Stream With The Founders Of 1inch: About Fusion 2.0, Cross-chain Swaps And The Threat Of AI

On May 9, 2024, Incrypted hosted a live stream with the founders of the 1inch project, Anton Bukov and Sergej Kunz. They shared their vision for the 1inch protocol and ecosystem development, as well as talked about the Fusion update to version 2.0, integration of cross-network exchanges, and the possibility of adding futures trading.

The Incrypted put together a text summary of the video, which covers the main topics discussed.

Two Years Later

Over the past two years, the 1inch team has implemented a series of significant updates to its core product, the liquidity aggregator. At the same time, the project ecosystem has grown to include many valuable services and solutions.

According to Sergej Kunz, the 1inch team has approximately 150 employees worldwide. The company behind the project is working to get a license in the UAE. They are also preparing to set up a headquarters in Dubai.

Andrey Bukov believes the most important decision for 1inch was introducing the limit order protocol. This allowed them to surpass their only competitor, 0x Protocol, and also shaped the current look of the service.

During the stream, it was noted that 1inch handles about 80% of all trades using limit orders on decentralized marketplaces.

Messari reports that in the fourth quarter of 2023, 1inch holds 64% of the market for aggregators and decentralized exchanges on the Ethereum network. During this time, the protocol handled transactions worth over $30 billion in total. In the first quarter of 2024, the figures were 51% and $43 billion, respectively.

However, Kunz observed that Messari employed an extensive method when compiling the report, which involved a comparison of various products. A further analysis of the liquidity aggregator market reveals that, according to the project analysts, approximately 80% of all transactions utilizing such services are conducted through 1inch.

Bukov suggests that the data differences happen because there’s no standard way to measure specific things like user traffic.

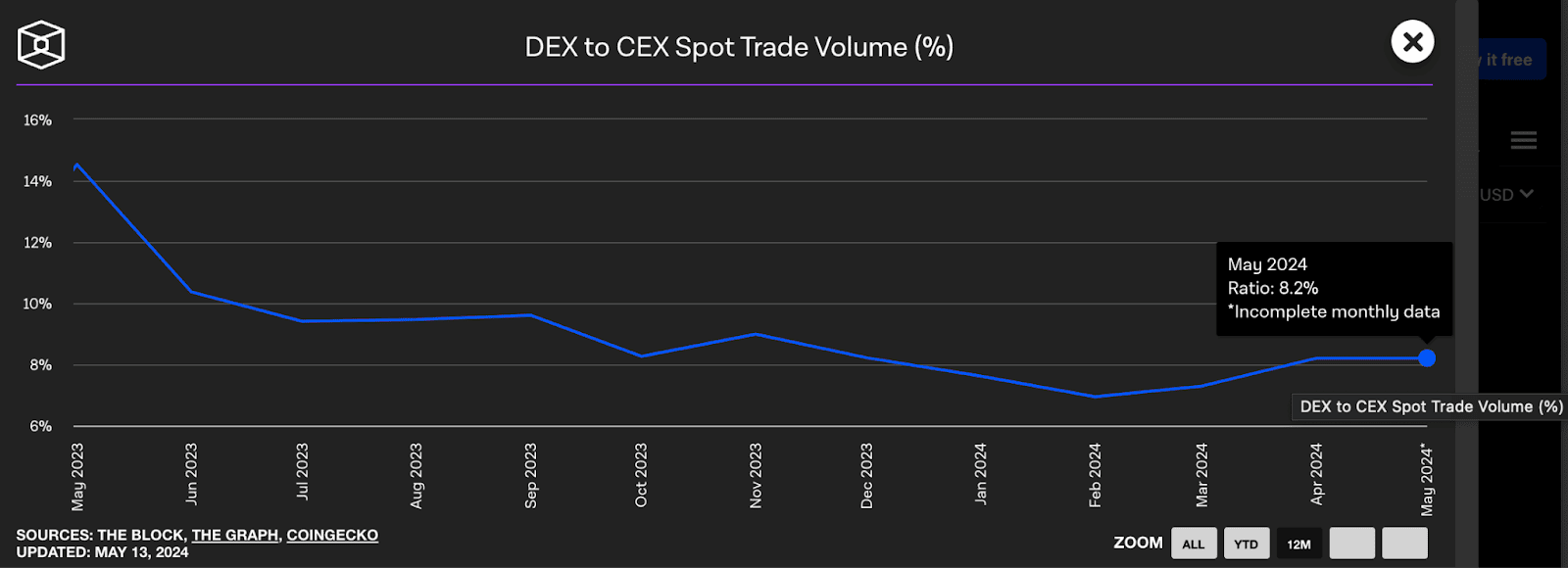

Ratio of DEX and CEX Share in the Crypto Market

In February 2020, Sergej Kunz suggested that in the future, users would stop using centralized crypto exchanges. While this prediction didn’t happen, the move from CEX to DEX continues, although it’s taking longer than expected. For instance, in 2020, about 0.16% of all spot trading happened on DEX. But by 2024, this number is close to 10%.

Bukov suggests that DEX growth will speed up soon because more people know they can trade assets without centralized exchanges.

The project’s co-founders noticed that many users had been harmed by centralized platforms like FTX. Still, they continued to place their trust in other exchanges. The best way to break the CEX monopoly is by using good technology.

1inch Ecosystem Products: New and Updated

1inch Card

One of the recently announced ecosystem products is the 1inch Card, which is issued through a partnership with Crypto Life. The 1inch Card can be used to pay for real goods and services with assets stored on Crypto Life’s custodial addresses.

The project can handle over 1,000 virtual cards. It’s improving its expertise in this area to support more development. Sergej Kunz said the main goal now is to expand operations to include the EU and the UAE. Besides, the team is contemplating the potential for launching the product in Ukraine.

One of the primary obstacles to scaling is the challenge of identifying local partners to provide card services and navigating the complexities of regulatory requirements across different jurisdictions. So it is challenging to provide specific information about countries and launch dates.

Fusion: Advantages over Aggregators and the Transition to Fusion 2.0

Fusion is a solution based on the 1inch limit order protocol. It aims to improve user experience and reduce slippage on major exchanges.

Sergej Kunz says the main benefit of Fusion is how it uses the idea of “intents,” or intentions. This architectural approach enables users to create an intent (or order) with information about their desired outcome, such as converting 1,000 ETH at the optimal value.

Special protocol participants, called resolvers, have the job of making the intention happen without the user needing to start a transaction. This enables the execution of gas-free swaps and provides protection against MEVs. Furthermore, the interaction with the service becomes more intuitive.

Behind Fusion are professional resolvers — market makers and arbitrage traders. To make an order happen, they can gather liquidity from many blockchains, along with centralized exchanges and other offline sources. This approach prevents the slippages common in traditional DEXs that use liquidity pools and AMM algorithms.

One advantage of 1inch is that Fusion resolvers can use meta-aggregators to make orders happen. But they’re not restricted to just this method.

Still, the main problem with Fusion is that it works best for big exchanges but not as well for smaller transactions compared to AMM.

To address this weakness, the team developed Fusion 2.0. The new version has a revised auction mechanism, improved code, and uses an updated limit order protocol.

These innovations allow profitable trading of even small amounts of digital assets, from several hundred dollars to just tens of dollars.

Bukov underscored the security of 1inch in general and Fusion 2.0 in particular. He said the project’s main goal is to protect users. This can happen through three main factors:

- a modest amount of code;

- the use of immutable smart contracts;

- high-quality auditing.

Sergej Kunz observed that the team typically requests audits from ten different organizations, with at least one of them being a leader in the field, such as Consensys. This approach helps the team find potential issues and weaknesses in the code that a single auditor or an independent audit might miss.

How Are Resolvers Tested?

The resolvers are the main participants in the 1inch Fusion solution. They execute orders placed by users. As mentioned before, they are professional market makers with their own sources of liquidity.

To gain access to the protocol, resolvers must fulfil some conditions. Specifically:

- pass the KYB procedure;

- block or attract a certain number of 1INCH tokens from delegates.

Delegation of tokens to a resolver is another way to use 1INCH. It allows 1INCH owners to participate in project management and, in some cases, be rewarded by resolvers for delegation. You can find a list of active market makers on the project’s website.

Kunz also noted that 1inch uses TRM Labs’ solution to screen addresses used in transactions. This ensures that when an order is executed, the user won’t get compromised cryptocurrency.

In addition, the wallets’ reputational risk assessment reduces the possibility of using 1inch to exchange stolen funds or circumvent sanctions — the resolver is automatically blocked from accessing the order.

Inter-network Exchange

The team plans to add a cross-chain exchange solution to Fusion in 2024. The goal of the new feature is to enhance the quality of the user experience. The new feature will let you exchange assets from different blockchains, like Bitcoin, without needing intermediary bridges.

The protocol is fundamentally a new 1inch protocol based on the concept of atomic swaps. While this is an older and well-known method, it hasn’t been widely used in the industry because of security worries.

The 1inch team has undertaken a reworking of the technical implementation of atomic swaps. In particular, the cross-chain swap protocol will be enhanced with new security mechanisms that will eliminate known attack vectors.

This way, 1inch uses its own ecosystem resources, like resolvers, for liquidity. This eliminates the typical drawbacks of bridges or bridge aggregators, including slippages, security risks, delays, and high commissions.

The precise date of the launch is yet to be determined, as the protocol is still in the process of being developed. However, it is anticipated that the update will be made available as early as this year.

Hardware Wallet

In January 2023, 1inch announced the launch of its proprietary 1inch Hardware Wallet.

As the founders mentioned, the product is now in its early production phase. They’re setting up the manufacturing process and optimizing hardware. Additionally, the software is being developed, with a particular focus on integrating it with the non-custodial 1inch Wallet.

Sergej Kunz said the wallet will have a touchscreen and a fingerprint scanner. Users will use these to access asset management and mnemonic phrases. The initial shipments of the device are scheduled to start in 2024.

Futures Trading

Regarding speculation about adding perpetual contracts trading functionality, the team says they’re not currently working on that.

Kunz says futures could greatly boost trading volumes. However, they are classified as securities by regulators, which necessitates the acquisition of an appropriate license prior to their launch.

1inch is in the process of obtaining approval for regulated trading in the United Arab Emirates and has already received approval to operate in Switzerland. Still, the cross-chain exchange protocol is a big goal for 2024. It would reduce the splitting of liquidity in the market.

About Airdrops

One of the earliest projects to use retrodrop to incentivise users was 1inch. The 1INCH giveaway was held in 2020.

The founders say the community’s attitude towards giveaways has changed a lot in recent years. Before, people saw airdrops as a perk for loyal users. Now, they’re a normal thing. This has led to criticism of projects due to the excessive screening of Sybil addresses or the distribution of small amounts.

Also, in 2020, people didn’t often farm retrodrops on purpose. It appears that the process is now well-oiled, resulting in the creation of a significant number of fake accounts belonging to the same individual.

Nevertheless, traditional farming methodologies, such as the exchange of identical amounts, may be perceived as antiquated and susceptible to detection. Upon visualizing such activity, it is relatively straightforward to identify anomalies, which are typically the basis for address screening.

At the same time, many projects that use aidrops to stimulate activity frequently confront a challenging predicament: if the number of participants is drawn in excessively, the community will remain discontented, yet if a large sum is distributed to sybil addresses associated with a single individual, it almost invariably culminates in a sale and token dump.

About Memcoins

Anton Bukov posits that each bull run is accompanied by a particular narrative or asset that captures the general attention. The focus is not on technology per se, but rather on the profitability of the venture.

Viral narratives disseminate narratives of rapid wealth accumulation, which in turn cause FOMO and attract individuals seeking to profit from this perceived “casino”. Furthermore, the influx of new investment drives the market as a whole to expand. Subsequently, professional investors, seeking to achieve super profits, commence their search for promising startups. This process allows for the testing of new ideas and the advancement of the industry.

The founders of 1inch posit that memcoins are an integral component of the current economic cycle. In the last bull market, NFTs did the same thing. Before that, it was tokens from DeFi projects, and so on.

Token and DAO

Users often complain about the lack of use-cases for the 1INCH token, whose usefulness is limited to delegating resolvers and participating in governance. As Anton Bukov suggests, this problem happens because the functional implementation is complicated. Nevertheless, despite its apparent simplicity, the 1inch token is distinguished by its internal architecture.

The project employs a system of so-called token plugins, which is analogous to ve (3;3) but more efficacious because it precludes abrupt alterations in the proportions of participants, which is a crucial aspect when constructing an incentive system.

Furthermore, plugins permit the implementation of intriguing mechanics, such as farming, delegation, voting, and other activities that are wholly dependent on the blockchain and do not necessitate blockchain deposits. Additionally, these mechanics are devoid of the risks associated with theft or fraud.

According to Bukov, more and more projects will start using token plugins. They offer benefits over the traditional architecture of similar assets.

A further crucial inquiry pertains to the DAO and the efficacy of employing this model in conjunction with a governance token for decision-making purposes.

Sergej Kunz posits that the 1inch community fulfills two crucial roles:

- manages the treasury. They use the funds for grants, hackathons, and investing in other projects and promising products. One of the projects funded by the DAO was the 1inch Hardware Wallet, which received 2 million USDC;

- affects some modifiable parameters of the protocol. These changes are made by consensus of the project participants represented by the DAO.

According to Kunz, the main advantage of DAO is to prevent “bad kings.” This means important decisions aren’t made by just one developer.

Regulation and Work in the US

Sergej Kunz says many local blockchain projects, even big ones like Consensys, are having trouble because of the SEC’s actions.

1inch’s policy is to protect the site and team members, so due to legal uncertainty, access to the protocol is restricted to U.S. citizens.

These rules will remain in effect as long as required by law.

About AI and a Bit of Motivation

At the end of the stream, the participants also talked about things that weren’t directly about the crypto market. In this context, Kunz talked about his worries about AI, especially with new robots from Boston Dynamics or Tesla. He posits that artificial intelligence, in general, may pose a threat to humanity.

Bukov, for his part, identified potential benefits of integrating AI into various spheres. He thinks that in the next two to five years, developers will make AI agents for programming and other tasks. These agents will do basic jobs like writing and testing code. This will let people focus on bigger things, like building the main framework of a project.

He also thinks AI will speed up robotics development. Soon, robots will be common in many city streets.

In conclusion, the story of 1inch is about taking action and how it leads to success. The project started as a startup in a hackathon and now dominates the liquidity aggregator market.

“One should always do and do everything for 100% and more. This will definitely lead to success.”, — Sergej Kunz.