Bulls or Bears: Who Will Lead the Crypto Market in the Near Future?

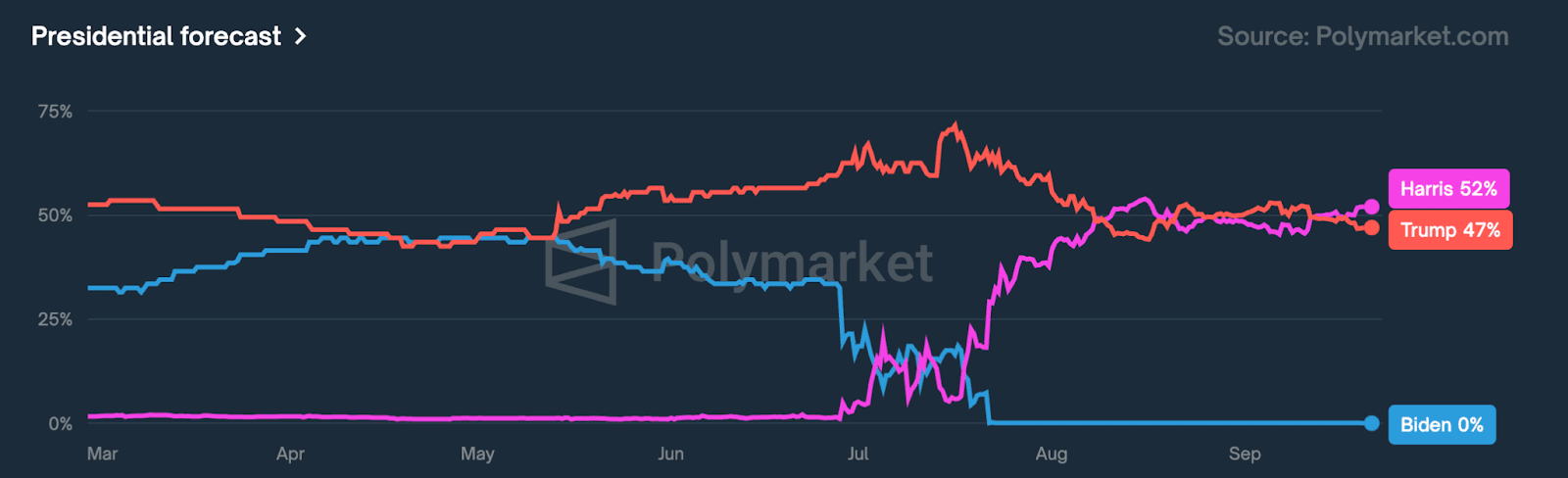

Most participants of the Polymarket prediction platform, as well as many experts, are confident that Bitcoin will reach a new price peak in 2024. According to some estimates, this new high could significantly surpass the level recorded in March 2024.

At the same time, a number of analysts believe that Bitcoin is showing bearish signals, and a significant correction ahead of the U.S. elections could benefit the leading cryptocurrency. Moreover, the market is still under the shadow of unfavorable economic and political factors, which could either halt or at least slow down the growth of digital assets this year.

The Incrypted’s editorial team delved into the reasons behind the uncertainty in the market and what drives both bullish and bearish sentiments among investors.

At a Crossroads

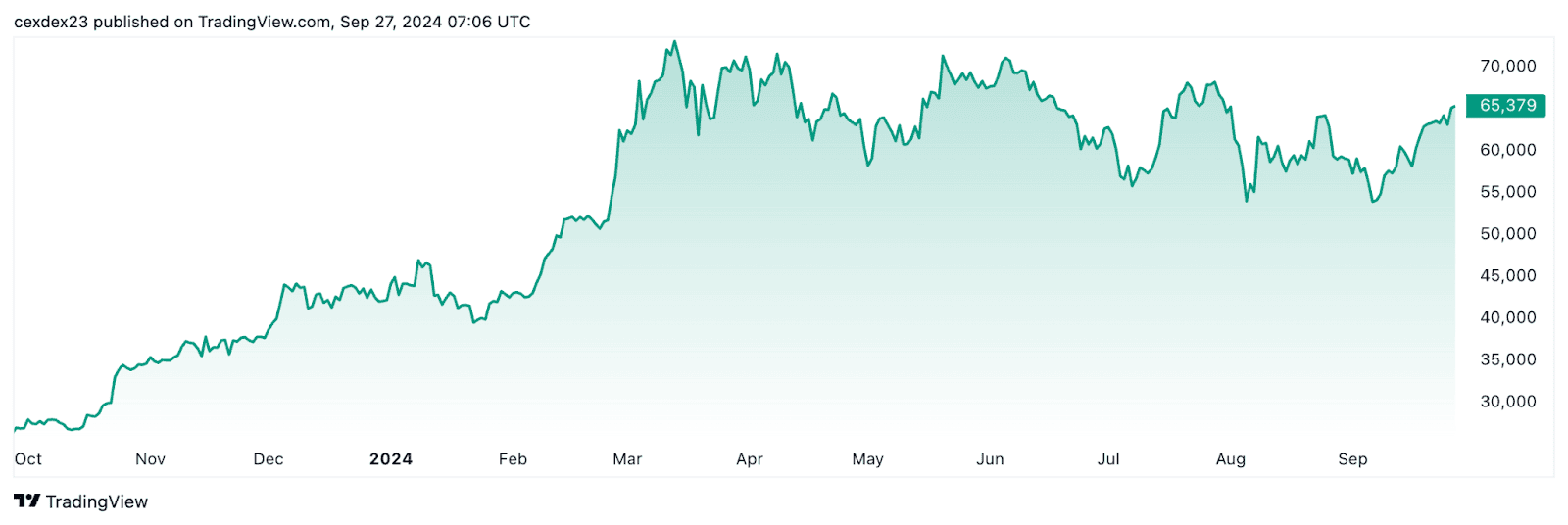

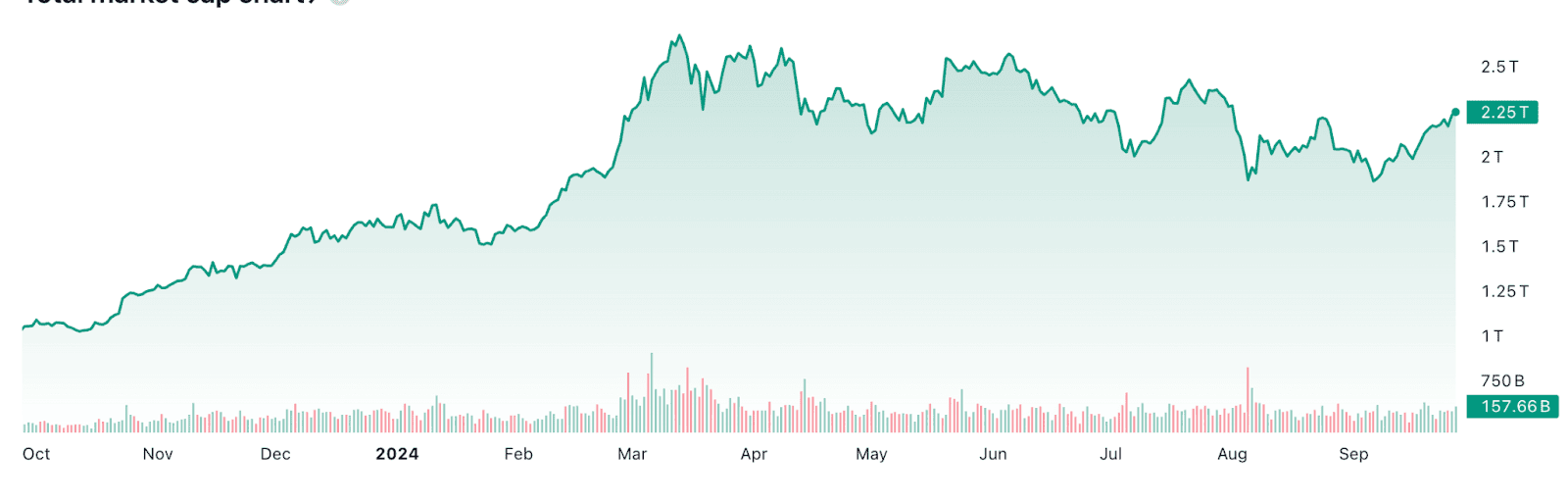

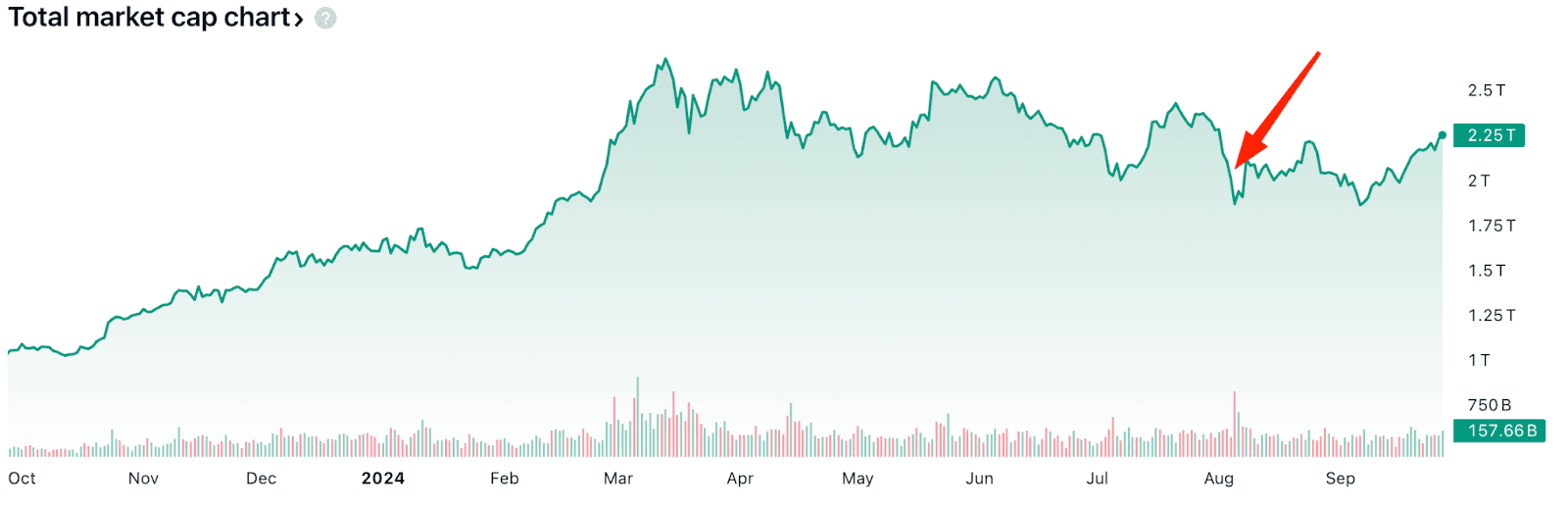

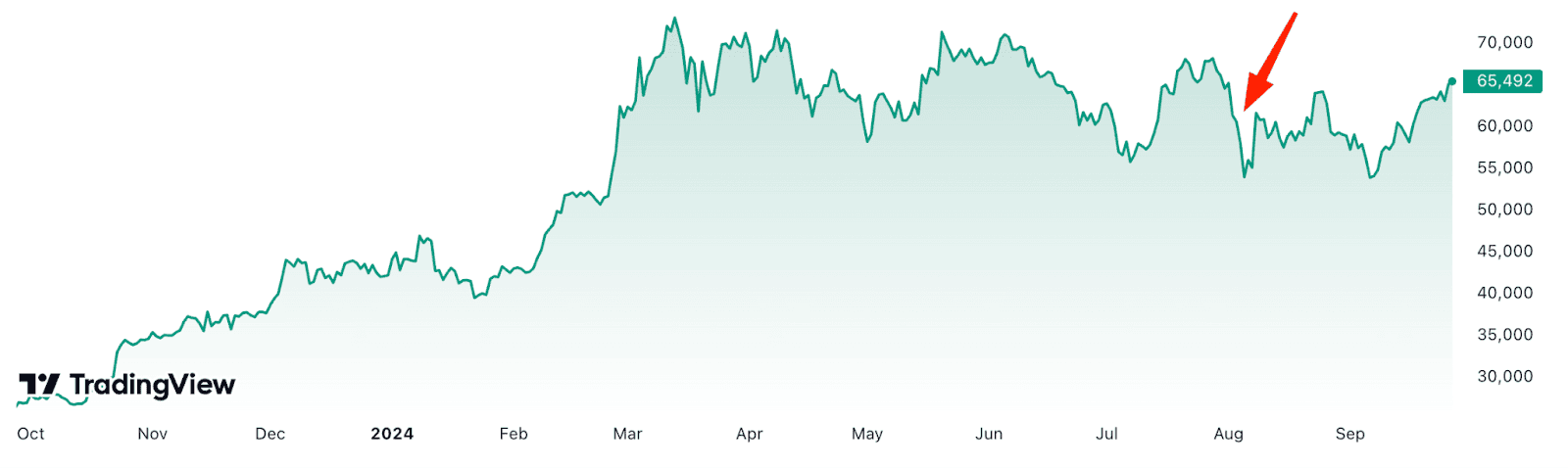

After the April rally faded, the crypto market, and Bitcoin in particular, entered a sideways trend, with a gradual shift in the price range towards lower support levels. In recent months, there have been several sharp drops and jumps; however, their magnitude was relatively minor.

In his essay “Water, Water Everywhere” Arthur Hayes links the spring market rally to increased fiat liquidity due to actions by the U.S. Treasury, while the subsequent sideways trend is attributed to the exhaustion of that liquidity. Additionally, the lack of clarity regarding how long and how intensely the U.S. Federal Reserve (Fed) plans to continue its quantitative tightening (QT) policy may have played a role.

Some of the market downturns coincided with macroeconomic and political events, such as Iran’s missile attack on Israel in April, the Bank of Japan’s interest rate hike in July, and the release of new U.S. employment data in August. On the other hand, the market was buoyed by factors like Donald Trump’s support for the cryptocurrency industry and a shift in the monetary policies of central banks.

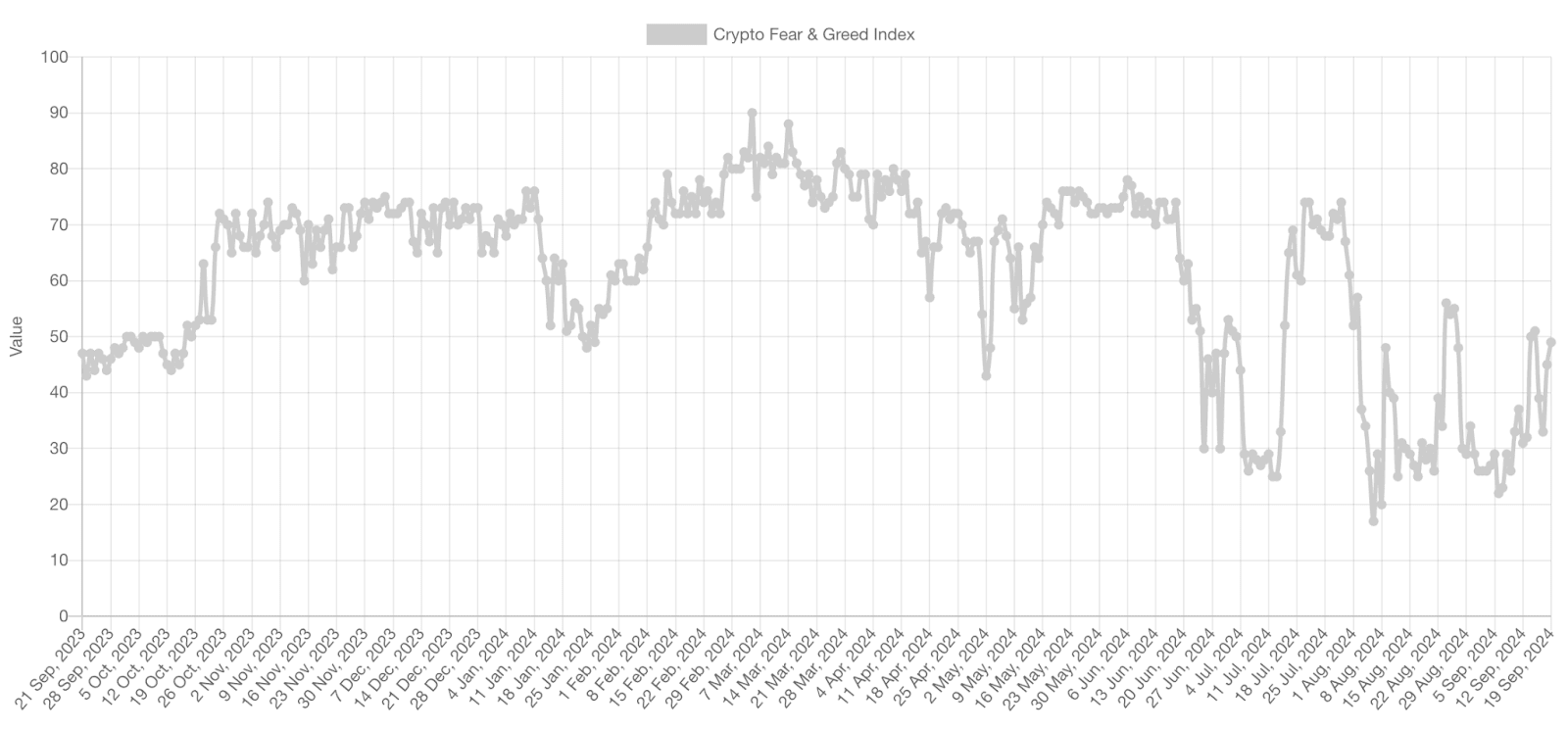

The lack of consensus among market participants regarding future price movements is further evidenced by the Fear and Greed Index, which has shown high volatility and wide swings in sentiment over the past few months.

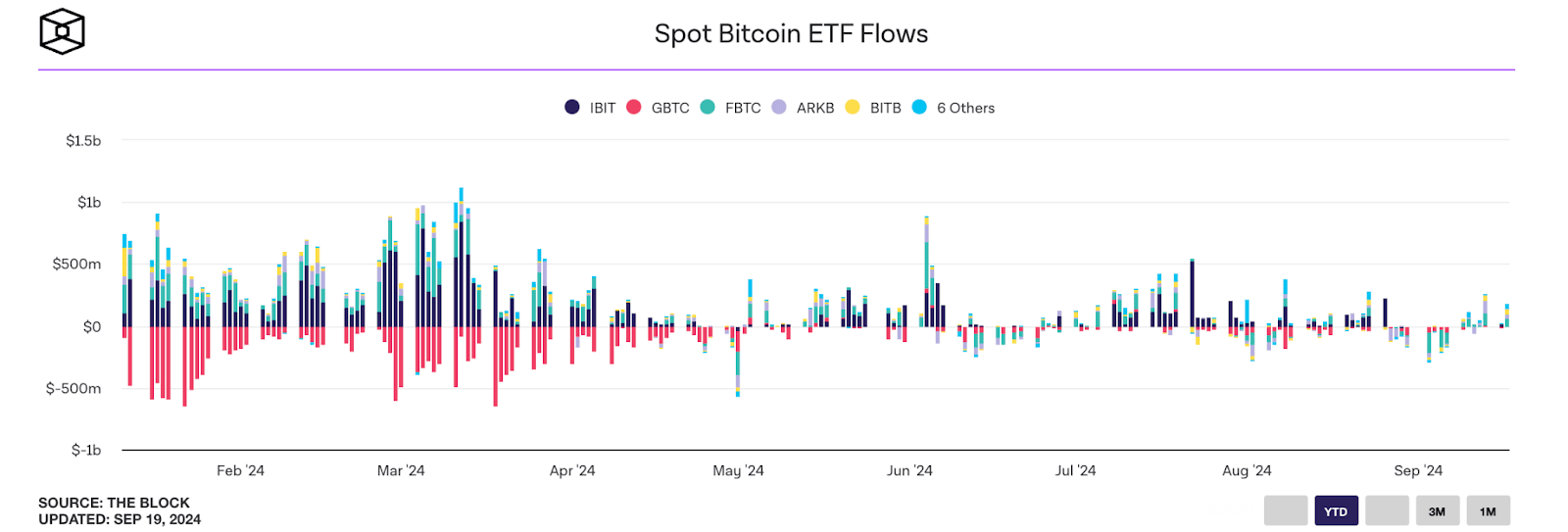

Another indicator has been the gradual decline in interest in Bitcoin ETFs from traditional investors. However, this trend could be explained by the natural saturation of the funds and the fulfillment of market demand.

At the beginning of the fourth quarter of 2024, the industry finds itself at a crossroads, where the future trajectory of digital asset prices will be influenced by events whose exact outcomes and significance remain uncertain. Many expect that the historically weak September for Bitcoin will be followed by a bullish October (“Uptober“), while others fear the consequences of financial regulators’ decisions and the upcoming presidential elections.

What events could drive the crypto market upward, and which might prolong or even worsen the sideways trend that has persisted since the summer?

The Road Upward

Several factors could contribute to the rise of digital asset prices:

Favorable Macroeconomic Conditions

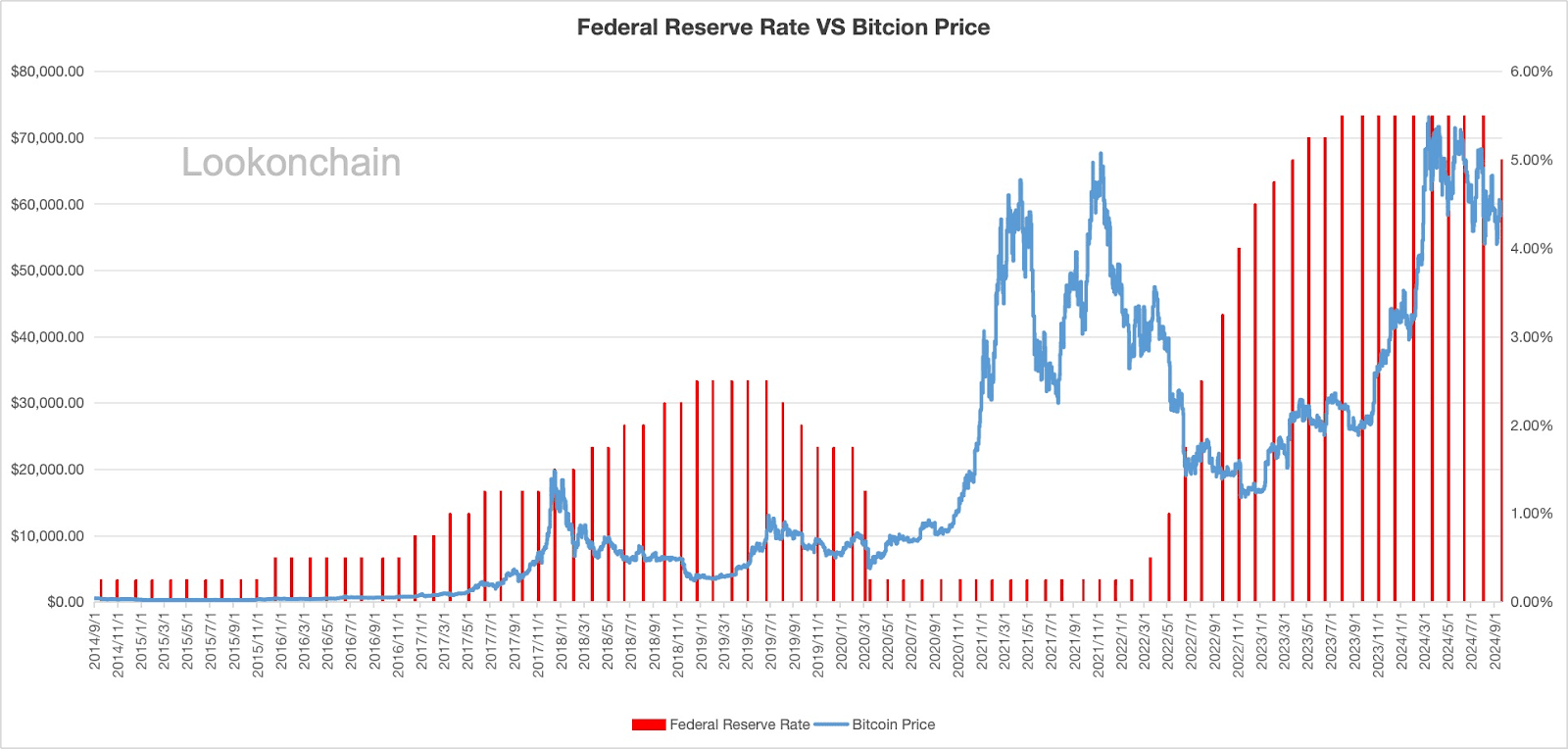

The Federal Reserve’s rate cut on September 18 led to Bitcoin’s price increasing by more than 6% in just one day, jumping from $58,000 to $63,000. This is likely not the full effect of the monetary policy easing in the U.S.

According to Arthur Hayes, the Fed’s rate cut is one of the prerequisites for the growth of the crypto market, but in addition to that, an increase in available liquidity and the continuation of yen-funded carry trades, which depend on the Bank of Japan’s monetary policy, are also necessary. He further notes that lower rates will lead to a decrease in U.S. Treasury bond yields, causing capital outflows from related products like RWAs (Real World Assets).

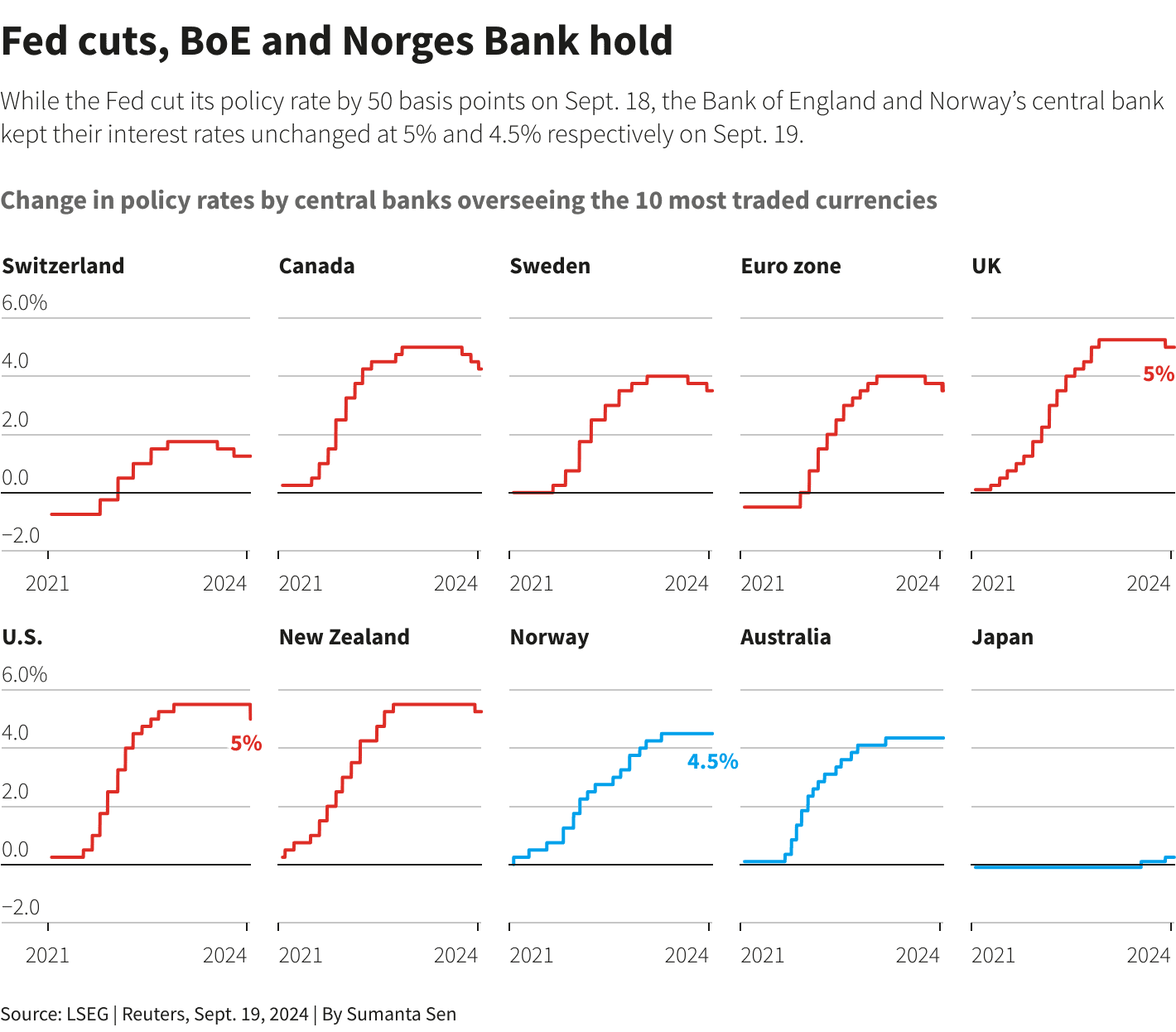

That said, a single rate cut of 50 basis points has not caused significant changes in the U.S. financial system. The positive impact is mostly tied to the expectation that this is just the beginning of a broader monetary policy reversal by the Federal Reserve, following in the footsteps of other major central banks.

In addition, some experts believe that by the end of 2024, the market could see an additional 75 basis point rate cut, which would likely lead to further growth for Bitcoin and other risk assets.

Donald Trump’s Victory in the U.S. Presidential Election

Since July 2024, Donald Trump has been positioning himself as the “crypto president” during his campaign, contrasting himself with Joe Biden, who is not well-regarded in the industry.

Trump has made several bold statements, including a promise to fire Gary Gensler, the current head of the U.S. Securities and Exchange Commission (SEC), who is viewed as unfriendly toward the crypto sector. He has also vowed to turn the U.S. into the “crypto capital” of the world and even suggested considering Bitcoin as a tool to address the growing national debt problem.

As a result, the community and many experts, including Bernstein and VanEck, have begun linking Trump’s potential victory in the election to the prospects of the crypto industry in the U.S. and further Bitcoin growth. Whether these expectations are justified remains to be seen, but the market could respond positively if Trump becomes the next president of the United States.

According to user bets on the Polymarket prediction platform, at the time of writing, the Democratic presidential candidate Kamala Harris holds a slight lead in the race. However, the balance could still shift as the election progresses.

Additionally, analysts from Standard Chartered and Matrixport suggest that Bitcoin’s growth is likely to occur regardless of the election results.

The Expansion of Cryptocurrency ETFs

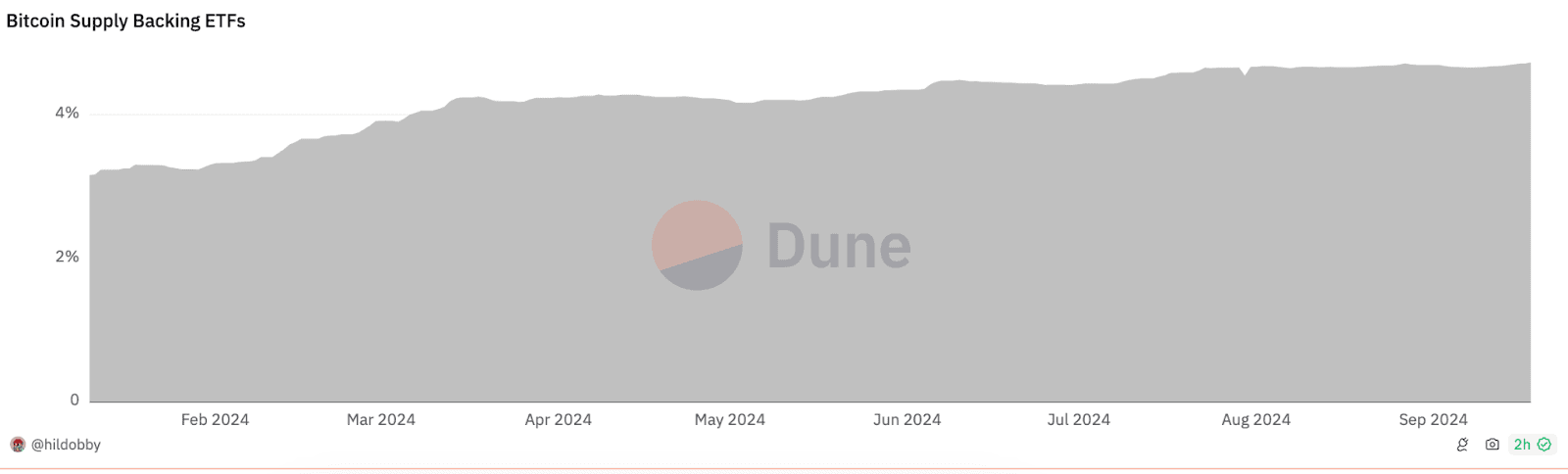

At the time of writing, issuers of spot Bitcoin ETFs hold approximately 5% of the available supply of the leading cryptocurrency, making these exchange-traded funds some of the largest holders of BTC. Furthermore, since their launch, there has been a steady trend of asset accumulation by these structures.

Despite the aforementioned trend of decreasing cash flows into Bitcoin ETFs, the financial instrument has gained wide adoption among financial advisors and some major financial companies, such as Morgan Stanley. This could potentially spark renewed interest from retail investors.

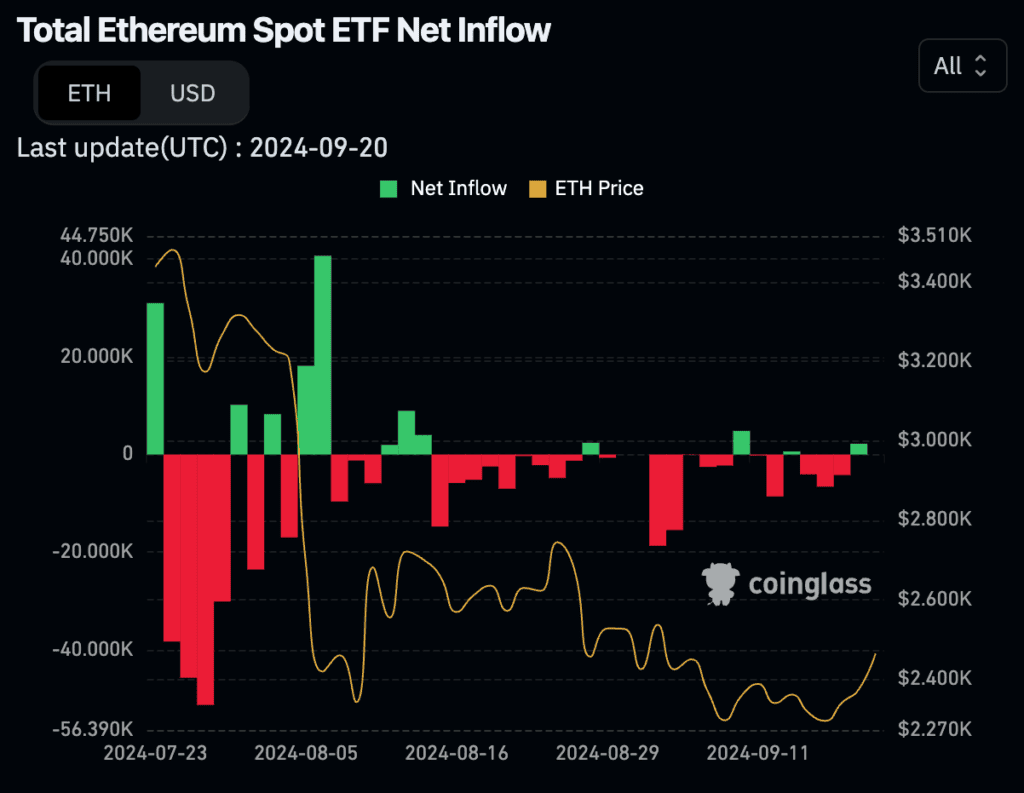

Additionally, the spot Ethereum ETF, launched in July 2024, might reverse the outflow of funds triggered by the Grayscale Ethereum Trust and shift towards accumulating ETH, absorbing part of the supply of the second-largest cryptocurrency by market capitalization. However, the cash flows into Ethereum ETFs still remain relatively small compared to Bitcoin ETFs.

Easing Price Pressure

Several Bitcoin sell-offs that occurred between June and August 2024 were driven by large cryptocurrency sales from some government institutions and private companies:

- In April, the bankrupt platform Genesis began distributing digital assets worth $4 billion, some of which have already been absorbed by the market.

- In June, the government of one of the German states started transferring cryptocurrency confiscated from the creators of the piracy website Movie2k to exchanges. A total of 50,000 BTC, valued at $2.9 billion, was sold as part of this campaign.

- In July, the bankrupt cryptocurrency exchange Mt.Gox began refunding its customers, removing another looming threat of a potential Bitcoin dump that had hung over the market and other assets.

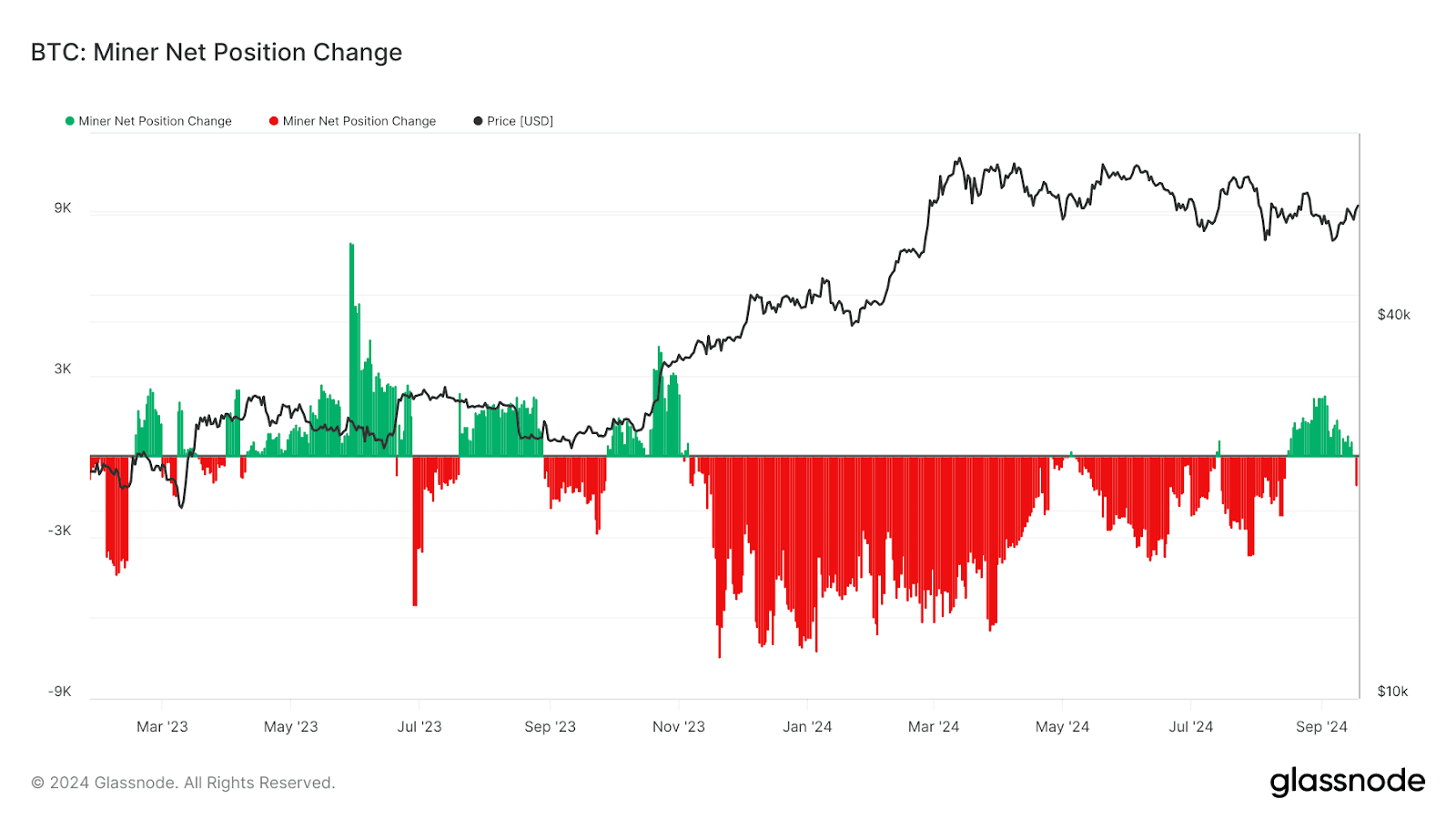

Furthermore, for a long time, a background trend involved miner sell-offs, which are typical before and after Bitcoin halvings. However, according to Glassnode, starting in August, miners began accumulating Bitcoin, eliminating yet another potential source of selling pressure.

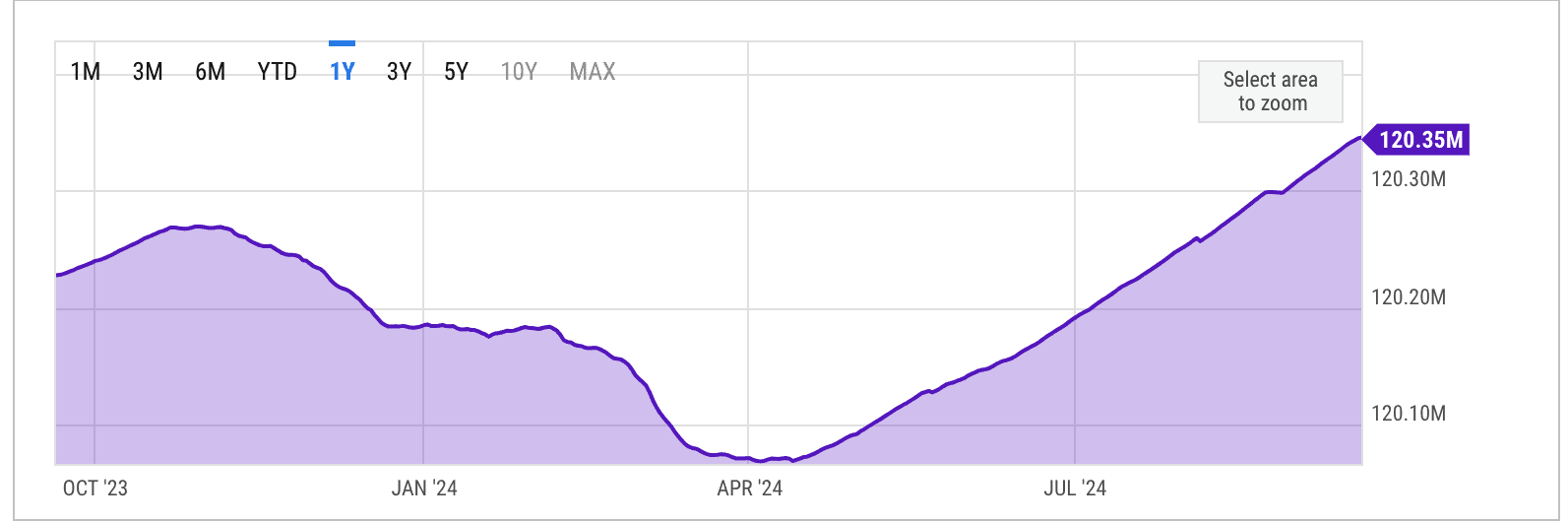

Growth of Stablecoin Supply

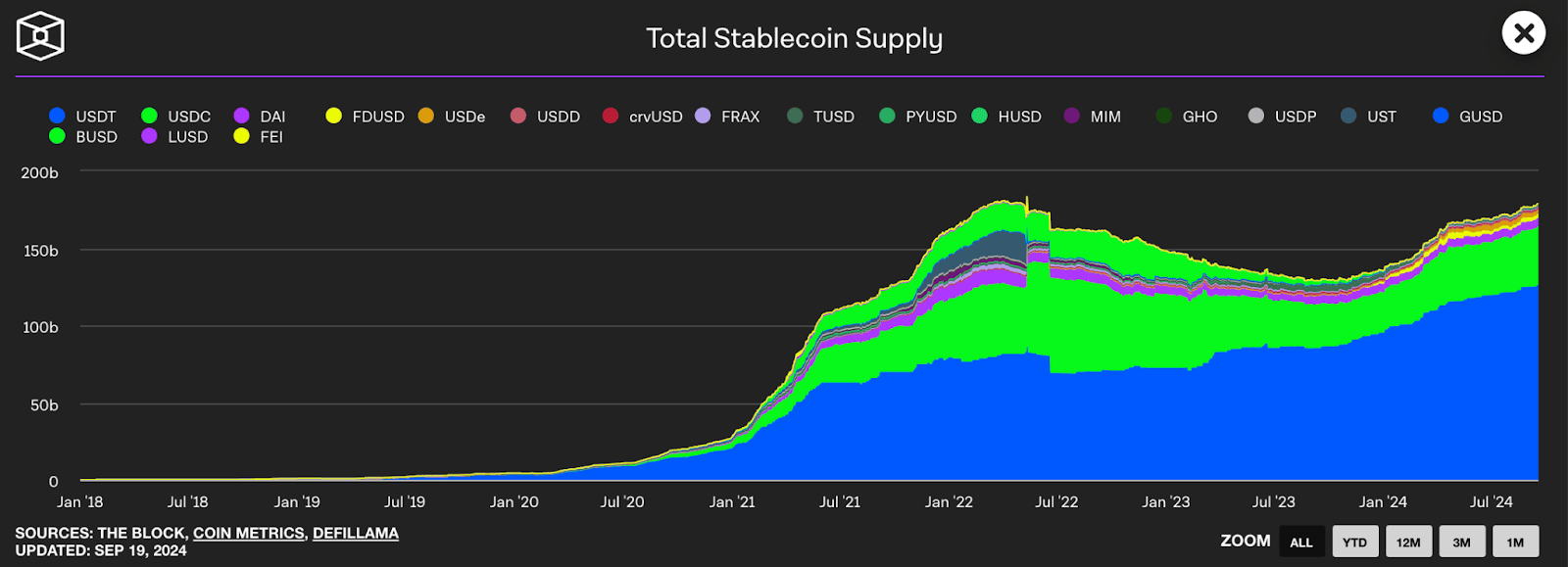

Stablecoins play a central role in providing liquidity to the cryptocurrency market, as the majority of trading pairs are denominated in USDT, USDC, and other tokens pegged to the U.S. dollar. According to CoinMarketCap, these two instruments account for over 80% of the daily trading volume.

For this reason, the total supply of stablecoins is considered one of the indicators of demand in the industry, and an increase in this supply signals potential growth in trading activity.

According to The Block, this metric currently stands at $179 billion—the last time such a level was observed was just before the collapse of the largest algorithmic stable asset, UST, in 2022. The current supply is now on the verge of reaching a new all-time high, which could also be one of the signs of a new bull run beginning.

Obstacles to Growth

On the other hand, several factors could lead to unfavorable scenarios for the crypto industry, heightening investor concerns in the short to medium term.

Strengthening Yen and the Unwinding of Carry Trades

One of the key factors affecting the stock market and other risk assets in a declining interest rate environment set by the Federal Reserve is the decisions made by the Bank of Japan and the potential consequences of unwinding yen carry trades. For more on the significance and mechanics of these trades, you can refer to Arthur Hayes’ essay “Spirited Away”.

The issue is that a strengthening yen could prompt Japanese companies to exit carry trades and sell foreign assets, particularly stocks and bonds in the U.S. market, where Japan is the largest holder of government bonds.

The consequences of the past strengthening of the yen due to a rate hike by Japanese regulators were evident from August 2 to August 5, 2024. During this period, the market capitalization dropped by $400 billion, and Bitcoin fell from $65,000 to $53,000.

On September 20, 2024, the Bank of Japan left interest rates unchanged; however, it is difficult to predict how long the necessary gap between the dollar and the yen will be maintained to sustain carry trades (and market stability).

Kamala Harris’s Victory in the U.S. Presidential Election

In the previous section, we mentioned that many analysts view Donald Trump’s victory as a positive event for the crypto industry in the U.S. Conversely, a win for the Democratic candidate could have mirrored consequences on asset prices.

This assumption is based on the contrasting views of Harris and Trump and expectations that if she wins, the Democratic administration would continue the repressive policies against cryptocurrencies spearheaded by the SEC. The head of Nansen even stated that many American crypto companies might have to leave the country if Harris is victorious.

It is worth noting that there have been no direct statements from the Democratic candidate confirming this view. Additionally, during the campaign, an advisor to Harris stated that she supports the crypto industry, and the vice president herself indicated that the U.S. would dominate sectors that will define the next century, including the blockchain industry.

However, several experts agree that Bitcoin’s growth in 2024 is inevitable, regardless of the outcome of the U.S. presidential elections.

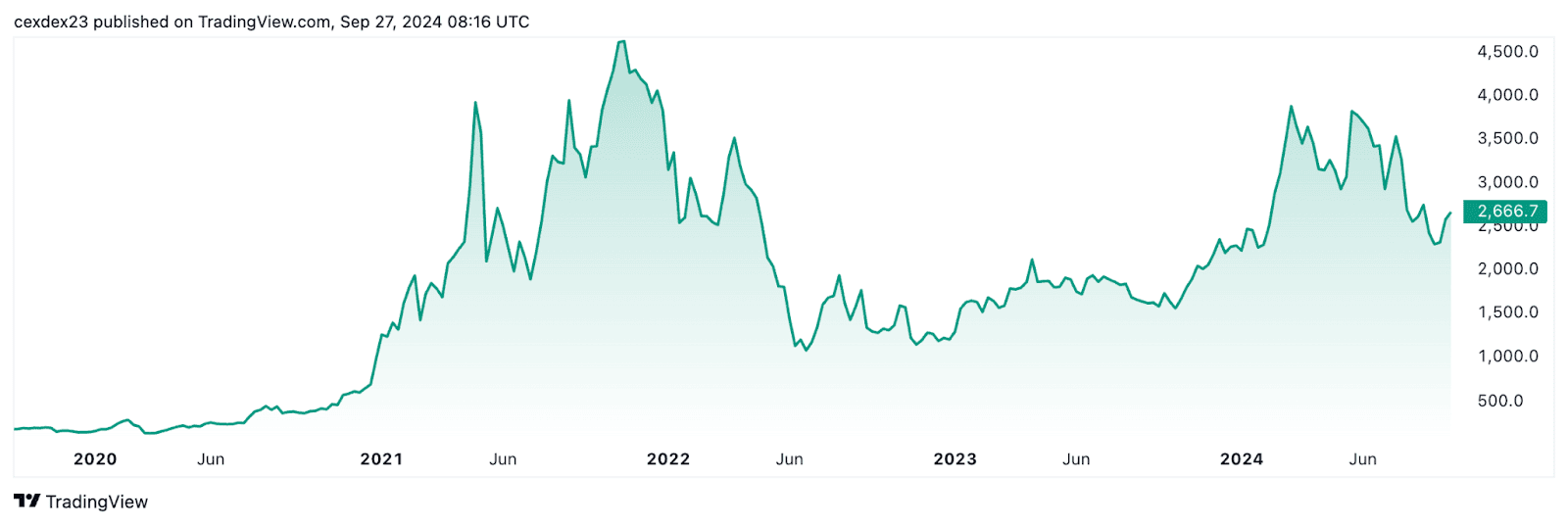

Problems for Ethereum

Due to the increasing number of Layer 2 (L2) solutions and the decreasing transaction costs following the Dencun upgrade, activity within the Ethereum ecosystem is gradually shifting from the main blockchain to L2 networks.

In the long term, this could pose a serious ecosystem problem, as these changes are already exerting price pressure on the second-largest cryptocurrency by market capitalization. The decline in activity—and, consequently, transaction fees—has led to a significant drop in the volume of burned tokens, which had previously offset the issuance of ETH for validator rewards. As a result, the network, which had long remained deflationary, has turned inflationary once again.

Spot Ethereum ETFs are reinforcing the trend, as of the time of writing, the overall outflow of funds exceeds the amount of incoming investments, and it remains unclear when exchange-traded funds will be able to reverse this dynamic.

This should also be noted: sales from whales, including Donald Trump and the Ethereum Foundation, which has sold 239,000 ETH for over $500 million over the past three years.

The best indicator of investor sentiment is the asset’s price—at the time of writing, Ethereum is trading at nearly half its peak values from 2021, and the waning spring momentum has resulted in a more pronounced and rapid decline compared to Bitcoin.

Diminishing Key Drivers of Activity

One of the primary incentives for activity in 2023-2024 has been airdrops. Over the years, the perception of this concept has evolved among both developers and regular users, leading to several revisions of the technical mechanisms for its implementation. This has resulted in the emergence of point-based distributions and a crisis of trust between the audience and the teams. In particular, this has manifested in the “sybil hunting” efforts from zkSync.

At the time of writing, airdrops remain the dominant strategy for market entry for new projects. However, the direction of their evolution and effectiveness are uncertain, raising again the issue of attracting and retaining retail investors in the face of intense competition in the crypto market.

Another important narrative has been meme coins. However, the “meme coin mania,” which began in late 2023 in the Solana ecosystem and gradually spread to nearly all major networks, is beginning to wane.

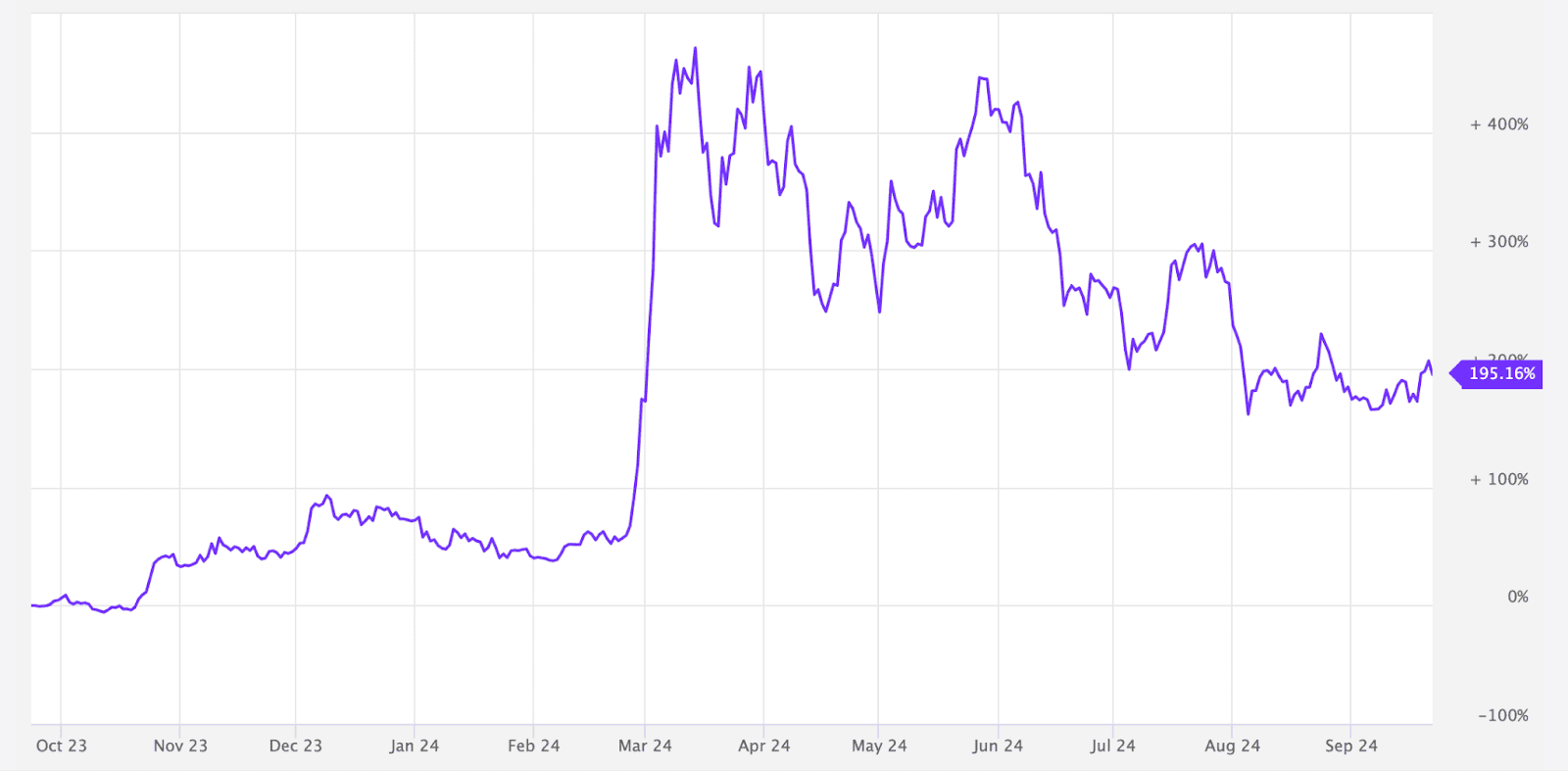

This is evidenced by the MarketVector Meme Coin Index from VanEck, which tracks the six most capitalized meme tokens.

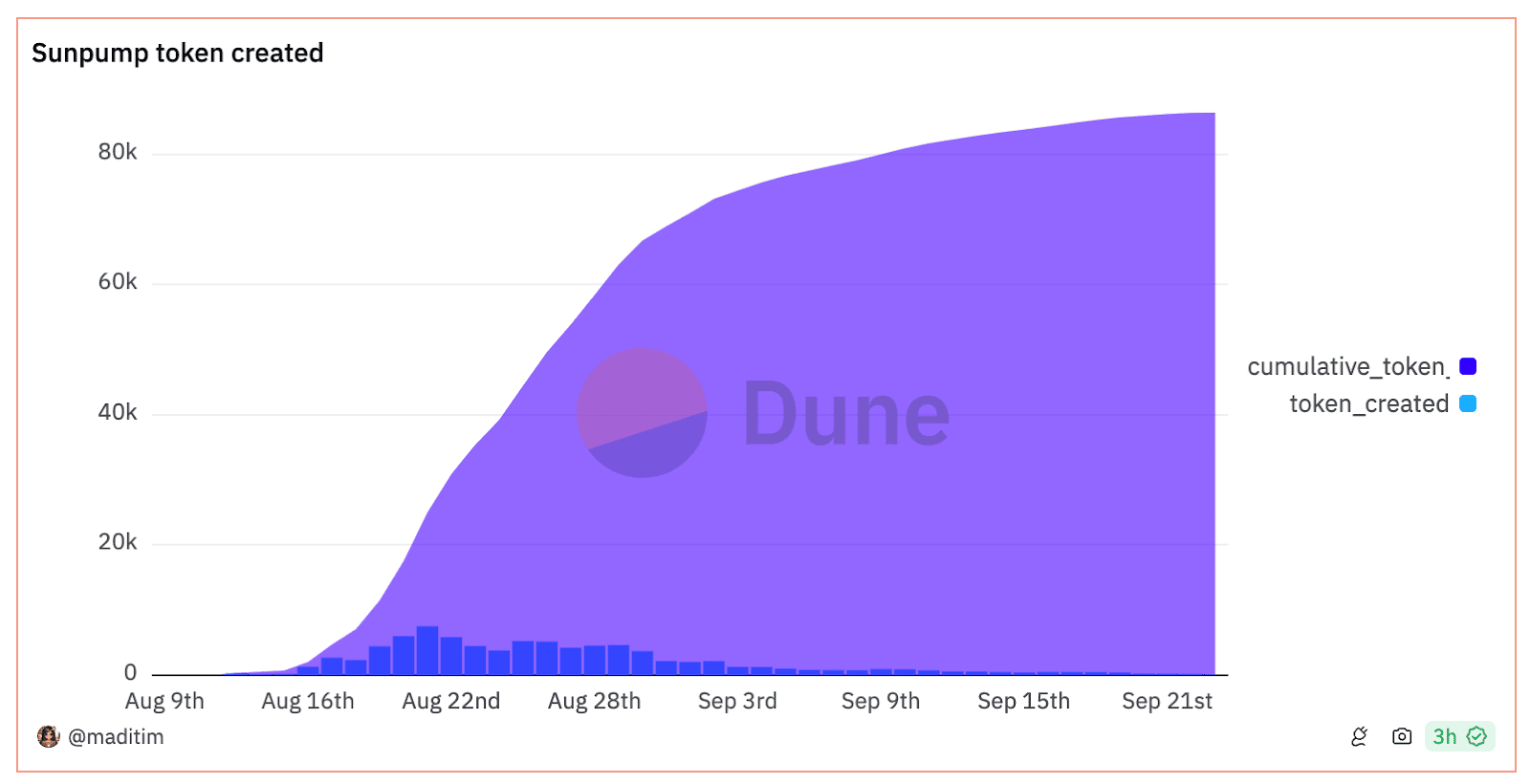

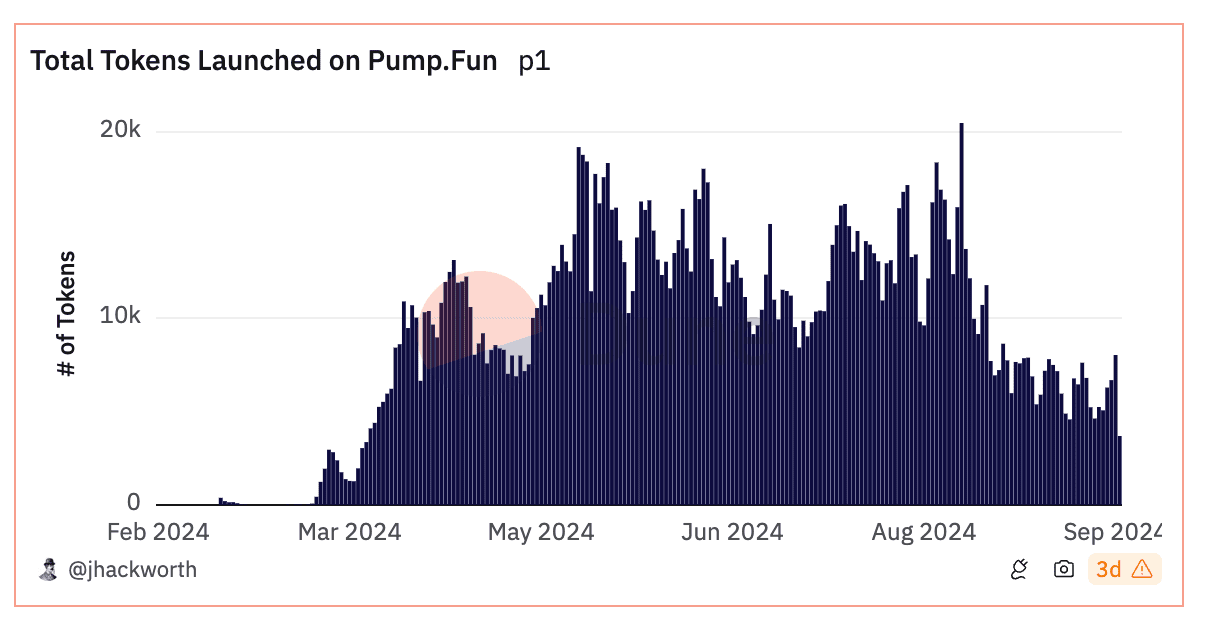

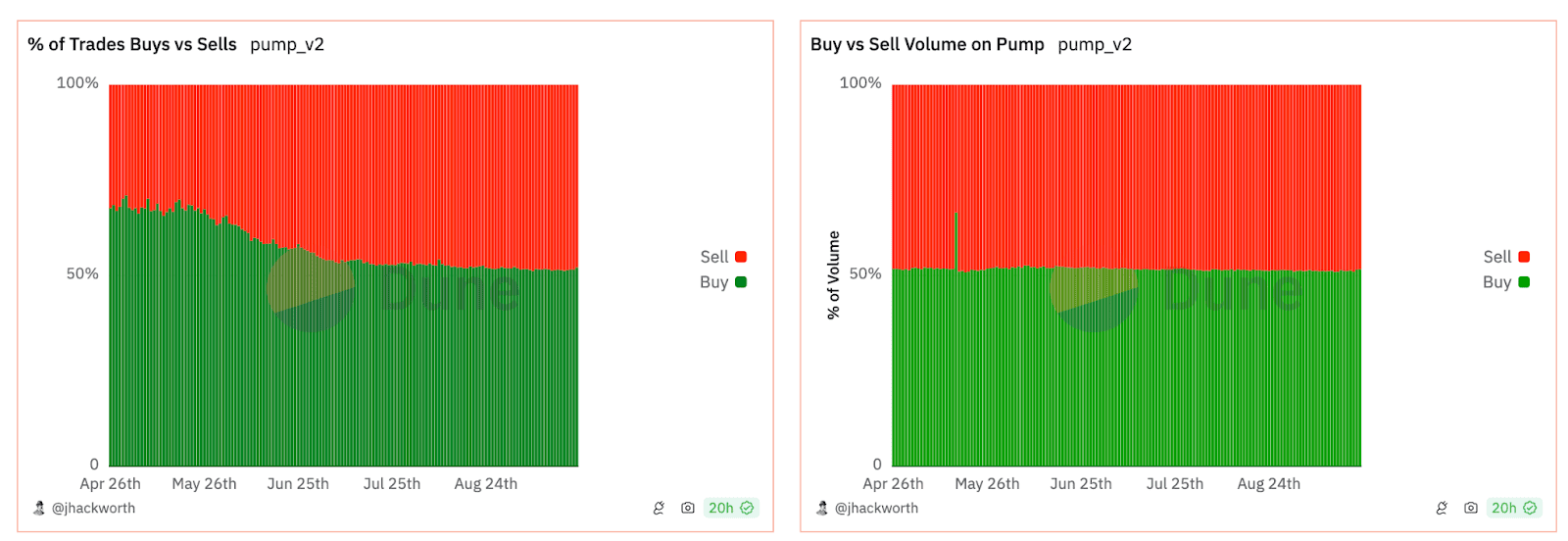

Additionally, the statistical indicators for the most active platforms for launching meme tokens—pump.fun and Sunpump—have plateaued, leading to a decline in the revenues of these services.

It seems that meme coins—or at least the segment of the market associated with the platforms for launching them—are beginning to lose their appeal. The main issue with this mechanism appears to be the high proportion of failed tokens and the low chances for participants to achieve profits.

Decline in Investments in Blockchain Projects

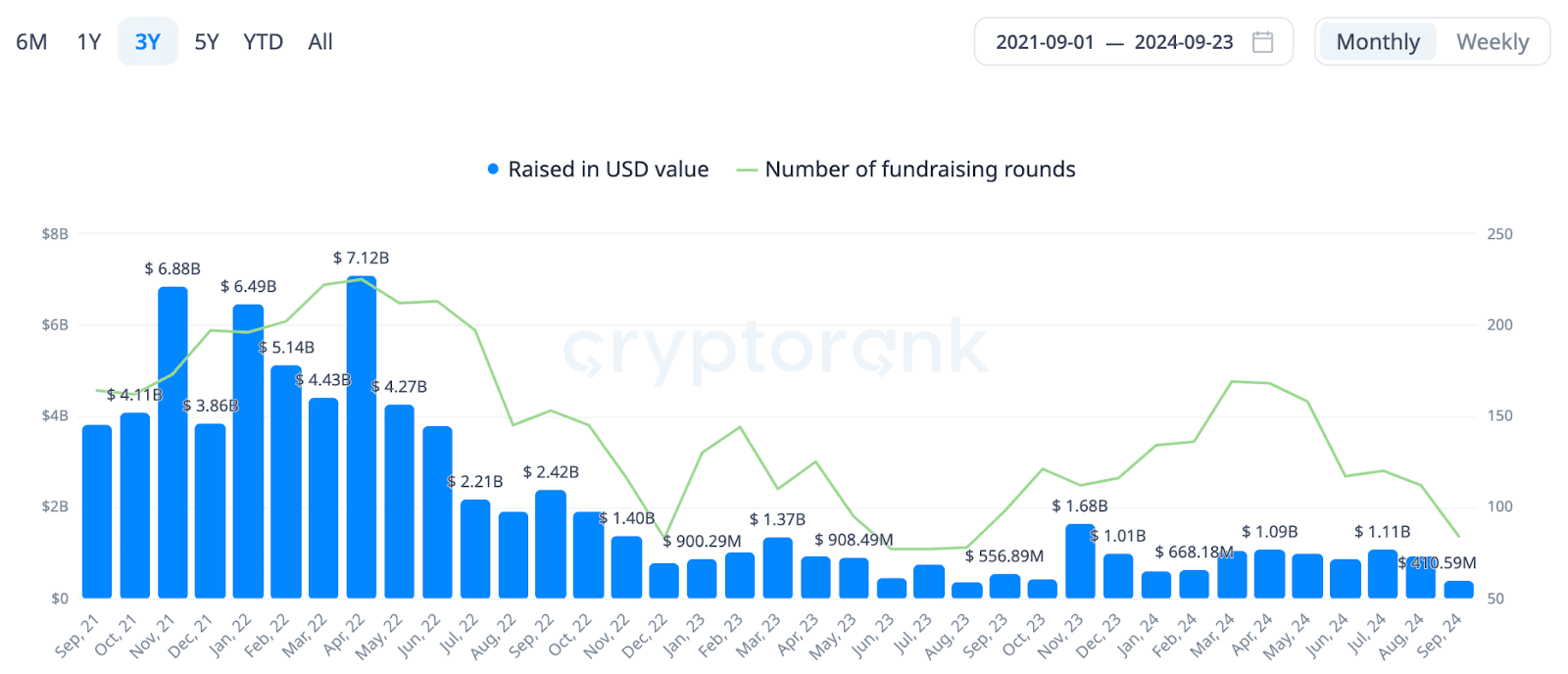

According to Cryptorank, the average monthly investment in blockchain projects from venture funds in 2024 fluctuates between $0.6 billion and $1.1 billion. This is seven times lower than during the peak interest in the industry in 2021 and three times lower compared to the “pre-bull run” figures of the previous cycle.

Investigating the reasons behind such a significant decline in interest from institutional capital warrants a separate in-depth article. However, it is likely a systemic issue influenced by several factors. One of them is the imbalance in the tokenomics of new projects and the inequality of opportunities between major players and retail investors, which has resulted in low activity among the latter.

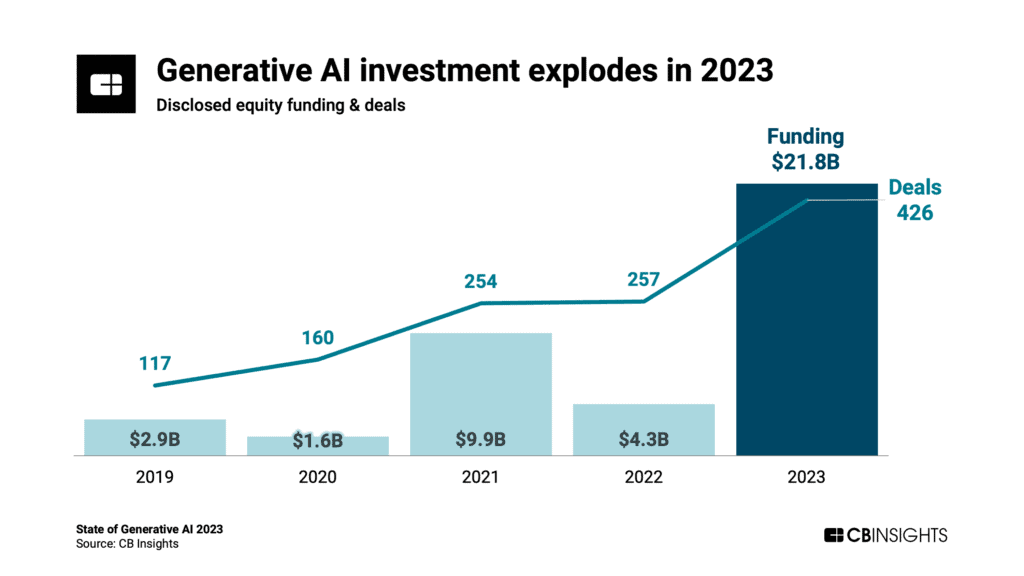

Another reason may be the explosion of the AI sector, which is diverting the attention and capital of venture firms away from the crypto industry. According to CB Insights, investments in generative AI-based projects increased from $9.9 billion in 2021 to nearly $22 billion in 2023.

In any case, venture capital is scaling back investments in blockchain projects, which may impact overall activity in the industry and the prices of many projects in the medium to long term.

Historical Experience

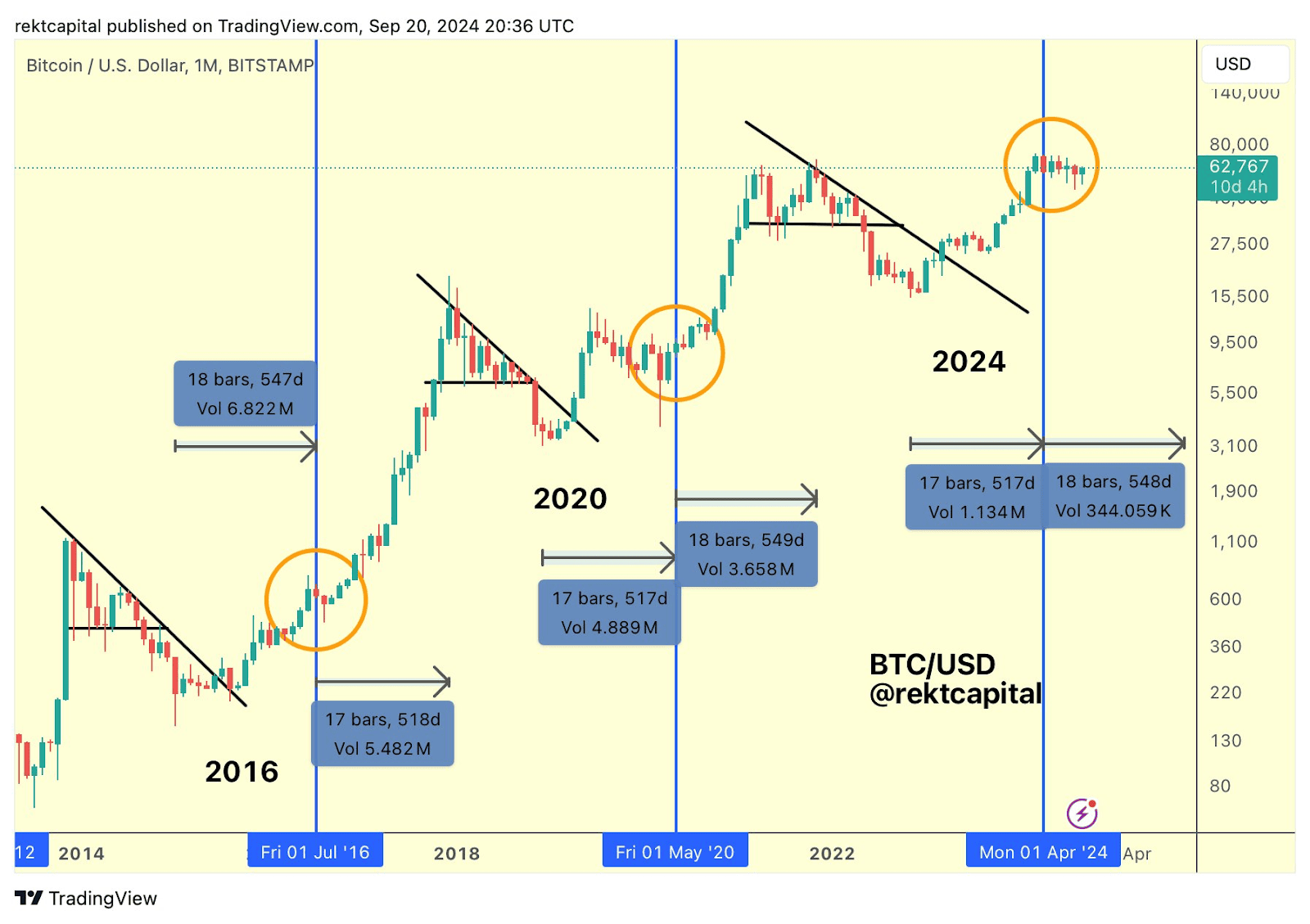

One of the most common tools for positioning the current market stage of Bitcoin is comparing it with previous cycles. According to this method, the first cryptocurrency is currently on the brink of exponential growth.

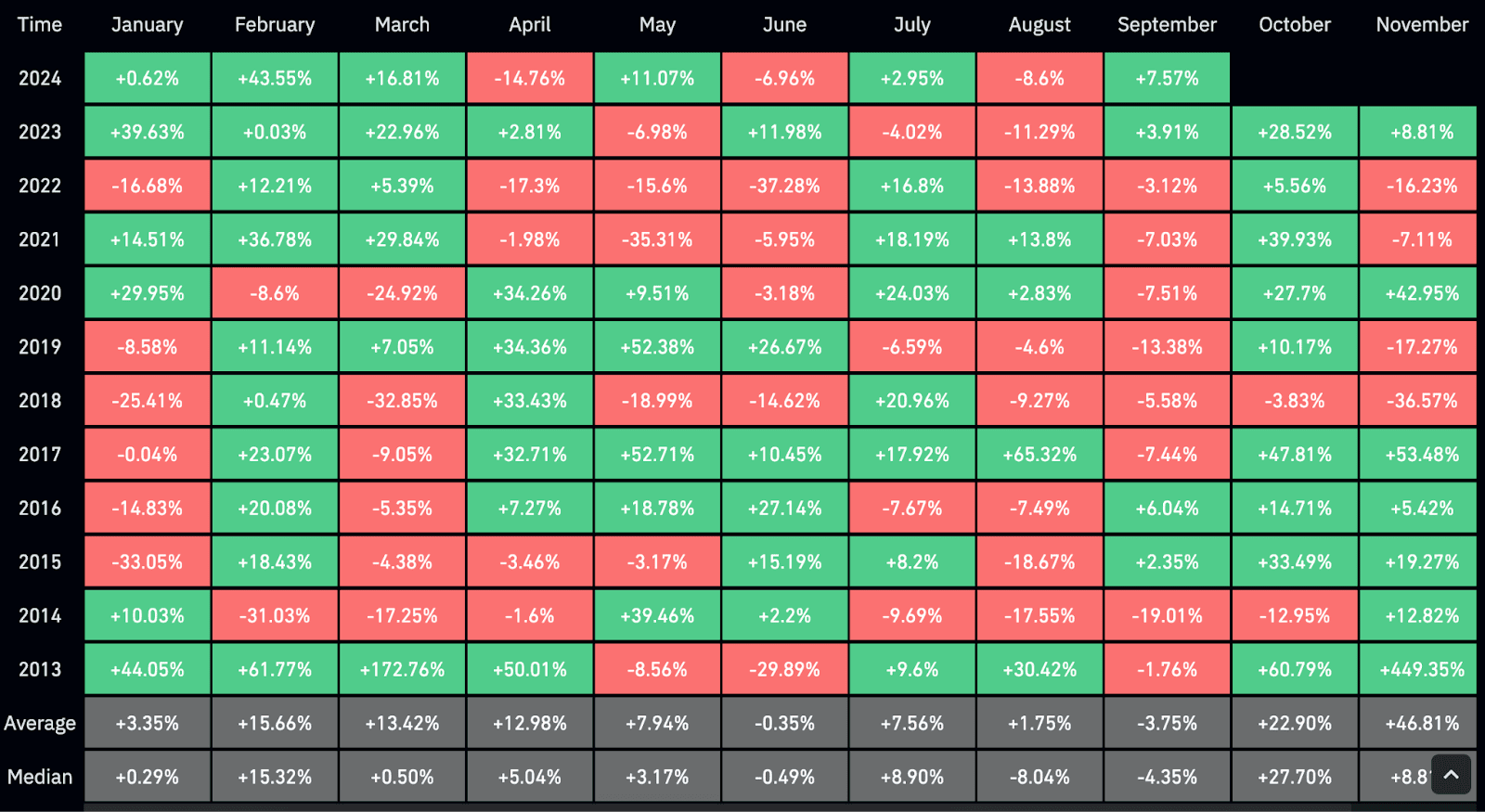

As for short-term expectations, they are often formed based on historical data regarding the asset’s monthly growth. This is how the popular memes in the community, “sell in May and go away” and “uptober,” emerged.

However, despite the fact that historical analysis allows for effective determination of the current market phase, the dynamics of quotes in each cycle have their own characteristics. Thus, in 2024-2025, the state of the crypto market may be influenced by factors that were absent during the previous bull run:

- Macroeconomic Situation: The exponential growth of the crypto market at the end of 2021 was largely driven by the easing of U.S. monetary policy and fiscal stimuli in the context of a potential recession due to the COVID-19 pandemic. Currently, the U.S. government has no reason to provide comparable support to the economy and financial sector, although, as mentioned earlier, the Federal Reserve has ended its tightening cycle.

- Politicization: Regulatory issues have always been pressing for the crypto industry, but the sector remained relatively apolitical during the last cycle. In 2024, however, Bitcoin and cryptocurrencies have become a factor potentially capable of influencing the outcomes of the U.S. presidential elections. This opens new opportunities for digital assets but also places them under the influence of political power—a new factor for this market.

- Exchange-Traded Funds (ETFs): The spot Bitcoin ETFs launched in early 2024 have mostly operated in a relatively stable market, and it remains unclear how they will affect cryptocurrency volatility—whether they will enhance it or limit it by creating strong levels of support and resistance. Regardless, ETFs will introduce their own adjustments to this cycle.

- Problems with “Venture” Altcoins: The aforementioned issue of “broken” tokenomics has led some retail users to perceive most altcoins as “meme coins in suits,” i.e., useless assets created to profit venture funds. The emergence of nihilism in this context and the potential for a “meme coin mania” could alter the established structure of capital distribution from “Bitcoin → high-cap altcoins → higher-risk tokens.” However, it remains unclear what this change will look like.

- Stagnation in the Industry: The market’s growth in the previous cycle was largely due to the development of DeFi and the emergence of a new class of assets—NFTs. Currently, we observe an evolution of infrastructure solutions in the form of layer two networks, modular blockchains, and abstractions, but not user products. Platforms capable of attracting the “next million users” to Web3, such as messengers or seamless payment services, are still in their early development stages, while trends that many bet on have fizzled out without taking off.

Thus, historical experience and data from previous cycles suggest that Bitcoin, followed by the rest of the market, should soon transition into a phase of exponential growth. In particular, the last quarter of 2024 could be “green” for the industry, facilitating the establishment of new price records.

However, in this cycle, there are several factors—such as the U.S. presidential elections and the carry trade in yen—that can alter the usual phases of market development. These will determine the cycle’s characteristics and show whether established patterns work under conditions of institutionalization and politicization of cryptocurrencies, as well as against the backdrop of changing retail investor attitudes toward most digital assets.