The “Ultimate” Stage of Evolution: How the Concept of Airdrops Has Changed and What’s Next

The first-ever airdrop in the crypto industry was conducted by the AuroraCoin protocol in March 2014. The team wanted to distribute the AUR tokens among Iceland residents to encourage them to use it as a payment method.

In 2020, the decentralized exchange Uniswap carried out the first “retroactive” airdrop (or retrodrop), rewarding the community and distributing the governance token UNI to a large number of people at the same time.

By 2024, airdrops had become the most popular way to launch tokens and attract users. “Hunting” for the rewards from these campaigns had even turned into a professional activity.

The market has gone from free airdrops as a “thank-you” to users of different protocols to point farming, inflated user expectations, and the fight against multi-accounting. The Incrypted team looked into how this concept is changing, why developers are complicating the criteria for token recipients, and whether this helps achieve the desired results.

The Evolution of Airdrops

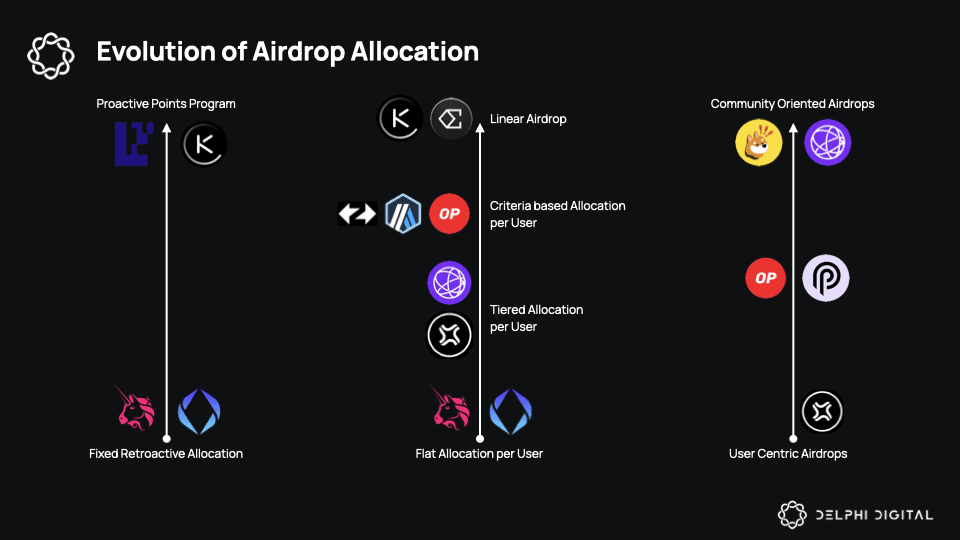

Analysts at Delphi Digital believe that airdrops have evolved in several directions. However, in the context of the distribution mechanism itself, four main archetypes have formed: based on participation, user categories, the value of actions, and a points system. Let’s take a closer look at each of them.

Classic Retroactive Airdrops

One of the first projects to use an airdrop to reward the community and distribute tokens was the decentralized exchange Uniswap, which announced the campaign in September 2020. It was notable because:

- users didn’t know about the developers’ plans in advance;

- the reward was received by 90% of the addresses that had interacted with the protocol’s smart contract at least once.

This made Uniswap a canonical example of a retrodrop, where the tokens serve as a reward tool, but are not an incentive for interaction, since any activity is rewarded post facto.

The minimum reward for Uniswap users was 400 UNI, which was valued at around $1,400 at the time of launch.

Distribution by User Categories

This is a more complex distribution model that involves dividing users into several categories based on their activity and the value they provided to the project. But the key principle of retroactive airdrops — no prior promises about launching or distributing tokens — is still maintained.

One of the most well-known examples of such a distribution is the Aptos campaign. The developers divided the audience into two groups:

- users who applied to be validators on the testnet received 300 APT;

- participants in the APTOS:ZERO NFT mint on the testnet received 150 APT.

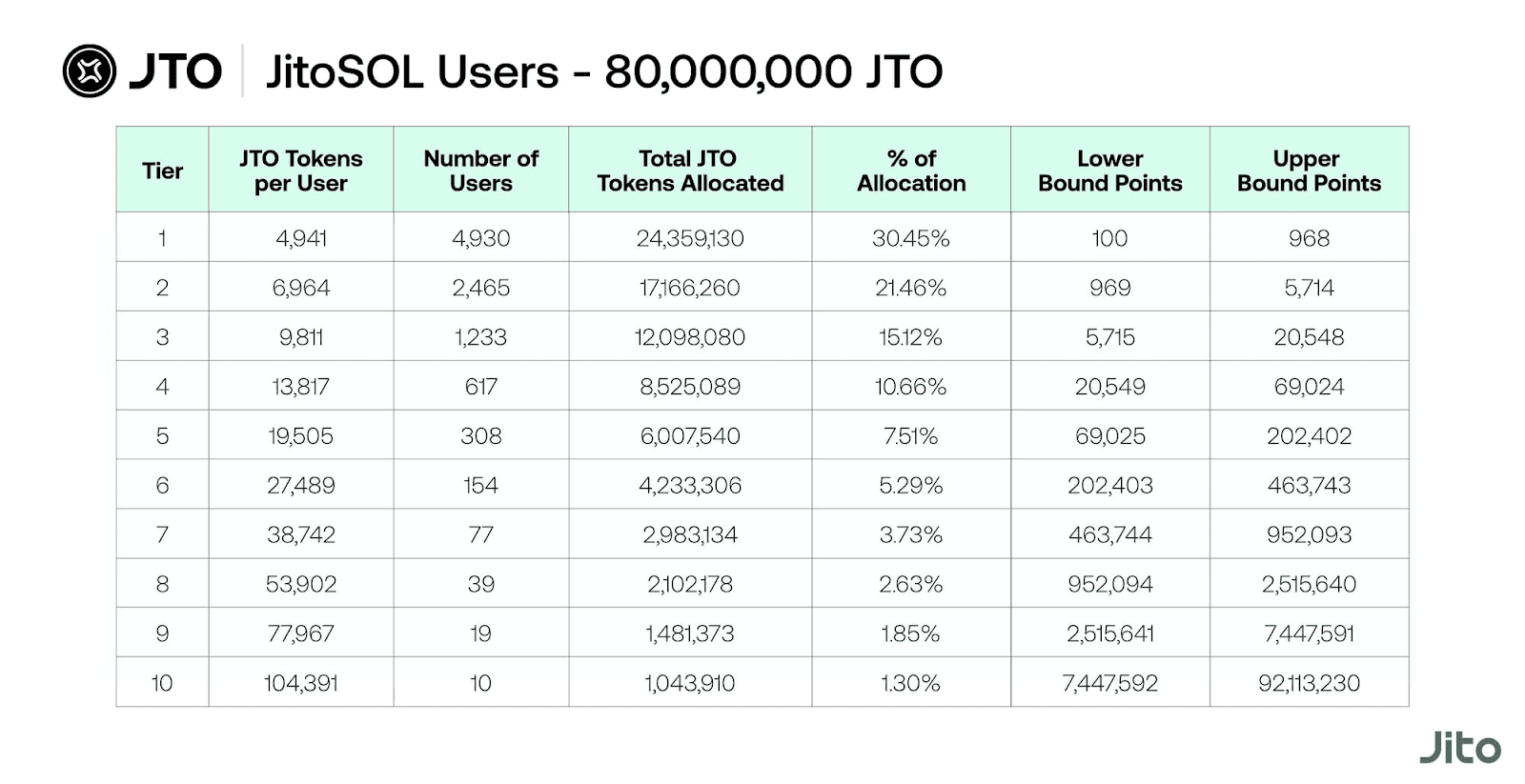

In December 2023, the Solana liquid staking protocol Jito used a modified version of this approach, dividing participants into several categories and then adding a tiered system within each one.

Distributions Based on Action Value

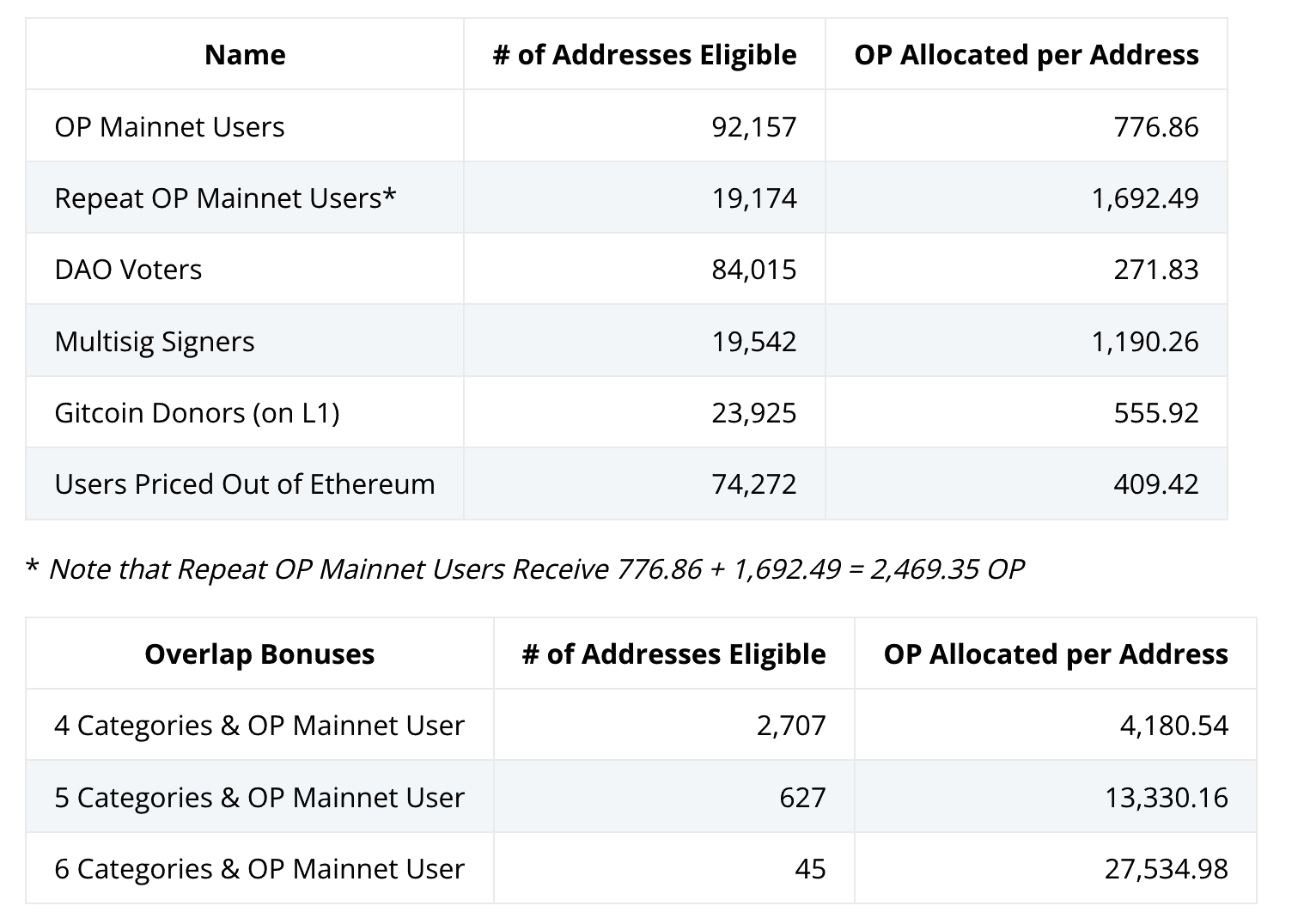

A slightly different approach was used by the teams of the L2 projects Arbitrum and Optimism in 2023. They introduced categories of actions, each of which provided a certain amount of tokens as a reward. This created a more flexible distribution model where the allocation size for each participant depended on their on-chain activity.

The Arbitrum airdrop is also notable for the fact that the team used scoring system for addresses based on points, which then were converted into tokens. However, the details of this system were not publicly disclosed, so users couldn’t know in advance which actions they needed to perform and how they would be evaluated.

Point-Based Distributions

Another distribution method is point-based programs. This mechanism involves a campaign to attract users, during which active addresses receive points for performing certain actions.

At the same time, participants know in advance how many points they’ll get for each action, and the developers can dynamically change the reward size, thus prioritizing certain types of activity.

The mechanism for converting points into tokens, as well as the exchange rate, is set by the team and can be combined with the solutions mentioned above. For example,in the Renzo protocol campaign, users earned points, and the token distribution was based on levels.

Projects using point programs include Blast, Ethena, EigenLayer, and most other new protocols. The rapid spread of this model in 2024 effectively displaces retroactive airdrops with unknown conditions.

Searching for Balance

At first glance, teams are trying to change the mechanism to ensure a more fair distribution of rewards in proportion to each user’s contribution:

- the Uniswap team conducted a retrodrop for 90% of addresses that had interacted with the protocol at least once, filtering out only the most insignificant transactions;

- the Jito developers introduced a tiered system so more active addresses could get more tokens;

- optimism developed this approach, determining the distribution size for each wallet based on its actions.

In theory, these mechanisms aim to reduce the number of dissatisfied users and build a stronger and healthier community. However, for these goals to be achieved, the audience must perceive airdrops as a reward for the value provided, not as an incentive for interacting with the platform.

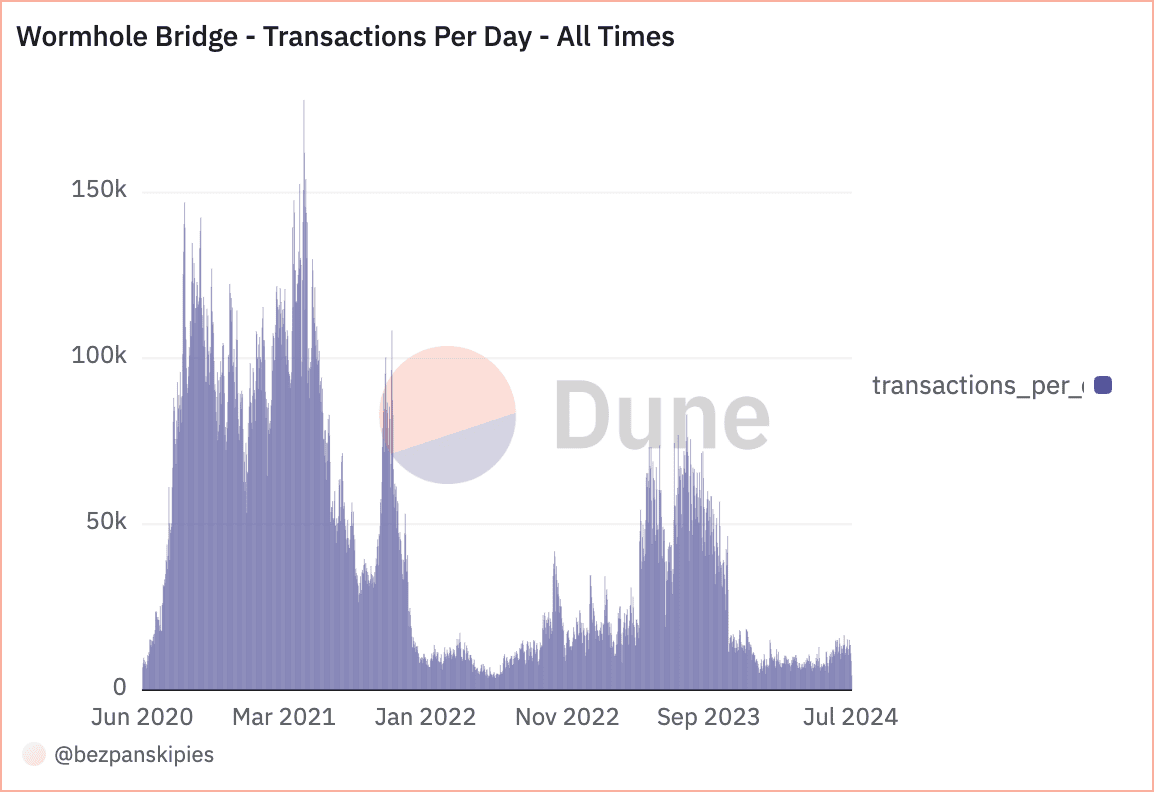

An example is the cross-chain Wormhole protocol, which distributed tokens in March 2024 without any prior marketing campaign. Since in this case the audience growth was organic — people were interested in the product — the airdrop had virtually no impact on the user base size and, as a result, the transaction volume in the ecosystem.

The volume of transactions conducted through the protocol’s largest cross-chain bridge Portal has not decreased either.

The situation began to change after the Aptos, Optimism and Arbitrum campaigns, which were carried out with a relatively small time gap and had very generous rewards.

Deliberately or accidentally, the teams of these projects reinforced the community’s confidence that every new app should launch a token and distribute it, thus forming the concept of “default airdrops”.

The change in perception is even demonstrated by the Arbitrum case. The project team stated several times that there were no plans to launch a token, but against the background of the actions of the Aptos and Optimism developers, the community remained confident that the project would follow the same path. And, in the end, it turned out to be right.

Another example is Sui — the project faced user discontent after refusing an airdrop in favor of a token sale.

Probably, the main reason for the emergence of the “default distributions” concept is that they more effectively solve the “cold start” problem. User activity increases significantly if people are confident in the future reward, and retroactive airdrops do not give this confidence. However, the risk of corruption of incentives also increases, as rewarding becomes a priority over the product itself.

Airdrops have similar or even identical goals to farming — to attract users' activity to the protocol and to insentivize them. The key difference is that retrodrops are historical activity, while farming occurs in real-time.

I believe these are the two main mechanisms, and developers use both because, often in the beginning, a project may already have activity, users, and some level of success and only then the token appears. To reward early participants, a distribution is made. However, the goals are essentially very similar.

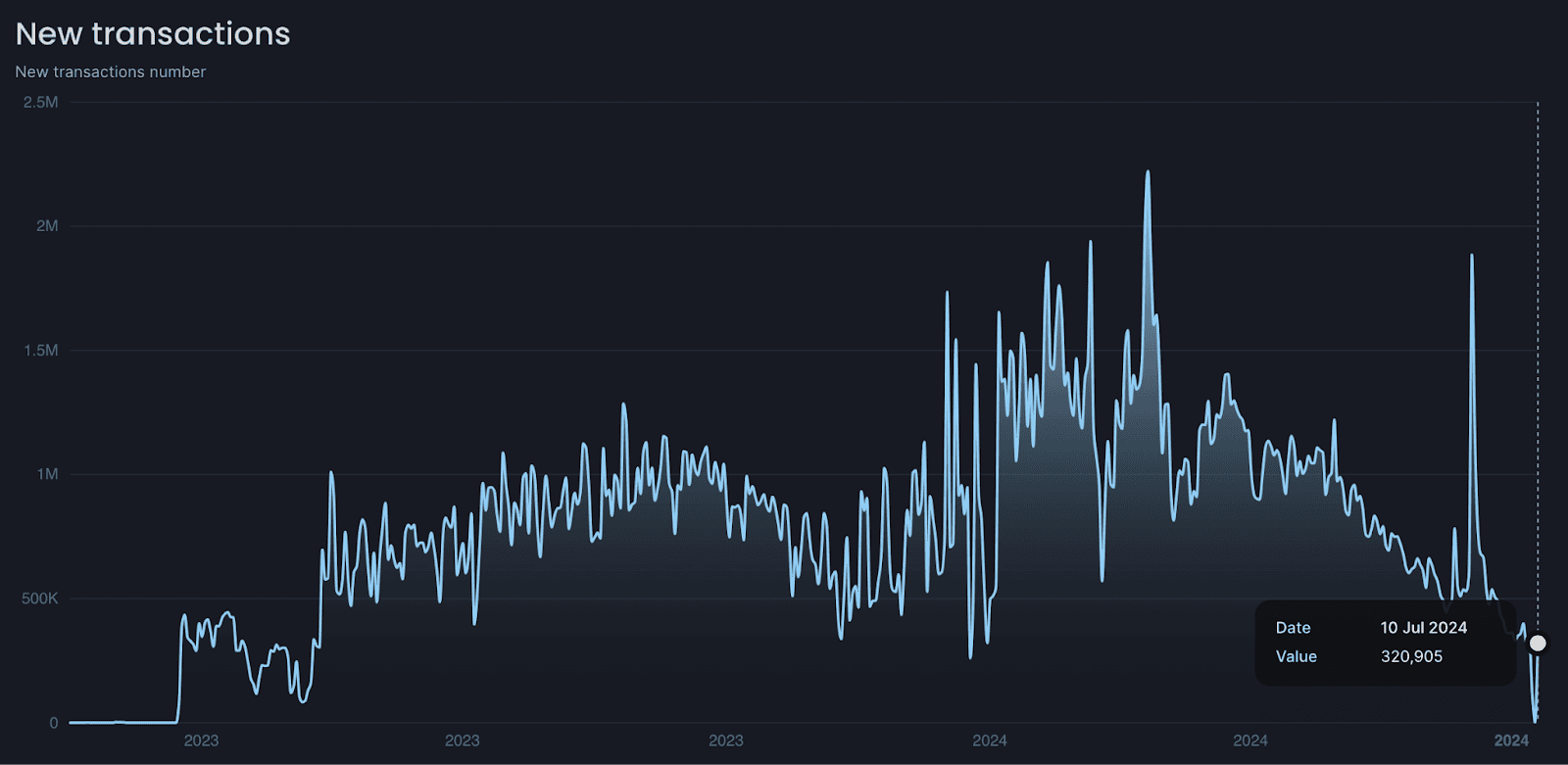

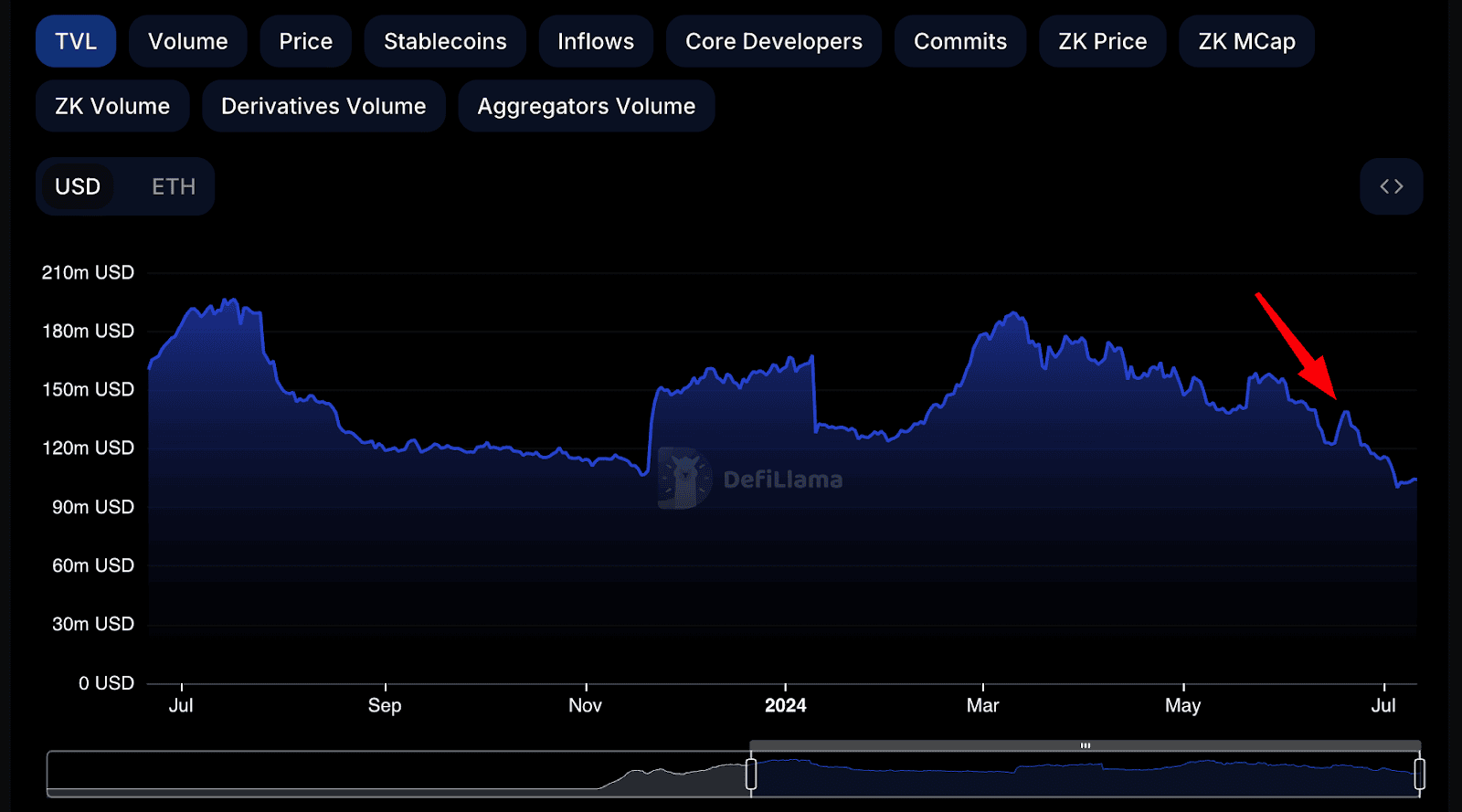

The advantages and disadvantages of this approach are demonstrated by the ZKsync distribution, carried out in June 2024 after long efforts to attract an audience. For example, the number of new transactions after the airdrop began to decline sharply, reaching the mark of 320 000 at the time of writing this article, which is about five times less than on the first day of the campaign.

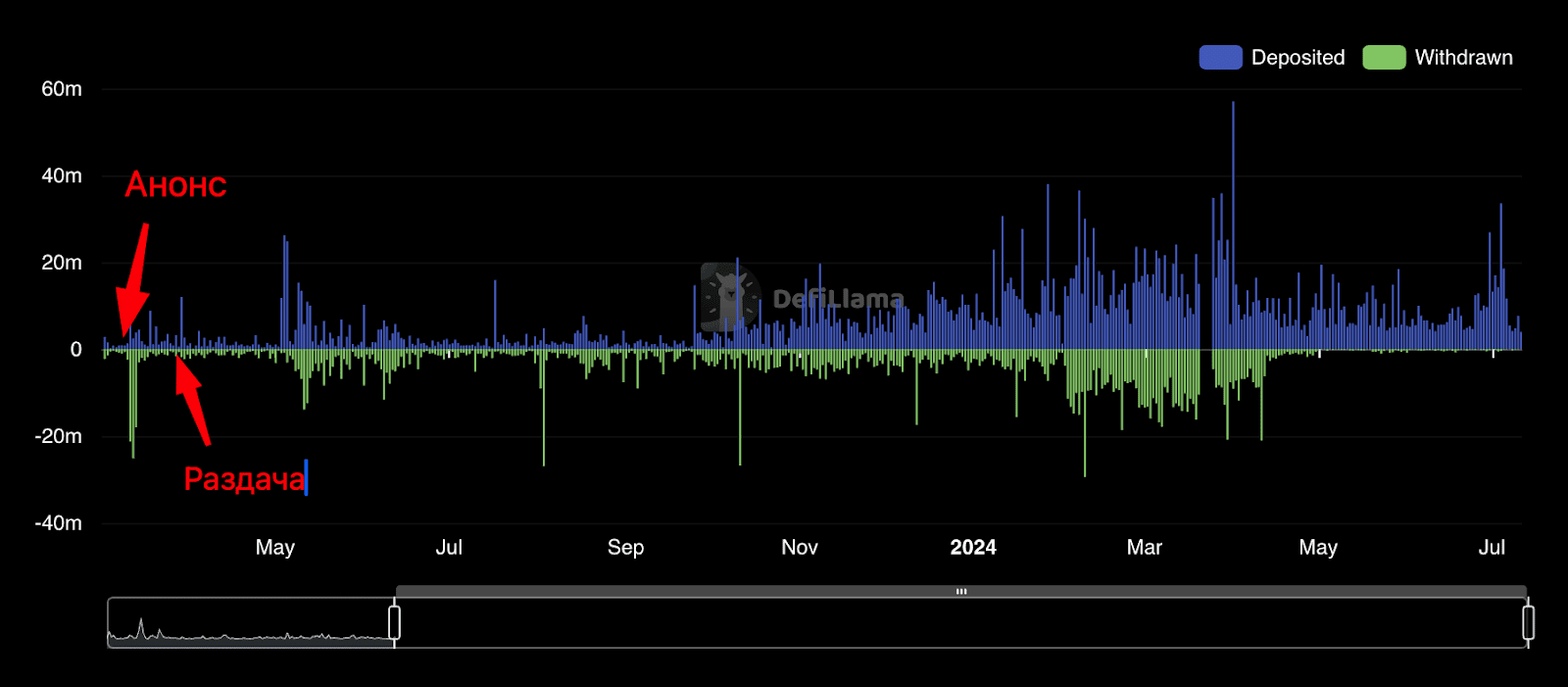

After the token distribution, the total value locked (TVL) in the project’s smart contracts also decreased. However, this decline occurred within the context of an overall downward trend.

The transition to points-based programs has really cemented this utilitarian approach, leaving the retrospectivity of rewards in the past. Now the participants know in advance for which specific actions the team is ready to distribute tokens.

The HOT Protocol team noted that the airdrop proved to be an effective marketing tool for attracting users. While market entry strategy and community incentives are also important, the primary focus is on attracting liquidity and engaging users based on their expectations of the distribution, a project representative added.

On one hand, points give developers a quick way to attract users. On the other, it massively reduces audience quality, since the reward becomes the priority, not the product itself.

According to the HOT Protocol team, the points system is not a perfect solution either. The project representative explained that such a model solves some problems of retroairdrops — for example, it clarifies the distribution criteria. However, at the same time, the mechanism has obvious disadvantages. In particular, it allows the use of automated services for farming points, which reduces the value of participation and can negatively affect the quality of the attracted audience.

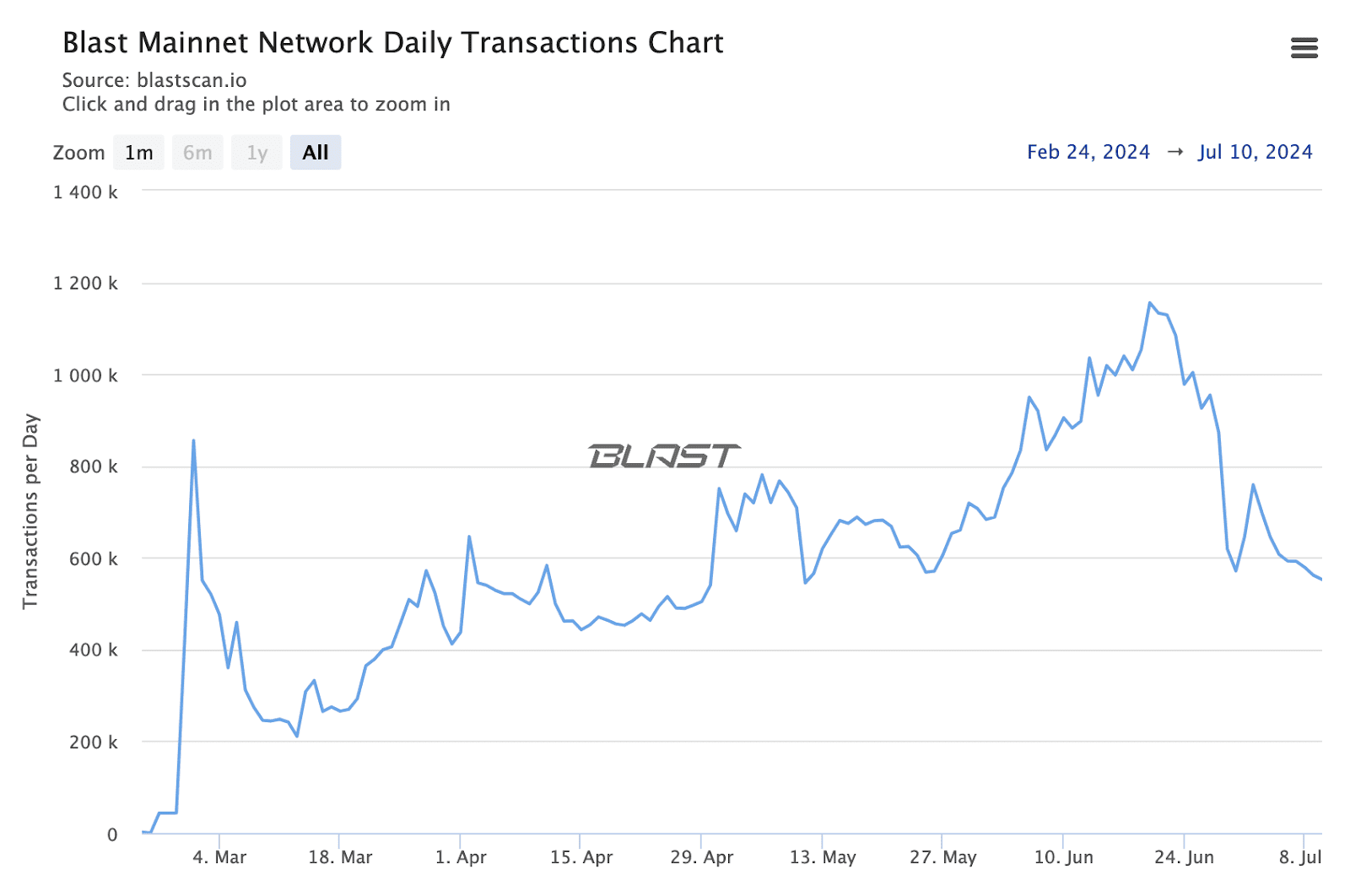

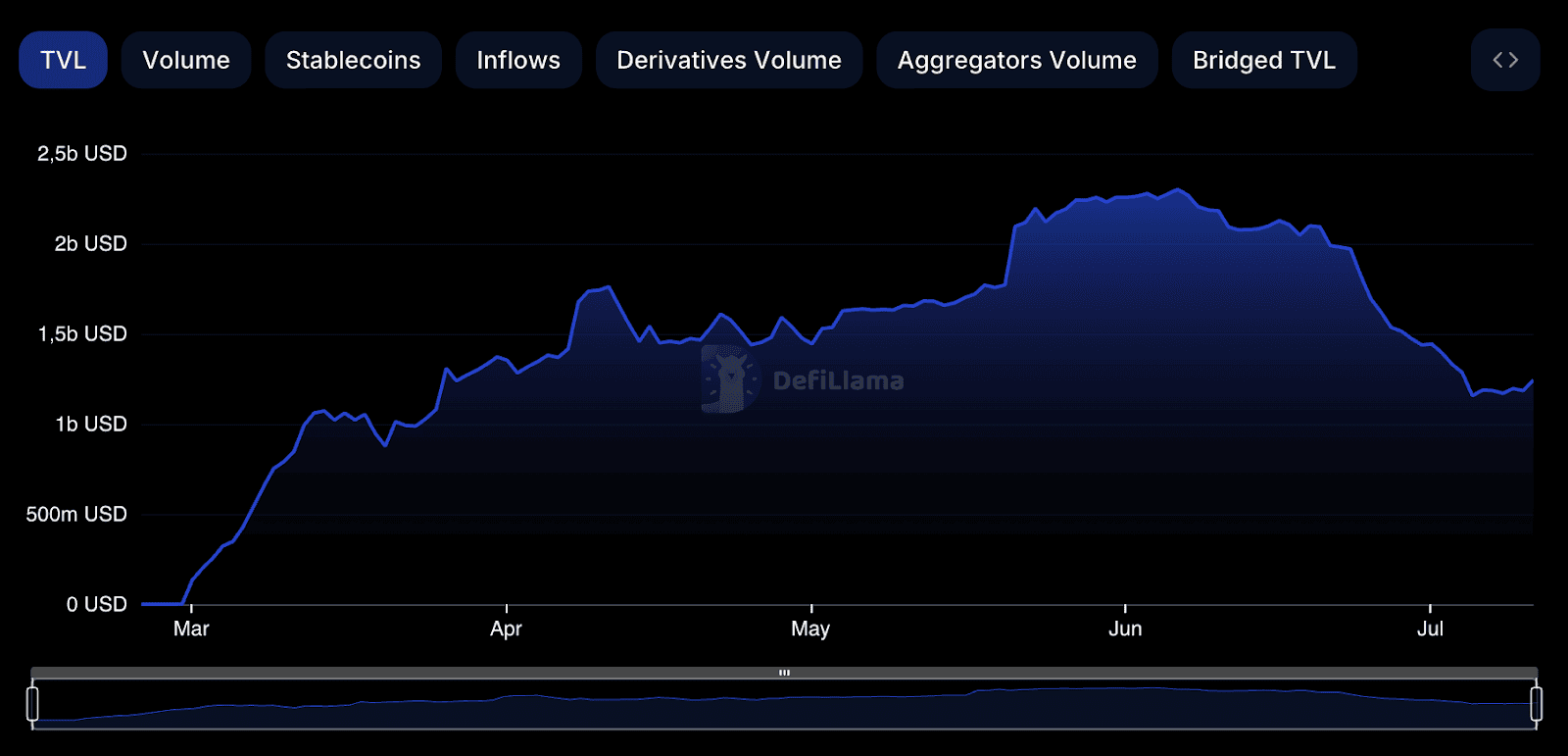

An example is the Blast project, which distributed tokens in June 2024 based on the results of a four-month campaign. The number of transactions in the network reached its peak on the eve of the airdrop announcement, after which it began to decline rapidly, reaching the mark of 550 000 at the time of writing, which is half the maximum values.

A similar trend is also being observed in the network’s TVL.

It is important to note that Blast, despite the launch of the token, continued the program of accruing points, which may contribute to the retention of users and capital in the network.

In general, in the light of the changing perception of airdrops, it’s evolution looks like an attempt to balance between the quantity and quality of attracted users using increasingly complex incentive systems.

Airdrops as a P2P Arena

We mentioned that users have begun to perceive airdrops not as gratitude, but as something they’re owed by default. However, a similar shift happentd on the developers’ side — from “token for the community” to “community for the token”.

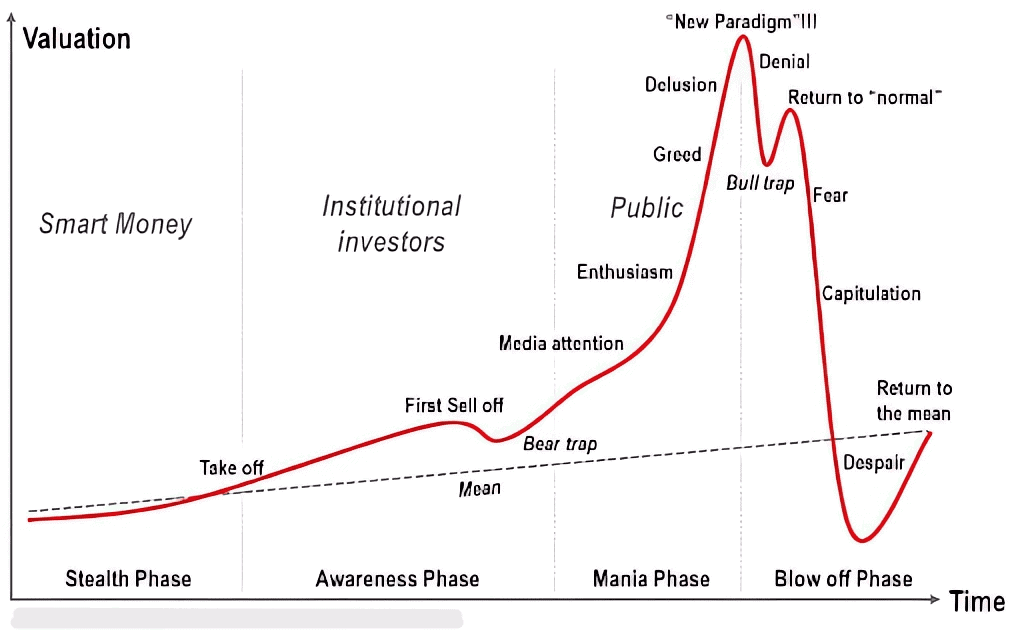

Influencer Axel Bitblaze points out that this change is rooted in narrative psychology. According to this concept, airdrops are at the stage of development when the mere announcement of a distribution already creates a buzz. The team reinforces it using marketing tools, then uses it to improve the product’s performance and attract additional funding. This is why the market is seeing prolonged campaigns and numerous farming seasons.

The visible growth in user activity and big investment rounds create the conditions for overvaluing the token price during the launch of trading and, ultimately, lead to the problem of the asset’s high fully diluted valuation (FDV) with low circulating supply.

This is why teams usually turn a blind eye to multi-accounting, which will be discussed below, and the actions of whales, as was the case with EigenLayer. The project distributed about 2 million EIGEN tokens to several of Justin Sun’s addresses. For comparison: the median airdrop size was 110 EIGEN per user.

From this point of view, the evolution of airdrops boils down to a competition between developers and the community, in which each side tries to exploit the other’s expectations as much as possible.

Points programs are an attempt to maximize the distribution efficiency as a market entry strategy by being able to influence audience activity. Users understand this and respond accordingly — instead of building a community around the product or at least the token, they immediately sell in order not to become the “exit liquidity” for venture investors.

So, out of the 10 000 largest recipients of the ZKsync airdrop, 41% sold all their assets within a day after the start of the distribution, and another 30% made a partial sale.

The Sybil Factor

Along with the shift to “default airdrops”, the above-mentioned practice of multi-accounting has also become widespread. Being confident in the reward, some participants started using multiple addresses to interact with protocols in order to multiply their financial results. This led to the emergence of professional so called drop hunters and the spread of account “farms” that were de facto conducting a Sybil attack on the project.

Until a certain point, “Sybils” were seen as a normal phenomenon, and teams didn’t try to fight them. Moreover, due to the growth of the product’s performance metrics, many developers effectively gave their tacit consent to the spread of multi-accounting, not taking active measures to stop it.

For example, Aptos only blocked access to distribution if more than 20 wallets used the same IP address, and, according to the results of the Arbitrum airdrop, experts found that about 150 000 addresses that received the token were somehow related to “Sybils” in one way or another.

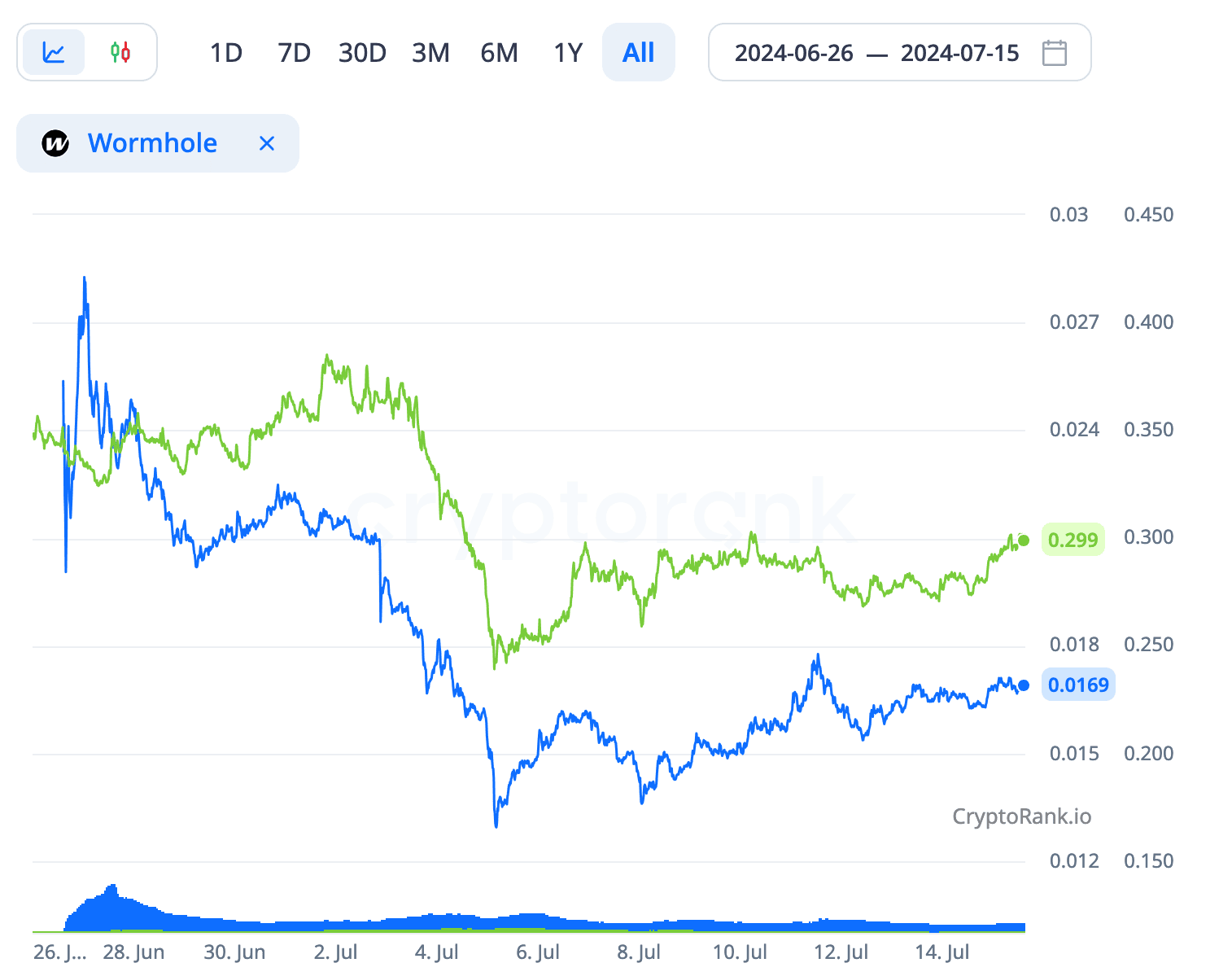

However, drop hunters are not interested in the product or the community. Most of them just want to sell the tokens as soon as possible to cover their operating costs and lock in profits. The price dynamics of BLAST and W tokens clearly demonstrate this trend.

The above-mentioned influence of venture capital also plays a significant role here — large investors seek to turn community members into their “exit liquidity”.

The spread of multi-accounting amplifies these trends, and, judging by the latest distributions, the industry is close to the point where the harm from token dumps and post-airdrop performance declines began to outweigh the benefits. Therefore, teams have begun to look for tools that would help to filter out drop hunters and improve the audience quality. Possible solutions include:

- Identification of related addresses and banning them from participating in the campaign. This method was used by LayerZero and ZKsync, arranging the largest “Sybil hunts” in the industry. However, this only caused community discontent, which negatively affected the projects’ tokens;

- cross-distributions for users who hold certain assets or participate in other ecosystems. An example is the distribution of the memecoin BONK for active developers and users of DeFi-applications, as well as NFT-services in the Solana network.

The main problem with retroactive airdrops is "Sybils" who create thousands of wallets and try to get more than everyone else. There are various detection techniques, but it's very difficult to conduct a fair filtering of addresses, so classic airdrops are a thing of the past.

The only way to protect distributions is to develop a mechanism where the reward would be tied not so much to the wallet as to the capital used. Then the distribution of assets between ten addresses would give the same result as participation with the entire amount from one address. This is what will protect airdrops and make them even more similar to farming.

For some highly capitalized projects, large participants accumulating a large volume of tokens during the airdrop are also becoming an issue. For example, to mitigate their impact on prices, the Ethena and Blast teams used a reward vesting mechanism.

Will Airdrops Die and What Will Come After Them?

The distributions from ZKsync and LayerZero have become proof for many that the industry is close to the “sunset of airdrops”. By fundamentally changing the original purpose of this tool, market participants have essentially found themselves in a stalemate:

- developers are trying to “squeeze” the maximum out of users through point programs, openly promising rewards;

- users are trying to get as many tokens as possible using multi-accounting, in order to then immediately sell them.

And it seems that neither the first nor the second group believes in the possibility of building a community using an airdrop anymore. So the question arises: what will happen next?

According to Alex Bitblaze, the industry is now approaching the peak of the narrative, after which there will be a sharp decline in interest and a “return to the beginning.” Over time, the market should come to the original perception of airdrops, where the parties are mutually honest and don’t try to exploit each other’s expectations.

The HOT Protocol team indicates that the points model will be iteratively improved and the airdrop distribution scheme will be replaced by something new. Perhaps this will be a return to old solutions, for example, the NFTs or retroactive airdrops.

“However, in general, the distribution scheme is taking a back seat. The main thing is to achieve good virality and product quality. If these conditions are met, airdrops can become one of the tools for attracting attention and distributing tokens, but will not be the only or the main method,” the project representative noted.

This “peak” may be a new round in the “sword and shield” struggle, where developers try to find ways to eliminate the problem of multi-accounting and the initial token dump, while participants try to protect themselves from dilution of value and venture investors actions [code word – retrodrop].

Examples of the “Sybil hunt” from ZKsync and LayerZero, Blast’s token vesting, and the change in the StarkNet tokenomics due to community discontent suggest that the industry may continue to move towards the escalation of this unspoken confrontation, after which there will be a sharp decline in interest if one of the sides “goes too far”.

An alternative option is the cooling of the confrontation through the development of fairer distribution mechanisms and transparent pricing during the token launch. Probably, the latter factor is the true reason for the transition from providing mutual value to mutual exploitation.

However, this is possible only if all market participants, including regular users, developers and venture investors, are willing to compromise, which requires restoring the lost trust and a balance of opportunities.

Another important factor may be the creation of a legal framework for blockchain projects, since the emergence and development of airdrops was largely driven by the search for a token distribution mechanism that would not allow them to be classified as securities. In addition, regulatory requirements may limit the activity of venture investors or provide mechanisms to protect retail buyers from price manipulation.

Ultimately, this could lead to a normalization of relations and a healthier approach to token distribution at the organizational and technical levels.