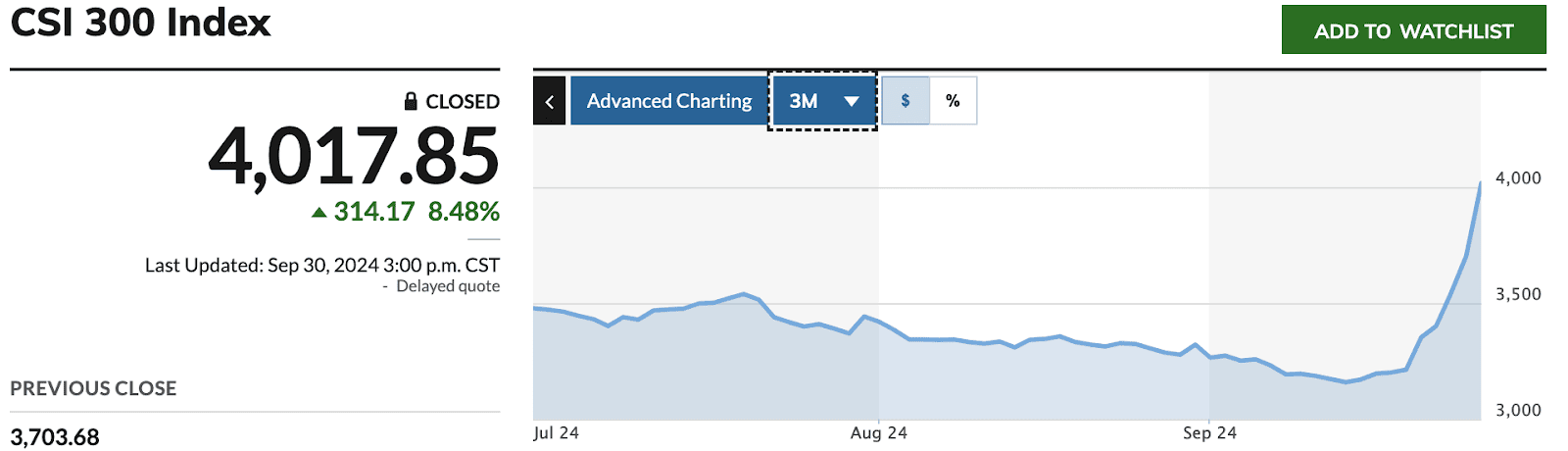

In each major economy, certain assets respond more quickly or strongly to an increase in the money supply. For example, the CSI 300 Index (the Chinese equivalent of the S&P 500) experienced a rapid increase after the People’s Bank of China announced the largest financial stimulus package since the COVID-19 pandemic, aimed at pulling the economy out of deflation.

The movement of liquidity between countries and assets is not always obvious and is a subject of research for experts. An example is the carry trade funded in yen, which effectively facilitates the outflow of money from Japan’s economy to the US bond market.

Given the complexity and diversity of available assets, mechanisms for directing liquidity, and regulatory features in each country, it is challenging to predict in advance the impact of an increase in the money supply on a specific asset. This is why assessments are often based on prior historical experience.

Growth of Liquidity and the Price of Bitcoin

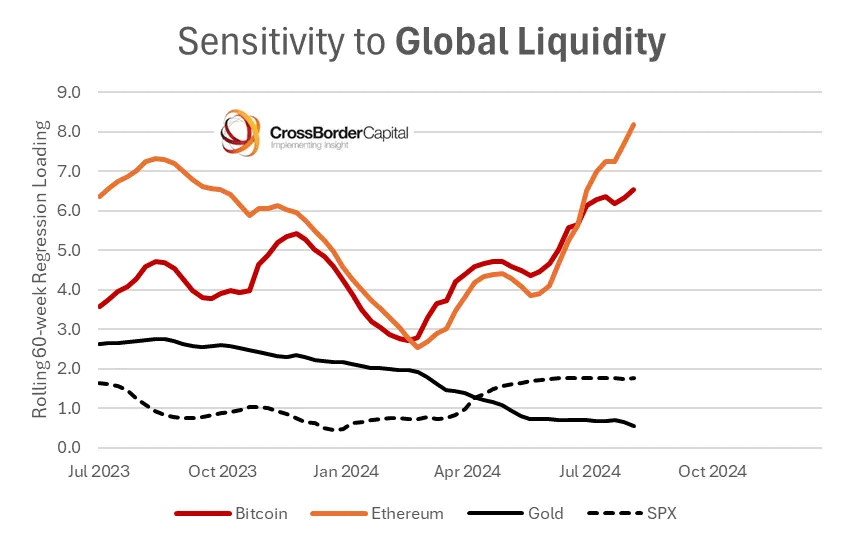

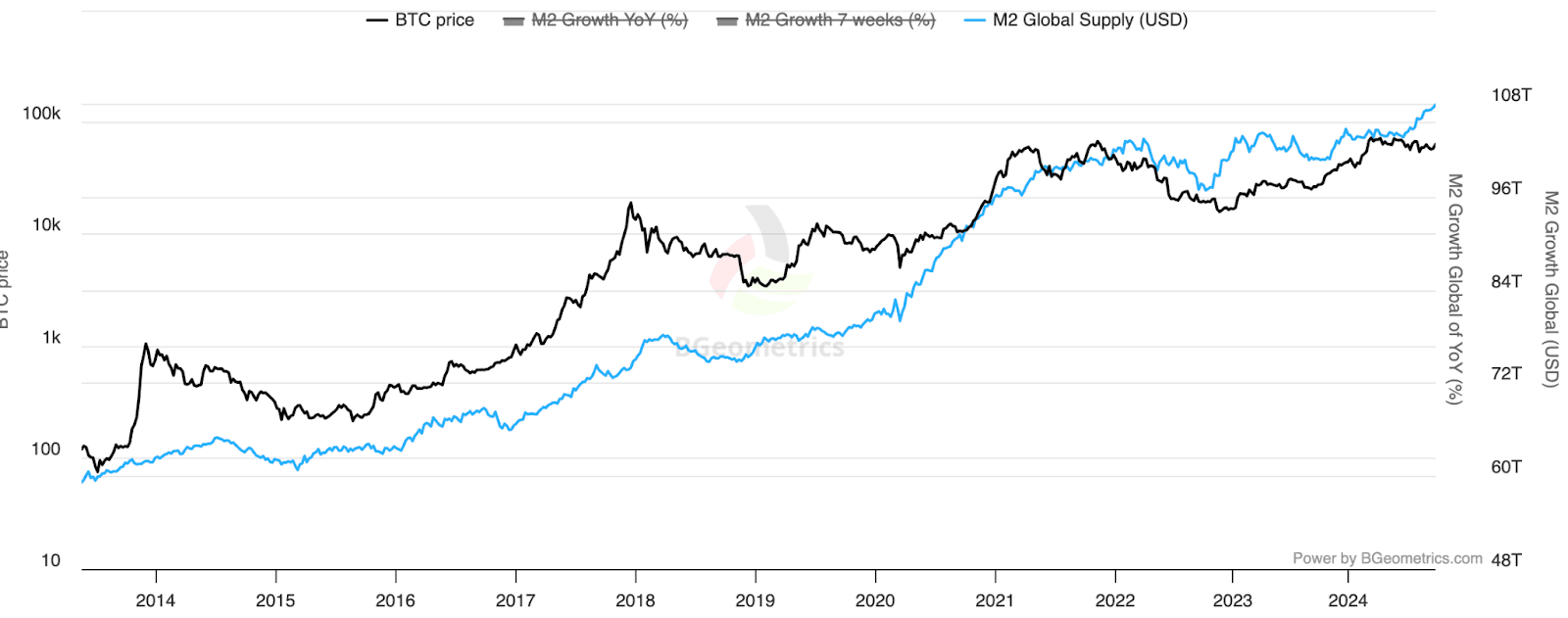

In his essay “The Bullrun… is delayed,” Arthur Hayes expressed the opinion that Bitcoin is one of the most sensitive instruments to market liquidity. This is generally confirmed by the quotations of the first cryptocurrency and data from CrossBorder Capital.

Hayes also refers to Bitcoin as a “pressure release valve” for excess fiat funds, which he believes arise from governments’ attempts to suppress volatility in the markets and the consequences of unpredictable events. The most vivid illustration of this is the comparison of the value of the first cryptocurrency and the money supply of the largest global economies.

Neither Hayes nor the analysts at CrossBorder Capital explain why Bitcoin demonstrates such a strong correlation with liquidity and the growth of the money supply. This is likely due to the positioning of the first cryptocurrency as “digital gold” and its limited supply, causing it to be perceived by many investors as a safe-haven asset.

Moreover, due to the use of faster and more open blockchain infrastructure, as well as fewer regulatory restrictions in many jurisdictions, Bitcoin is more accessible compared to traditional gold or stock market assets. This is particularly relevant for retail investors who can invest in cryptocurrency to protect their savings even without access to banking services or brokerage accounts.

Notably, statistical data reduces the dynamics of Bitcoin to just one variant of increasing liquidity — an increase in the money supply — despite the fact that we already know liquidity can also rise due to a decline in production. However, neither in March 2016 nor in February 2020 or 2023 did the value of the cryptocurrency rise, despite a slowdown in global economic activity during these periods while the money supply remained unchanged. This confirms Bitcoin’s prevailing anti-inflationary significance.

Ultimately, the volume of the money supply and the liquidity it creates is one of the main indicators of Bitcoin’s growth and the cryptocurrency market as a whole. While it is difficult to say for certain what causes the prioritization of digital assets among other instruments when investors allocate excess cash, statistical indicators suggest that alongside the stock market, the first cryptocurrency shows active growth every time governments turn on the “money printer.”