What is an order book and how does it work on the example of the DeGate service

All people in financial markets, regardless of the amount of capital, assets, or level of experience, should use various tools during a trading session to better understand price dynamics. One of these tools is an order book, which stores all the information about current trades and orders for their execution.

In this article, we will take a closer look at what is an order book, how it works, and what advantages it provides to traders using the DeGate service.

What is an order book and how does it work?

An order book is a register used on exchanges, including cryptocurrency exchanges, to display current orders for a transaction with assets in a particular market or trading pair.

As a rule, buy and sell orders are displayed on the left and right sides of the trading terminal, respectively, or one above the other in a tabular format. Order book includes:

- buy orders (bids). They contain the price and volume at which traders are willing to buy an asset. As a rule, they are ordered from the highest to the lowest price;

- sell orders (asks). They contain the price and volume at which market participants are willing to sell an asset. As a rule, these bids are ordered from the lowest to the highest price;

- last price. The value at which the last transaction was closed in a particular market and which reflects the most current market value of the asset;

- spread. The difference between the highest price of a buy order and the lowest price of a sell order. It is an important indicator of market liquidity — the smaller the price gap between supply and demand, the easier it is to sell an asset at the current price.

How an order book works

An order book is updated as new orders appear and previously published ones are closed.

For example, when a trader wants to buy or sell an asset at a certain price, he creates a limit order, specifying the desired price per unit of the asset and the volume of the transaction.

This order is then placed in the order book, and if there is already a sell order with the same conditions, the transaction is executed, after which both orders are deleted. In cases where the buy and sell prices match, but the order volume does not, one of the orders is partially satisfied and remains in the order book until it is fully executed and closed.

Note: Market orders that are created to buy or sell an asset at the current price are not included in the order book and are executed instantly.

What is an order book for?

An order book is an important tool for traders to monitor various aspects of the market, assess its dynamics in real time, and make more informed trading decisions.

For example, an order book can provide a clear picture of the price trend: if there are more buy orders than sell orders, this can be a sign of potential growth, as it indicates a prevailing demand for an asset. And vice versa, a large number of ask orders indicates the dominance of sellers.

An order book is also used to assess the liquidity (depth) of the market, which is determined by the number of buy and sell orders at different price levels.

For example, a price range with many orders indicates the possibility of executing a transaction in a short time and with minimal impact on the market value of an asset. Conversely, low activity at a particular price level indicates that it can be quickly broken through in one direction or another, depending on the nature of the dominant orders.

Analysis of this data also allows you to identify:

- the support for an asset. The price range in which buyers dominate and demand for the asset is high enough to keep the price from falling further;

- resistance level. A price at which sellers dominate and the supply of an asset is so high that it keeps it from rising further.

For example, if there are many sell orders at a certain price level, this may indicate that sellers are ready to exit their positions, which ‘absorbs’ buy orders and creates resistance to further price growth.

DeGate review: the benefits of using the decentralized exchange with an order book

An order book is not only about the user interface, but also about the quality of the trading experience in general. Unlike automated market makers (AMMs) and liquidity pools commonly used in decentralized exchanges (DEXs), an order book provides a more user-friendly mechanism for pricing, initiating and executing trades, etc.

Traditionally, an order book is considered an advantage of centralized exchanges, which puts traders in a choice between managing their own assets or a high-quality user experience. DeGate breaks this stereotype by integrating a user-friendly interface with decentralized trade execution and combining convenience with security.

To use DeGate’s trading tools, you need to go to the project’s website and click the Trade button in the upper right corner.

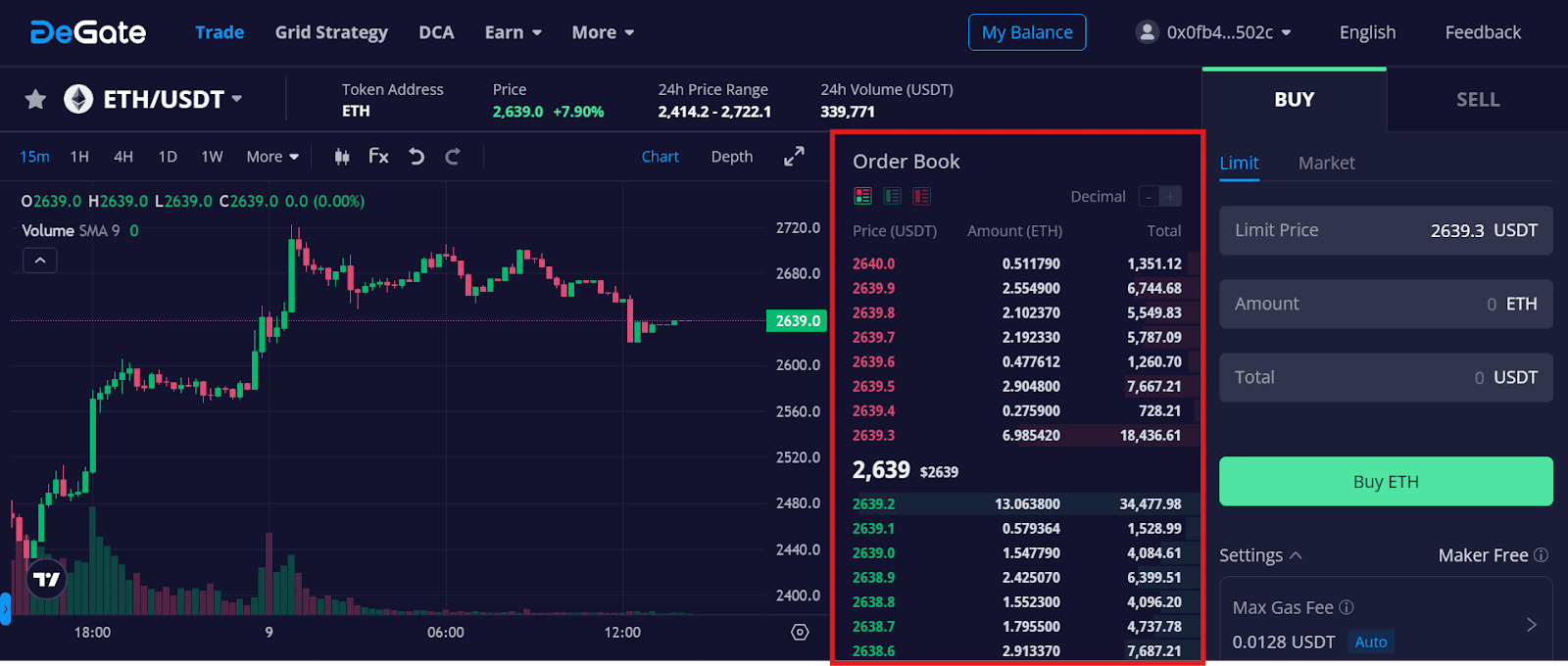

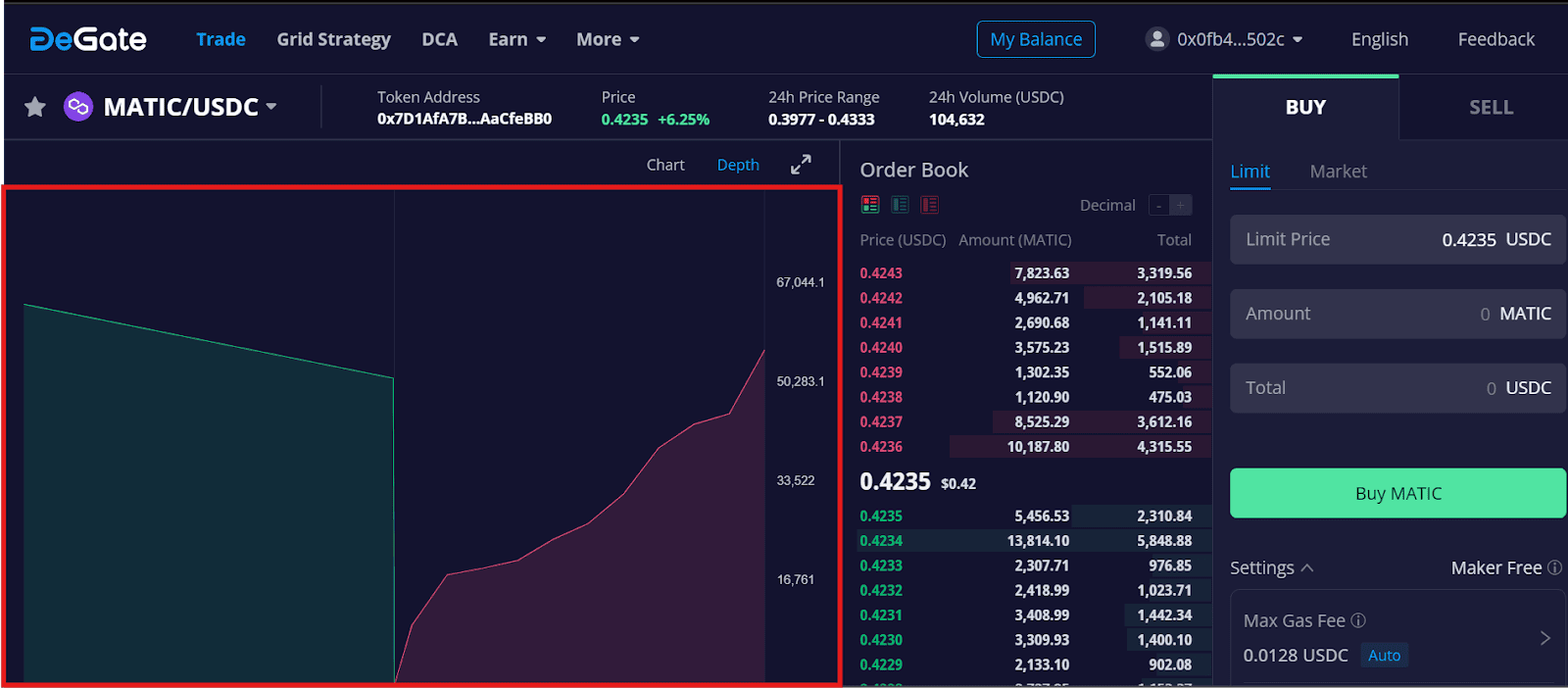

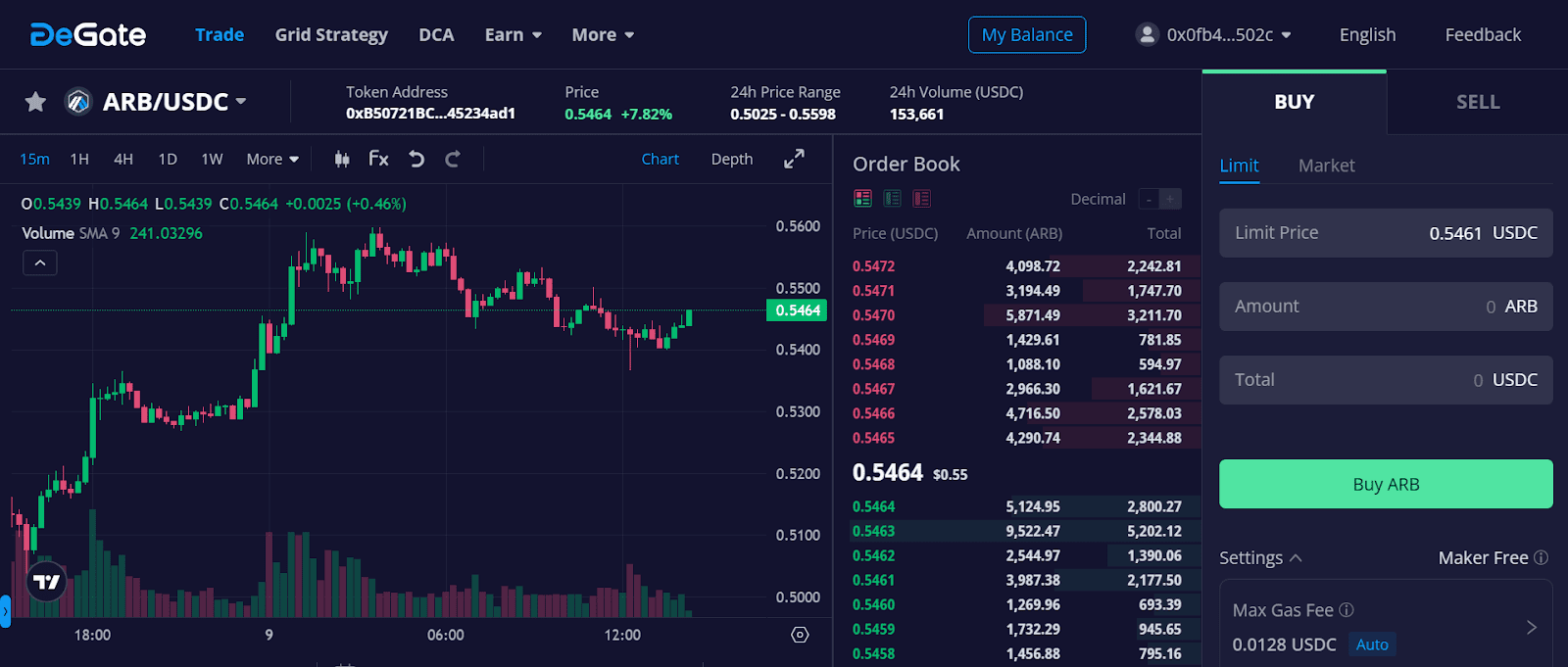

This will open a trading interface with a price chart, transaction history, and a stock ticker with sell orders at the top and buy orders at the bottom. For each listing, the price, order volume, and total number of orders at a certain price level are available. In between, the automatically calculated current market value is displayed.

However, despite the use of the traditional CEX interface, DeGate as a decentralized platform has a number of features that expand user capabilities:

- non-custodial architecture that ensures full control of the trader over the assets. All transactions must be confirmed by the wallet’s signature, which guarantees that the user’s cryptocurrencies cannot be used by a third party. The reliability of this protection and the overall security of the platform has been confirmed by audits;

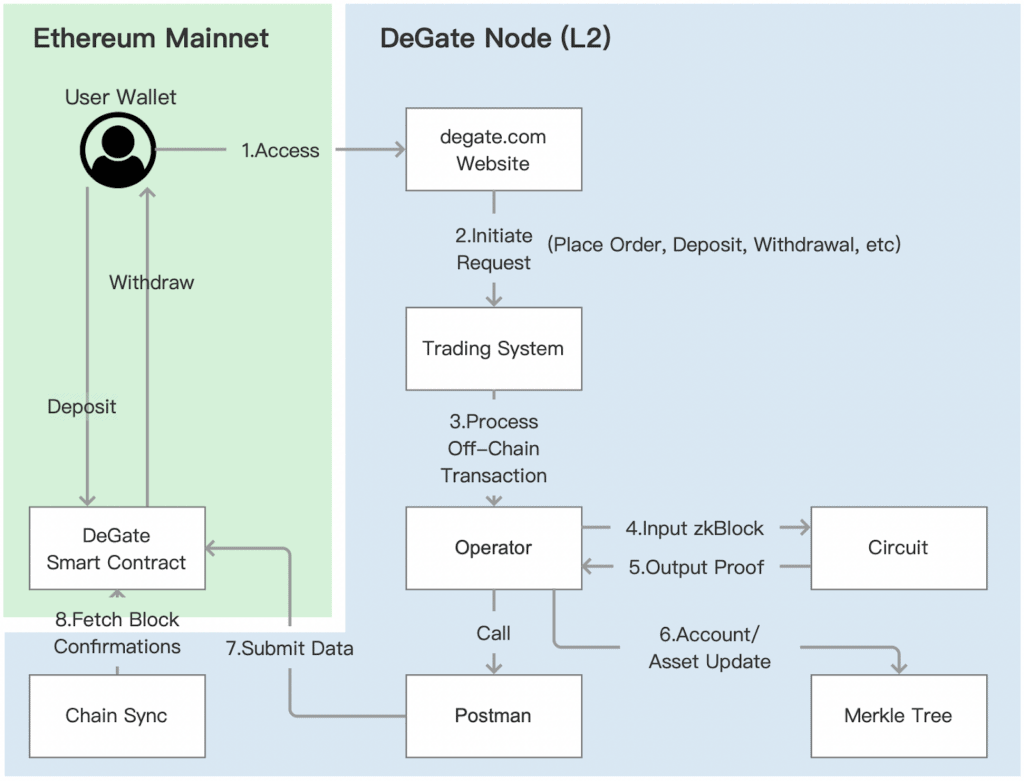

- decentralized infrastructure based on ZK-Rollup-based infrastructure. At the time of writing, DeGate is the only decentralized trading protocol with an order book built on Stage 2 ZK Rollup.

At this stage of development, the network’s security system operates in a fully decentralized and autonomous manner, without the need for manual control. In addition, users can withdraw assets if they do not like the protocol update. In particular, DeGate traders have 30 days to make a decision, which distinguishes the service from centralized exchanges that usually do not provide such an option; - no fees for maker limit orders, as well as low fees for executing market orders (0.05%-0.01%) and any taker orders. This creates better conditions for traders and allows them to save on fees, which is especially noticeable in case of large volumes of transactions or high-frequency trading;

- the function of grid trading. This is a familiar functionality for users of centralized exchanges, which, however, is still absent for most DEXs. Combined with the absence of certain commissions on DeGate, this feature allows professional traders to develop and implement complex strategies while retaining all the advantages of decentralized trading. DeGate also offers an automated bot DCA with zero commission;

- open addition of digital assets. Allows any user to place tokens on the platform, making them available for trading without prior approval from DeGate;

- exodus mode. It supports the withdrawal of assets even if the operator responsible for creating blocks and sending proofs to the Ethereum network suddenly stops working. Once Exodus is activated, the DeGate smart contract will reject new data while keeping the last known state of the network unchanged to prevent hacking or theft.

Thus, on DeGate, traders can use an order book to track and execute trades while retaining all the benefits of using DEX.

Conclusion

An order book is an important tool for any market, including cryptocurrencies. With its help, traders can explore real-time information on supply and demand, liquidity, resistance and support levels for a particular pair, using this data to develop strategies and make decisions.

Thanks to DeGate, traders can use the familiar mechanism of a stock ticker to make trades or analyze the market, while retaining full control over assets and the ability to trade without intermediaries. This saves on trading commissions and increases the security of all market participants without compromising the quality of the user experience.