0G Labs project key metrics and node sale

0G Labs — is a protocol whose team is developing a modular blockchain focused on decentralized applications using artificial intelligence.

In addition to the modular blockchain, 0G Labs includes three other market segments:

- Storage — a decentralized storage network designed to handle large amounts of information;

- DA — a segment that enables Web3 dApps to achieve performance comparable to Web2 competitors;

- Serving — a universal framework for searching and working with AI models.

In the first round of funding, the team managed to raise $35 from Hack VC with participation from OKX Ventures, GSR, Animoca Brands, Arca, NGC Ventures, DWF Labs, Foresight Ventures, gumi Cryptos Capital and Dispersion Capital.

About the project token

As with other similar projects, the 0G token will occupy a key place in the ecosystem. One of its main uses will be as a gas token to pay commissions on the L1 network. However, other functions are envisioned as well:

- Staking: to secure the network, users will be offered the ability to tokenize their tokens, and in return they will be able to earn revenue from staking, participate in management, and receive airdrops from projects in the ecosystem;

- Services: projects utilizing the 0G Labs infrastructure will pay for services with 0G token;

- Token Burn: a portion of the tokens generated by collecting commissions will be burned, providing a deflationary model;

- Ecosystem rewards: the token will be used for network development, e.g. as grants for projects or direct rewards to active users.

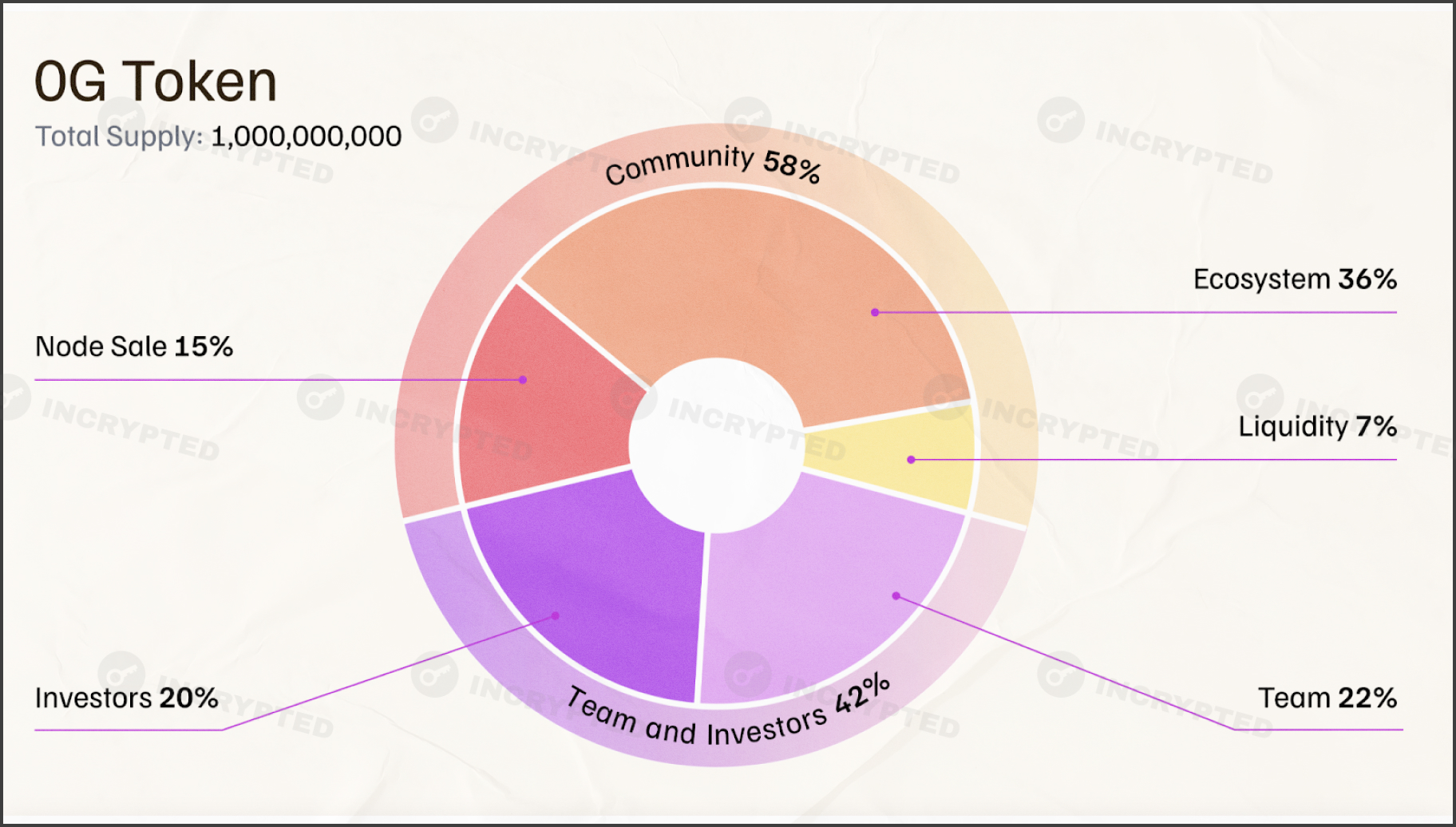

Tokenomics of the project

At the time of writing, it is known that the total token supply will be 1 billion, of which:

- Node Sale: 15% of the total supply (33% available on TGE and then a 36-month linear vesting);

- Ecosystem: 36% (at TGE 10.8%, after cliff for 12 months and then 36-month linear vesting);

- Liquidity: 7% (at TGE 100%);

- Team: 22% (at TGE 0%, after a 12-month cliff followed by a 36-month linear vesting);

- Investors 20% (at TGE 0%, after cliff for 12 months and then 36-month linear vesting).

Summarizing the above, we can understand that up to 15.9% of the total token supply will be in the market at the time of TGE.

Importantly: the project team has developed a non-standard system of token claiming on the TGE for node holders, the purpose of which is to contain the cascade of sales at the start of trading. Technically, at launch, you will have 33.3% of the tokens reserved for you available. However, in order to claim the full amount, you will need to go through a cooling off period. Failure to do so will result in a penalty.

- 180 days — 0% penalty;

- 90 days — 35% penalty;

- 0 days — 50% penalty.

About nodes

According to the project documentation, the nodes that we will be able to install after purchasing access to them will have limited functionality at the initial stage. Their main purpose is to provide validation of top-level nodes (validator nodes, storage nodes, security nodes) and they will be one of the links for decentralization of the project. However, once the main network is up and running and debugged, nodes will be able to perform a wider range of tasks, such as AI tracking and other functions.

Note: the mainnet and TGE are scheduled to launch in the first quarter of 2025.

The purchased nodes will be lightweight, so they will not require a lot of power to install and run.

System requirements provided by the team:

- 64MB RAM;

- 1 CPU;

- 10GB Disk Space;

- X86 Processor.

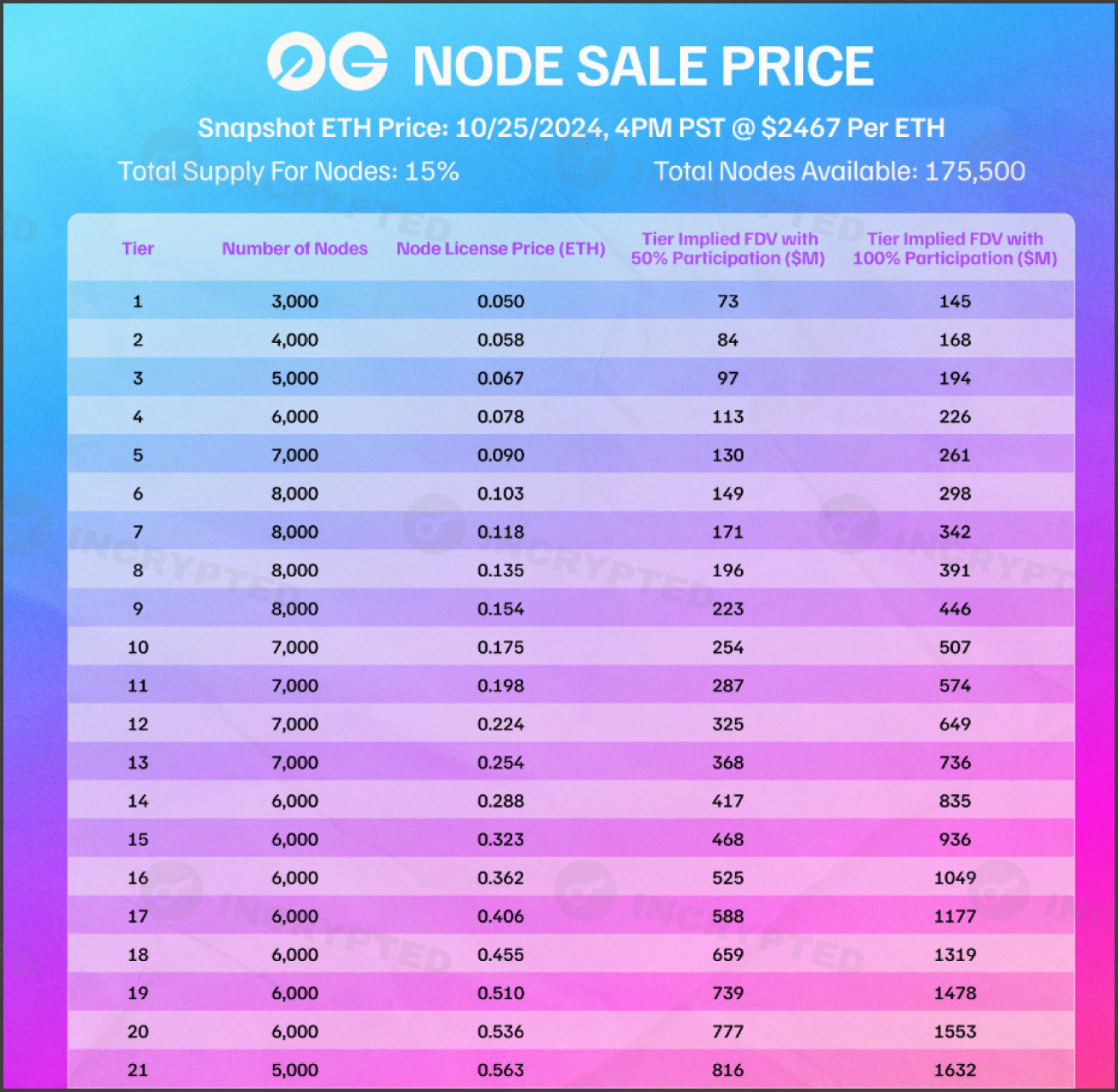

How the sale will be held

The team has chosen a standard system based on dashes. When a certain quota is redeemed, the price of the next dash will increase by a certain percentage. In total, the plan is to sell up to 175 500 nodes, each containing 854.7 0G tokens.

It should also be noted that part of the quotas will be shared between users and WL allocated to 0G Labs community members and partner projects.

You can learn about one of such partner events in our article:

Dates of the event:

- for whitelist — beginning November 11, 2024;

- public sale — from November 13, 2024.

How to participate in the sale

Depending on the round you will be participating in, you will need to prepare your USDC in advance on the Arbitrum network.

Important: you will need to complete the KYC process in order to receive node rewards. Take this into account, as well as regional restrictions.

- Go to the site and connect your wallet.

- Purchase the desired number of nodes.

Important: sales will start on November 11 for whitelist, and public sales will start on November 13. To buy a quota, you can use the code Incrypted, which entitles you to a 10% discount.

- Follow the social networks of the project and raise a node on the official guide when it will be published by the team.

After the purchase, within 3-6 weeks, you will receive an NFT that gives you access to the node. It will be possible to transfer it to another user only after one year from the date of sale.

Conclusion

When participating in such sales, it is important to clearly understand that their main purpose is to attract additional funds to the project, rather than nominally stated decentralization and other similar goals. Therefore, before participating, one should form a buying strategy based on the FDV of a particular shooting gallery.

Highlights:

- public sale starts on November 13, 2024;

- plans to sell up to 175,500 nodes in total;

- kYC process will be required to receive the awards.

If you have any questions when going through the activities, you can ask them in our X.

Useful links: Website | X | Discord

All information is provided for informational purposes only and should not be used as a basis for making investment decisions, nor should it be considered as a recommendation or advice to participate in investment transactions. Do Your Own Research.