By Right of The NFT: The ERC-5725 Standard and Its Approach to Vesting

In April 2023, the teams of ApeBond and Paladin suggested adding the ERC-5725 token standard to Ethereum. This standard allows the use of NFTs in the vesting mechanism..

The developers say the new standard will fix problems with vesting. It will also let blocked tokens move in a market.

Incrypted spoke with one of the authors of the proposal and broke down how ERC-5725 works and how the cryptocurrency community will benefit from the new standard.

What Is Vesting?

The cryptocurrency industry borrowed the term ‘vesting’ from corporate finance. Traditionally, it refers to a set of rules determining the transfer of the right to dispose of assets after certain conditions are met.

For example, companies often distribute stock options to employees as part of incentivization programs. But if there’s vesting, the employee only gets the securities after serving a set period.

In the cryptocurrency industry, the term refers to a similar process where tokens are locked for a predetermined time. Only after the expiration of this period will the owner have free access to them.

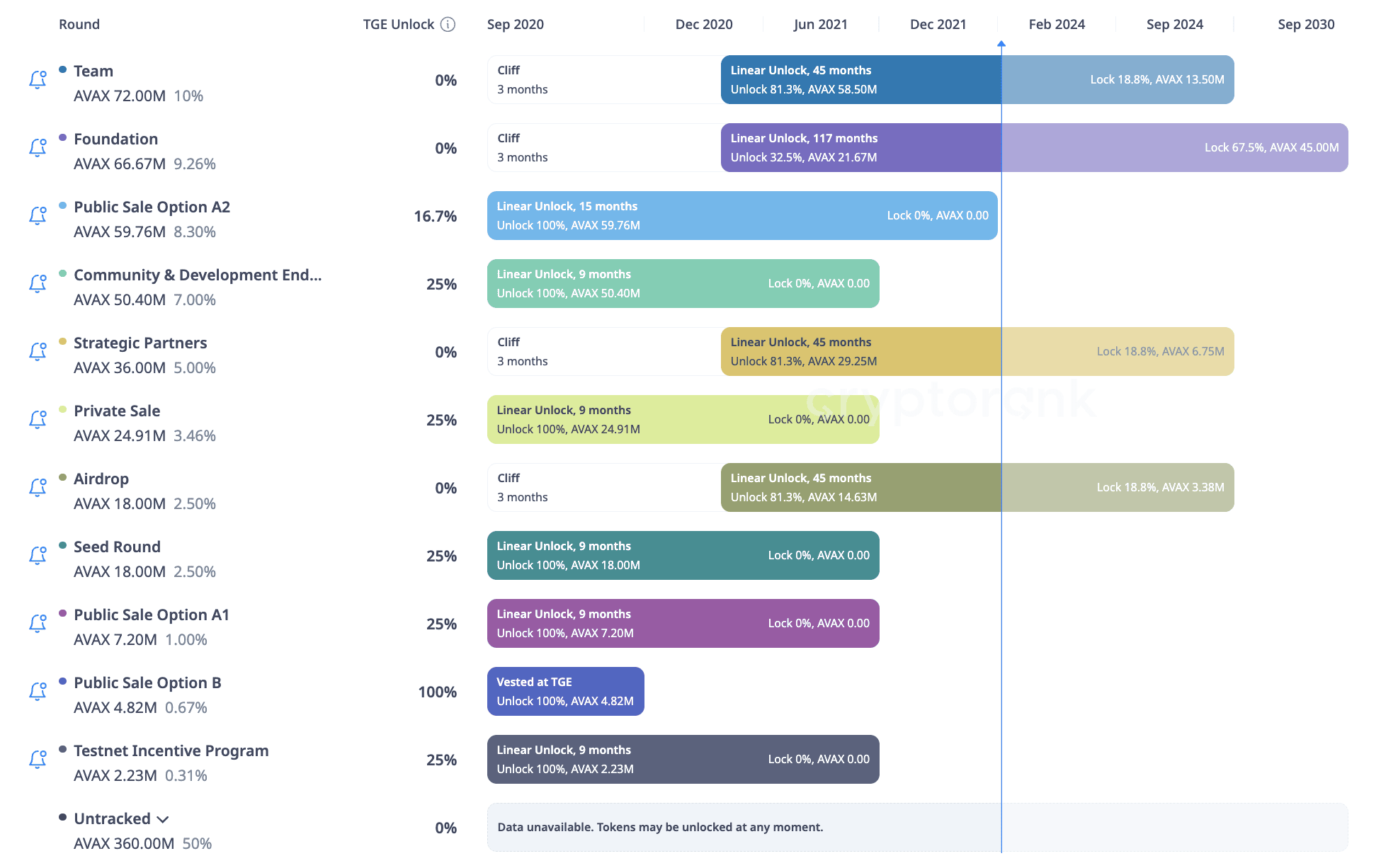

Vesting is widely used as part of fundraising related to digital assets. To reduce risks and prevent investors and team members from rushing to sell tokens for profit, most of their funds are locked and released at predetermined intervals.

Vesting conditions can change. They might depend on time or the project meeting certain goals or performance targets.

Typically. vesting is implemented using smart contracts. These contracts enforce rules automatically. There are various design variations, including contracts for tokens themselves, separate smart contracts or systems, and specialized platforms.

Speaking to Incrypted, the co-founder of ApeBond, who goes by the nickname ApeGuru, noted that these modifications have one thing in common — they all rely on wallet addresses to implement vesting.

«The standard aims to broaden adoption, ease of use and implementation. By having a unified interface, we not only make it easier for developers to implement, but we also make it easier for third parties to read and integrate with this asset class,» said ApeGuru.

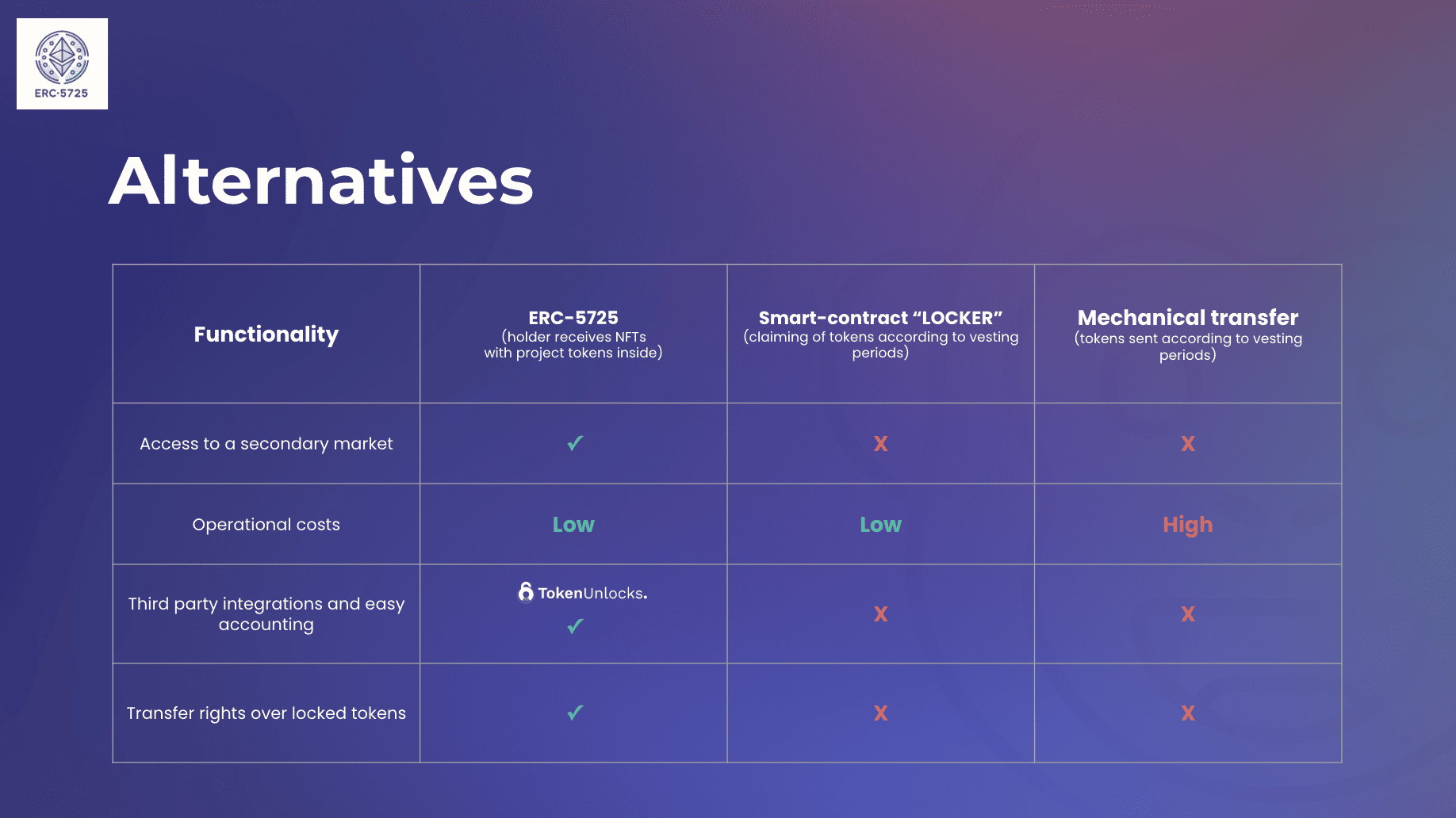

Although the mechanism is popular, it still has several issues that need to be solved. For example, the industry doesn’t have unified interfaces. This makes it nearly impossible to build an ecosystem around the model. This includes analytical tools, secondary markets for blocked tokens, and other related aspects.

Also, there are community concerns about the fairness of this approach. If the protocol shares some revenue with token holders, early investors in vesting won’t get rewards, unlike later ones.

What ERC-5725 Offers

ERC-5725 builds on ERC-721, which brings non-fungible tokens (NFTs) to Ethereum. NFTs are unique objects on the blockchain and are not equal to each other in value. The specification assumes ownership fixation in a distributed registry.

The new standard includes the implementation of an API for NFT contracts that store and represent underlying (vesting) tokens. This allows them to automatically allocate assets to the holder’s address according to the vesting curve.

The authors propose that their solution addresses the issue of non-standardized vesting.

«While time locks and vesting are both important mechanisms for controlling the distribution of ERC-20 tokens and have been around since the age of ICOs, the lack of standardization across the industry can be problematic. Without a standardized approach, it can be difficult for investors to understand how a particular token is being distributed and what the implications of that distribution might be,» ApeBond and Paladine explained.

As mentioned before, EIP-5725 allows a standard API for NFT contracts. It has two main functions: vesting token rights and transferring those powers.

Such a contract acts as an escrow account, holding assets. They’re released based on the chosen vesting curve when deployed. Only the NFT holder can access them.

The developers state that the standard will enable projects to integrate with an NFT marketplace or create their own to use as a secondary for tokens in vesting.

ERC-5725 has many potential use cases, such as:

- creation of intricate financial products that use vested tokens as underlying assets;

- registering SAFT on the blockchain;

- creating services that add data on ‘vesting’ NFTs to provide analytics.

For instance, ApeBond is currently utilizing ERC-5725 in its Bonds product. This lets various cryptocurrency projects create transferable NFTs. Users can buy them with LP tokens.

NFT holders receive the underlying asset at a discounted rate over a period determined by the issuer, based on various factors.

The Future of NFT Vesting

Despite being simple, ERC-5725 lets vested assets be transferred, making them more liquid. This is a clear use case. It creates a new market and solves problems in token distribution. It also boosts venture capital flexibility.

The standard simplifies the customization of vesting in the context of defining triggers and unlock timestamps. It also enables the inclusion of third-party resources, such as analytics, in the process.

At the time of writing ERC-5725 has been implemented only by niche products. For example, the ApeBond did it, but the relatively low volume of operations on the platform does not allow us to draw conclusions about the popularity and prospects of the new model.

However, ApeGuru said that a number of platforms – notably TrustSwap and Polkastarter – are already working on integrating the standard. He added that several projects are also using it in their fundraising.

If industry participants support the implementation of the standard, there will be a unified interface for vesting in the market. However, mass adoption of the concept is needed to have a meaningful impact on the industry.