What Are Airdrops, How to Participate, and How Much You Can Earn

The intention of a project to launch its own token and distribute it among its active audience is often known in advance, but most users take no action to participate. Typically, activity begins after a major distribution and quickly leads to disappointment due to the lack of immediate results. This sporadic approach is more likely to result in losses than profits.

In this article, we will explore what airdrops are, the specifics of this token distribution model, and how to turn participation in them into a legitimate form of income.

What is a Token Airdrop?

Due to the discrediting of this format, developers started using a new market entry model —distributing tokens among active users and community members. These campaigns are called airdrops, as the team “drops” assets into users’ wallets.

During the “crypto winter” of 2018-2019, airdrops proved to be a more effective tool for attracting an active audience and entering the market compared to token sales.

Depending on who the tokens are distributed to and under what conditions, there are several types of airdrops, such as hold-drops, lock-drops, and others. However, retroactive drops (retro-drops) have gained the most popularity. These are distributions conducted after a product launch aimed at rewarding active users.

The conditions for retro-drops are typically unknown in advance, which helps to identify an audience genuinely interested in using the product without additional incentives. Many well-known projects, including Arbitrum, Aptos, 1inch, and Uniswap, have run such campaigns.

At the time of writing, distributions based on point allocation (point programs) are gaining popularity. Participants know in advance which actions are rewarded by the project, but the size of the reward is often unknown until the actual distribution.

How Are Airdrops Beneficial?

For developers, an airdrop is a market entry strategy that attracts a loyal audience. This model has proven to be more effective compared to token sales, taking into account the following industry features:

- The abundance of speculators who buy tokens solely for quick profit. This often leads to liquidity drain and a price drop after the token launch.

- The ability to track on-chain activity of addresses to determine how interested a user is in cryptocurrency, which projects they have interacted with, etc. This helps to identify the most relevant target audience.

Thus, airdrops help avoid distributing tokens to “weak hands” and increase the effectiveness of marketing campaigns. Moreover, this tool addresses the issue of a “cold start” and reduces the costs of attracting an initial audience.

Token distributions are also used when entering a competitive market through so-called “vampire attacks” — distributing assets among the opponent’s community to lure users away.

In 2020, the decentralized exchange SushiSwap conducted a vampire attack on its direct competitor, Uniswap. The service rewarded Uniswap liquidity providers with additional SUSHI tokens for locking their LP assets.

For users, the value of airdrops lies in the following aspects:

- The opportunity to receive a conditionally free asset. Although airdrop hunters have to cover transaction fees and other operational costs, successful distribution allows them to obtain the token at a much lower price than most other market participants.

- Community integration. Tokens often provide holders with certain privileges in using the product or voting rights, making them a part of the community.

- Social and reputational capital. For some users, financial outcomes are secondary, but thanks to airdrops, they know that their contributions have not gone unnoticed.

Additionally, by interacting with projects during such campaigns, newcomers gain the opportunity to learn the basic principles of blockchain technology and better understand how various tools work.

How Much Can You Earn from Airdrops?

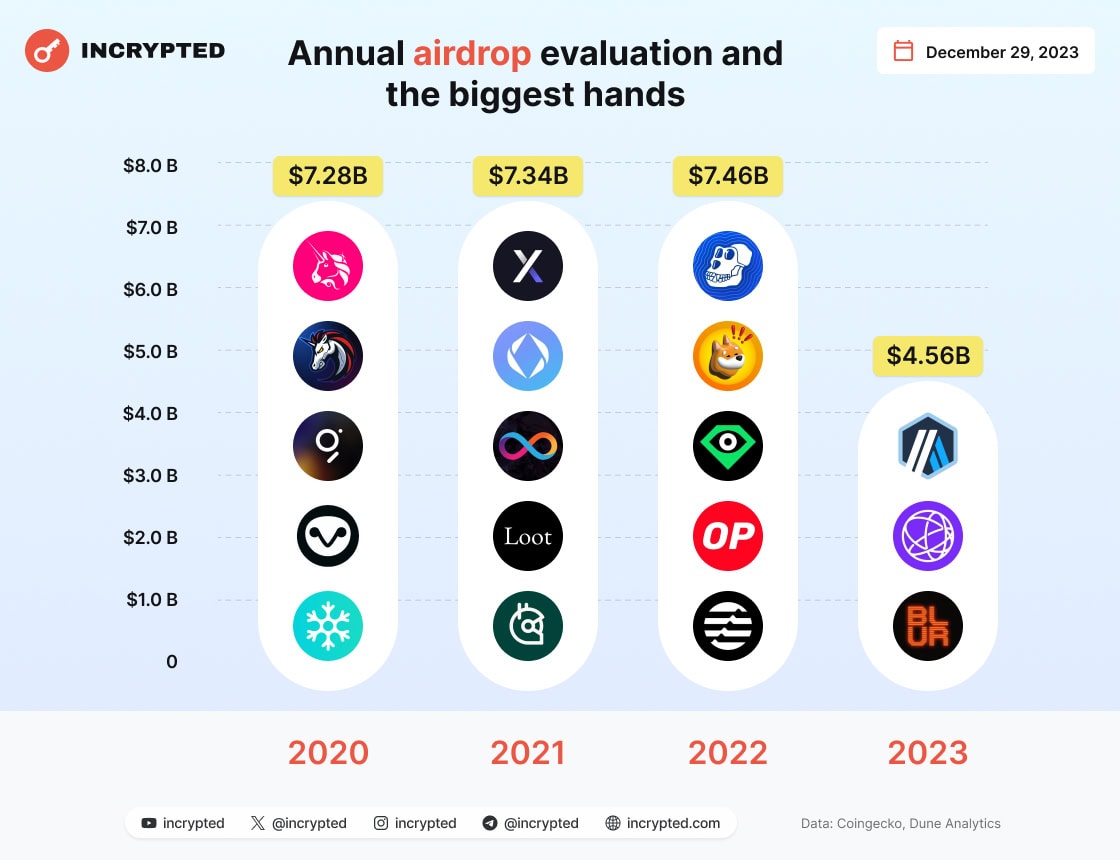

The scale and profitability of a particular airdrop depend on how much funding the project has raised and the specifics of its tokenomics. Speaking of the industry as a whole, projects distribute literally billions of U.S. dollars through airdrops. For instance, in 2023, the total volume of distributed assets exceeded $4 billion, and by mid-2024, projects reached this figure in just six months.

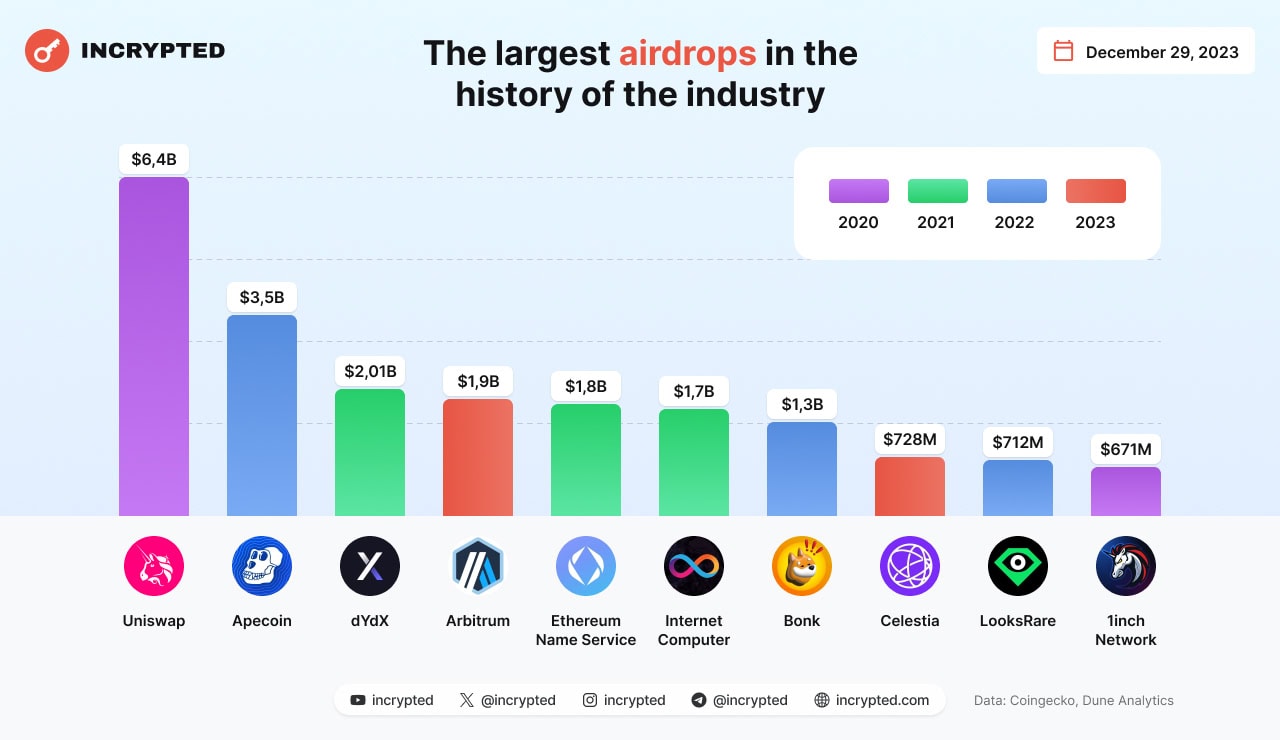

When it comes to individual airdrops, the numbers can also reach billions. For example, the Uniswap team distributed UNI tokens worth $6.43 billion to users, while the developers of Apecoin sent a total of $4.5 billion in digital assets to the wallets of NFT holders from the Bored Ape Yacht Club (BAYC) collection.

In some cases, you can receive rewards even for simple actions that require no operational costs and are accessible to most users. For example:

- Aptos distributed 150 APT tokens for minting NFTs in the testnet;

- The Wormhole team sent 8,000 W tokens to users who obtained a Discord role in the Monad project;

- Uniswap’s early user reward amounted to at least 400 UNI for making a few transactions.

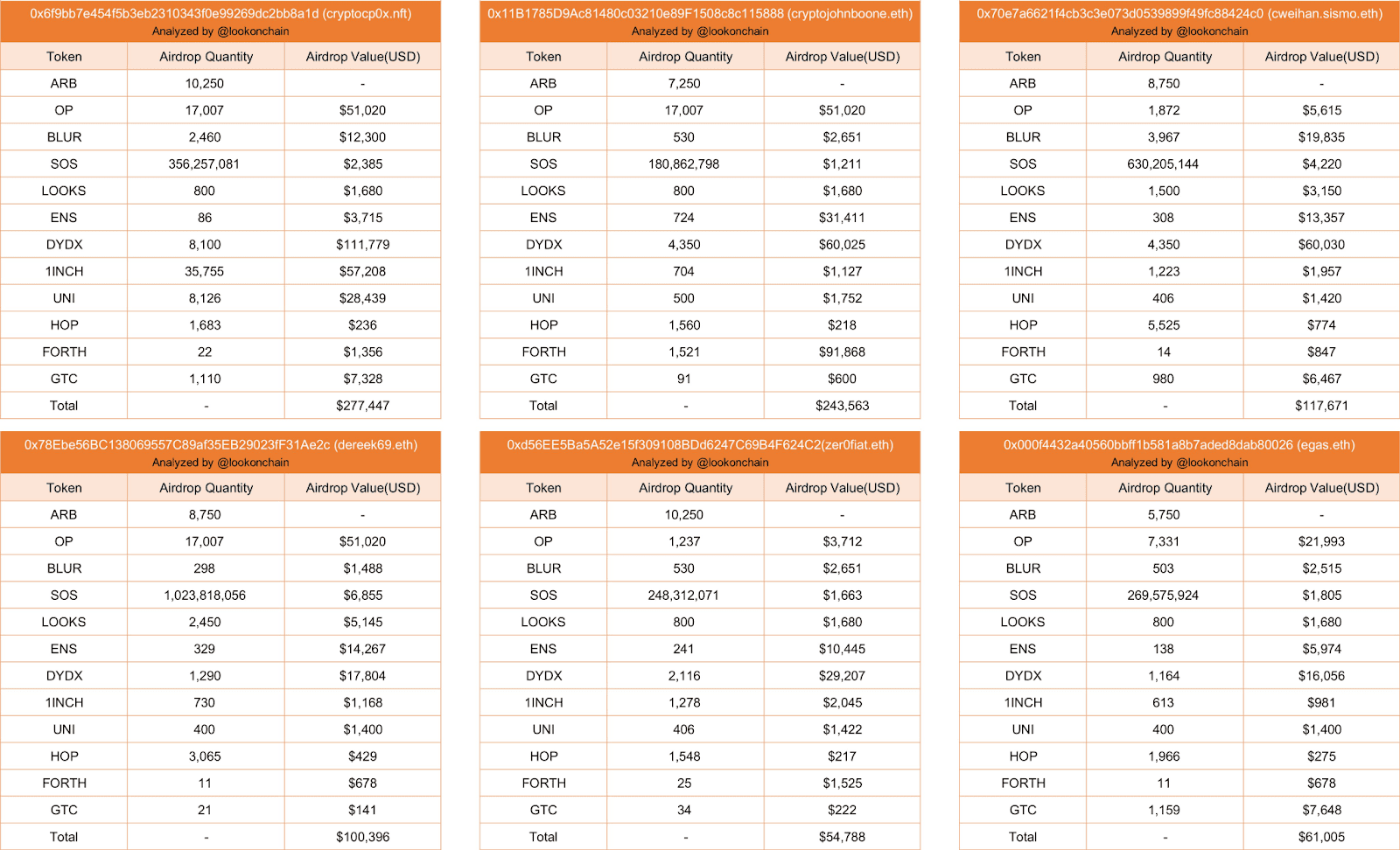

Active community members with significant capital can earn much larger rewards for their contributions. According to Lookonchain, the value of some airdrops received by certain addresses amounts to hundreds of thousands of dollars.

Of course, potential earnings often depend on the size of the capital invested in a particular project. However, even with small investments, you can earn substantial profits by using multi-accounting and effective strategies for interacting with platforms.

Moreover, we contacted the record-holder on Lookonchain’s leaderboard—cp0x—and asked for some advice for airdrop hunters.

Question: What qualities are important for an airdrop hunter?

Answer: If you’re serious about turning airdrop hunting into a major source of income, you need to bring it to an industrial level in one form or another.

To do this, you need to learn how to automate actions, as it’s very difficult to achieve significant sums manually. You should also understand the market to avoid wasting time on unworthy projects, know how to identify promising ones, and be disciplined and hardworking enough to keep going despite initial failures.

But if you have these qualities, I believe it’s more productive to engage in something more creative, such as helping a project with tasks they haven’t gotten around to—this is usually better rewarded than retro-drops. Or even start your own project—build something! And the drops will come, even if in slightly smaller amounts.

Question: How much deposit is needed?

Answer: This is the good part. Rarely does more than $50-100 in non-recoverable losses get spent per account, meaning your capital is limited only by proper portfolio management (how much you can afford to lose if you make the wrong bet) and your technical capabilities (how many accounts you can create and maintain).

To verify the authenticity of the comment, follow the link and click “Verify Signature.” In the window that opens, enter:

- Address: 0x6f9BB7e454f5B3eb2310343f0E99269dC2BB8A1d

- Signature Hash:

0x1d02e97308375d4d6333b5b9a97921209f6ced6ba1076a9cc4827af169dfe81d38cf0544b7c2099519c94773afe60beb9018603cef3e779101096a4cdfb80def00Check the box for Client-side verification only (not shared publicly) and click Continue.

Top 5 Airdrops for 2024-2025

In late 2023 and the first half of 2024, there were relatively large airdrops from popular projects like Starknet, zkSync, and Layer Zero. However, the airdrop trend continues, and several more distributions from major protocols and platforms are expected in the second half of 2024 and early 2025. Notable projects include:

Zora

Zora is an NFT marketplace with its own Layer 2 network for Ethereum, launched in June 2023. The blockchain and platform aim to provide a better user experience for interacting with non-fungible tokens compared to existing solutions. The team is likely to announce a token distribution closer to the end of 2024 or early 2025. With $60 million raised at a valuation of $600 million, the project may generously reward early users and active participants. A detailed guide on interacting with Zora is available on the Incrypted website.

Scroll

Scroll is a Layer 2 blockchain for Ethereum based on zero-knowledge proofs, launched in October 2023.

Since the beginning of 2024, the developers have held several campaigns aimed at attracting users and capital. Future token distributions will likely be based on the results of these events.

Scroll raised $80 million at a valuation of $1.8 billion, suggesting potentially high rewards for active users. A detailed guide on interacting with the protocol is available on the Incrypted website.

Fuel

Fuel is one of the most well-known modular blockchain projects. The network was in the testnet phase for a long time, but in July 2024, the team announced a points program to attract activity “in preparation for the mainnet launch.”

Fuel raised $81.5 million at a valuation of $1 billion, increasing the likelihood of a significant airdrop. You can use the Incrypted guide to participate in the Fuel campaign.

Babylon

Babylon is a staking protocol that allows Bitcoin holders to earn rewards from staking. Since early 2024, Babylon has been in the testnet phase, but in August, it launched the first phase of its mainnet.

The project’s roadmap includes a token launch, so despite the lack of official announcements from the team, there is a high probability of distribution via airdrop. Babylon also raised $96 million in funding, with Binance Labs among its investors.

Linea

Linea is another Layer 2 solution for Ethereum from the developers at ConsenSys, widely known after the launch of the non-custodial cryptocurrency wallet MetaMask.

ConsenSys has not announced specific funding rounds for Linea, but the company has raised $725 million in investments overall, with a valuation of $7 billion.

At the time of writing, users can interact with the network through the Linea Voyage: The Surge campaign. A detailed guide is available on the Incrypted website.It’s worth noting that while these are some of the most anticipated and capitalized projects with potential token airdrops, they are far from the only ones in the market. For example, in the Solana ecosystem, the restaking protocol Solayer is gaining popularity with $12 million in investments.

Another potentially significant project is Farcaster, a blockchain platform for creating decentralized social networks, funded with $180 million from a16z, Paradigm, and other notable funds. Instructions on interacting with most airdrop-oriented projects, as well as additional information on token distributions, can be found in the Airdrops section on the Incrypted website.

How to Participate in an Airdrop

The conditions for participating in a token distribution vary from project to project and often depend on the product’s development stage. Therefore, airdrop hunters can categorize their activities as follows:

- Interaction with the product: Token swaps, using bridges, providing liquidity, and other operations. These activities require understanding blockchain services and covering fees.

- Quests: Typically, projects conduct quest campaigns on services like Galxe, Zealy, or Layer3 to attract users and stimulate specific activities. Often, completing these tasks is considered when distributing tokens or is directly rewarded.

- Participation in testnets: Before launching on the mainnet, most products undergo testing on a testnet. During this phase, users can interact with the project without risking real assets, and feedback is considered a valuable contribution.

- Ambassador programs: Ambassadors are active community members who help create and distribute project-related content, attract audiences, and increase brand awareness. Often, this activity allows participants to be eligible for an airdrop.

Another type of rewarded activity is running and maintaining nodes. The airdrop size for node operators is generally higher than for regular users, though this requires investment and certain technical skills.

Security Rules for Airdrop Participation

Airdrops target a broad audience and attract many newcomers to the industry, which scammers and dishonest developers take advantage of. The most common dangers for participants include:

- Phishing: This primarily involves fake websites, social media pages, or email campaigns distributing malicious links to steal assets or personal data.

- Scam projects: During active phases of the crypto market, hundreds of teams announce token launches, leaving newcomers with little time for research. Some of these services are created solely to steal user funds through methods like rug-pulls or insider operations.

- Hacks: Often, airdrop organizers are in the testing phase with products that have not undergone security audits. Interacting with such platforms comes with an increased risk of hacking and fund theft.

To protect your wallet and safeguard assets during an airdrop, follow these safety guidelines:

- Verify announcements: Phishing links are often distributed via direct messages or social media announcements using cloned profiles or hacked official accounts. If you encounter a suspicious announcement, check the information through multiple sources and contact the team’s representatives if necessary.

- Separate your capital: A “warmed-up” wallet with a history of activity is often required to participate in an airdrop, but it’s better to use a dedicated address with a set amount, not your main wallet. This will help protect most of your savings in case of a hack or theft.

- Practice risk management: Treat lesser-known projects as high-risk—even honest teams can fall victim to hackers and lose user funds. Keep this in mind when determining the size of operational capital for new protocols and platforms.

- Pay attention to security: Monitor publications by security experts like PeckShield, who report on hacks and fraudulent developer actions. Also, don’t forget about useful wallet protection services like Revoke.

And most importantly — always do your own research. The more thoroughly you study a target project, the less likely scammers are to take your money. This rule applies to any segment of the cryptocurrency market.

At the time of writing, the airdrop narrative is experiencing a boom, so news of token launches and distributions appears almost daily. You can find new and up-to-date projects in the Airdrops section on the Incrypted website, as well as in our Telegram channel.