The $50 Billion “Trojan Horse”: Why the Market Is Swept by “Memecoin Mania”?

According to Google Trends, the number of searches for the term “memecoins” in March 2024 increased tenfold compared to February. At the time of writing, the corresponding asset category on the CoinGecko aggregator counts nearly 900 tokens, with a total market capitalization exceeding $50 billion.

The Incrypted team explored why memecoins are becoming increasingly popular among retail investors, which networks they have gained the most traction in, and what benefits they can bring to the community and the industry.

What is “Memecoin Mania”?

The concepts of “memecoin mania” and “memecoin supercycle” have emerged in the media against the backdrop of the rapid growth of this segment, accompanied by an influx of new users and investments. They denote an abnormal interest in meme tokens, which has become a hallmark of the current market cycle.

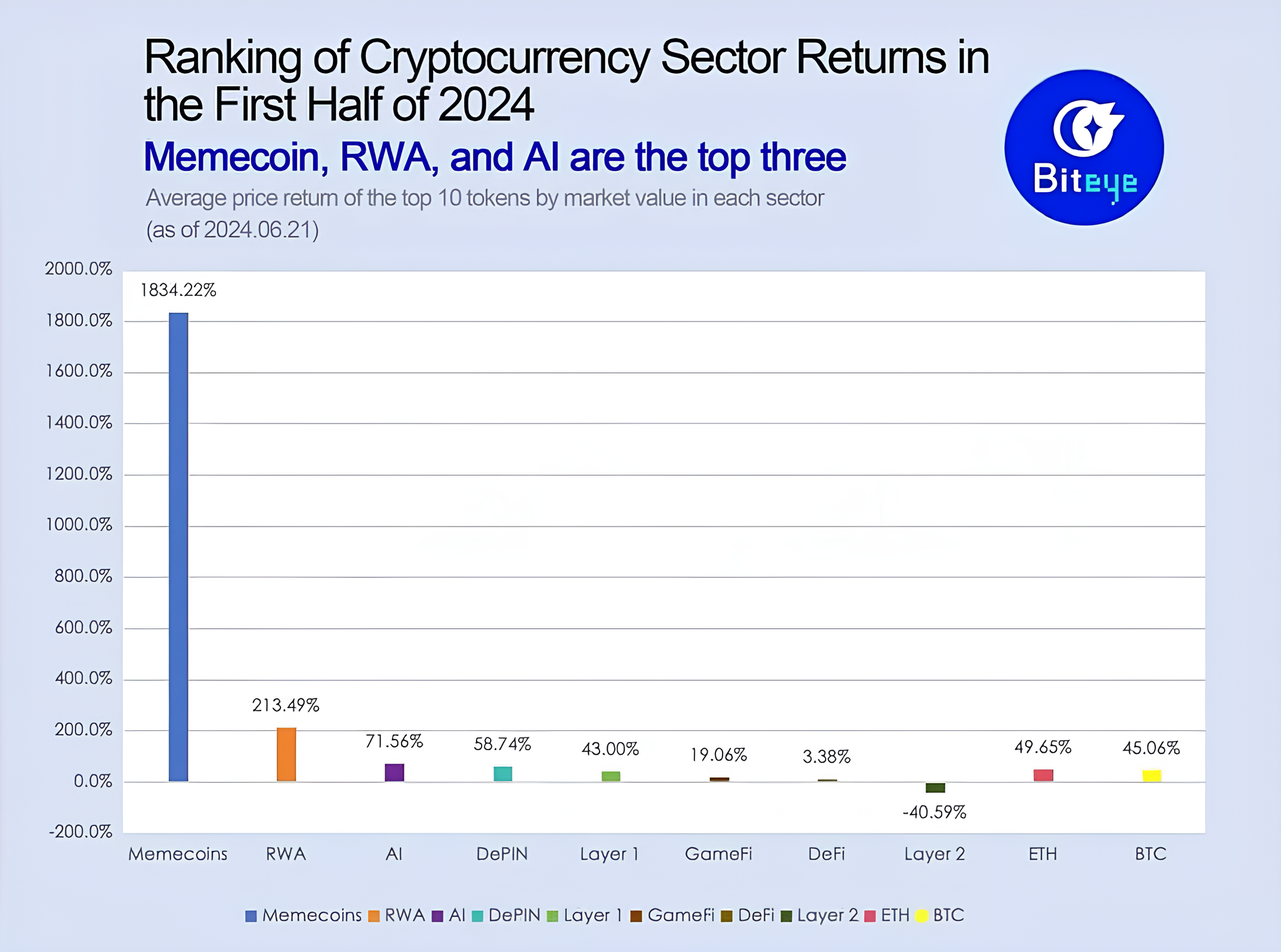

According to Coingecko, the total market capitalization of this asset class increased by nearly 1313% in the first quarter of 2024. Journalist Colin Wu also reported that the profitability of memecoins for the first half of the year was 1834%, which is nine times greater than the RWA segment. Moreover, the GMCI Meme index, which includes 19 popular memecoins, showed a 174% increase year-on-year.

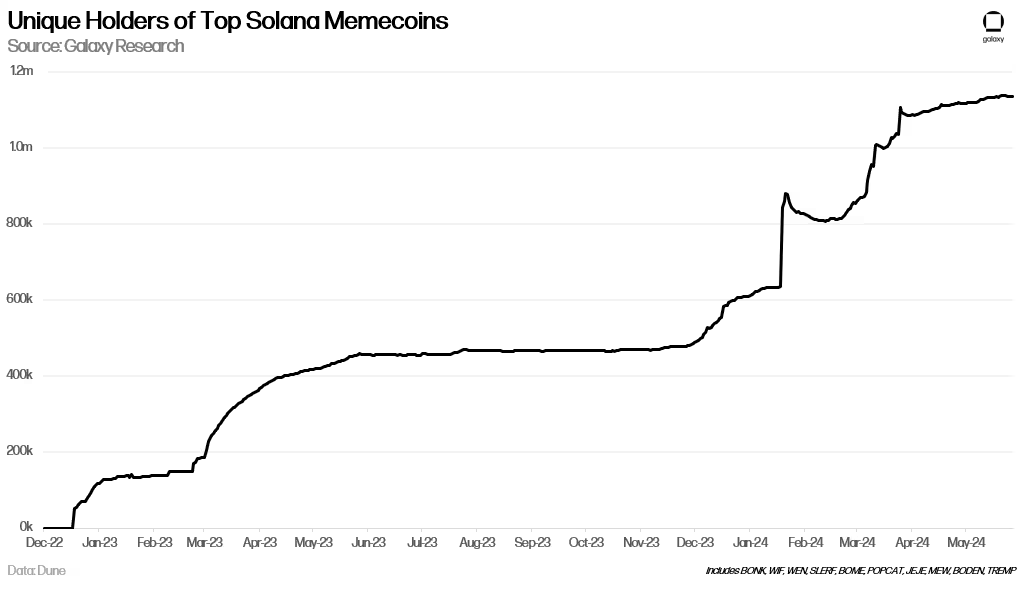

Additionally, IntoTheBlock reported a record influx of new traders into this market segment in March 2024. Interest in memecoins is shown not only by retail investors but also by some venture firms like Mechanism Capital, as well as blockchain projects such as The Sandbox

Key Ecosystems of Memecoins

Despite the fact that memecoins are available on virtually all major networks, some ecosystems have taken leading positions in this segment. Among the key players are Solana and the Layer 2 solution Base.

Solana

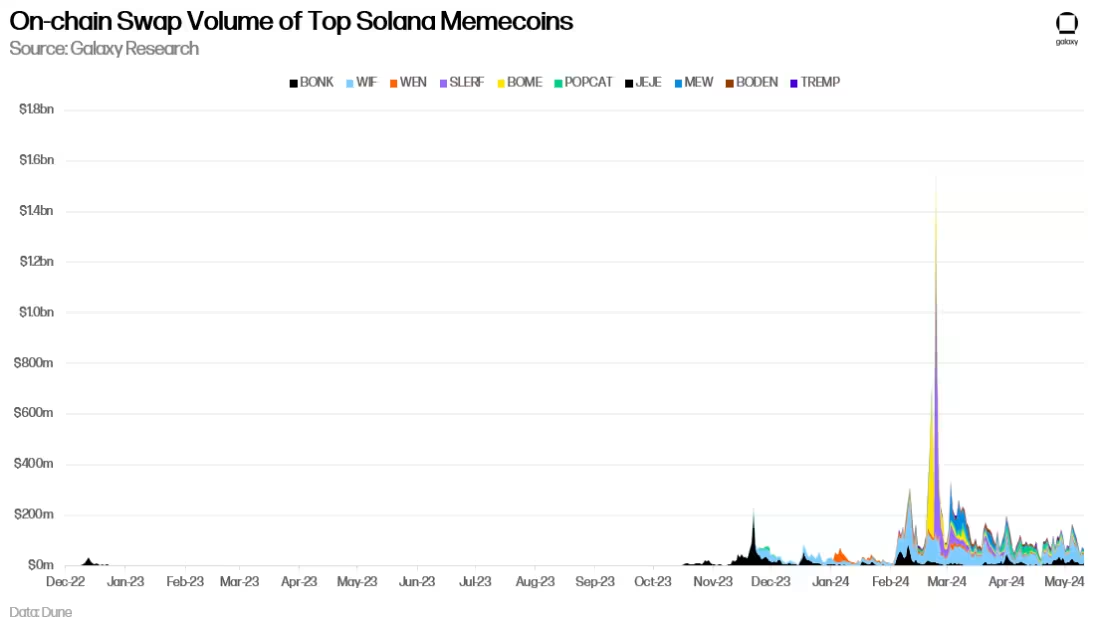

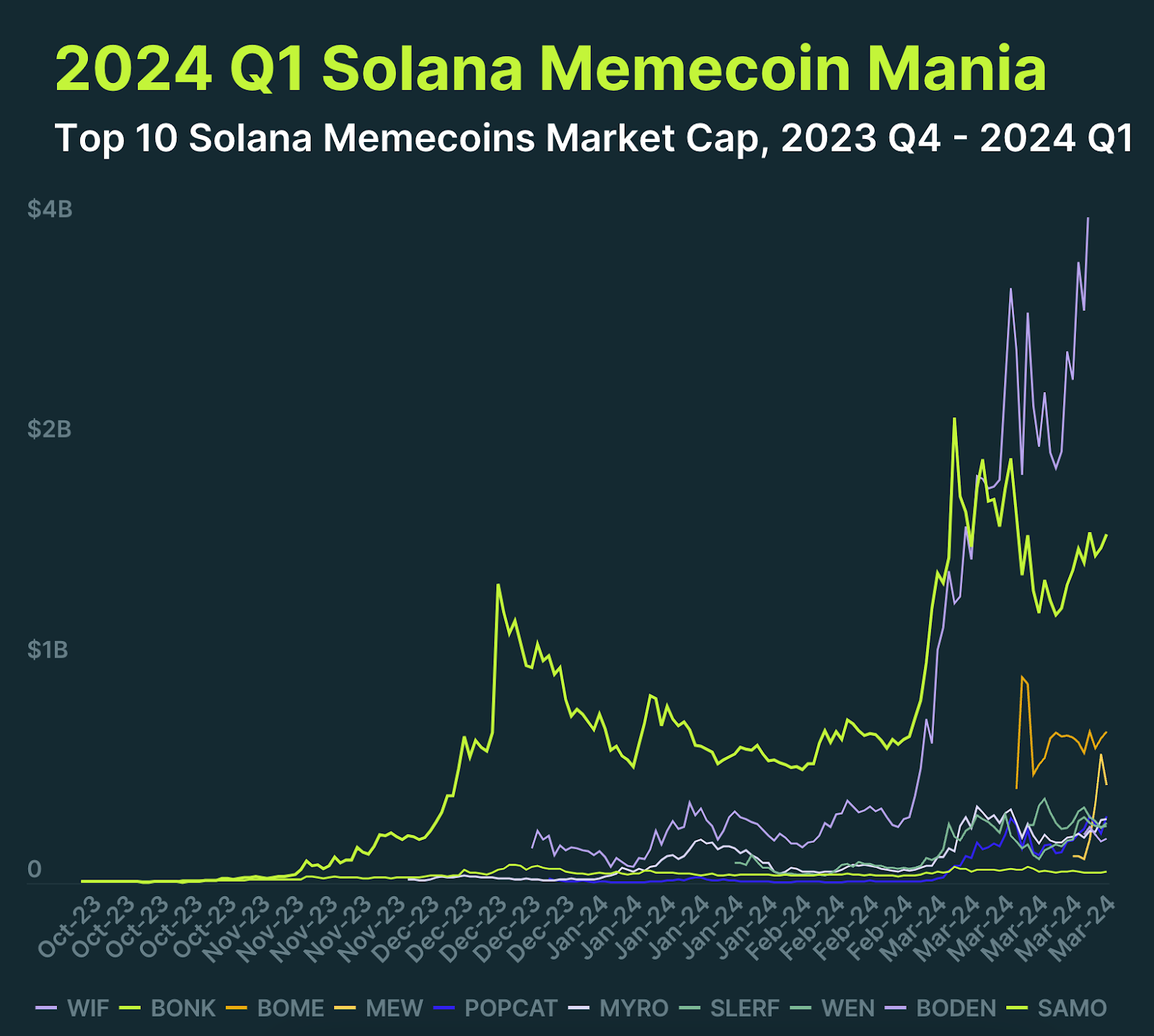

According to The Block, over 450,000 tokens were created on the Solana network in May 2024, the majority of which are memecoins. As of June 26, more than 1 million new assets had been launched solely through the pump.fun service, making Solana the largest memecoin ecosystem in the industry. The peak of memecoin trading occurred in March 2024, primarily driven by the tokens BOME and SLERF, which offered the launch and distribution of new assets in a presale format.

Several factors contribute to the rising popularity of Solana in the context of memecoin launches:

- High throughput. Solana can process over 3,000 transactions per second, ensuring a quality user experience even during peak load periods.

- Low fees. At the time of writing, the average network fee on Solana is 0.00015 SOL or $0.02, which is ten times lower than on Ethereum and even lower than the fees of most Layer 2 networks.

- Availability of infrastructure. A key platform for launching and trading memecoins in the ecosystem is the pump.fun service, which allows users to create a token without the need for liquidity or technical skills.

Base

Base is the leader in user activity and the number of new tokens among Layer 2 networks. At the time of writing, the blockchain processes over 3 million transactions daily, and the number of active addresses exceeds 600,000. According to Coingecko, the token BRETT, launched in this ecosystem, ranks among the top 10 memecoins by market capitalization.

As with Solana, key drivers of growth include low fees and the availability of user-friendly infrastructure in the form of the Basecamp service and the specialized Layer 3 network Degen Chain, which features its own memecoin. Such projects contribute to forming a strong community in the Base ecosystem that is interested in trading high-risk assets.

Another potential hub for memecoins could be the TON ecosystem, thanks to its connection with the messaging app Telegram and the launch of the Memelandia platform. However, memecoins in this network have yet to gain widespread adoption.

Reasons for the Boom in the Memecoin Segment

At the time of writing, the memecoin segment is actively developing, making it difficult to determine the value and place of this asset class in the industry. Influencers, analysts, investors, and other market participants present various theories to explain the popularity of such tokens. All of these are based on economic or cultural components.

Economic Narrative

The economic narrative attempts to justify the growing demand for memecoins by the financial problems that force investors to seek new tools for earning. Among these issues:

Dominance of Venture Capital

Within the blockchain industry, this trend is most widely discussed through the problem of tokens with high FDV (fully diluted value) and low circulating supply. Such assets reflect an imbalance between the share of retail and venture investors in the funding structure of projects and indicate a reduction in opportunities for the former.

A report published by Binance in May 2024 raised important questions for token holders, such as off-market pricing, artificial supply crises, and inflated valuations of many projects. Some participants in this discussion seem to believe that memecoins attract retail investors more than manipulative “VC tokens.”

Financial Nihilism

Among others, Jason Choi, the founder of Tangent, points to financial nihilism as a reason for the popularity of meme assets. In his view, buyers are inclined to take significant risks in hopes of changing their financial situation and lifestyle.

This phenomenon arises from the decline in real incomes, the dominance of large capital in various sectors, and the growing gap between the rich and the poor. As a result, people lose hope of changing their lives through honest and hard work and tend to regard regular income with disdain, betting instead on more risky methods such as gambling or trading memecoins, viewing the latter as a more socially acceptable form.

Due to this high tolerance for risk, Quinn Thompson, founder of the hedge fund Lekker Capital, has referred to memecoins as the “madness of retail traders.”

Speculative Expectations

Thanks to limited initial liquidity and the attention of traders, some memecoins experience a rapid increase in value right after their launch. Consequently, a belief has formed within the community about the profitability of these instruments compared to Bitcoin or altcoins.

In practice, in most cases, the rapid increase is followed by an equally swift decline in prices due to market manipulation or waning attention. Only a few projects, such as PepeCoin (PEPE), Bonk (BONK), or Shiba Inu (SHIB), manage to get listed on major exchanges and establish a stable market position by having a large number of holders and creating fundamental value.

It is worth noting that, despite the intuitive appeal of the financial narrative, there is no direct correlation between the popularity of memecoins and the decline of “VC tokens,” as emphasized by Hashib Qureshi, managing partner at the investment fund Dragonfly Capital.

As for financial nihilism and the associated speculative expectations of retail investors, several questions arise that prevent definitive conclusions. For instance, do buyers of these tokens employ alternative methods of getting rich quickly? And is the pursuit of easy money indicative of investors’ tendencies toward gambling?

Cultural Narrative

Another perspective prioritizes the cultural significance of memecoins. Proponents of this view argue that the true reason for the popularity of this asset class is not tied to the pursuit of easy money but is based on other foundations.

Rise of Tribalism

Tribalism is a phenomenon where members of a specific community criticize competing social groups, insisting on their own uniqueness and superiority. An example of this can be seen in Bitcoin maximalists.

Yi Lin, co-founder of the venture fund VariantFund, notes that due to the widespread prevalence of tribalism, for a project to succeed in the crypto industry, it must first attract attention and build a strong community, and memecoins are an effective tool for achieving this goal.

A New Way to Spread Memes

To explain the importance of memecoins, analysts at Galaxy employ a broader understanding of memes as basic cultural units. They believe that the value and role of memes remain unchanged, but the methods of dissemination are constantly evolving—cave paintings, newspapers and books, the internet, and today, tokens.

In their view, one aspect of the value of memecoins is that they represent the most modern format of cultural code from a technical perspective. Tokenized memes are easy to create and distribute, and blockchain ensures their secure storage and resistance to censorship.

This elevates memecoins beyond the crypto market, making them part of the broader cultural process.

In practice, there is a combination of economic and cultural factors—just as various analysts emphasize different aspects of memecoins, so too can individual investors see them as a means of quick profit, a symbol of community belonging, or an important cultural meme. Additionally, it is often difficult to separate material value from cultural significance.

For example, purchasing memecoins as an alternative to “VC tokens” has both economic (higher potential returns and fair distribution) and cultural (“rebellion” against venture investors) components. Likely due to these features, Kane Warwick, the founder of the Synthetix protocol, believes that memecoins encapsulate culture, financial instruments, and tokenized assets.

Is There Really No Fundamental Value in Memecoins?

Eddy Lazarin, the CTO of a16z, expressed the opinion that memecoins “undermine the long-term vision of cryptocurrency” and are not very interesting from a technical standpoint, thus deterring serious developers. Meanwhile, Michael Novogratz, the CEO of Galaxy Digital, referred to memecoins as the “cornerstone of the crypto economy.”

These two individuals hold diametrically opposed views, yet neither has provided substantiated arguments in the public space. At the same time, according to Vitalik Buterin, the issue lies not in the absence of fundamental value for such assets but in the community’s inability to apply them for useful purposes, such as charity.

He noted the ability of memecoins to attract attention, a feature many experts consider to be the main advantage of tokens in this segment. Declan Keen, an analyst at DeSpread, remarked that memecoins are the crystallization of the attention economy.

In his view, memecoins are the simplest way to monetize the attention a meme (event, personality, object, etc.) can attract. The value of the token is directly proportional to its popularity.

This assertion is indirectly supported by analysts at Messari, who studied the distribution structure of memecoins. According to the data presented, the most successful assets are characterized by gradual dissemination among an increasing number of owners with minimal influence from “whales.” The study shows that memecoins in the Solana ecosystem need 3,000 investors to attract initial attention and 10,000 for rapid growth.

Bright examples of attention tokenization include celebrity memecoins like MOTHER from Iggy Azalea, as well as assets referencing candidates in the upcoming US elections—Donald Trump and Joe Biden. For instance, Jeo Boden (BODEN) demonstrated growth during the hearing in Hunter Biden’s case, when the president’s name was mentioned in all news outlets.

Amid the popularization of PolitFi, Andrew Kang, co-founder of the venture firm Mechanism Capital, suggested that a new class of memecoins is emerging in the market, utilizing political and religious narratives to attract attention.

Thus, in a broad sense, memecoins enable the tokenization of attention toward any event, person, or object, allowing for profit generation.

Memecoins as a New Project Launch Strategy

According to Li Yin, an increasing number of projects are using memecoins as a tool for market entry strategy. Developers first launch an asset that attracts user attention and helps form a strong community, and then they create a product associated with the token. An example of this is BonkBot.

This approach aligns with the principles of the attention economy and fundamentally differs from the strategy of most contemporary projects, which typically create a product first and attract users through incentives (potential airdrops) before attempting to leverage the attention gained to sell tokens.

As researcher Yash Agarwal from Superteam DAO asserts, in this sense, the governance tokens of many projects are practically indistinguishable from memecoins. Often, these assets do not fulfill their intended function or do so ineffectively, and the primary goal of their issuance is to attract market participants’ attention. Therefore, Agarwal refers to them as “memecoins in disguise.”

Attracting New Users

The third aspect of the utility of memecoins lies in their ability to attract users from outside the industry. Drawing on Agarwal’s position and the core principles of the attention economy, the main advantage of memecoins over other tokens is that they are associated with well-known personalities and events, making them more recognizable to a broader audience.

For instance, the governance token Arbitrum (ARB) captures the interest of investors who have studied Ethereum’s issues and are familiar with the concept of L2 networks. In contrast, PEPE attracts attention from users who recognize this character through memes and comics. Likely, there are more people in the latter category than in the former, and many of them are outside the crypto market.

By focusing on a broader cultural field and, as a result, a wider audience, memecoins can bring “fresh blood” into the crypto market. This is similar to how NFTs did so in 2021-2022.

This position is echoed by Arthur Hayes, who points out that networks supporting memecoins and fostering their further integration into the industry will become increasingly valuable over time. Meanwhile, Maarte Bouss, vice president of research at Messari, referred to memecoins as a “Trojan horse” promoting the mass adoption of technology.

This is also facilitated by more effective marketing campaigns compared to other Web3 projects. For example, the Dog Wif Hat (WIF) memecoin community raised over $700,000 to buy advertising on MSG Sphere in Las Vegas, Iggy Azalea posts several times daily to promote the Mother (MOTHER) token, and Elon Musk periodically acts as an “attention magnet” for Dogecoin (DOGE).

Many teams form partnerships, purchase ads, and mobilize their community’s resources with a single goal: to gain recognition.

As a result, active social media profiles and the marketing strategies of meme projects, grounded in broad cultural narratives, often attract a wider and more engaged audience than financially incentivized activities through airdrops or point programs.

Thus, the fundamental value of memecoins is that they capture audience attention, which can then be used for various purposes, such as launching a new product. This is why Vitalik Buterin does not dismiss memecoins as inherently worthless, instead highlighting the lack of worthy objectives for their application.