Delta-Neutral Sustainability: Exploring Ethena’s USDe and How It Relates to Arthur Hayes

Stablecoins are crucial in crypto, forming a core part of the industry. Their representatives are among the most successful products in the industry. The normal functioning of the market relies heavily on these instruments, as evidenced by the total capitalization of this asset class, which is currently estimated at nearly $145 billion.

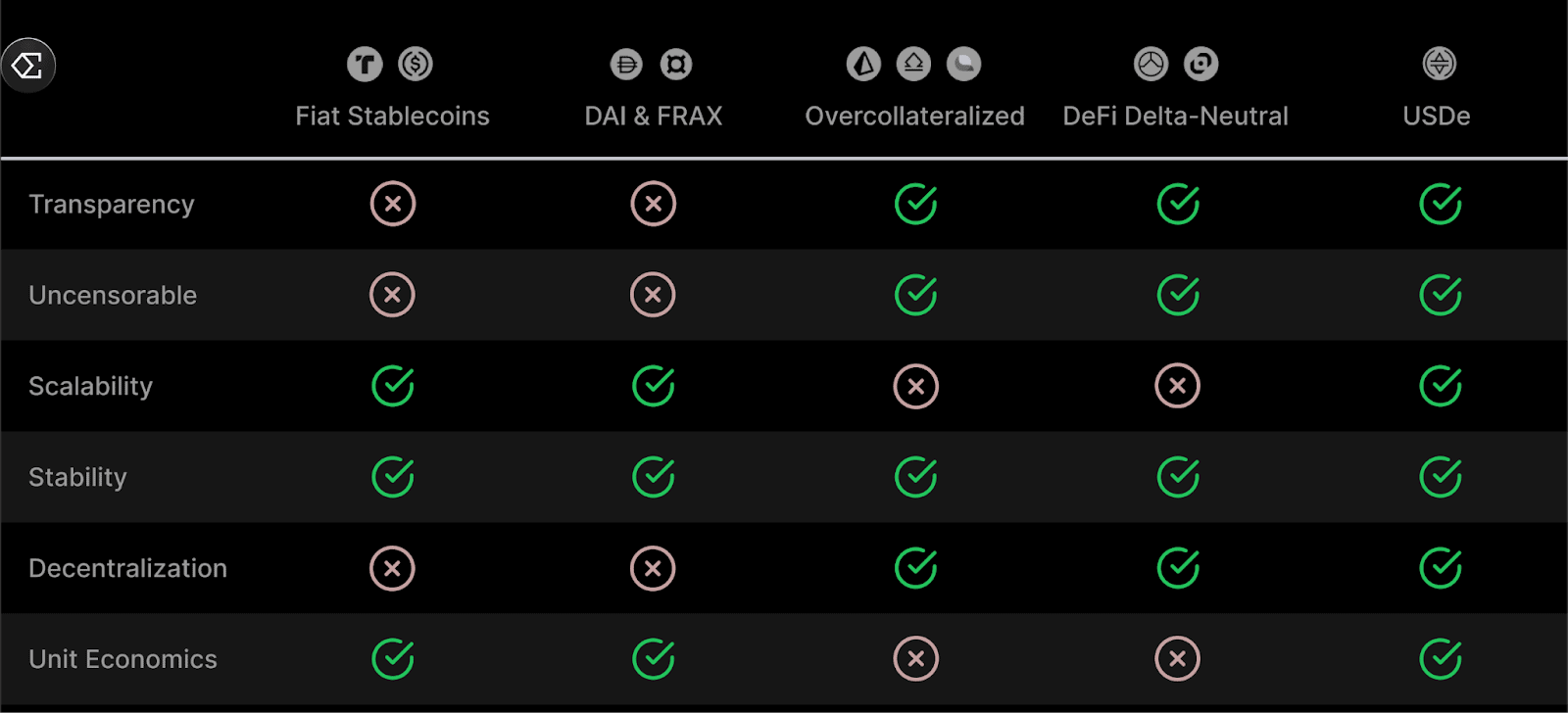

There are several types of stablecoins, which can be broadly categorized as centralized and decentralized. Each group has its own set of advantages and disadvantages.

The Ethena project was launched on February 19, 2024. It aims to blend the advantages and counter the disadvantages of both categories. Incrypted’s editorial team examined how the USDe stablecoin works and whether it has achieved its goals.

Single Point of Failure and Scalability Issues

Due to their stability and scalability, centralized stablecoins such as USDT and USDC dominate the market. They use collateral baskets to ensure parity with the underlying assets, easily maintained by market participants engaged in arbitrage operations.

However, a centralized model has major risks. These include ease of censorship, lack of transparency, and regulatory pressure.

Assets in the collateral structure can be seized, frozen, or otherwise compromised. In March 2023, when Silicon Valley Bank collapsed, USDC lost value against the US dollar. This happened because the issuer kept some of its reserves in the failed bank.

Decentralized stablecoins aim to overcome the limitations of their centralized counterparts by fully migrating all mechanisms to the blockchain, eliminating the risk of a single point of failure. However, they do have some drawbacks, including scalability and design issues.

Over-collateralized stablecoins like MakerDAO’s DAI rely heavily on the demand for in-network leverage. This reliance forces them to leverage traditional assets such as US Treasuries, which can compromise transparency.

Algorithmic stablecoins, including Terra USD (UST), are considered fragile and unstable, making their effective development difficult.

There are still delta-neutral stablecoins, including USDe from Ethena. The project isn’t the first of its kind. Previous attempts to create such an instrument haven’t been successful.

Delta-neutral stablecoins face scaling and sustainability challenges due to their reliance on decentralized trading platforms with insufficient liquidity. The UXD quotes from UXD Protocol exemplify this issue.

Delta is a mathematical term that represents the difference between variable values. In finance, it refers to the price change of one asset in response to a change in the quotes of another.

A delta-neutral portfolio is a collection of instruments that maintains an unchanged total value with low volatility of the underlying assets. This strategy is also known as a delta-neutral hedging.

For example, the delta of a futures contract and a spot contract is equal to one. If one takes a short position in one futures contract and a long position in one spot contract, the delta of such a structure will be zero.

In stablecoins, a delta-neutral instrument is one that structures its collateral according to a delta-neutral hedging strategy.

But as mentioned earlier, the Ethena team says they have solved these problems. Their stablecoin merges the best of both types, offering transparency, censorship resistance, scalability, and sustainability. They achieve this through mechanics that rely on cryptocurrency derivatives.

Our Favorite Blogger

In May 2022, Arthur Hayes, the former Head of BitMEX and now Chief Investment Officer of the Maelstrom, wrote an essay titled «Luna Brothers, Inc». In the essay, he describes the concept of a «crypto-dollar» that is not tied to the traditional banking system.

Guy Young, Founder of Ethena Labs, says that this text inspired him to quit his job and start the project that became USDe.

Hayes suggested that a decentralized stablecoin could use bitcoin and its derivatives to keep a stable value compared to the U.S. dollar.

«A variety of the top crypto derivatives exchanges offer inverse style perpetual swap and futures contracts. These derivatives contracts have an underlying of BTC/USD, but are margined in BTC. That means profit, loss, and margin are denominated in Bitcoin, while the quoted price is in USD,» he noted.

The idea is that bitcoin acts as a synthetic asset reserve. Perpetual contracts keep the price stable. As bitcoin grows, derivative positions become unprofitable. But, the stablecoin’s price in dollars stays the same because it needs less cryptocurrency for issuance.

On the other hand, when bitcoin quotes decrease, positions become profitable, which also helps to maintain parity. Issues arise only when the price of the underlying asset drops to zero. But in this scenario, as Hayes noted, the whole system collapses, so it «can be ignored».

The model has drawbacks because it needs some centralization. Perpetual contracts used to issue stablecoins are traded on CEX, which introduces relevant risks associated with having a single point of failure, according to the ex-Head of BitMEX.

However, Hayes expanded the idea and wrote an essay titled «Dust on Crust» in March 2023. In this essay, he explained the mechanics of a stablecoin:

- delta-neutral hedging achieves price stability;

- the liquidity of centralized exchanges drives scalability;

- CEX holds the assets.

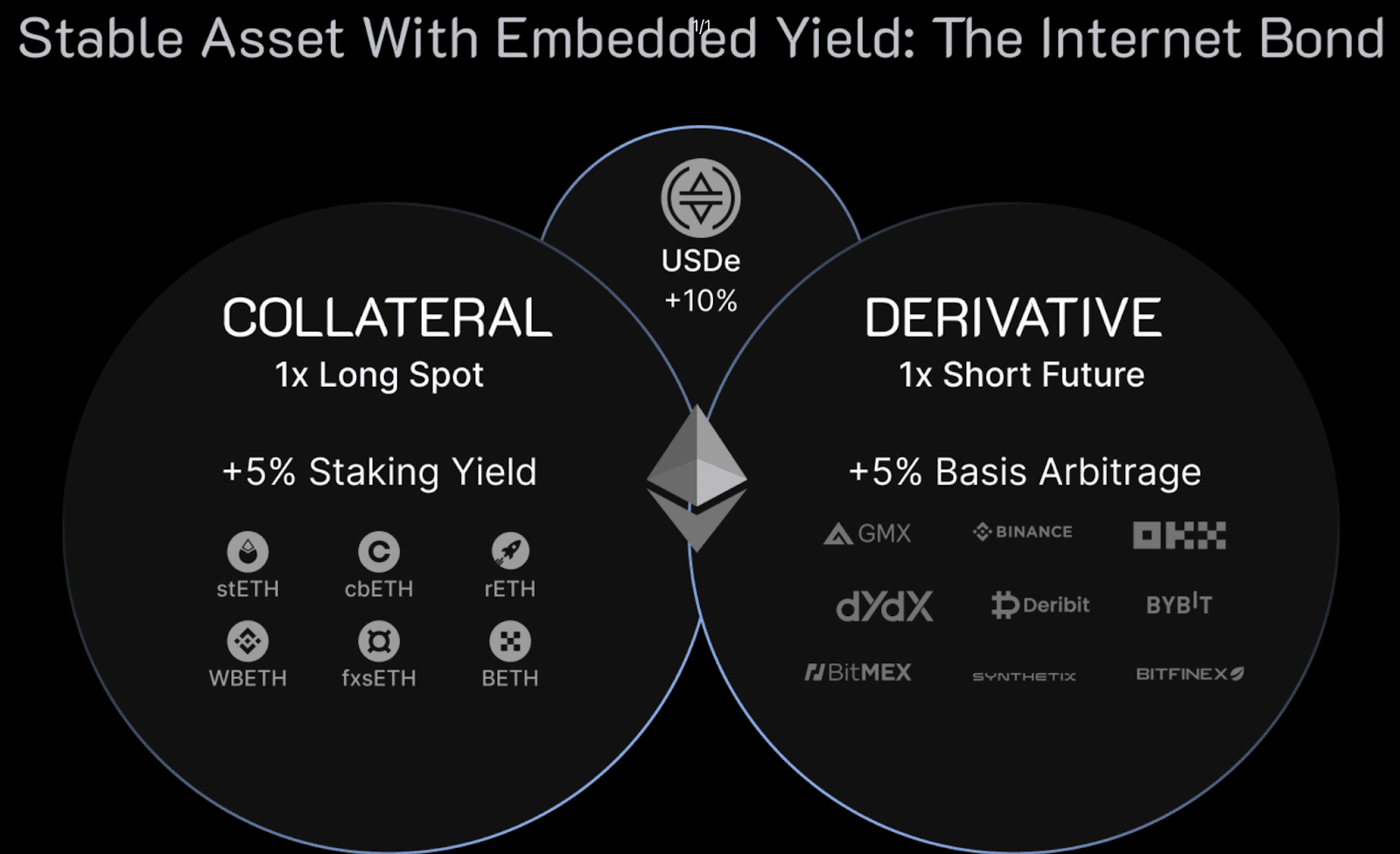

The Ethena team implemented Hayes’ proposed design with some modifications. They used Ethereum and Liquid Staking Tokens (LST) instead of Bitcoin. They also used more decentralized solutions to store assets.

How Does USDe Stablecoin Work?

USDe from Ethena Labs is a delta-neutral stablecoin with a value pegged to the US dollar at a one-to-one ratio.

«USDe is enabled by Ethena Labs via hedging the delta of spot assets backing the token during minting,» according to the project documentation.

According to the team, this approach offers several advantages. By using derivatives, stablecoins can scale without needing extra collateral to stay stable.

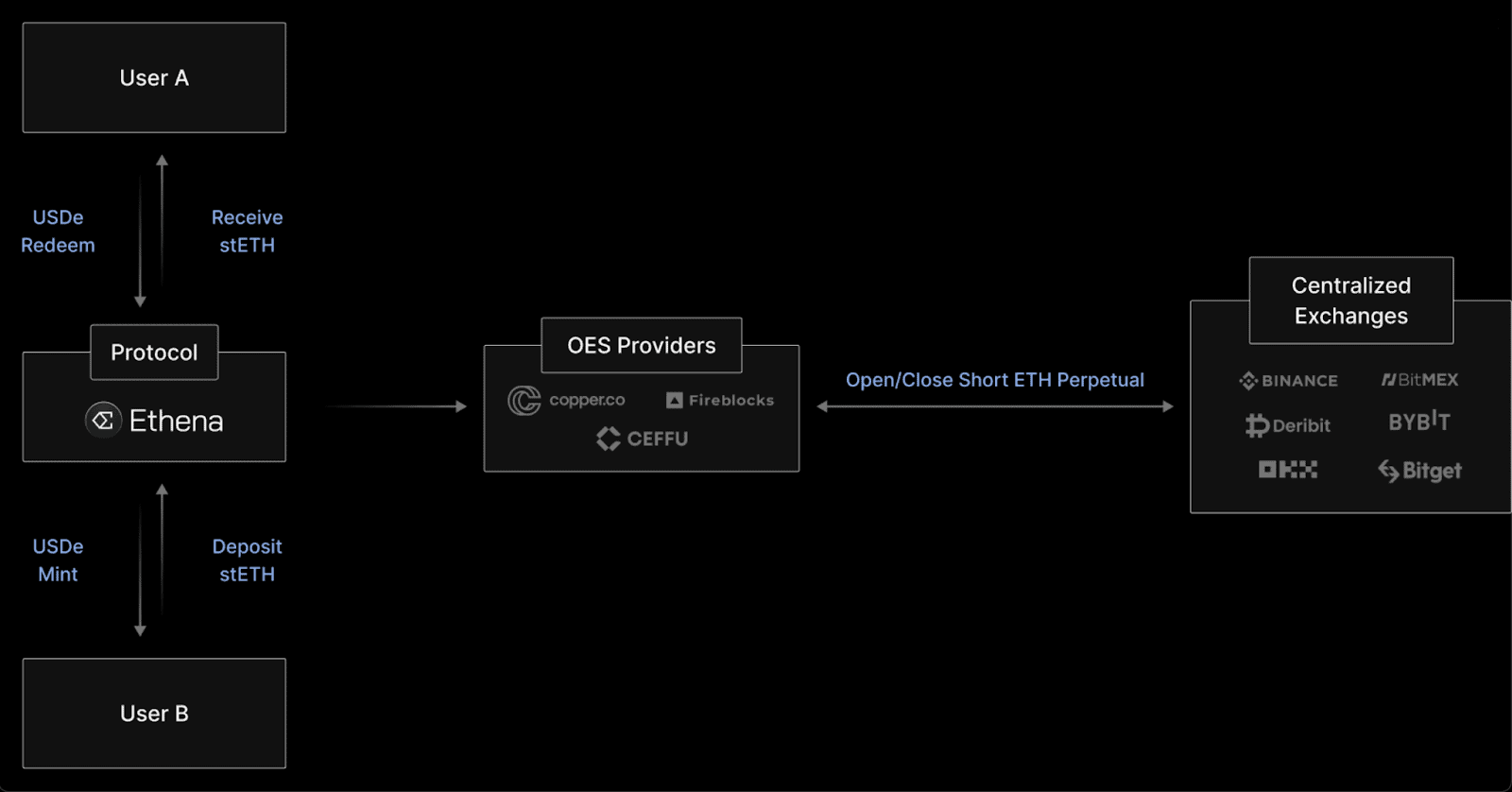

Currently, only whitelisted users have access to mine the instrument directly. These users can deposit Ethereum and other supported assets. They can do this through the platform interface or API to issue USDe.

The protocol sends deposited assets to a third-party custodian that supports Off-Exchange Settlement (OES). Ethena uses this to open perpetual short positions in Ethereum on centralized trading platforms.

These positions aim to maintain the value of collateral as delta-neutral or constant in dollar terms while paying interest income on the funding rate to USDe stakers. According to Messari, this is essentially a tokenization of a carry trade type transaction involving ETH and USDT.

Non-whitelisted users can exchange supported stablecoins for USDe through the Ethena interface. External liquidity pools process the transaction, and CowSwap routing protects against MEVs.

Whitelisted users can currently issue USDe against USDT, Ethereum, and liquid staking tokens like stETH, mETH, and WBETH. These assets are also integral to the security structure of the stablecoin.

Ethena collaborates with three custodians: Copper, Ceffu, and Cobo. The protocol uses their OES services. It spreads liquidity across five centralized exchanges: Binance, Bybit, OKX, Derbit, and Bitget. Although the project includes BitMEX among the supported exchanges, it does not hold any positions according to its own data.

Source: Ethena Labs.

Users who can’t mint USDe can buy it using one of the supported stablecoins. These include USDT, USDC, DAI, crvUSD, FRAX, and mkUSD.

All users can block USDe in favor of the protocol. These instruments earn yields, estimated at 67% per year as of March 12, 2024.

What Does the USDe Yield Consist of?

USDe derives its yield from two sources: the funding rate and the profit from owning Ethereum.

As mentioned before, USDe is designed to distribute revenue at the perpetuity funding rate to users who have locked stablecoins for the protocol.

Perpetual contracts are a derivative unique to the cryptocurrency industry. These instruments were first proposed by Hayes and have no end date. This allows traders to take short or long positions without any time limit.

Traditional derivatives execute at the index price of the underlying asset as the expiry date nears to reflect its quotes correctly. For perpetual instruments, the funding rate serves this purpose.

The funding rate is calculated as the difference between the mark price of a perpetual contract and the index price, which represents the value of the underlying asset.

The market-to-market price, or current market value, is the estimated true value of the contract.

The funding rate helps derivative quotes match the index. It encourages contracts to trade close to spot prices. When the rate is positive, long position holders pay a commission to traders who take short positions. On the flip side, when the rate is negative, short position holders pay a commission to long position holders.

The mechanism described above generates most of the returns paid out to Ethena users. Currently, because most investors are optimistic, the protocol is getting big payouts on the funding rate for open short positions on Ethereum. But it’s crucial to remember that if investor sentiment changes, the funding rate for Ethena could turn negative.

The Ethereum ecosystem is the second factor affecting the protocol’s profitability. Ethena profits from:

- consensus-layer rewards — validators receive payments for maintaining Ethereum’s security;

- execution-layer rewards — payments to ETH stakers;

- profits from MEV.

Ethena Labs reports that the average annual yield for the «embedded» option is 5%. This feature helps USDe users during times of negative funding rates by partly reducing the negative impact.

Points System

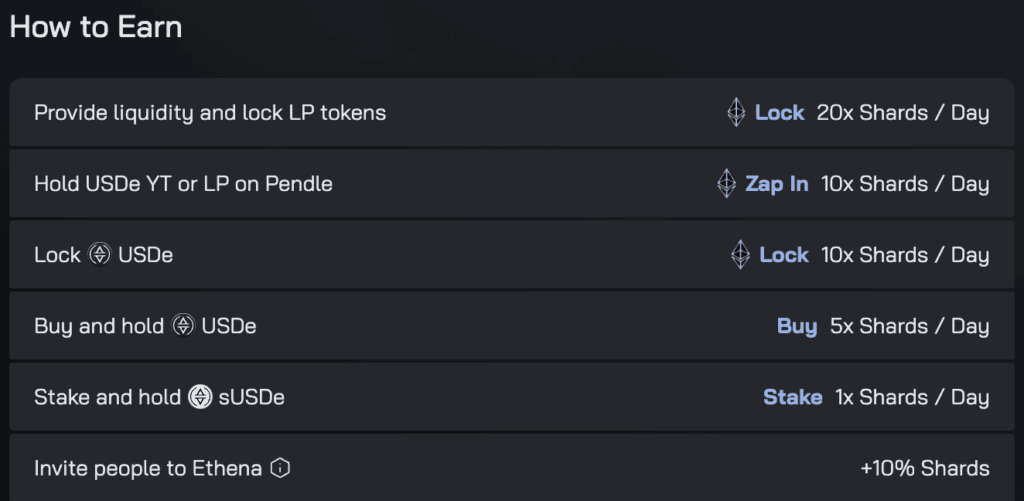

Rewarding tokens to users based on earned points is becoming popular. Ethena is an example of a project that has adopted this approach.

Users can earn shards, which are the points in this context, through the following ways:

- adding liquidity and locking LP-tokens;

- owning YT or LP-tokens of Pendle;

- blocking USDe;

- buying and holding USDe;

- owning and depositing USDe;

- referring other users to join.

Users can earn Shards until May 2024 or until the smart contract protocol’s Total Value Locked (TVL) reaches $1 billion. Analysts from Messari expect the TVL condition to be met earlier, possibly on March 20. At that point, the total points issued will reach $189 billion.

The OTC Whale Market currently has Ethena points available for trading, with prices ranging from $0.000355 to $0.00401 per shard. As an estimate, the average price per point is approximately $0.002185.

Following in Do Kwon’s Footsteps?

The structure mentioned above has already attracted over $920 million in liquidity, largely due to its high APY. However, some community members might link such a high yield to the Anchor from Terraform Labs. It offered a 20% annual return on UST deposits and ultimately led to the decline of the Terra ecosystem.

The level of decentralization in Ethena is under scrutiny because of potential risks with asset custody, even though trustworthy custodians are involved. There are also concerns that exchanges might block the protocol from accessing hedging markets.

The yield structure of USDe isn’t ideal. It only relies on positive net yields from Ethereum and funding rates to make returns for its holders.

If the specified rate remains negative for a prolonged period, it may create a risk of gradual decline in the stablecoin’s value. This could lead users to opt for selling USDe instead of bearing the losses.

Some people think USDe is more like a structured product than a stablecoin. One main argument for this view is that the link to the underlying asset is at risk because of third-party involvement, potential liquidity worries, and the yield structure.

Response to Criticisms

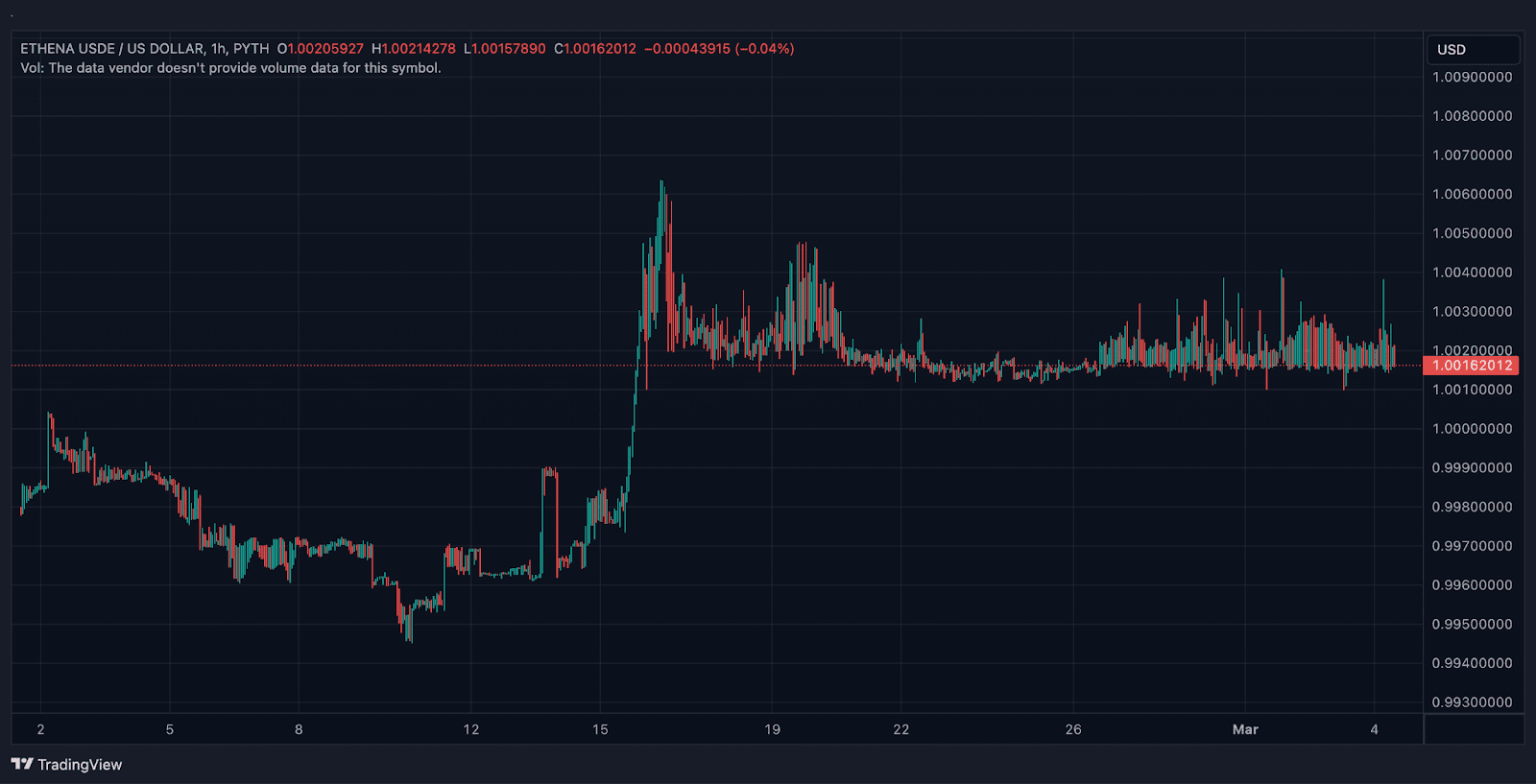

Since the launch of Ethena on the main network, USDe has been very successful in holding parity against the US dollar, mostly trading at a premium to the index asset. Using data from the Pyth Network’s oracles, at the time of writing, quotes of the instrument have never dropped below $1.

Such dynamics may show the effectiveness of the USDe collateral model. It’s still too early to draw conclusions since the instrument just launched recently, and the liquidity it attracted is relatively low.

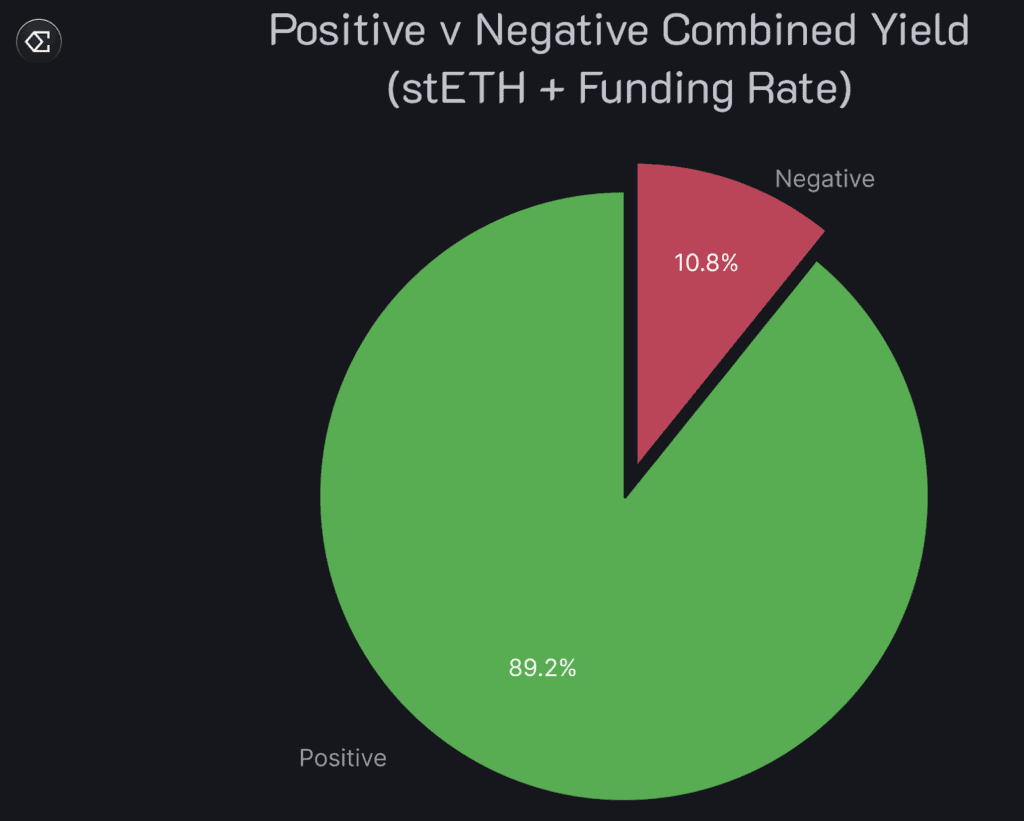

The project team claims that the combined USDe yield has yet to take a negative value for a long time. This is mainly because the liquid staking segment is incorporated into token issuance.

«There has only been one quarter in the last 3 years where the average sum yield was negative and this data was polluted by the ETH PoW arbitrage period which was a one-off event that dragged funding deeply negative,» the document states.

Ethena set up an insurance fund to cover any losses from negative returns. This fund has a structure that comprises collateral to fund payments. As of now, the structure’s valuation stands at $16.1 million.

Cross market arbitrage is one way to ensure the stability of USDe. If a stablecoin’s value deviates from its peg level, those who can issue or redeem the coin can take advantage of the difference between the cost of issuing the stablecoin and its value on external markets.

Experts note that USDe and UST are fundamentally different instruments. USDe is a fully secured Ethena instrument, and its yield is determined by the funding rate, not inflation. This distinction greatly reduces the risks of repeating historical issues with the Terraform Labs product.

Ethena Labs has managed to secure over $20 million in investments thus far. During the most recent round of funding, investors valued the project at $300 million. Delphi Digital, DragonFly Capital, and Binance Labs, among others, supported the protocol.

This may show venture capital interest in the proposed model. Alternatively, it could be that the funds were drawn to the project due to the association with Hayes and his affiliation.

It is possible that USDe could become UST’s «good twin». The stablecoin can attract liquidity fast and has the potential to scale swiftly if the market keeps demanding on-chain leverage.

Users certainly remember moments when stablecoins traded at 95 cents for each dollar. Conventional centralized and decentralized instruments may pose problems, but Ethena offers a unique approach that can effectively address these issues.

An ecosystem could potentially develop around USDe. If USDe succeeds, decentralized exchanges will aim to be included in its «white list.» This will enable protocols to access hedging markets and generate revenue through commissions.

Even if USDe doesn’t become widely adopted, its mechanism could still change the stablecoin market significantly. Perhaps, after some improvements and refinements. At the current stage, the product should be treated as a kind of proof of concept, with monitoring the dynamics of its development as it scales up.