Activities on the Polymarket for a potential airdrop

Polymarket is a decentralized platform built on the Polygon blockchain. It is a platform for predicting various events, from the results of sports matches to choosing the winner of the presidential race.

Within three investment rounds, the team raised more than $70 million from DragonFly Capital, Founders Fund, Polychain Capital and others.

You can read a detailed review of the platform and the peculiarities of interaction with it at this link:

Against the backdrop of ever-growing interest in the project, the team announced on September 23, 2024 that it is considering options to raise an additional $50 million in investment and launch its own token. Therefore, it is possible that there will also be a drop for active Polymarket users.

Further in the article, we will review the available activities and show how to interact with the project to be able to qualify for an airdrop.

Guide to completing the activities

Note: you will need a Metamask-type wallet to pass. If you don’t have one, you can use our guide to install and set it up.

- Go to the site and register with your wallet by clicking Sign up.

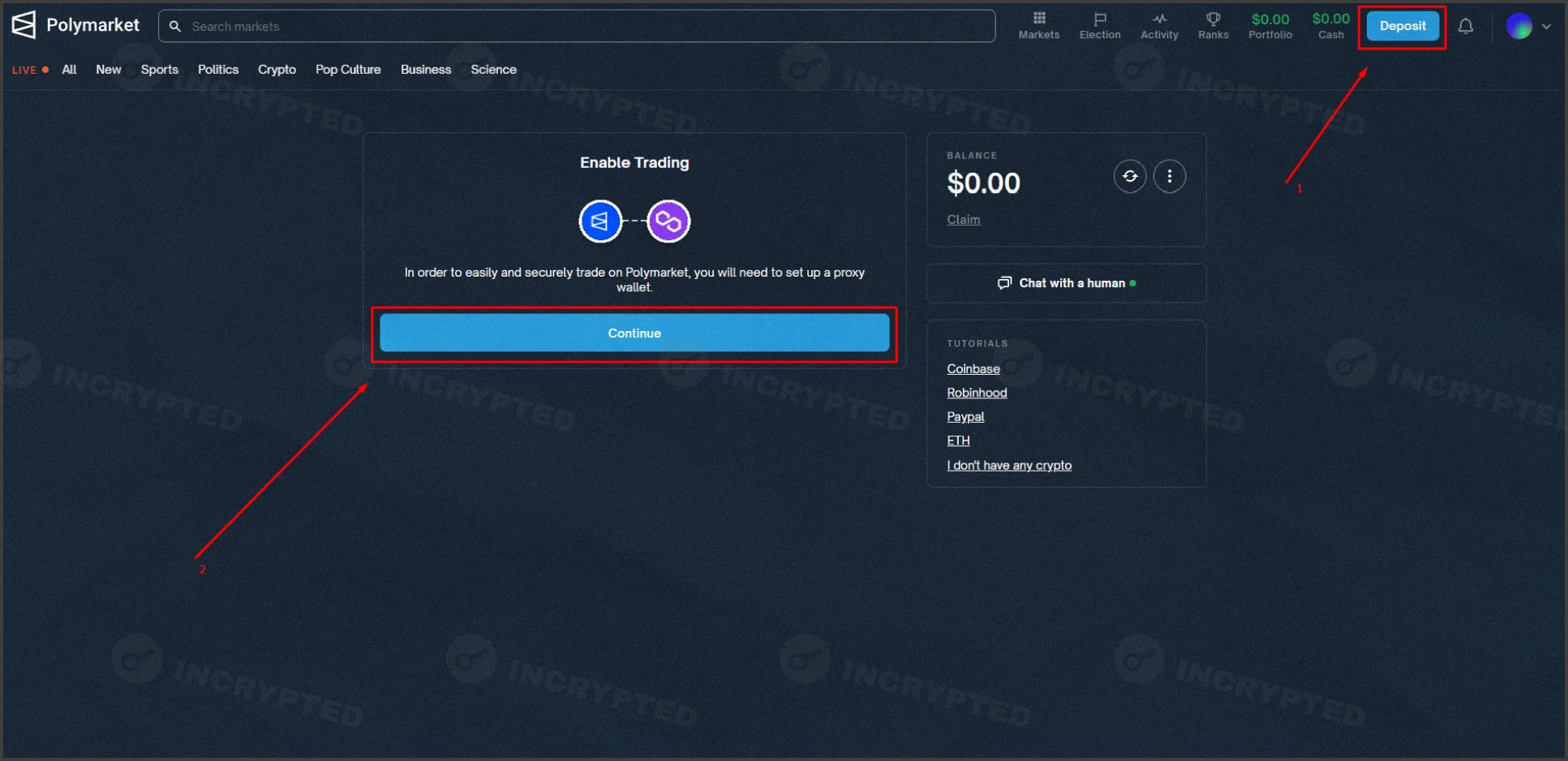

- Open the Deposit tab, set up the proxy wallet by clicking Continue on the pop-up window:

- Make a deposit in USDC of Polygon network to the specified internal address.

Note: you can also choose other deposit methods.

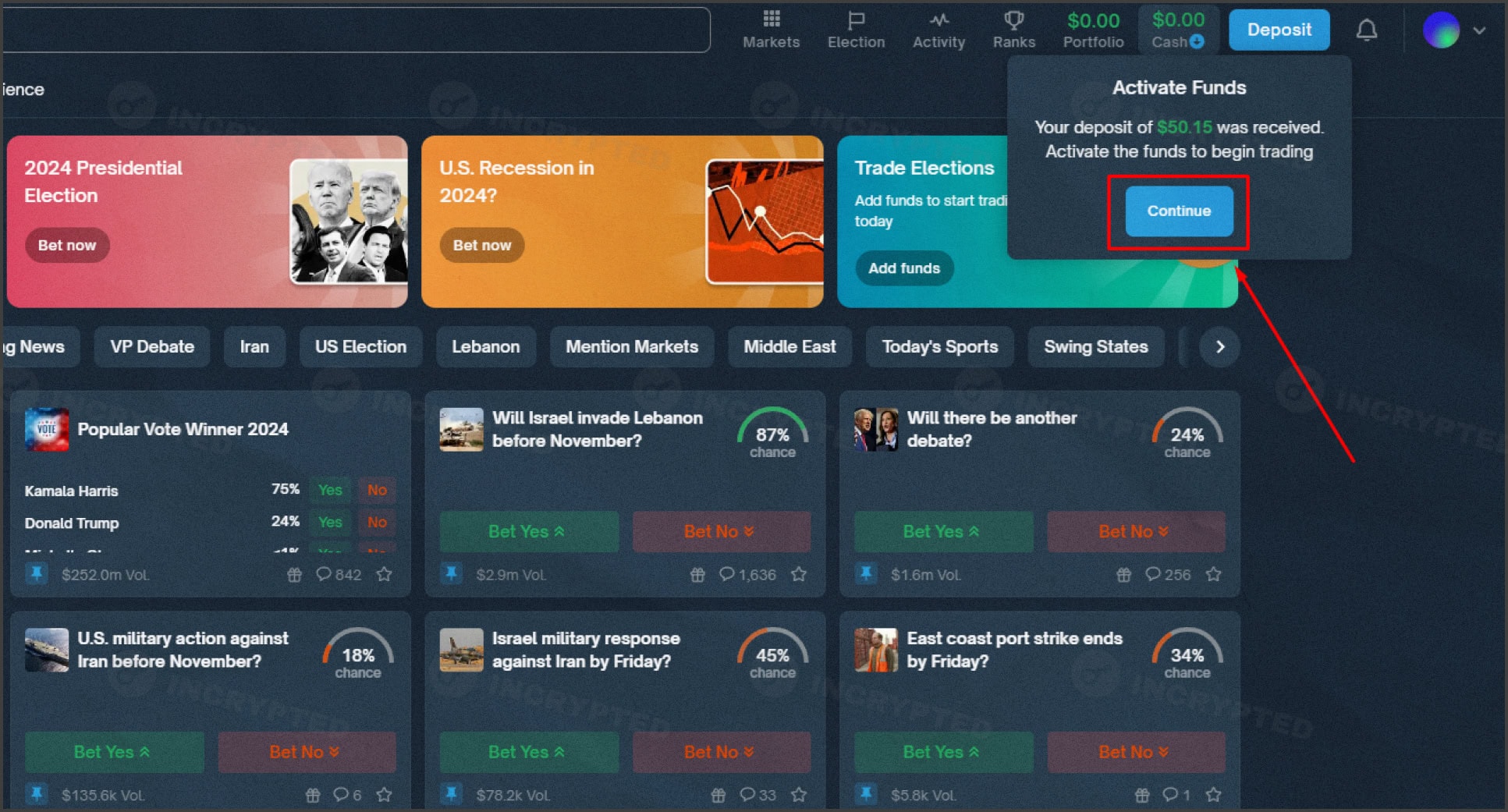

- After activating your deposit by clicking Continue:

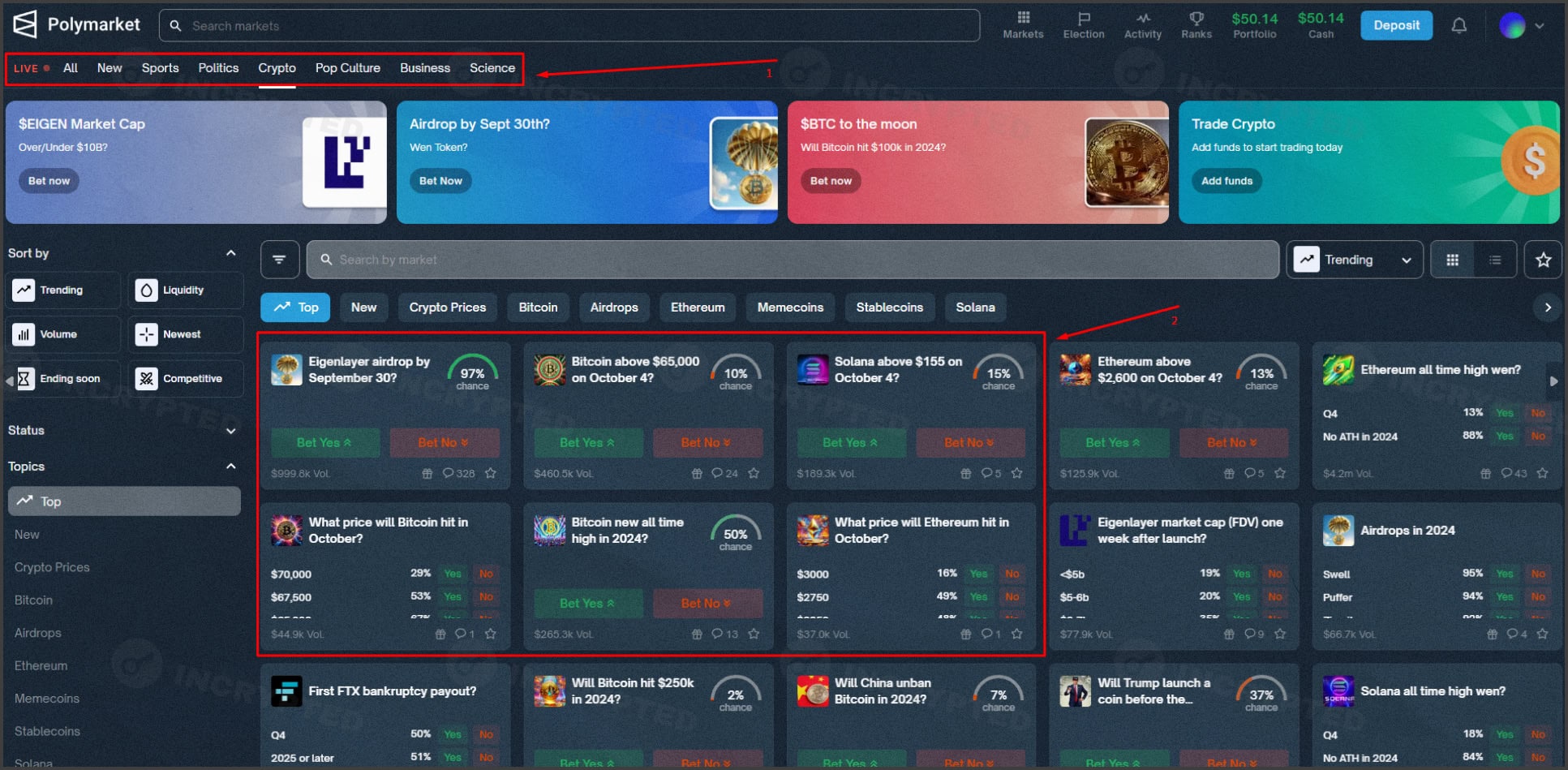

- Select the category and event of interest:

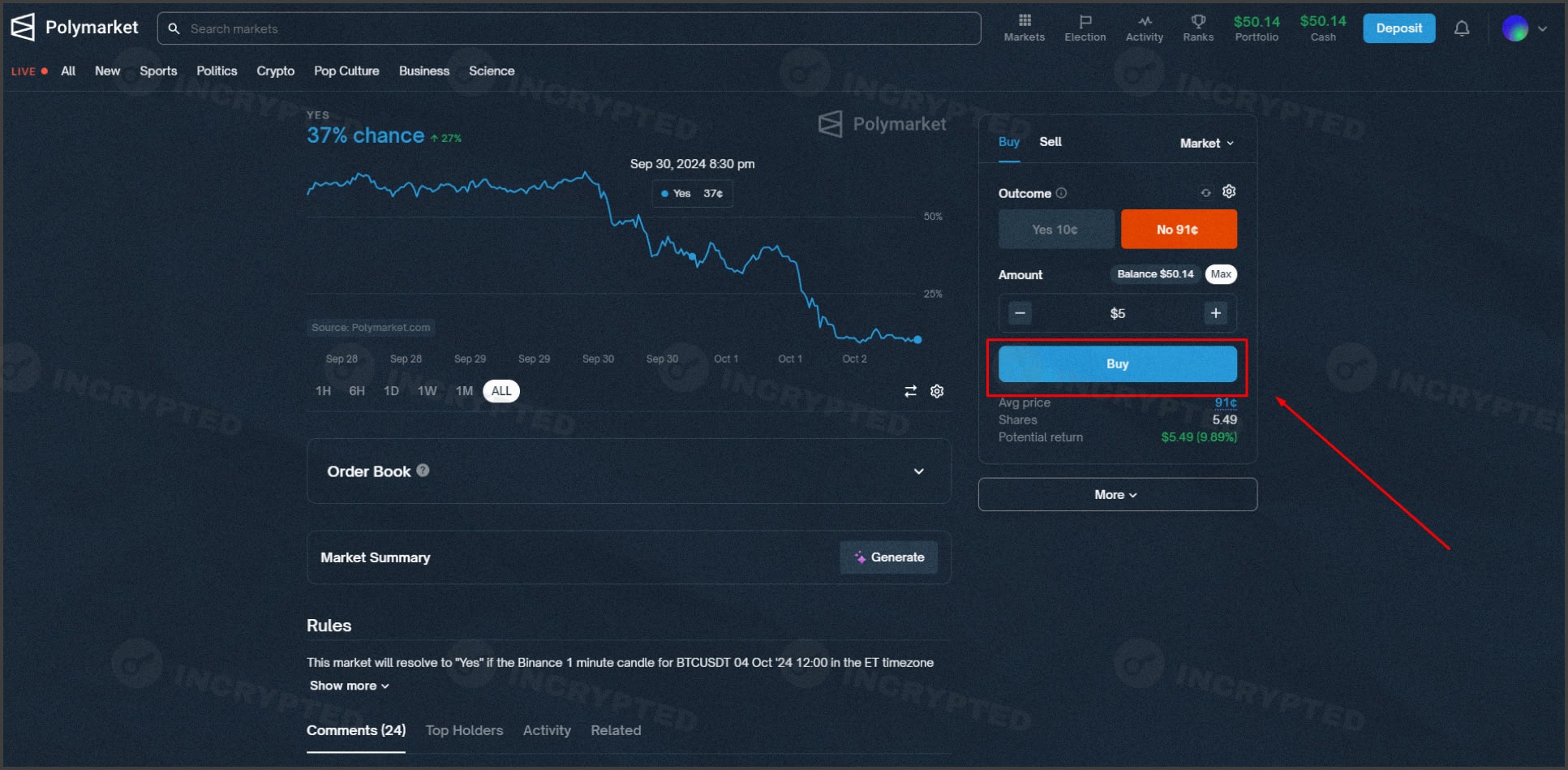

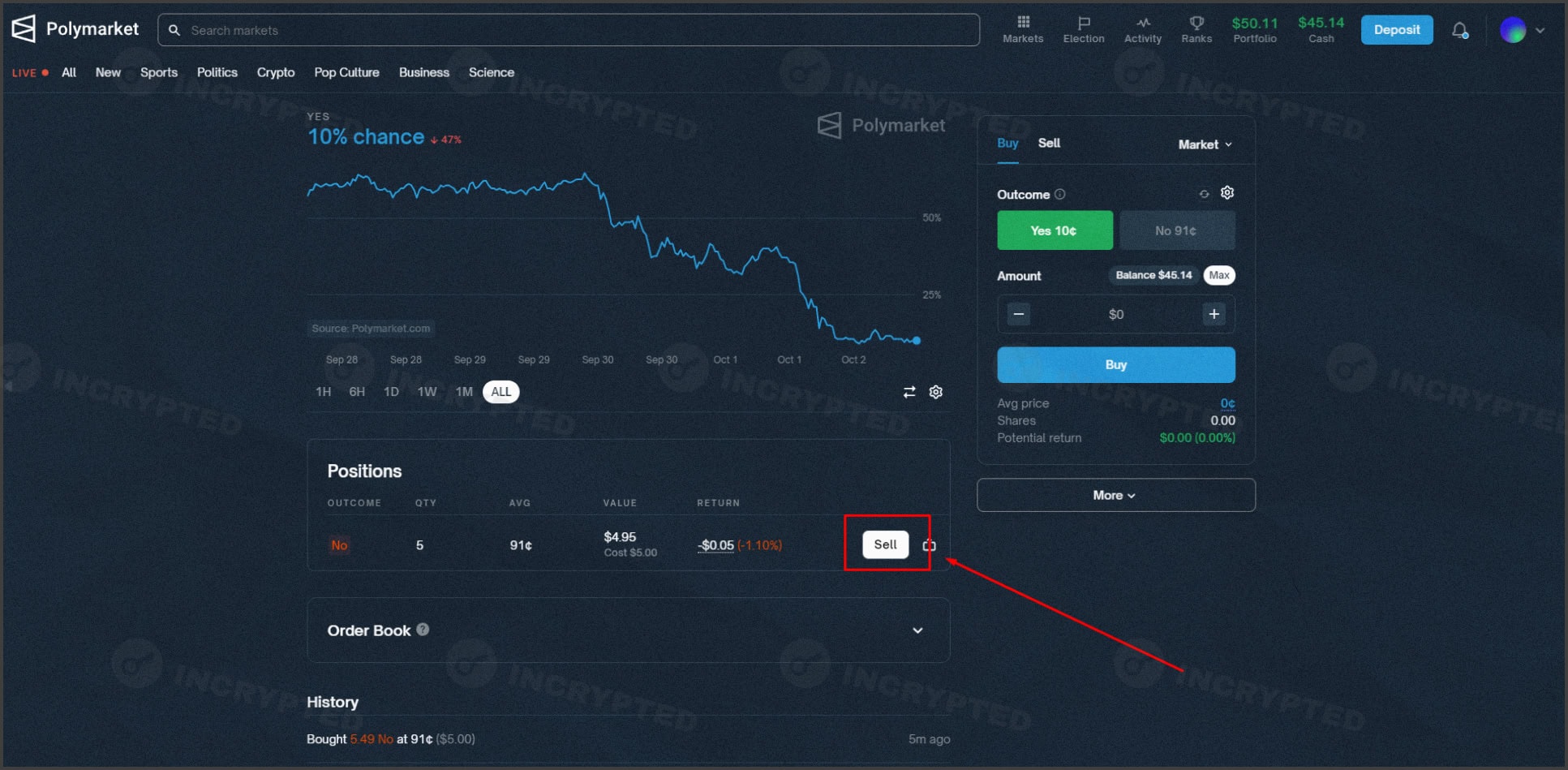

- Customize the position and confirm the option purchase by clicking Buy.

Note: before opening a position, please read all the terms and conditions in detail in the Rules section.

- You can always find an open position in the History section of your portfolio. To redeem it, if you are satisfied with the result, you can click Sale:

Conclusion

Despite all of the above, you should not forget that Polymarket is a kind of betting platform, so you should always consider the risks. In this activity, they are much higher than in others. To minimize them, one of the tools can be hedging open positions with the help of delta-neutral strategy.

Highlights:

- possible risks should be monitored;

- over $70 million raised in total;

- one of the explicit criteria for the drop may be the volume of your trades.

Useful links: Website | X | Discord

All information is provided for informational purposes only and should not be used as a basis for making investment decisions, nor should it be considered as a recommendation or advice to participate in investment transactions. Do Your Own Research.