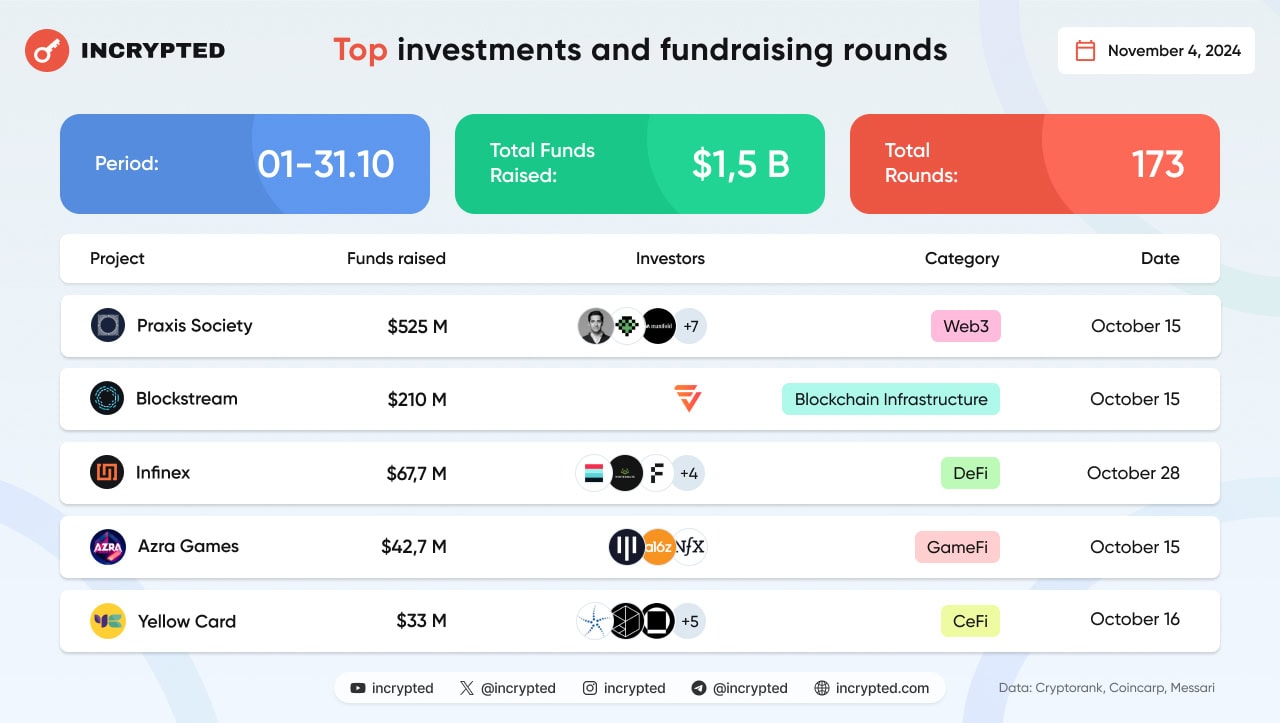

In October, Web3 and Blockchain Projects Raised Over $1.5 Billion in Investments

- In October, blockchain-oriented projects secured more than $1.5 billion in total funding.

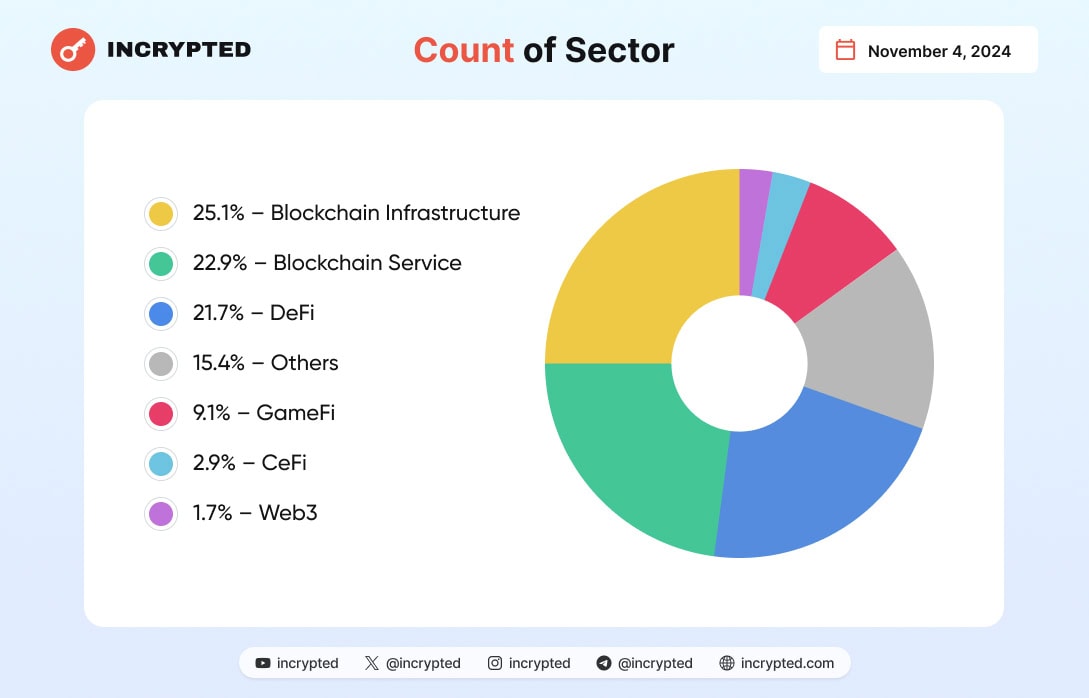

- The focus of the funds was mainly on the blockchain infrastructure development sector.

In October 2024, 173 projects in the Web3 and blockchain sectors raised a collective sum of over $1.5 billion, with the team at Incrypted providing a detailed breakdown of the month’s investments.

The Praxis Society startup attracted the most funds in October — $525 million.. This startup aims to establish an online city supporting cryptocurrency, artificial intelligence, biotechnology, and energy initiatives. The funding came from Arch Lending, GEM Digital, Manifold Trading, and private investors. With the new capital, Praxis is set to advance its vision of building a digital city.

Following Praxis, other high-value funding rounds included:

- $210 million — Blockstream: This Bitcoin infrastructure development company concluded a funding round by selling convertible bonds to the investment firm Fulgur Ventures. The funds will be directed towards accelerating L2 solution development and expanding mining operations.

- $67.7 million — Infinex: The decentralized exchange reported capital raised through the sale of its NFT collection, Patron. Founders Fund emerged as one of the primary investors, joined by Wintermute, Framework Ventures, Vitalik Buterin, Anatoly Yakovenko, and others. The funds are earmarked for preparations for the “post-CEX” phase.

- $42.7 million — Azra Games: This gaming project, focused on developing a mobile Web3 game, raised funds in a Series A round led by venture firm Pantera Capital, with participation from a16z and NFX. The new capital will enable the team to realize its game development plans.

- $33 million — Yellow Card: This African payment startup, which provides cross-border transfer services in 20 countries, received investments from Blockchain Capital, Polychain Capital, Galaxy, Castle Island Ventures, Winklevoss Capital, and others. With this new funding, Yellow Card plans to expand its customer base and enter new markets, including Ethiopia, Egypt, and Morocco.

Additionally, the cryptocurrency exchange Kraken disclosed a grant previously provided by the Optimism Foundation. The deal, signed in early 2024, involved transferring 25 million OP tokens. At the time of signing, this token allocation was valued at $100 million, but subsequent market fluctuations reduced its value to $37.4 million. The grant will be disbursed in multiple tranches, with the primary goal being the launch of the Layer 2 solution Ink. Moreover, Kraken will become part of the Superchain project in exchange for this funding.

Undisclosed details

Several projects received funding but chose not to disclose the investment amounts. Among these projects are Sophon, RoOLZ, Tradias, Bitwave, Elfa AI, TSFC, NameFi, Bison Swap, Airdrop2049, Scallop, PinGo, Bracket Labs, World of Dypians, NPCS, Bsquared Network, Echo Protocol, Port3 Network, BlueMove, Pulse, Kroma, DuckCoop, U2U Network, Talent Protocol, Libraro, GEODNET, AiGO Network, Titan Network, and U-topia.

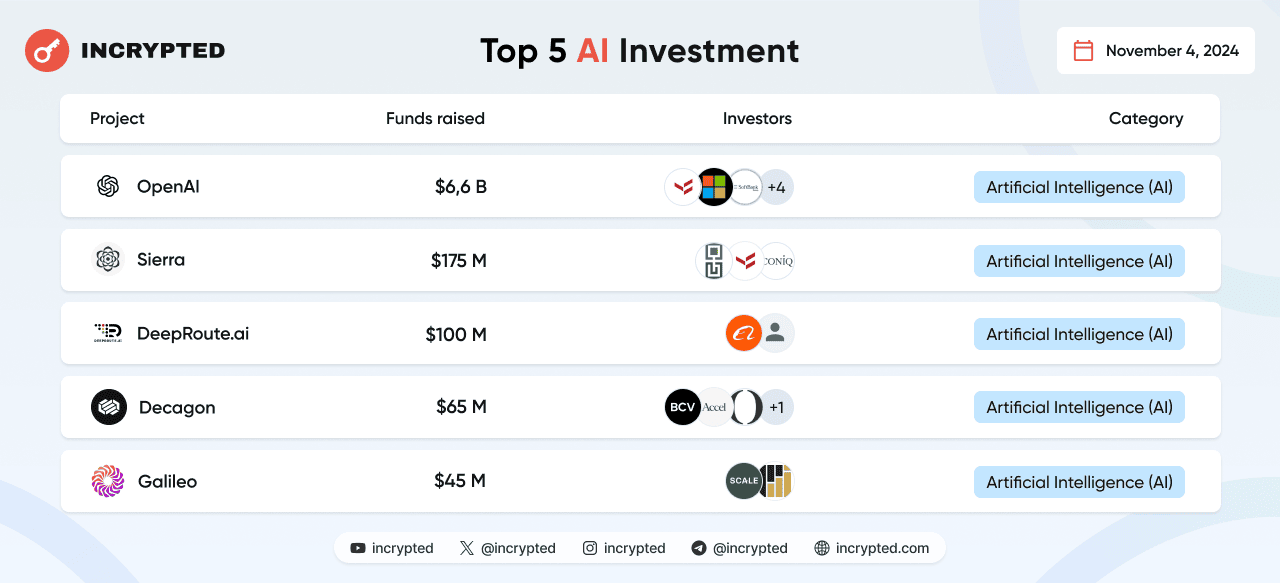

Artificial intelligence

In October, AI-focused projects also saw significant investment activity. The Incrypted team highlighted the top five startups that raised the most funding.

$6.6 billion — OpenAI: The company announced a $6.6 billion investment at a valuation of $157 billion, led by Thrive Capital with a $1.3 billion contribution. Other major investors included Microsoft ($750 million), SoftBank ($500 million), Tiger Global Management ($350 million), Altimeter Capital ($250 million), Khosla Ventures, Fidelity, Nvidia, and others.

$175 million — Sierra: The startup raised funds in a new round led by Greenoaks Capital, with additional backing from Thrive Capital and Iconiq, reaching a valuation of $4.5 billion. Sierra focuses on AI-powered chatbots for customer service.

$100 million — DeepRoute.ai: The Chinese developer of autonomous driving technology received a new round of capital from Alibaba and an undisclosed investor, aiming to drive large-scale adoption of its systems, surpassing competitors like Tesla.

$65 million — Decagon: The AI agent developer closed a Series B funding round led by Bain Capital Ventures, with participation from Accel, BOND Capital, ACME Capital, and private investors. These funds will accelerate Decagon’s mission to revolutionize enterprise-level customer support and unlock new levels of economic productivity. $45 million — Galileo: The company, which provides enterprises with a comprehensive platform enabling teams to utilize more accurate and reliable artificial intelligence, has secured new investments. The Series B funding round was led by Scale Venture Partners, with participation from Premji Invest. The new capital will allow Galileo to scale its go-to-market strategy and expand its product development efforts.

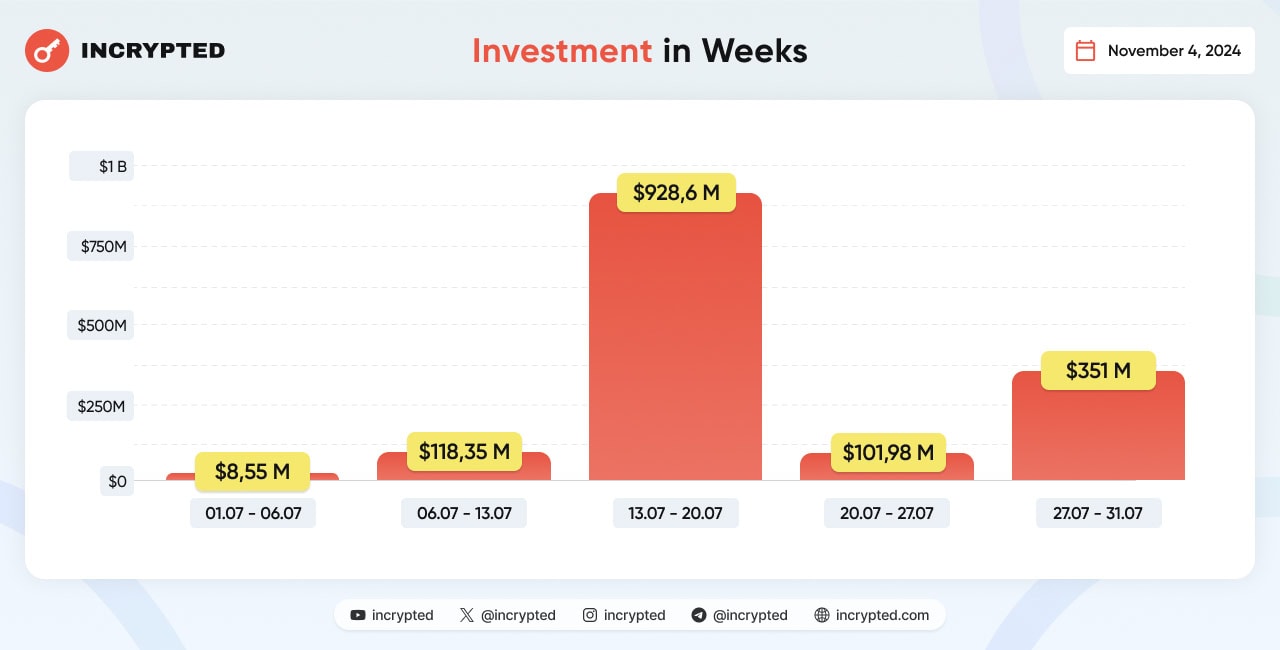

Dynamics

The highest investment amount, totaling $928.6 million, was raised by projects from October 12 to October 19. During this period, the leaders in funding were Praxis Society and Blockstream, with funds primarily focused on the DeFi sector.

From October 1 to October 5, 2024, seven projects secured investments totaling $8.55 million, with the largest contributions going to Layer and Infinite Giving.

From October 5 to October 12, 2024, 24 projects attracted a total of $118.35 million in funding. Notable capital influxes were seen by Delta Network, the blockchain project The Open Network, and the GameFi company PiP World.

Between October 19 and October 26, 2024, 37 projects secured investments totaling $101.98 million, with the social network BlueSky leading by closing a Series A round of $15 million. Investor attention during this period was concentrated on blockchain infrastructure and service development.

At the end of the month, from October 26 to October 31, 80 projects attracted a total of $351 million in funding. The leaders in this funding round were the exchange Kraken and the platform Infinex.

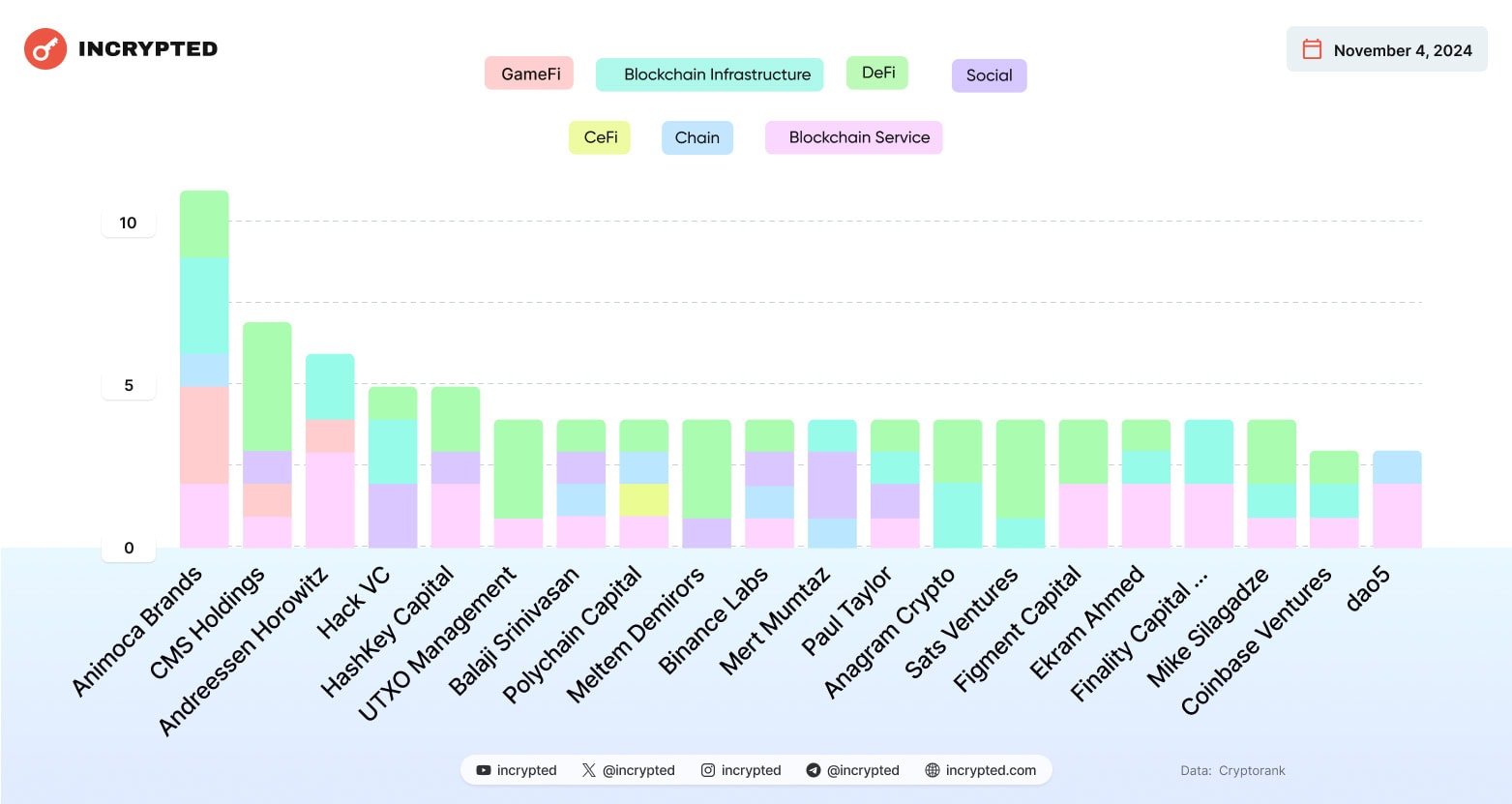

Investors and Segments

According to CryptoRank, the most active investor in October was Animoca Brands, which invested in 11 startups.

In August, investor interest was primarily focused on the DeFi sector and blockchain infrastructure development.

Stay tuned to Incrypted, for updates on new investments in the digital world.