Why Bitcoin’s Price Surged So Rapidly and What to Expect Next — Experts Weigh In

- On November 12, Bitcoin continued its upward trend, reaching yet another all-time high.

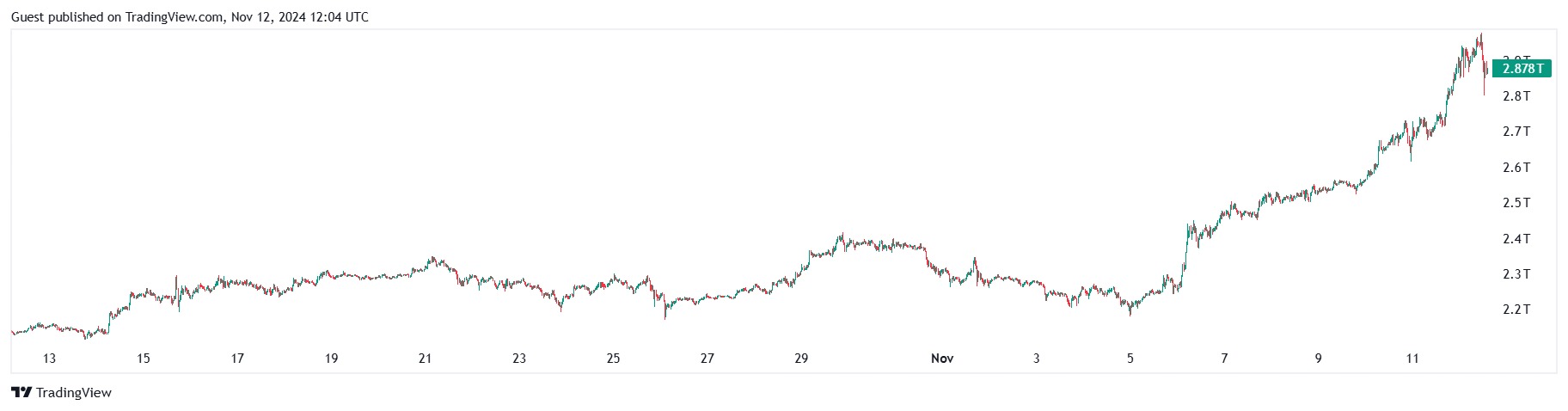

- The new ATH also pushed the cryptocurrency market capitalization to a record high, surpassing the $3 trillion mark.

- The Incrypted editorial team gathered opinions from various experts on the matter.

On November 12, 2024, Bitcoin reached a new all-time high (ATH) of $89,900, continuing its rapid rally of recent days. The Incrypted editorial team collected insights from various experts regarding this trend and their forecasts for the future.

Current Situation in the Cryptocurrency Market

In addition to Bitcoin once again setting a new all-time high, several other significant events have occurred. The total cryptocurrency market capitalization reached a new ATH, hitting approximately $3 trillion.

A correction occurred later, and by the time of writing, the figure had fallen below the $3 trillion mark. However, overall, it has increased by more than 36% over the past month.

On November 11, trading volume for spot Bitcoin ETFs on the U.S. market reached $7.3 billion, with a net daily capital inflow of $1.11 billion into these products.

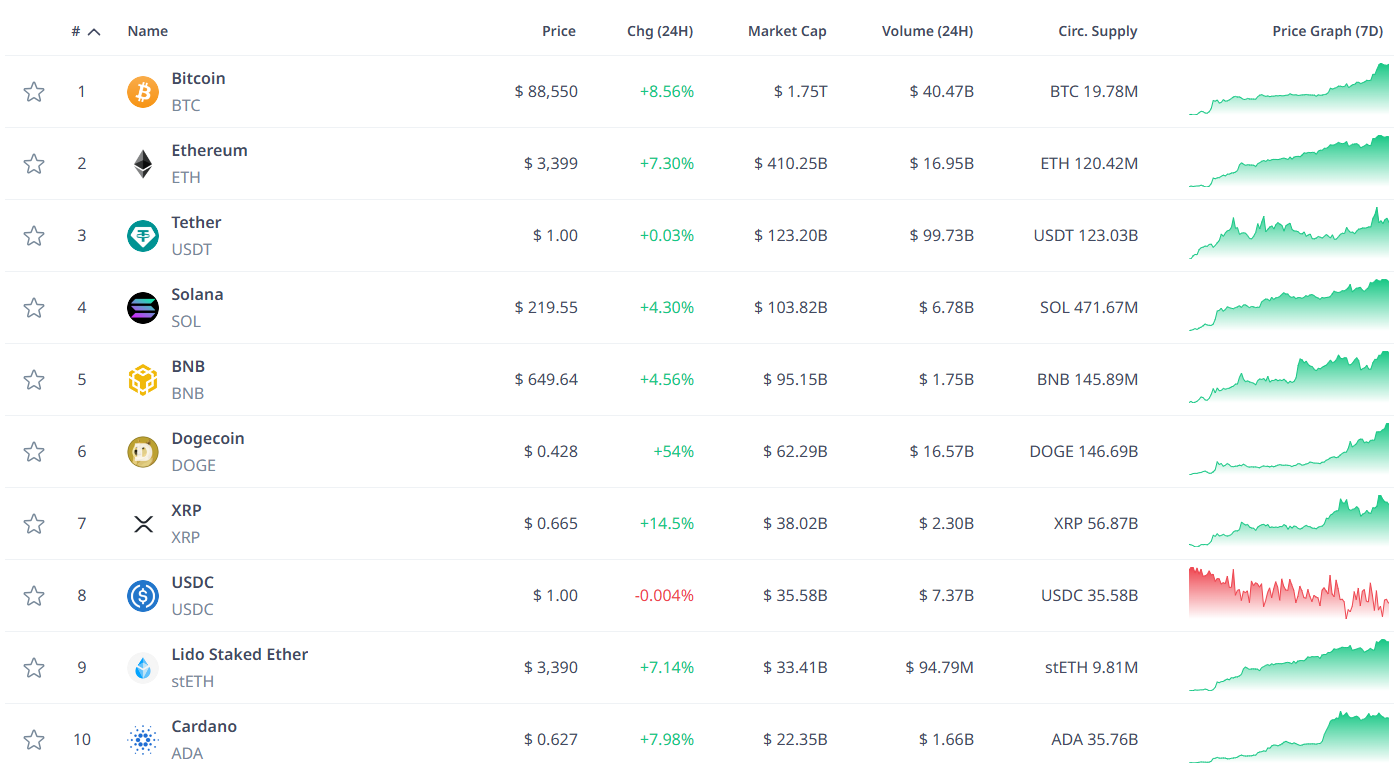

It is also worth noting that Bitcoin surpassed silver in market capitalization. The figure reached $1.78 trillion before experiencing a pullback.

In addition to Bitcoin, other cryptocurrencies also showed positive dynamics. Specifically, Ethereum rose by 7.3%, Dogecoin by 54%, XRP by 14.5%, Shiba Inu by 16.2%, and Cardano by 8%.

Probable Reasons for the Growth and Community Opinions

It is important to note that in early November 2024, the U.S. presidential elections were held, with Donald Trump emerging as the winner. On December 17, the Electoral College will officially certify the results, and the inauguration will take place in January 2025. Until then, Trump is considered the elected president.

Trump’s victory sparked a strong reaction in both the cryptocurrency and stock markets.

Additionally, the U.S. Federal Reserve lowered interest rates on November 7, 2024. Together, these factors provided the necessary momentum for further market growth.

However, some experts at that time expressed concerns that the intense rally in December could lead to overheating. This, in turn, could lead to a subsequent correction at the beginning of 2025.

However, in the long term, Bitcoin is likely to experience steady growth. This was particularly noted by influencer Anthony Pompliano, who believes that the leading cryptocurrency will become an essential part of every investor’s portfolio:

Earlier, we covered the opinion of experts from Fidelity Investments. Back in June 2024, the company advised everyone to invest a portion of their funds in Bitcoin, regardless of their investment strategy, risk tolerance, or preferences.

The CIO of Bitwise, Matt Hougan, on the other hand, noted that long-term holders have stopped selling their Bitcoins. According to him, they are targeting a price level of $100,000 for the asset. The continued dominance of demand over supply could lead to further price growth:

The CEO of the startup JAN3com, investor, and entrepreneur Samson Mow, pointed out that the market is experiencing a “theory of maximum pain.” He suggested that there may no longer be a comfortable entry price for the Bitcoin market. As a result, most people will find themselves in a state of uncertainty due to indecision:

Analyst at UTXO Management, Dylan Leclerc, is also confident in Bitcoin’s bright future. He pointed out that the risk of a total ban or harsh regulation has diminished. This is happening against the backdrop of the likely establishment of Bitcoin as a reserve asset for the U.S. Treasury, a move that Donald Trump promised to implement during his campaign.

The CEO of Apollo, Julian Farrer, is also confident in this scenario. In his opinion, if Bitcoin becomes a reserve asset for the U.S. Treasury, the price of the asset could reach $1 million:

According to the analyst known by the pseudonym PlanB, the monthly Relative Strength Index (RSI) for Bitcoin is around $80,000. He views this as a potential entry point into the market.

What Experts Think

We reached out to representatives from cryptocurrency exchanges and various experts to inquire about the factors behind the rally and how the situation will unfold in the future.

In particular, Incrypted spoke on this topic with Benjamin Stani, the Head of Ecosystem Development at Matrixport.

“In recent days, we’ve seen a pronounced price movement following Trump’s victory in the elections. There are two factors to consider here. The first is a selfish one, where Trump is perceived as a good thing in and of himself. This is evident in most high-risk positions. The second is that people have remembered that Trump enjoyed significant support from the cryptocurrency community. During his campaign, he made several promises, including firing Gary Gensler. People are expecting that his administration, at least, won’t enforce a total ban, which is already a positive outcome,” noted the expert.”

According to Stani, it is these expectations that have driven not only Bitcoin’s growth but the market as a whole, including altcoins.

As for Bitcoin itself, Stani pointed to the actions of MicroStrategy, which he views as “well-executed work.”

It is worth noting that the company purchased more than $2 billion worth of Bitcoin between October 31 and November 10, 2024. Additionally, shares of this company and other players in the cryptocurrency space saw significant growth amid the recent surge.

“Also, it seems to me that meme coins look good. ‘Animal tokens’ are clearly trending again. […] Everything related to dogs is growing now. So yes, I believe the markets are in a ‘bullish’ phase. This rally has attracted a lot of attention from retail traders, and record flows into ETFs indicate that institutional investors are also showing interest,” emphasized Stani.”

It is worth noting that on November 11, 2024, the net daily capital inflow into spot Bitcoin ETFs amounted to approximately $1.1 billion.

The chief analyst at Bitget Research, Ryan Li, expects high volatility in the market. This is driven by both the increased pressure from leveraged positions and the absorption of liquidity:

“The key indicators to watch include funding rates for contracts. As Bitcoin rises, there is significant liquidation of short positions in the derivatives market. Funding rates for long positions in Bitcoin, Ethereum, and Solana contracts have started deviating from their normal level of 10% annually. If these rates continue to rise along with prices, it will indicate an increase in market leverage, which raises the likelihood of significant fluctuations.”

According to Li, Bitcoin is absorbing liquidity from the market, which is evident in the relative growth figures. If this trend continues, it could result in high volatility in the derivatives sector.

At the same time, Li noted that the overall market sentiment remains “bullish.” In his assessment, high volatility is still expected to persist in the near future.

The head of institutional and derivative instruments at Bybit, Shunyet Jan, evaluates the reasons behind Bitcoin’s growth as follows:

“[…] This is linked to the optimism following the results of the recent U.S. elections. The upward trend in the cryptocurrency market is accompanied by gains in the U.S. stock market, as traditional stocks are also benefiting from favorable economic factors. Investor sentiment has improved, and hopes that the Trump administration will be more open to regulating cryptocurrencies are providing additional momentum to digital assets.”

He also pointed out the dominance of optimistic sentiment in the market. At the same time, Jan urged traders to be cautious. According to him, the exact boundaries of potential support from the Trump administration for the cryptocurrency sector remain unclear.

Andrey Velykyy, co-founder of Allbridge.io, also associates the rally in the cryptocurrency market with the results of the U.S. elections. However, he stated that this is not the only reason:

“First of all, the market was generally prepared for a bull run. There was that kind of sentiment. This is what I call a self-fulfilling prophecy, when everyone talks about a bull run, the market starts moving, and then everyone begins actively buying, thus fueling its further growth.”

At the same time, according to Velykyy, the main factor remains the U.S. elections. The previous administration, particularly SEC Chairman Gary Gensler, was strongly against the cryptocurrency sector, while the current administration has taken a more friendly stance, he noted.

“The focus will once again shift towards the U.S. […] In previous years, crypto startups were leaving in large numbers due to persecution, with lawsuits and criminal cases being filed. This also creates a certain positive news backdrop,” added Velykyy.

He also noted that he always advises taking the risk of a correction into account. However, at the moment, the trend, in his words, is “more likely green,” and it will likely continue to be so for some time.

“It seems to me that until December, or the end of December, there won’t be any significant correction. Instead, we should expect growth,” believes Velykyy.

In a comment to Incrypted, the regional head of Binance for CEE, Central Asia, and Africa, Kirill Khomiakov, explained the current rally as follows:

“The new record is linked to the support of Bitcoin’s price by a number of macroeconomic and political factors. In particular, one of the main reasons was the U.S. elections, as many traders made large bets on the cryptocurrency market regardless of the election outcome. The election results had a significant impact on the cryptocurrency market: Bitcoin rose due to promises of support for the crypto community previously made by Trump.”

Khomiakov also highlighted the launch of spot Bitcoin ETFs, which served as a global catalyst for capital inflows.

The subsequent slight correction in Bitcoin’s price throughout the day was explained by Khomiakov as profit-taking.

“The new record for the coin, after a prolonged period of stabilization, is undoubtedly a challenge for investors and cryptocurrency enthusiasts. After Bitcoin’s new all-time high, many analysts adopt a cautious approach, which is tied to the traditional volatility of this historic coin, but the market is nonetheless unanimously focused on sustained growth,” said Khomiakov.

Like other experts mentioned earlier in this article, the Binance representative anticipates high volatility. In the medium term, according to Khomyakov, a reduction in taxes and an increase in fiscal spending are expected, which, along with other factors, will also provide a positive impulse.