Hayes on TOKEN2049: about the Fed, Treasury Yields, RWAs and Trends in the Crypto Space

- TOKEN2049 is taking place in Singapore on September 18-19.

- Among the speakers of the first day was Arthur Hayes.

- As part of his speech, he touched upon the topic of T-bills yields, Fed policy, and also named several trends in the cryptosphere.

On September 18-19, the largest cryptocurrency conference TOKEN2049 is being held in Singapore . One of the speakers of the first day was former CEO of BitMEX Arthur Hayes. During his speech, he covered several important topics, including the potential cut in the Fed’s interest rate.

Hayes expressed confidence that the Fed will reduce the interest rate, although he did not specify whether it would be by 25 or 50 basis points. And, in his opinion, it will crash the market.

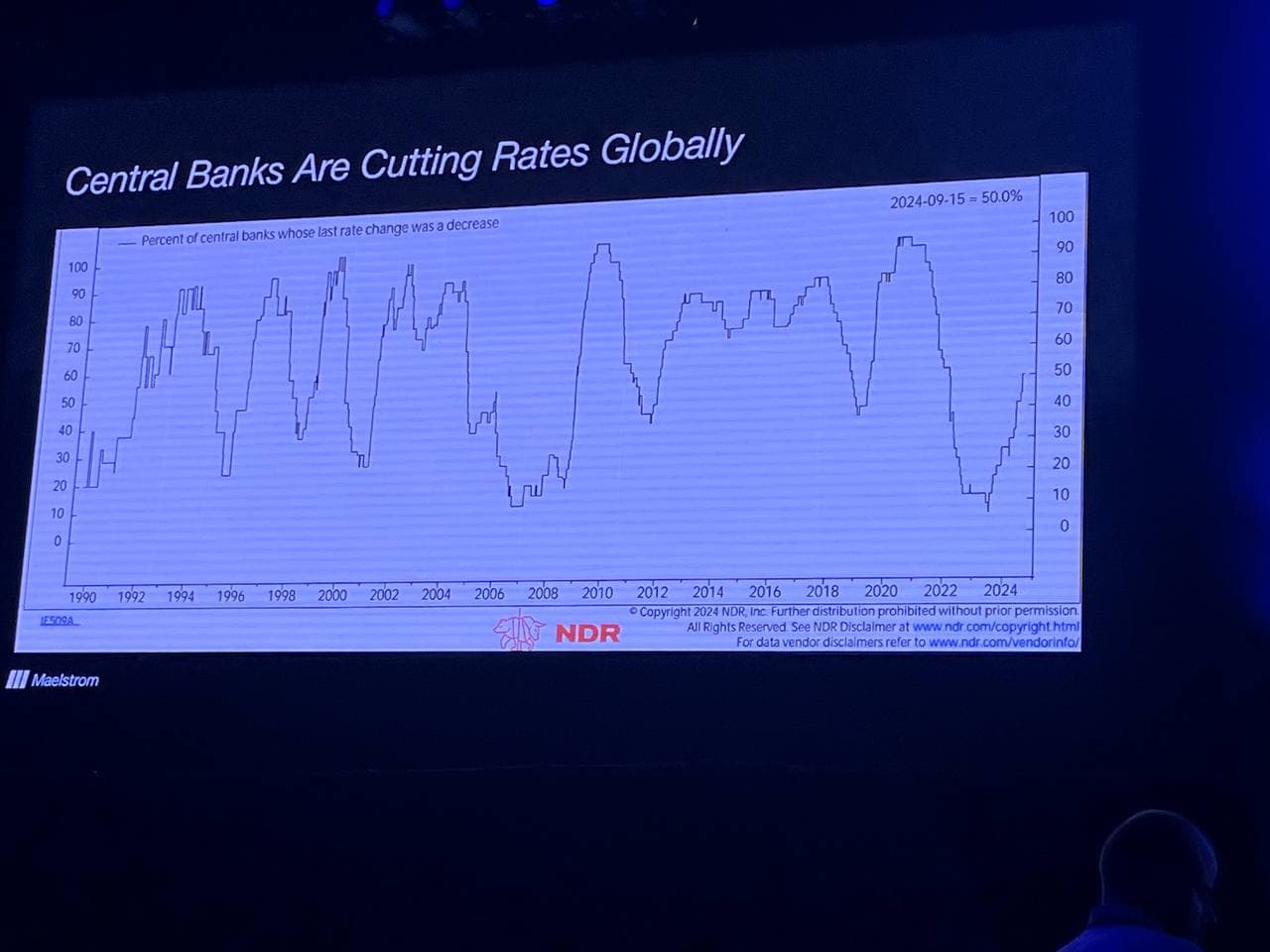

The expert backed up his analysis with the fact that this practice is followed by most central banks in the world:

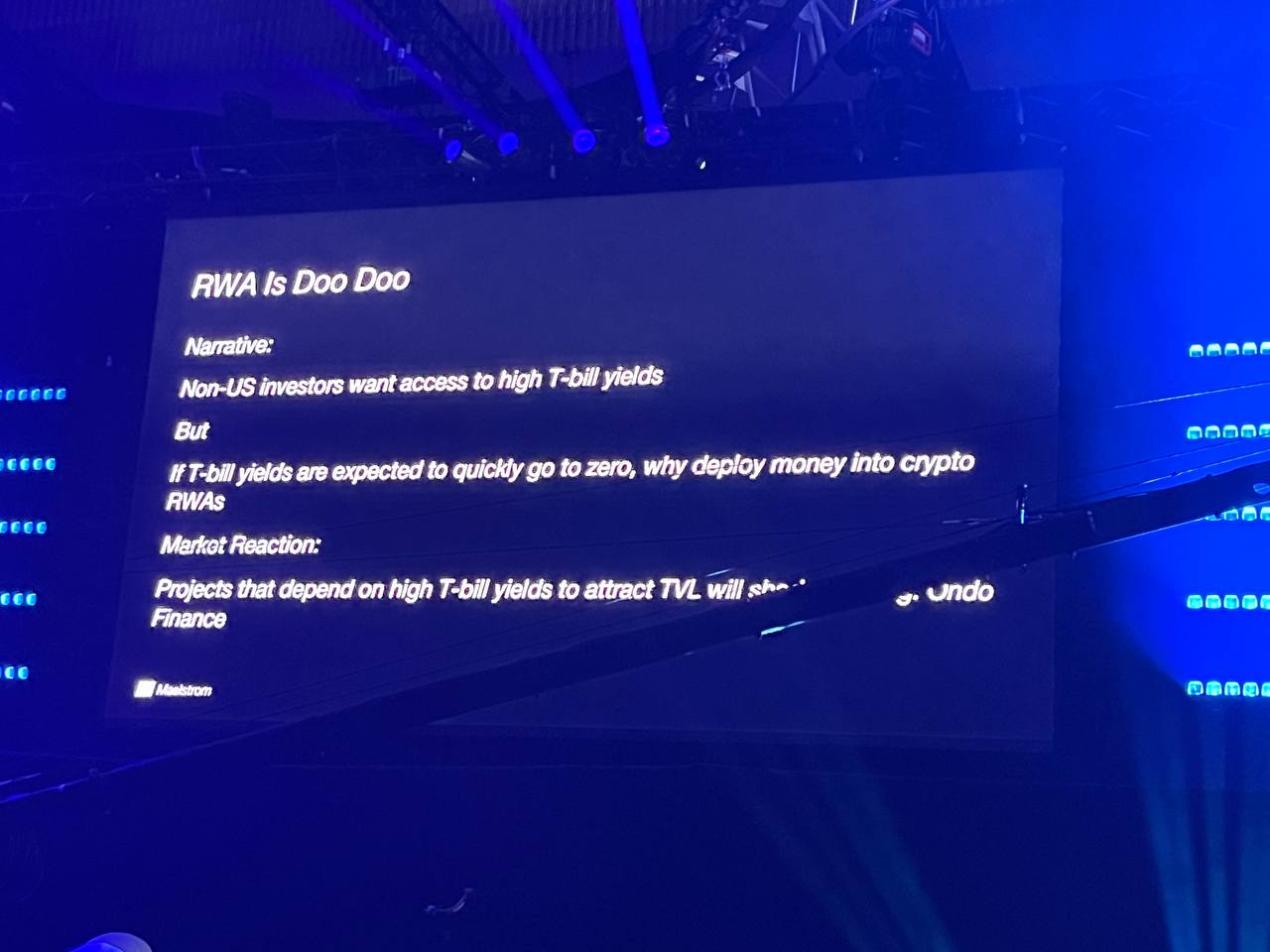

According to Hayes, this will lead to decline in the yield of U.S. Treasury bonds (T-bills) and, consequently, a downturn for products that depend on it. These include real-world tokenized assets (RWA).

The expert recognized the relevance of this product category as foreign investors are interested in accessing the bond market. However, a rate cut will lead to a drop in T-bill yields and, as a result, capital outflows from the RWA sector.

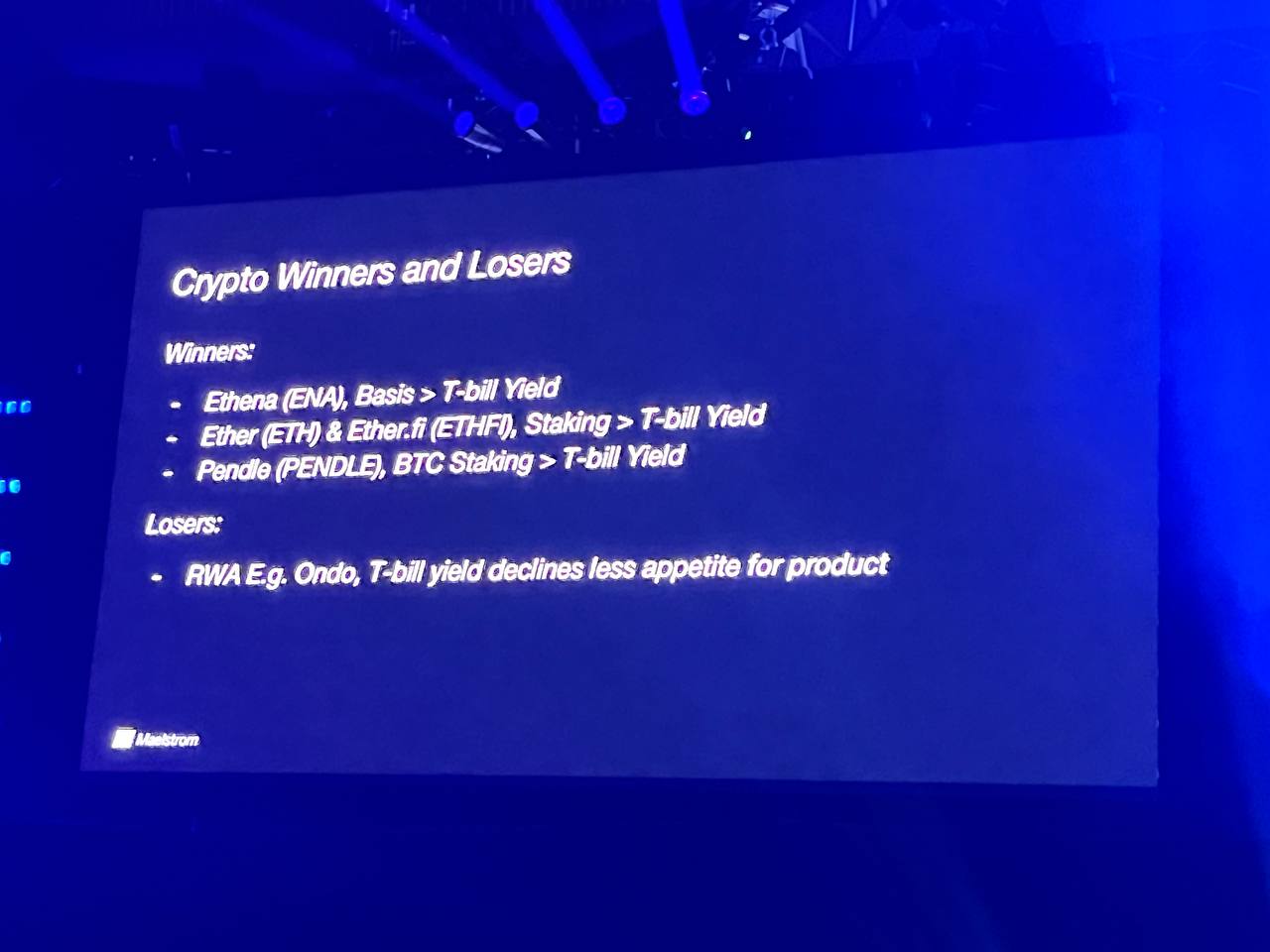

The expert highlighted a few product categories that he believes will be on trend when interest rates are cut. These are:

Notably, Hayes’ fund Maelstrom invested in Ethena. Also, the expert previously mentioned plans to invest in Pendle.

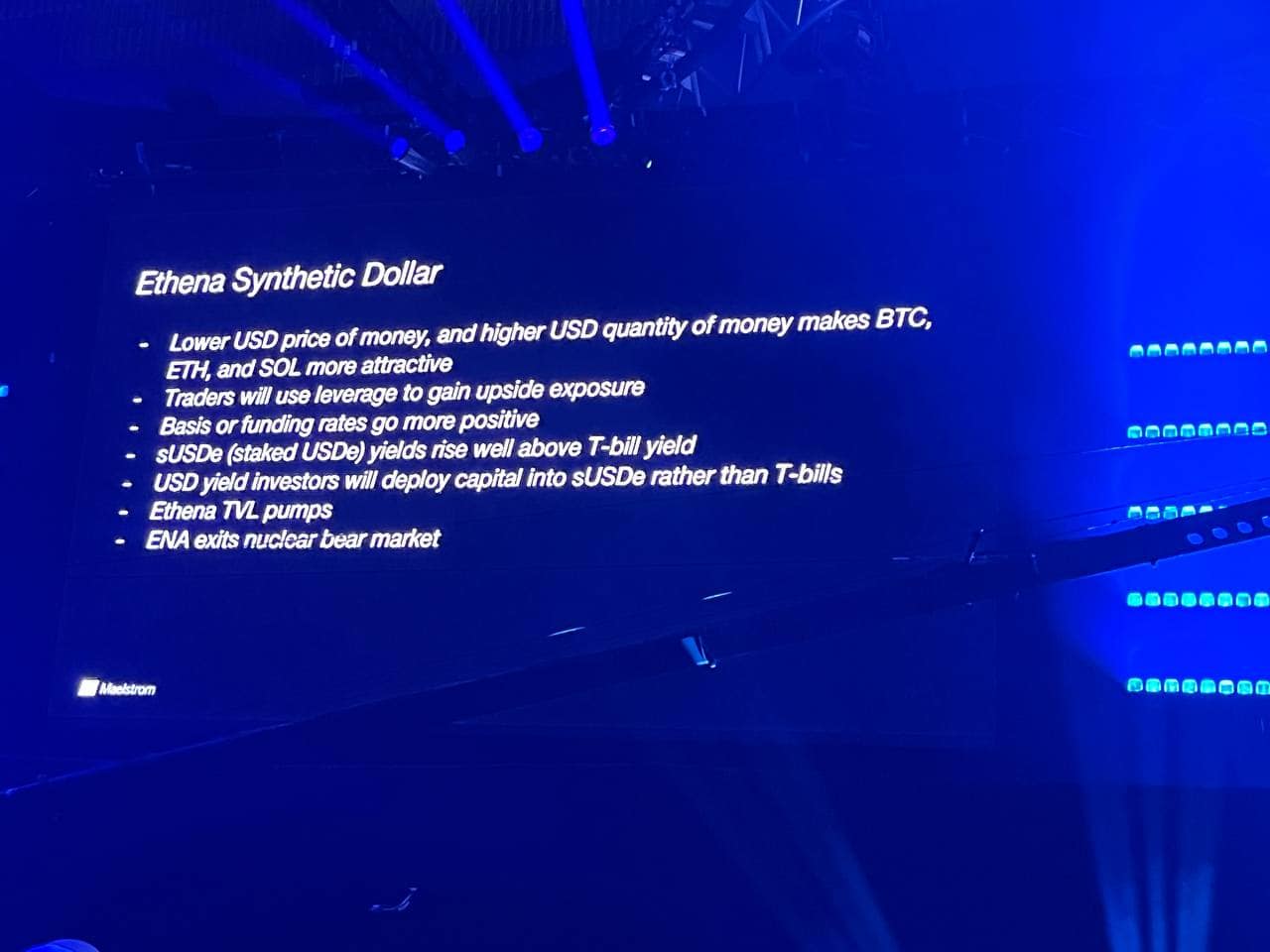

Specifically, according to the expert, the yield on Ethena’s synthetic dollar staking is higher than that of T-bills. Additionally, the Fed’s shift to a more dovish policy will make crypto assets more attractive, positively influencing capital inflows and, consequently, leading to an increase in Ethena’s total value locked (TVL).

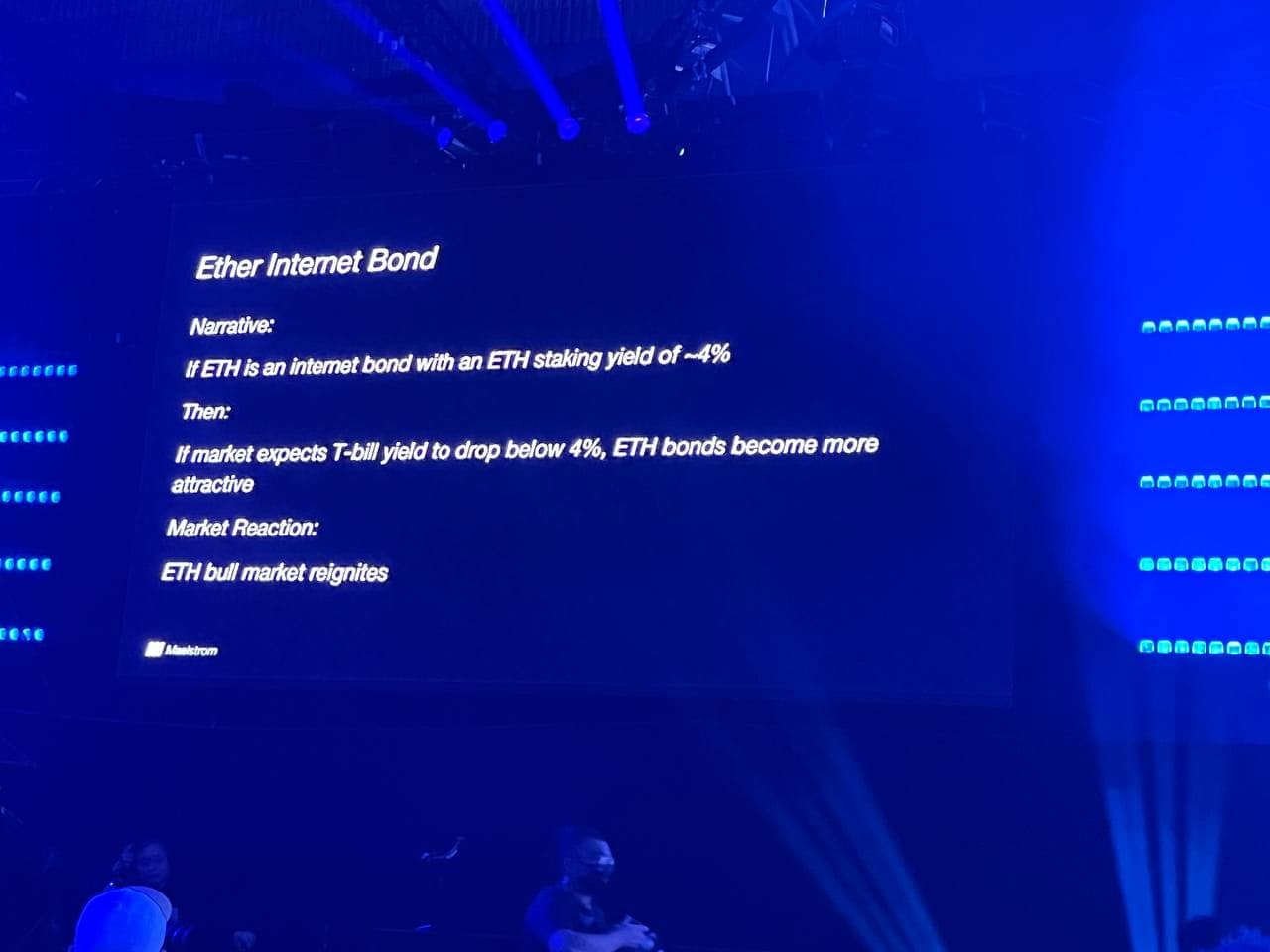

Another potential trend in a Fed rate cut scenario is Ethereum internet bonds with on-chain yield.

Globally, according to the expert, it is essential to monitor the USD/JPY exchange rate. In an environment where the Bank of Japan is raising interest rates while the Fed is cutting them, this rate will decrease, having a direct impact on markets.

Hayes noted that one of the most effective investment strategies in recent years has been to curry trade in the Japanese market. However, due to the actions of the Bank of Japan, this trend is changing as traders can no longer borrow on more favorable terms.

As a reminder, Incrypted is the official media partner for the event. Follow the updates on our website so that you don’t miss other important materials on the conference and side events.