Interacting with the Sei blockchain ecosystem

Sei is an open source Layer 1 (L1) blockchain built on Cosmos and focused on decentralized exchange trading. The network uses a modified flow.

Order matching, transaction batching and frontrunning protection mechanisms increase throughput and reduce latency. Claimed throughput is up to 20 000 transactions per second with finalization in 600 ms.

The team managed to raise $95 million from Multicoin Capital, Coinbase Ventures, Delphi Ventures, Jump Crypto and others. The team also received one round of funding from Circle, the amount of which was not disclosed.

A detailed overview of the project can be found here:

Before starting the activity, it should be noted that the Sei team has already held several airdrops, in which they distributed some tokens:

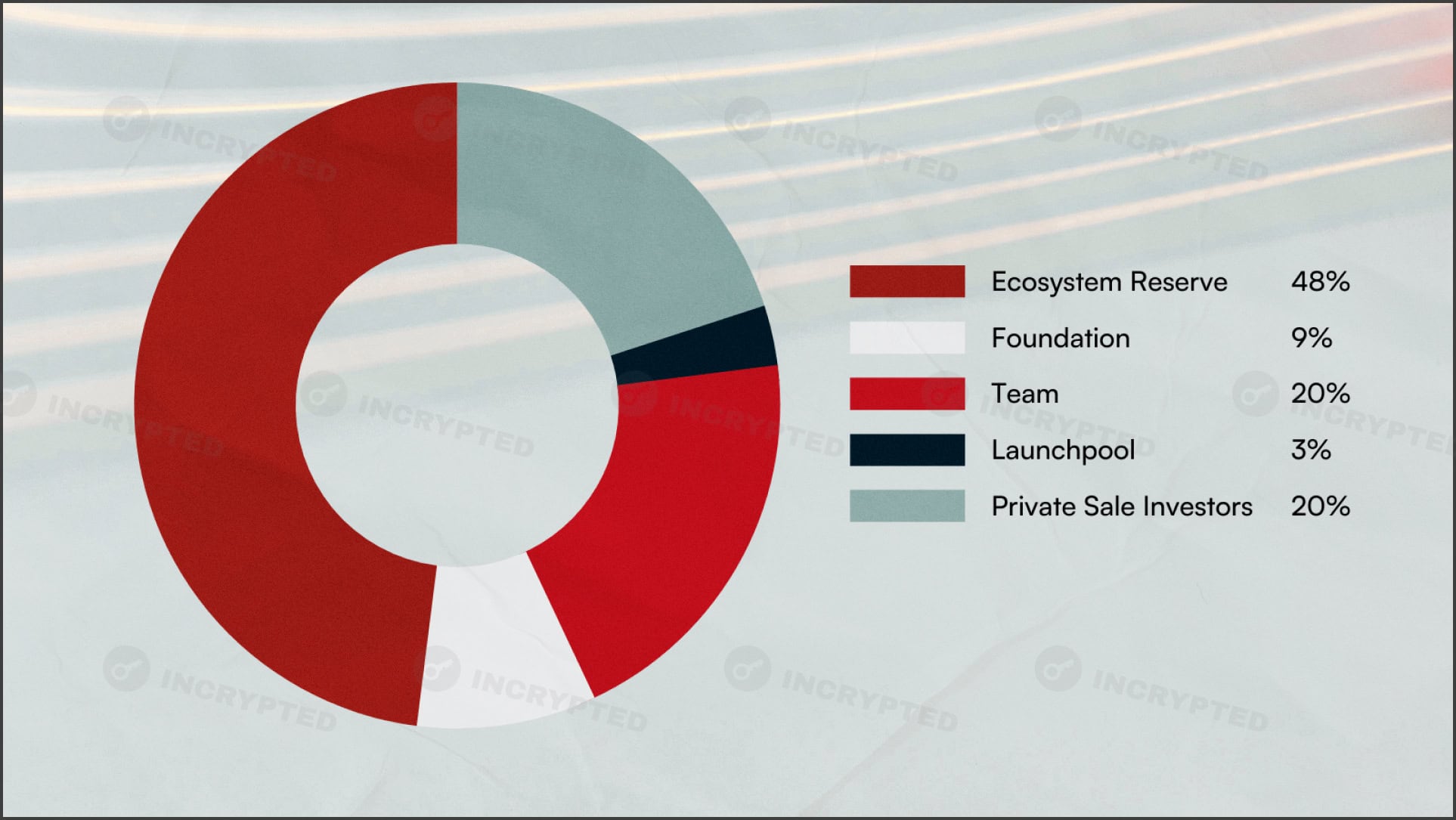

In Sei tokenomics, a significant portion of the overall offering is allocated to the community. Since the team has already held two airdrops, it’s not out of the question that it could go the way of Optimism by periodically holding token giveaways for certain activities.

Preparation

Note: you’ll need a Metamask-type wallet. If you don’t have one, you can use our guide to install and configure it.

Initially, the network only supported the Cosmos SDK and required the appropriate wallets to interact with it. However, with the development of Sei, EVM support was added, so we will use the more popular solution for convenience.

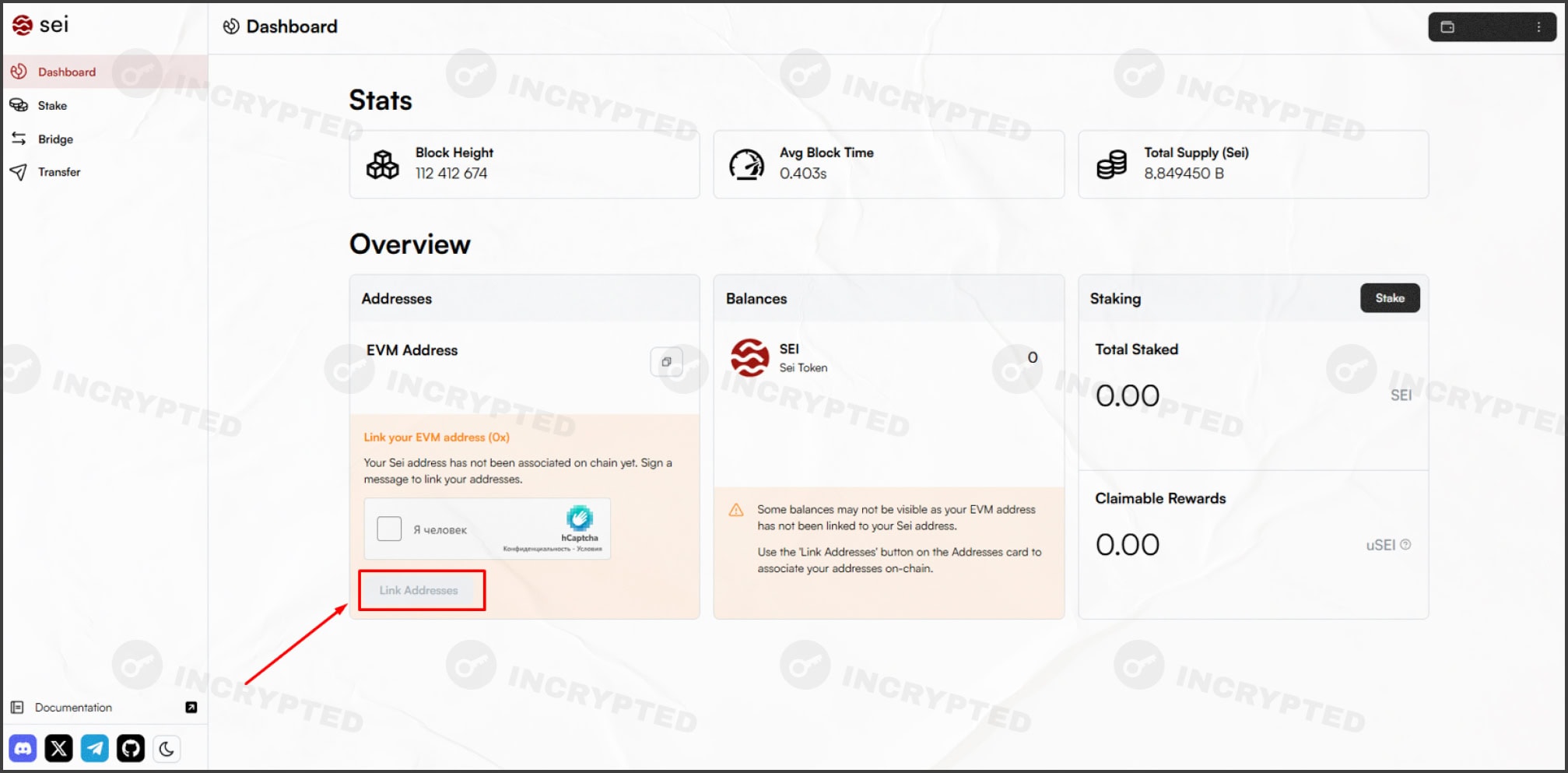

- Go to the site, connect the wallet and add the network.

- Next, pass the captcha and click Link Addresses to link the EVM wallet to the Sei address.

Dapps on Sei

The portal where you previously added the network and got Sei’s address is also the official dApp of the project. Here you can stack the native token and find the bridge.

Native Staking

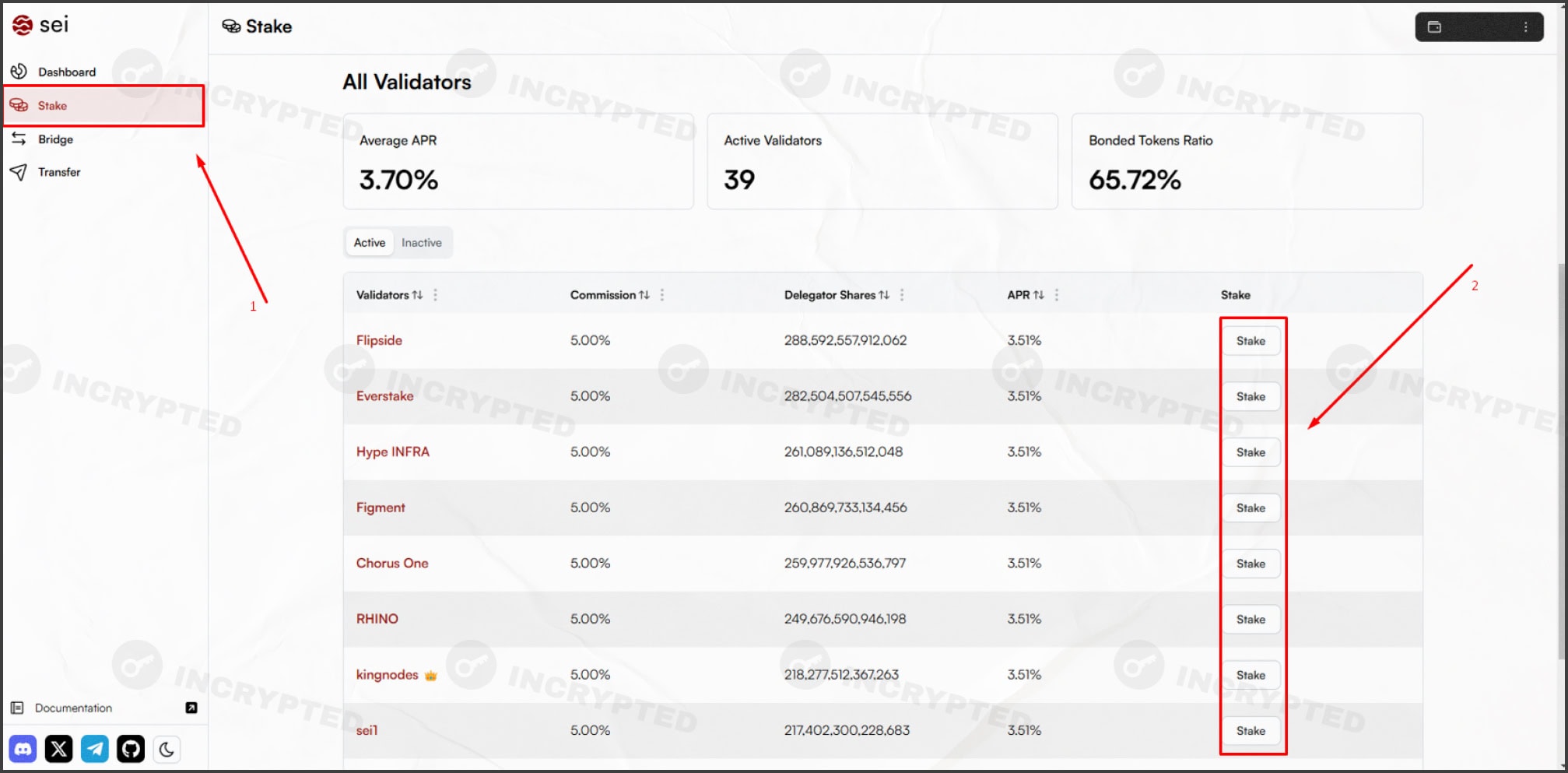

- Go to the Stake tab, select a validator and send the tokens to staking.

Important: it takes 21 days to withdraw tokens from staking. Also, further on we will interact with LST protocols, so we consider this activity as optional.

One more important aspect: when distributing the second airdrop, the team took into account staking from 42 tokens.

Bridges

In the Bridge tab, the team aggregates the available bridges to transfer assets to the Sei network. Many tokens are available for bridging, but unfortunately it is not possible to get a native SEI that is used to pay commissions.

DeFi protocols

Since the network is young — the mainnet was launched in August 2023 — it is actively developing, attracting new developers and dApps. Within this section, we will interact with three DeFi protocols, and the full list for a set of large number of interactions with different smart contracts can be found at the link.

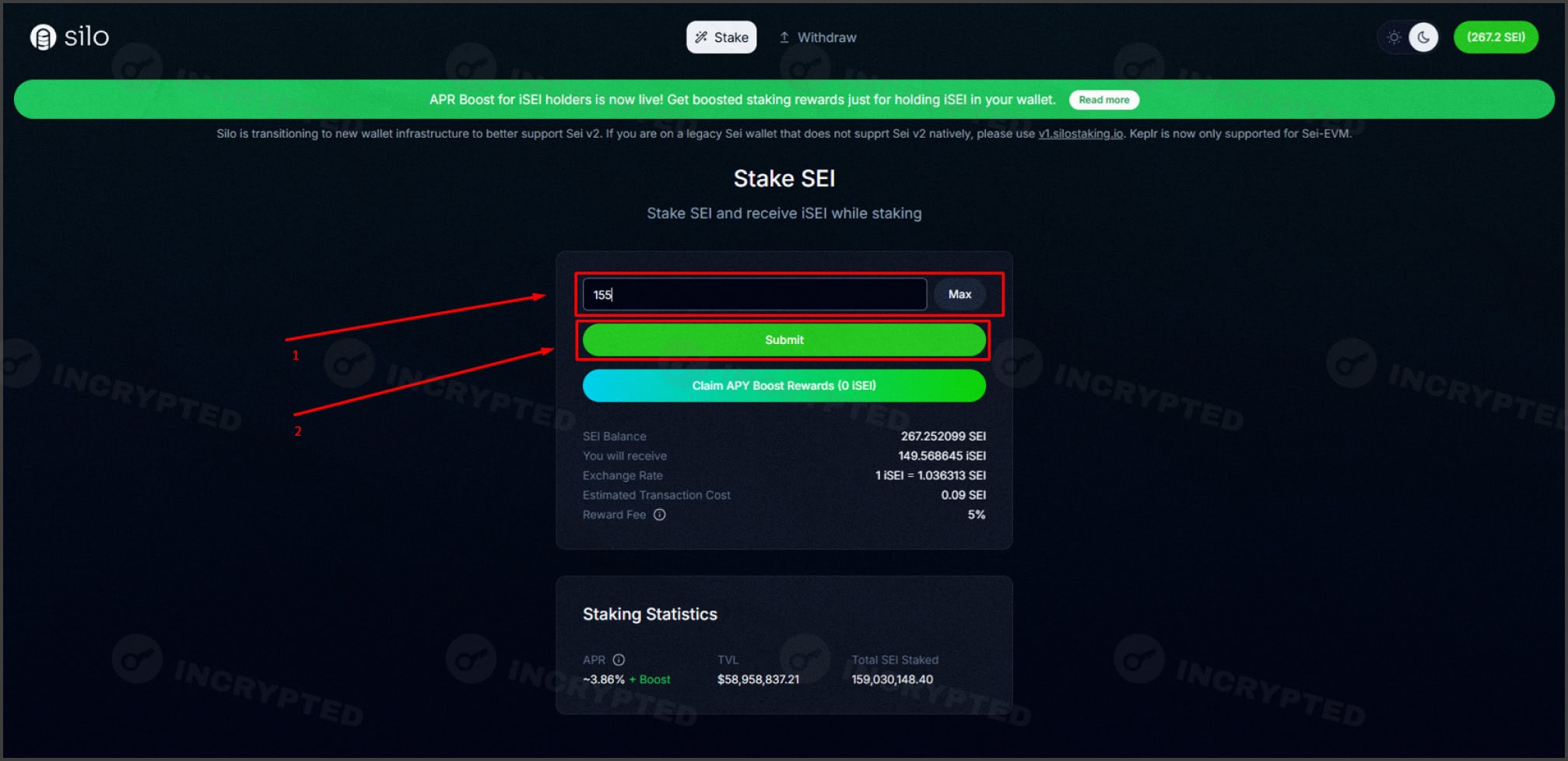

Staking on SiloStake

The LST protocol, to which you can provide your SEI, allows you to receive liquid iSEI in return. Thus, with SiloStake, we place our tokens in staking without actually locking them.

- Go to the website and connect the wallet.

- Enter the amount and confirm the deposit.

Note: if the protocol does not offer to automatically import iSEI into the wallet, you can do it manually by inserting the contract address: 0x5Cf682626140C1C56Ff49C808A1A75407Cd1DF9423.

- If you need liquidity, you can sell iSEI on one of the DEX.

Yei Finance Lending Protocol

- Go to the website and connect your wallet.

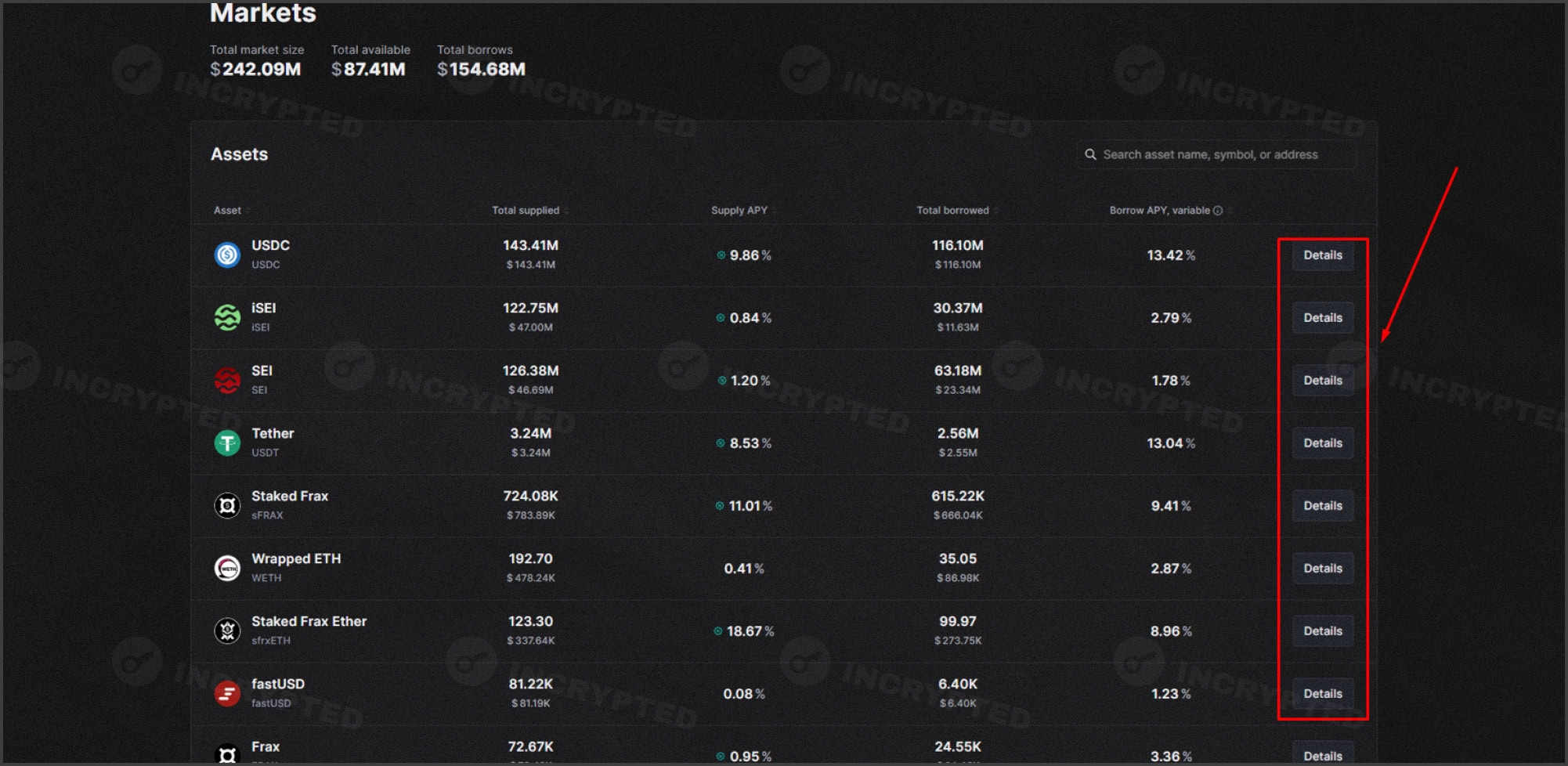

- Choose the asset you like and click Details:

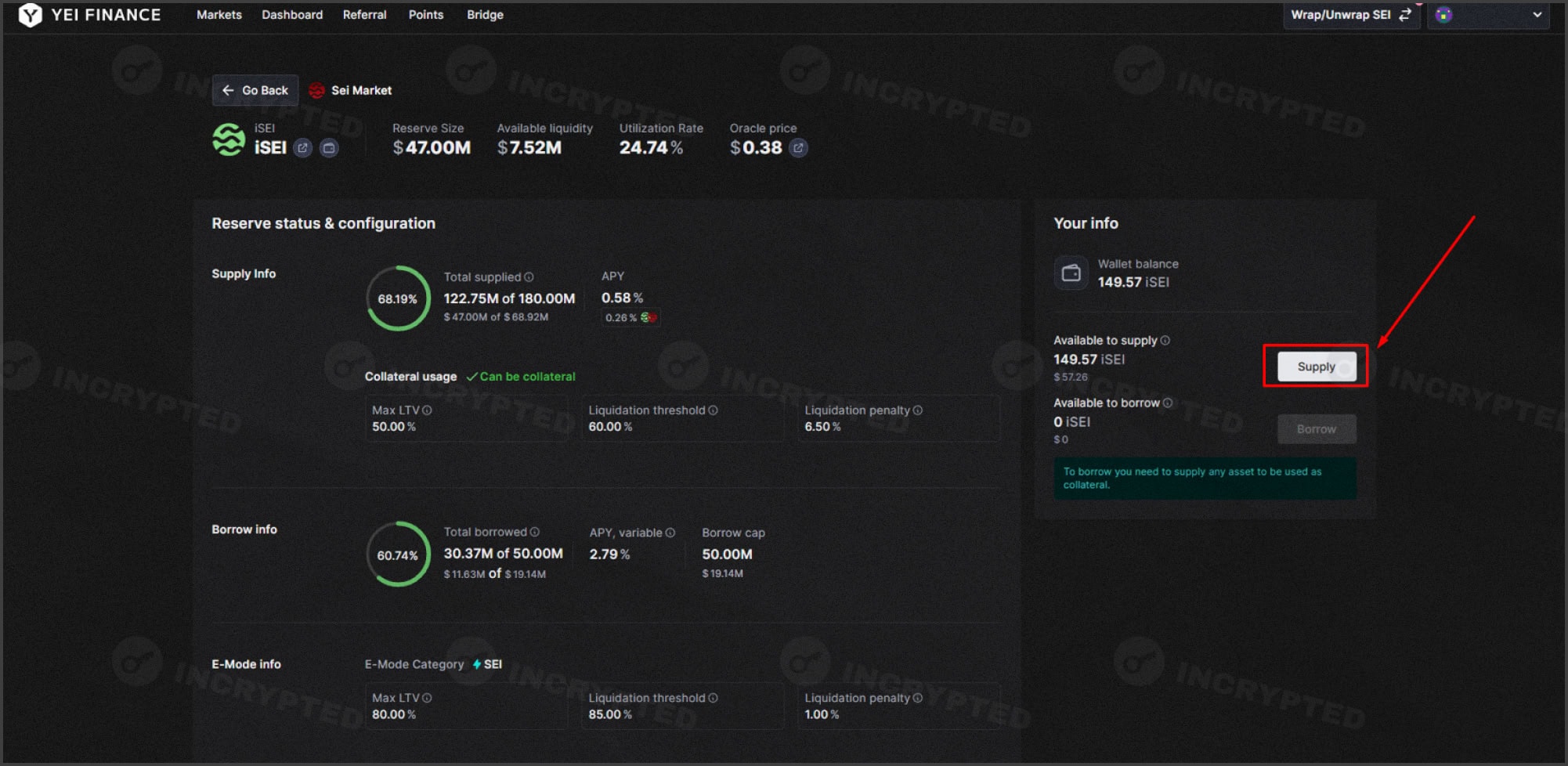

- Click Supply and provide liquidity to the protocol:

- If you wish, you can open the Markets tab again and borrow against the collateral of the tokens previously provided.

Important: if you use this feature, always consider the Risk Factor. If it is close to 1, your position may be liquidated even with minimal fluctuations in the exchange rate.

DEX Dragon Swap

- Go to the site and connect your wallet.

- On the Swap tab, exchange tokens and accumulate trading volume. Also, if desired, add liquidity on the Pool tab.

NFT

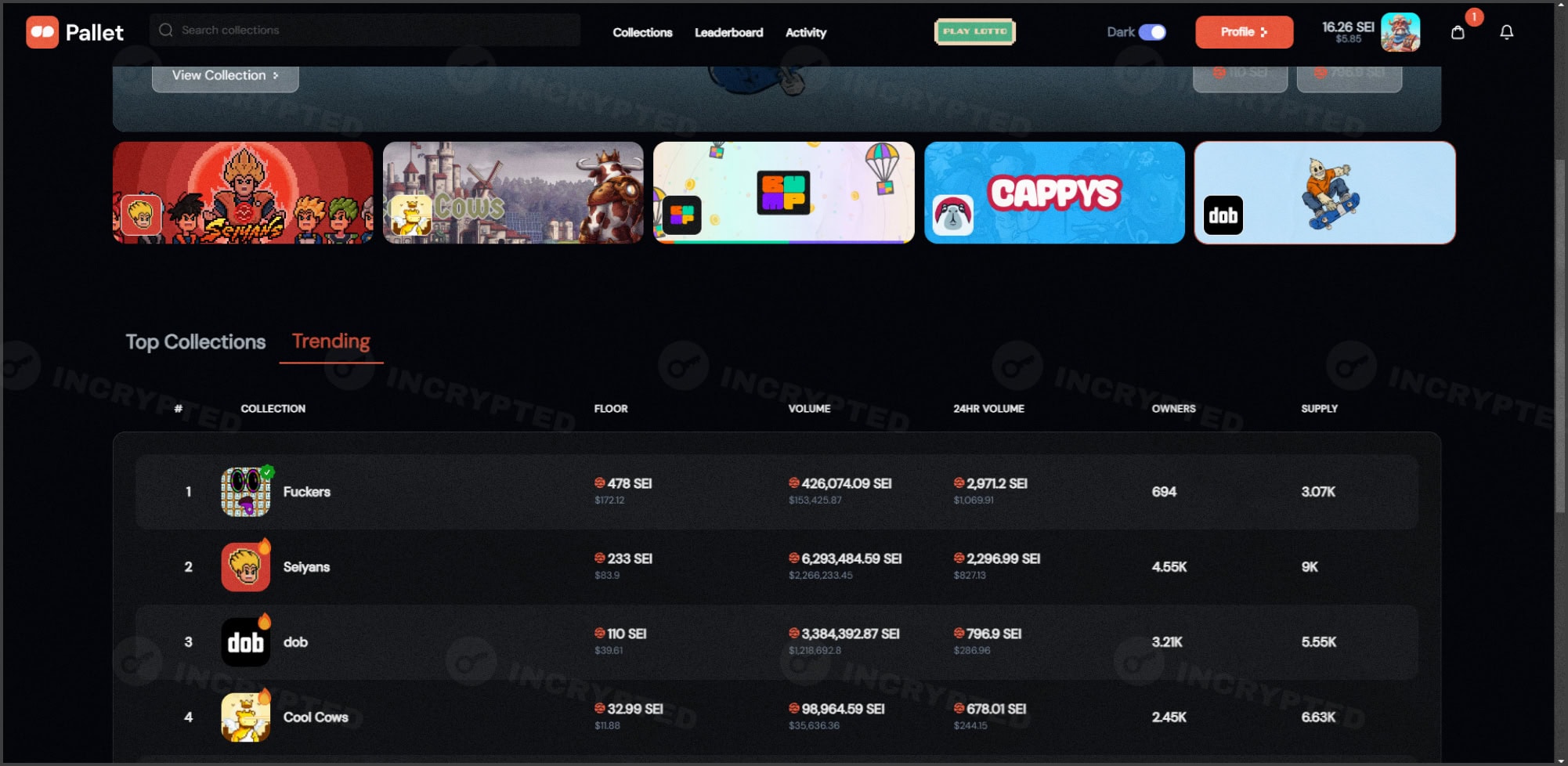

There are several NFT-marketplaces in the project ecosystem. However, the leader in terms of trading volume is Pallet, with which we will interact.

- Go to the site and connect the wallet.

- Choose the collection you like and purchase NFT and then, if desired, sell it.

Important: NFT markets are illiquid and very volatile, so always be aware of the risks.

Conclusion

At the time of writing, the project team has not made any announcements about a third airdrop or further distribution of the remaining tokens reserved for the community. If there are still such plans, it’s hard to speculate what the criteria will be. Therefore, if you like the project, you should interact with it natively, interacting with smart contracts, gaining trading volumes, and so on.

Highlights:

- the team has already conducted several airdrops;

- no information on plans to conduct further airdrops;

- should engage with blockchain natively, learning the ecosystem.

If you have any questions while going through the activities, you can ask them in our X.

Useful links: Website | X | Discord

All information is provided for informational purposes only and should not be used as a basis for making investment decisions, nor should it be considered as a recommendation or advice to participate in investment transactions. Do Your Own Research.